Investor Guide: Navigating High Stock Market Valuations With BofA's Analysis

Table of Contents

Understanding BofA's Current Market Outlook

Bank of America's analysts regularly publish reports offering their perspective on the overall market and specific sectors. Their stance on high stock market valuations often influences investor sentiment and strategies. While specific opinions fluctuate, BofA's analysis typically incorporates a multifaceted approach, considering macroeconomic factors, interest rate environments, and individual company performance. To get the most up-to-date information, it’s crucial to consult their latest publications directly.

-

Summary of BofA's key findings regarding high valuations: BofA's reports often highlight potential risks associated with elevated price-to-earnings (P/E) ratios and other valuation metrics, emphasizing the need for cautious investment strategies in such an environment. They frequently analyze the sustainability of current earnings growth and assess the potential for market corrections.

-

Identification of sectors BofA deems overvalued or undervalued: BofA's research often identifies specific sectors deemed overvalued (e.g., technology during periods of high growth) and undervalued sectors (e.g., cyclical industries during economic downturns). This granular analysis helps investors refine their portfolio allocation.

-

BofA's predicted market movements and potential catalysts: BofA's analysts regularly offer predictions on potential market movements, identifying key catalysts that could trigger shifts in valuations, such as interest rate changes, geopolitical events, and shifts in consumer sentiment.

-

Incorporation of relevant charts and graphs from BofA's analysis: BofA's reports frequently include charts and graphs illustrating key trends and supporting their conclusions. These visuals aid in understanding the complexities of high stock market valuations and interpreting their analysis. Remember to always refer to the original sources for the most accurate and up-to-date data.

Identifying Overvalued vs. Undervalued Stocks

Using BofA's analysis as a starting point, coupled with your own due diligence, is crucial for identifying potentially overvalued and undervalued stocks. This involves a combination of quantitative and qualitative analysis.

-

Explanation of key valuation metrics (P/E ratio, PEG ratio, Price-to-Sales ratio, etc.): Understanding key valuation metrics is fundamental. The P/E ratio compares a company's stock price to its earnings per share, while the PEG ratio adjusts the P/E ratio for growth. Price-to-sales ratio compares a company's market capitalization to its revenue. Each offers a different perspective on valuation.

-

Steps to analyze a company's financial statements to gauge intrinsic value: Scrutinizing a company's balance sheet, income statement, and cash flow statement provides crucial insights into its financial health and potential for future growth. This helps determine intrinsic value, comparing it to the current market price.

-

How to compare a company's valuation to its peers and industry averages: Comparing a company's valuation metrics to its competitors and industry averages helps determine if it's relatively overvalued or undervalued. Industry benchmarks provide crucial context.

-

Strategies for identifying growth stocks with sustainable valuations: Growth stocks can offer substantial returns, but sustainable valuations are essential. Look for companies exhibiting consistent revenue and earnings growth, strong competitive advantages, and a solid management team. Avoid companies solely driven by hype.

Risk Management Strategies in a High-Valuation Market

When high stock market valuations prevail, implementing robust risk management strategies is paramount.

-

Diversification strategies across asset classes (bonds, real estate, etc.): Diversifying your portfolio across different asset classes reduces your overall risk. Bonds and real estate can provide a hedge against equity market volatility.

-

Importance of a well-defined risk tolerance and investment timeline: Understanding your risk tolerance and investment timeline helps you tailor your portfolio to your individual needs. Long-term investors may tolerate more risk than short-term investors.

-

Utilizing stop-loss orders to limit potential losses: Stop-loss orders automatically sell a stock if it falls below a predetermined price, limiting potential losses.

-

Dollar-cost averaging to mitigate the impact of market volatility: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market price, reducing the risk of investing a lump sum at a market peak.

-

Exploring alternative investment strategies (e.g., value investing): Value investing focuses on identifying undervalued companies, potentially offering attractive returns in a high-valuation market.

Opportunities within High Stock Market Valuations

Even with high stock market valuations, opportunities exist for discerning investors.

-

Focusing on companies with strong fundamentals and future growth potential: Identify companies with consistent earnings growth, strong balance sheets, and a clear path to future expansion.

-

Identifying undervalued sectors or specific companies within overvalued sectors: Even within overvalued sectors, some companies may be undervalued relative to their peers. Thorough research and analysis are key.

-

Utilizing sector rotation strategies to capitalize on market shifts: Sector rotation involves shifting investments from one sector to another based on their relative performance and future prospects.

-

Exploring dividend-paying stocks for income generation: Dividend-paying stocks offer a regular income stream, which can be particularly attractive in a volatile market.

