Investor Guide: Understanding And Addressing High Stock Market Valuations (BofA)

Table of Contents

The current market presents significant challenges for investors due to high stock market valuations. This BofA investor guide will help you understand and address these elevated valuations, ultimately protecting and growing your portfolio. We'll explore the factors contributing to these high valuations, assess the associated risks, and provide actionable steps for navigating this complex environment.

Understanding High Stock Market Valuations

Defining Market Valuation Metrics

Understanding market valuation requires familiarity with key metrics. The Price-to-Earnings (P/E) ratio, for example, compares a company's stock price to its earnings per share. A high P/E ratio often suggests a high valuation, indicating investors are paying a premium for each dollar of earnings. Similarly, the Price-to-Sales (P/S) ratio compares a company's stock price to its revenue per share. Other relevant metrics include the Price-to-Book (P/B) ratio, which compares a company's market capitalization to its book value, and the dividend yield, which expresses the annual dividend per share relative to the stock price.

| Valuation Metric | Description | Interpretation | Application |

|---|---|---|---|

| P/E Ratio | Stock Price / Earnings per Share | High P/E suggests high valuation; low P/E may indicate undervaluation. | Useful for comparing companies within the same industry. |

| P/S Ratio | Stock Price / Revenue per Share | Useful for valuing companies with negative earnings. | Particularly relevant for growth stocks. |

| P/B Ratio | Market Capitalization / Book Value | Indicates the market's assessment of a company's net asset value. | Helpful for valuing asset-heavy companies. |

- Explain the limitations of using single metrics: Relying on a single metric can be misleading. A comprehensive analysis requires considering multiple metrics in conjunction with other factors.

- Highlight the importance of comparing valuations across sectors and industries: Valuation multiples vary significantly across sectors. Comparing a technology company's P/E ratio to that of a utility company is not directly meaningful.

- Discuss how interest rates affect valuation multiples: Lower interest rates generally lead to higher valuation multiples, as investors seek higher-yielding assets.

Identifying Factors Contributing to High Valuations

Several factors contribute to high stock market valuations.

-

Low interest rates: Low interest rates make borrowing cheaper for companies and reduce the opportunity cost of investing in stocks, pushing up valuations.

-

Quantitative easing: Central bank policies like quantitative easing inject liquidity into the market, increasing demand for assets and driving up prices.

-

Technological advancements: Rapid technological advancements can fuel strong growth expectations, leading to higher valuations for innovative companies.

-

Strong corporate earnings: Sustained periods of strong corporate earnings can justify higher stock prices.

-

Investor sentiment and market psychology: Market psychology and investor sentiment play a significant role. Periods of optimism and exuberance can inflate valuations beyond fundamental justification.

-

Analyze the impact of specific economic policies on valuations: Government policies, such as tax cuts or deregulation, can significantly impact valuations.

-

Examine the influence of global events and geopolitical factors: Global events, such as trade wars or political instability, can influence investor sentiment and valuations.

-

Assess the role of speculative investment: Speculative trading and momentum investing can amplify price fluctuations and lead to unsustainable valuation levels.

