Investors Are Piling Into This Hot New SPAC Stock: Should You Follow Suit?

Table of Contents

Understanding the Hype Surrounding This SPAC Stock

Before diving into the specifics, let's quickly define what a SPAC is. A SPAC, or Special Purpose Acquisition Company, is essentially a shell corporation formed to raise capital through an initial public offering (IPO) with the sole purpose of acquiring a private company. The allure of SPACs lies in their potential for high returns, but they also carry substantial risk.

This particular SPAC stock is generating significant buzz due to several key factors:

-

Strong leadership with a proven track record: The management team boasts extensive experience in the target industry, instilling confidence in their ability to successfully identify and integrate a promising acquisition target. Their past successes demonstrate a keen eye for opportunity and a knack for generating value.

-

Disruptive technology in a high-growth market: The SPAC aims to acquire a company operating in a rapidly expanding sector with a revolutionary technology poised to disrupt the status quo. This potential for exponential growth is a major draw for investors.

-

Favorable regulatory environment: The target industry benefits from a supportive regulatory landscape, minimizing potential roadblocks to growth and expansion. This reduces uncertainty and enhances the attractiveness of the investment.

-

Strategic partnerships secured: The SPAC has already established key partnerships with influential players in the industry, providing access to valuable resources, distribution channels, and expertise.

While the potential for high returns is enticing, it's crucial to remember that SPAC investments are inherently volatile. The SPAC market is known for its ups and downs, and the value of your investment can fluctuate significantly.

Analyzing the Financials and Projections of the SPAC Stock

Analyzing the financials of a SPAC presents unique challenges. Pre-merger, the SPAC's financials primarily reflect cash on hand and operating expenses related to the search for an acquisition target. Post-merger projections, often provided by the SPAC, are naturally subject to a higher degree of uncertainty.

-

Current valuation and market capitalization: [Insert current data here, if available. Otherwise, state that data is not yet available and explain why.]

-

Projected revenue and earnings growth: [Insert projected data here, if available. Clearly state any assumptions underlying these projections and emphasize that these are only projections and may not materialize.]

-

Debt levels and financial stability: [Insert relevant data, if available. Analyze the SPAC's debt-to-equity ratio and other relevant metrics to assess its financial health.]

Due diligence is paramount before investing in any SPAC. Scrutinize all available information, including the SPAC’s prospectus and any press releases. Don't solely rely on hype; focus on understanding the underlying fundamentals.

Comparing This SPAC Stock to its Competitors

To accurately assess the investment potential of this hot SPAC stock, it's essential to compare it to its competitors. Let's look at some key differentiators:

-

Market share and growth potential: [Compare the SPAC's projected market share and growth potential to its competitors. Highlight any competitive advantages or disadvantages.]

-

Technological innovation and intellectual property: [Analyze the technological advancements and intellectual property portfolio of the target company compared to its rivals. Identify any unique competitive advantages.]

-

Pricing strategies and profitability: [Compare pricing strategies and profit margins. Are there any pricing advantages or disadvantages compared to the competition?]

-

Management team expertise and experience: [Compare the experience and expertise of the management teams of the SPAC and its competitors. Highlight any significant differences.]

Assessing the Risks and Rewards of Investing in This SPAC Stock

Investing in SPACs involves significant risks. Unlike traditional IPOs where you're investing in an established company, SPACs present a higher degree of uncertainty.

-

Potential for high returns if the merger is successful and the target company performs well: Successful mergers and strong post-merger performance can lead to substantial returns for investors.

-

Risk of losing some or all of your investment if the merger fails or the target company underperforms: Merger failures or poor performance by the acquired company can result in significant losses.

-

Volatility of SPAC stock prices: SPAC stocks can experience significant price fluctuations, particularly in the period leading up to and following a merger announcement.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investing in SPACs is inherently risky, and you could lose all of your investment.

Conclusion

This hot SPAC stock presents a compelling investment opportunity, but it’s not without risks. The strong management team, disruptive technology, and favorable regulatory environment are positive factors. However, the inherent volatility of SPACs and the uncertainty surrounding the post-merger performance require careful consideration. The analysis presented here provides a framework for evaluating this specific SPAC, but it's not exhaustive.

Call to Action: Do your due diligence. Weigh the risks and rewards carefully. Consult a financial advisor before investing in this hot SPAC stock or any other SPAC. Remember that informed decision-making is crucial for success in the dynamic world of SPAC investments.