Conclusion

Successfully navigating high stock market valuations requires careful analysis and strategic planning. This guide, leveraging BofA's insights and incorporating diverse strategies, emphasizes the importance of understanding valuation metrics, managing risk effectively, and identifying potential opportunities even in a challenging market environment. Remember to conduct your own thorough research and consider consulting a financial advisor before making any investment decisions. Use this guide and BofA's insights to build a robust investment strategy tailored to your risk tolerance and financial goals. Learn more about managing your portfolio in the face of high stock market valuations by [link to relevant resource/BofA report]. Don't let high valuations deter you – utilize this knowledge to make informed decisions and potentially profit from the current market landscape.

Featured Posts

-

Ray Epps V Fox News A Deep Dive Into The Jan 6th Defamation Lawsuit

Apr 29, 2025

Ray Epps V Fox News A Deep Dive Into The Jan 6th Defamation Lawsuit

Apr 29, 2025 -

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 29, 2025

January 6th Hearing Witness Cassidy Hutchinson To Publish Memoir

Apr 29, 2025 -

Analyzing Pitchers Name S Performance Mets Rotation Contender

Apr 29, 2025

Analyzing Pitchers Name S Performance Mets Rotation Contender

Apr 29, 2025 -

Kl Ma Tryd Merfth En Antlaq Fn Abwzby Fy 19 Nwfmbr

Apr 29, 2025

Kl Ma Tryd Merfth En Antlaq Fn Abwzby Fy 19 Nwfmbr

Apr 29, 2025 -

Trumps Trade War Assessing The Impact Of Tariffs On Us Consumers

Apr 29, 2025

Trumps Trade War Assessing The Impact Of Tariffs On Us Consumers

Apr 29, 2025

Latest Posts

-

Wife Of Country Music Legend Addresses Sons Caretaker Rumors

Apr 29, 2025

Wife Of Country Music Legend Addresses Sons Caretaker Rumors

Apr 29, 2025 -

1 050 V Mware Price Hike At And T Sounds Alarm On Broadcom Acquisition

Apr 29, 2025

1 050 V Mware Price Hike At And T Sounds Alarm On Broadcom Acquisition

Apr 29, 2025 -

Report Country Music Icons Son Not Family Caretaker Wife Says

Apr 29, 2025

Report Country Music Icons Son Not Family Caretaker Wife Says

Apr 29, 2025 -

V Mware Costs To Skyrocket 1 050 At And Ts Concerns Over Broadcoms Price Hike

Apr 29, 2025

V Mware Costs To Skyrocket 1 050 At And Ts Concerns Over Broadcoms Price Hike

Apr 29, 2025 -

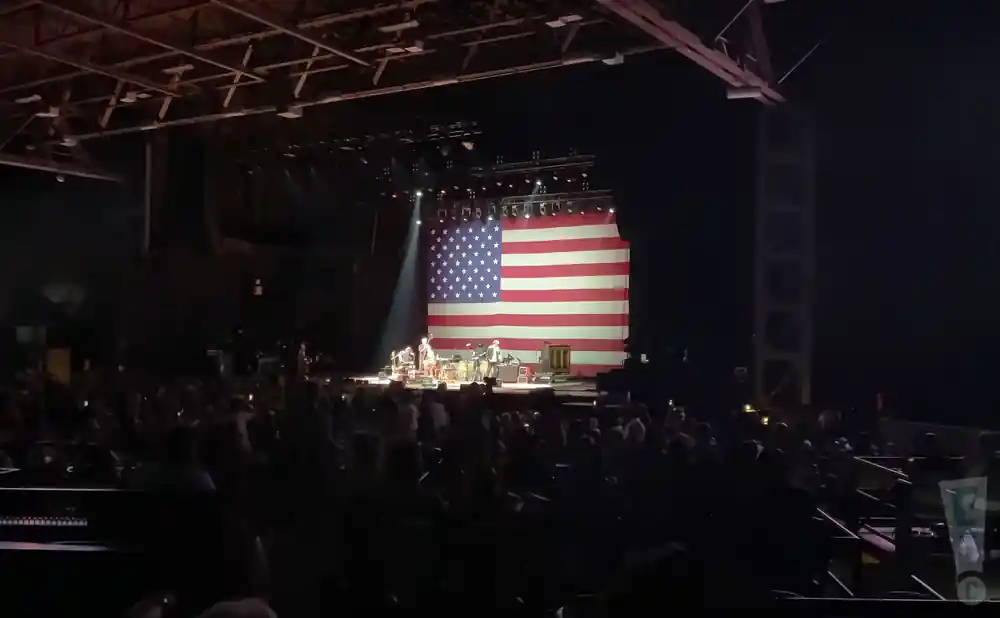

See Bob Dylan And Billy Strings At The Outlaw Music Festival In Portland

Apr 29, 2025

See Bob Dylan And Billy Strings At The Outlaw Music Festival In Portland

Apr 29, 2025