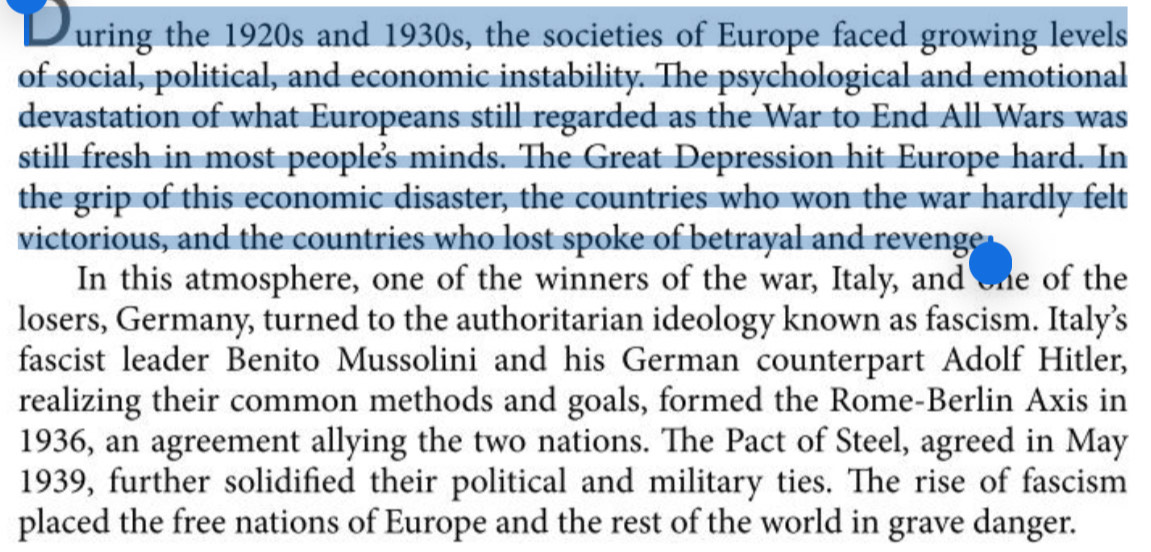

Assessing the Risks Associated with High Valuations

Increased Volatility and Market Corrections

High valuations increase the probability of significant market corrections. When valuations are stretched, even minor negative news can trigger sharp price declines.

-

Explain the higher probability of significant market corrections when valuations are high: History shows a strong correlation between high valuations and subsequent market corrections or crashes.

-

Discuss historical examples of market crashes following periods of high valuations: The dot-com bubble of the late 1990s and the 2008 financial crisis are prime examples.

-

Highlight the importance of diversification to mitigate risk: Diversifying your portfolio across different asset classes reduces your exposure to any single market segment.

-

Explain the benefits of having a robust risk management strategy: A well-defined risk management plan helps you identify, assess, and mitigate potential risks.

-

Discuss the potential impact on different asset classes: High valuations in one asset class may not necessarily translate to high valuations in others.

Reduced Potential Returns

High valuations generally imply lower expected future returns. Investors paying a premium for assets today are likely to see lower returns compared to investing at lower valuations.

-

Explain how high valuations translate to lower expected future returns: Basic valuation principles suggest a negative correlation between current valuation and future returns.

-

Discuss the impact on long-term investment goals: Lower returns can make it more challenging to achieve long-term financial goals, such as retirement savings.

-

Illustrate the relationship between valuation and future return using historical data: Empirical evidence supports the inverse relationship between valuations and subsequent returns.

-

Explain the concept of mean reversion in stock prices: While not guaranteed, market valuations tend to revert to their historical averages over the long term.

-

Discuss the importance of setting realistic return expectations: Investors should temper their expectations given the current market environment.

Strategies for Addressing High Stock Market Valuations

Diversification and Asset Allocation

A well-diversified portfolio is crucial in a high-valuation market. This involves spreading investments across different asset classes, such as stocks, bonds, real estate, and alternative investments.

-

Emphasize the importance of a well-diversified portfolio across asset classes (stocks, bonds, real estate, etc.): Diversification reduces your overall portfolio risk.

-

Discuss the benefits of strategic asset allocation based on risk tolerance and investment goals: Asset allocation should reflect your individual risk tolerance and investment timeline.

-

Provide examples of diversified portfolios: A sample portfolio might include a mix of domestic and international stocks, bonds, and real estate investment trusts (REITs).

-

Explain how to adjust asset allocation based on market conditions: Your asset allocation strategy should be regularly reviewed and adjusted to reflect changing market conditions.

-

Discuss the use of alternative investments to reduce risk: Alternative investments, such as hedge funds or private equity, can offer diversification benefits and potentially lower correlation with traditional asset classes.