Featured Posts

-

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Isverenler Ve Calisanlar Icin Rehber

May 08, 2025

Brezilya Bitcoin Maas Oedemelerini Yasallastiriyor Isverenler Ve Calisanlar Icin Rehber

May 08, 2025 -

Ethereum Price Prediction Significant Eth Accumulation Fuels Bullish Sentiment

May 08, 2025

Ethereum Price Prediction Significant Eth Accumulation Fuels Bullish Sentiment

May 08, 2025 -

Reakcija Pavla Grbovica Na Predloge Za Prelaznu Vladu

May 08, 2025

Reakcija Pavla Grbovica Na Predloge Za Prelaznu Vladu

May 08, 2025 -

Counting Crows Slip Into The Shadows A Deep Dive Into The Aurora Album

May 08, 2025

Counting Crows Slip Into The Shadows A Deep Dive Into The Aurora Album

May 08, 2025 -

Secure Your Psl 10 Tickets Sales Open Today

May 08, 2025

Secure Your Psl 10 Tickets Sales Open Today

May 08, 2025

Latest Posts

-

Lakers Kuzma On Celtics Tatums Viral Instagram Update

May 08, 2025

Lakers Kuzma On Celtics Tatums Viral Instagram Update

May 08, 2025 -

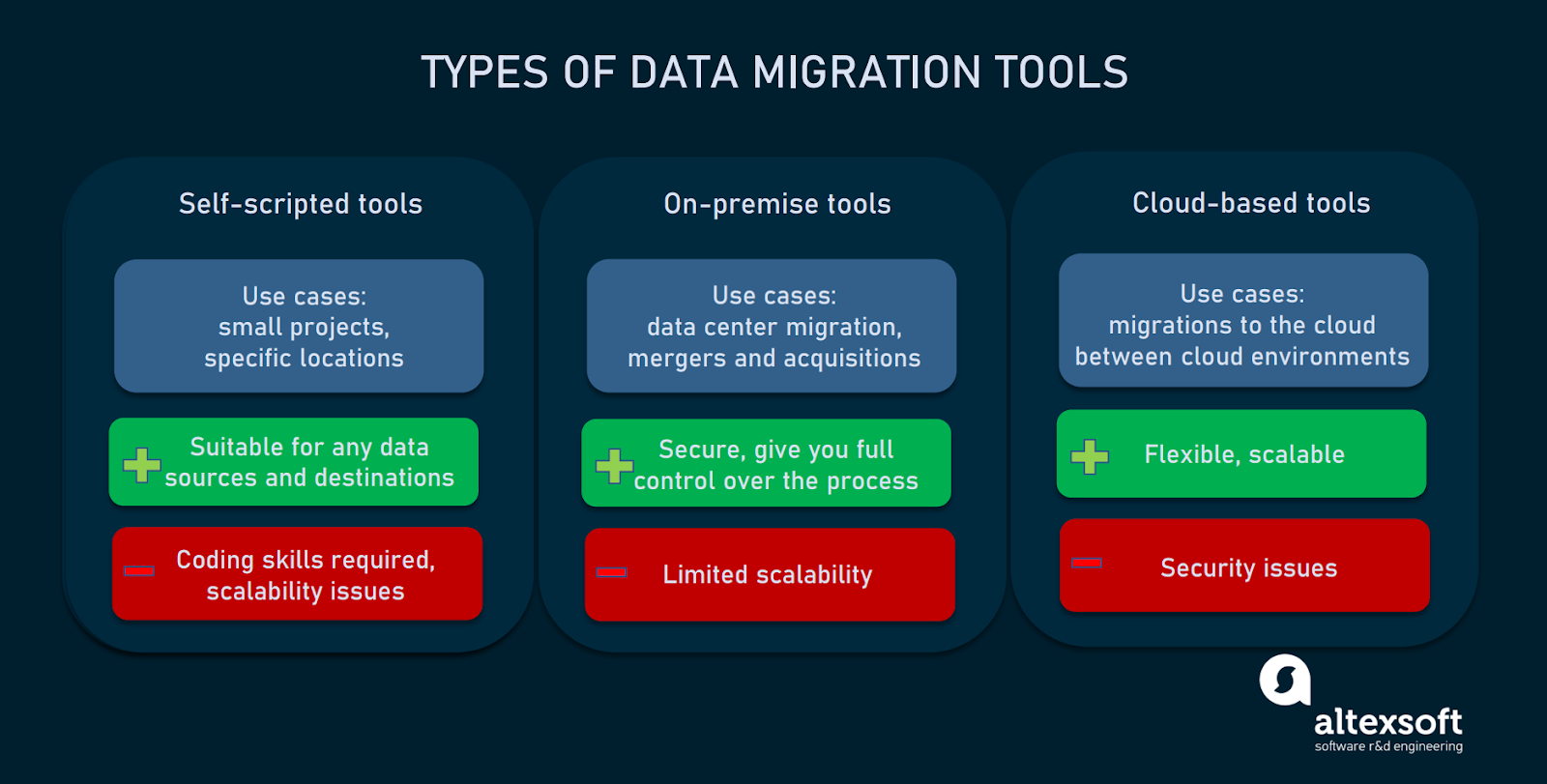

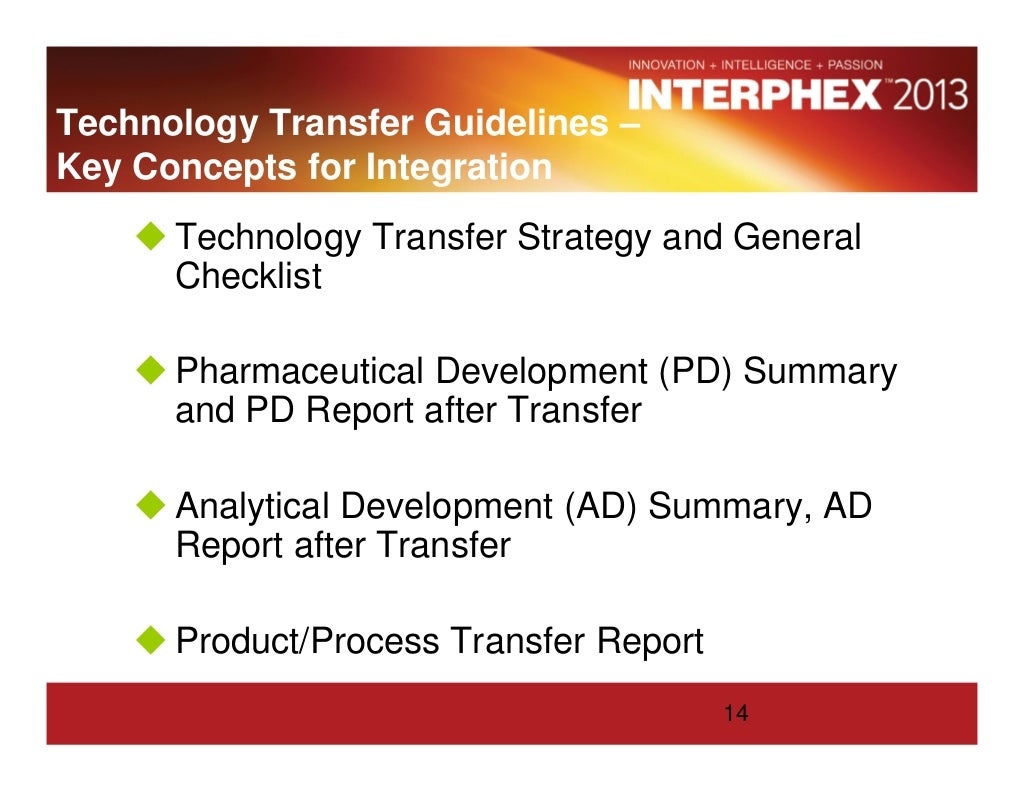

Efficient Data Transfer Methods And Technologies For Seamless Migration

May 08, 2025

Efficient Data Transfer Methods And Technologies For Seamless Migration

May 08, 2025 -

Kuzma Weighs In Viral Instagram Post By Jayson Tatum

May 08, 2025

Kuzma Weighs In Viral Instagram Post By Jayson Tatum

May 08, 2025 -

Understanding Data Transfer Best Practices And Challenges

May 08, 2025

Understanding Data Transfer Best Practices And Challenges

May 08, 2025 -

Kyle Kuzma Responds To Jayson Tatums Trending Instagram Post

May 08, 2025

Kyle Kuzma Responds To Jayson Tatums Trending Instagram Post

May 08, 2025