Value Investing and Stock Selection

Value investing focuses on identifying undervalued companies. This strategy becomes particularly relevant in high-valuation markets, where finding undervalued opportunities is key.

-

Introduce the concept of value investing and its relevance in high-valuation markets: Value investing emphasizes buying assets below their intrinsic value.

-

Explain how to identify undervalued stocks using fundamental analysis: Fundamental analysis involves examining a company's financial statements, business model, and competitive landscape.

-

Provide examples of value investing strategies: Look for companies with low P/E ratios, high dividend yields, and strong balance sheets.

-

Discuss the importance of due diligence in stock selection: Thorough research is essential to ensure you're making informed investment decisions.

-

Explain how to assess a company's financial health and future prospects: Analyze key financial ratios, assess management quality, and evaluate the company's competitive advantage.

Tactical Adjustments to Your Portfolio

Tactical adjustments may include reducing equity exposure, increasing cash holdings, or shifting to less volatile asset classes. Regular portfolio reviews are essential.

-

Discuss strategies such as reducing equity exposure, increasing cash holdings, or shifting to less volatile asset classes: These adjustments can help mitigate risk during periods of high valuation.

-

Highlight the importance of regularly reviewing and adjusting your portfolio based on market conditions: Market conditions change constantly, requiring proactive portfolio management.

-

Provide examples of tactical portfolio adjustments: Shifting from growth stocks to value stocks, increasing bond allocations, or moving into cash are potential tactical adjustments.

-

Discuss the importance of having a long-term investment horizon: A long-term perspective helps reduce the impact of short-term market volatility.

-

Explain the role of professional financial advice: Consider seeking professional financial advice to develop a personalized investment strategy.

Conclusion

High stock market valuations present both challenges and opportunities. By understanding the driving factors, assessing the risks, and implementing appropriate strategies, investors can navigate this environment effectively. This BofA investor guide provided tools for analyzing market valuations, managing risk, and making informed investment decisions. Remember to regularly review your portfolio, adapt your strategy, and consider seeking professional financial advice. Successfully navigating high stock market valuations requires consistent monitoring and a proactive approach. Don't hesitate to seek further information on managing your investments effectively in the face of high stock market valuations.

Featured Posts

-

Retos Legales 18 Recursos De Nulidad En Las Primarias 2025

May 19, 2025

Retos Legales 18 Recursos De Nulidad En Las Primarias 2025

May 19, 2025 -

The Eus Tightening Grip A Growing Exodus Of Europeans

May 19, 2025

The Eus Tightening Grip A Growing Exodus Of Europeans

May 19, 2025 -

Getting To Universal Epic Universe From Sun Rail And Brightline A Practical Guide

May 19, 2025

Getting To Universal Epic Universe From Sun Rail And Brightline A Practical Guide

May 19, 2025 -

March 17th Nyt Connections Puzzle 645 Hints And Solutions

May 19, 2025

March 17th Nyt Connections Puzzle 645 Hints And Solutions

May 19, 2025 -

Kristen Stewart Leading The Charge In Hollywoods Transformation

May 19, 2025

Kristen Stewart Leading The Charge In Hollywoods Transformation

May 19, 2025

Latest Posts

-

Cellcom Outage Extended Recovery Time For Calls And Texts

May 19, 2025

Cellcom Outage Extended Recovery Time For Calls And Texts

May 19, 2025 -

Can The Mets Break Out Of Their Hitting Slump

May 19, 2025

Can The Mets Break Out Of Their Hitting Slump

May 19, 2025 -

Phillies Triple A Slugger Promotion Or Patience

May 19, 2025

Phillies Triple A Slugger Promotion Or Patience

May 19, 2025 -

Mets Offensive Slump A Look At The Statistics

May 19, 2025

Mets Offensive Slump A Look At The Statistics

May 19, 2025 -

The Mets Hitting Woes Causes And Potential Solutions

May 19, 2025

The Mets Hitting Woes Causes And Potential Solutions

May 19, 2025