Investor's Guide: BofA's View On Elevated Stock Market Valuations

Table of Contents

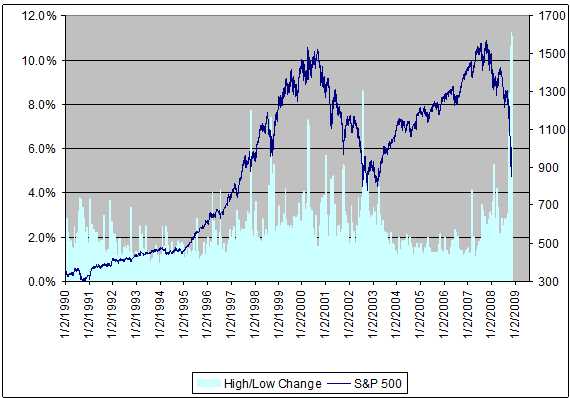

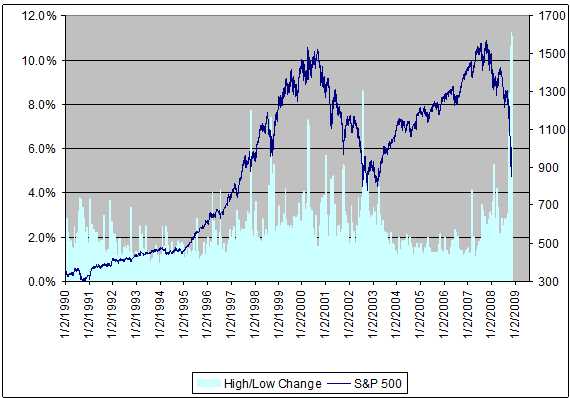

BofA's Assessment of Current Market Valuations

Bank of America's stance on current market valuations often reflects a cautious optimism, acknowledging the elevated levels but considering various factors before declaring them unequivocally "high," "fair," or "low." Their assessments are usually found in their regular market commentary and research reports, often referencing specific indices and sectors. It's important to note that BofA's view may evolve as market conditions change.

-

Key Arguments: BofA typically supports its valuation assessment by considering a range of factors, including:

- Strong corporate earnings growth (though potentially unsustainable).

- Low interest rates (historically low, impacting valuations).

- Strong investor sentiment (but susceptible to shifts).

- Geopolitical and economic uncertainty (introducing volatility).

-

Key Metrics: BofA's analysis uses various metrics, including:

- Price-to-Earnings (P/E) ratio: Comparing a company's stock price to its earnings per share. High P/E ratios often suggest overvaluation.

- Shiller P/E ratio (CAPE): A cyclically adjusted P/E ratio, which smooths out earnings fluctuations over a longer period, providing a potentially more stable valuation measure.

- Dividend yield: The annual dividend payment relative to the stock price; low yields can indicate overvaluation.

-

Economic Indicators: BofA considers key economic indicators like:

- Interest rates: Rising interest rates can negatively impact stock valuations.

- Inflation: High inflation erodes purchasing power and can impact corporate profits, influencing stock prices.

- GDP growth: Strong GDP growth can support higher stock valuations, but only if sustained.

Potential Risks Associated with Elevated Stock Market Valuations

BofA, like many financial institutions, highlights several risks associated with elevated stock market valuations. These risks can lead to significant portfolio losses if not carefully managed.

- Market Corrections: Overvalued markets are susceptible to sharp corrections, where prices fall rapidly. This can lead to substantial short-term losses.

- Reduced Returns: Even without a significant correction, overvalued markets often yield lower returns compared to markets with more reasonable valuations. Investors may experience slower growth of their investments.

- Potential Bubbles: In extreme cases, elevated valuations can indicate the formation of speculative bubbles, which can burst dramatically, causing significant market turmoil.

- Impact of Rising Interest Rates: Higher interest rates typically make bonds more attractive, drawing investment away from stocks and putting downward pressure on stock valuations.

- Sector-Specific Risks: BofA may highlight specific sectors particularly vulnerable to overvaluation, such as those experiencing rapid growth but lacking a strong foundation for sustained performance.

BofA's Predictions and Outlook for the Market

BofA's predictions are typically presented cautiously, acknowledging the inherent uncertainty in market forecasting. Their outlook usually considers the current elevated valuations and the potential impact of various economic factors. Accessing their most current reports is essential for up-to-date information.

- Short-Term and Long-Term Projections: BofA might offer short-term predictions (e.g., next 6-12 months) and longer-term outlooks (e.g., 3-5 years). These predictions will factor in elevated valuations and potential market corrections.

- Sectoral Outperformance/Underperformance: BofA may identify sectors they expect to outperform or underperform the broader market, based on their valuation assessments and economic outlook. This can inform strategic portfolio allocation decisions.

- Suggested Investment Strategies: BofA's suggested strategies might involve diversification, sector rotation, and a focus on undervalued or less-volatile assets.

Strategies for Investors in a Market with Elevated Valuations

Navigating a market with elevated valuations requires a prudent approach. BofA's recommendations often emphasize risk management and a long-term perspective.

- Diversification: Spread your investments across different asset classes (stocks, bonds, real estate, etc.) and sectors to reduce the impact of any single market downturn.

- Fundamental Analysis: Focus on analyzing the intrinsic value of companies rather than chasing short-term gains based on market hype. This ensures sound investments.

- Alternative Investments: Consider alternative investments like real estate or commodities to diversify beyond traditional stocks and bonds.

- Long-Term Investment Horizon: Adopt a long-term investment strategy, allowing time to weather market fluctuations and benefit from long-term growth.

Understanding BofA's Methodology and Limitations

It’s crucial to understand the limitations of any market analysis, including BofA's.

- Data Sources and Models: Transparency regarding the data sources and analytical models used by BofA is essential. Understanding their approach allows investors to assess the reliability of their conclusions.

- Potential Biases: Recognize that BofA, like any financial institution, may have inherent biases or conflicts of interest that could influence their analysis.

- Inherent Uncertainty: Market predictions are inherently uncertain. Even the most sophisticated analyses can be inaccurate.

Conclusion

This investor's guide has summarized BofA's perspective on elevated stock market valuations, highlighting potential risks and suggesting strategies for navigating this challenging environment. Understanding BofA's analysis, along with your own due diligence, is crucial for making informed investment choices. Remember that even with expert opinions like BofA's, market fluctuations are unpredictable.

Call to Action: Stay informed about the latest developments regarding elevated stock market valuations by regularly reviewing financial news and expert analysis. Use this knowledge to carefully manage your portfolio and make sound investment decisions based on your risk tolerance and financial goals. Continue your research on navigating elevated stock market valuations for a more comprehensive understanding of current market conditions.

Featured Posts

-

Wind Power For Trains A Cost Effective And Eco Friendly Approach To Rail Travel

May 03, 2025

Wind Power For Trains A Cost Effective And Eco Friendly Approach To Rail Travel

May 03, 2025 -

April 16 2025 Lotto Results Winning Numbers

May 03, 2025

April 16 2025 Lotto Results Winning Numbers

May 03, 2025 -

Loyle Carners 3 Arena Show All The Details

May 03, 2025

Loyle Carners 3 Arena Show All The Details

May 03, 2025 -

Mta Sysdr Blay Styshn 6 Melwmat Wtwqeat

May 03, 2025

Mta Sysdr Blay Styshn 6 Melwmat Wtwqeat

May 03, 2025 -

Chat Gpt And Open Ai Face Ftc Investigation Data Privacy Concerns

May 03, 2025

Chat Gpt And Open Ai Face Ftc Investigation Data Privacy Concerns

May 03, 2025

Latest Posts

-

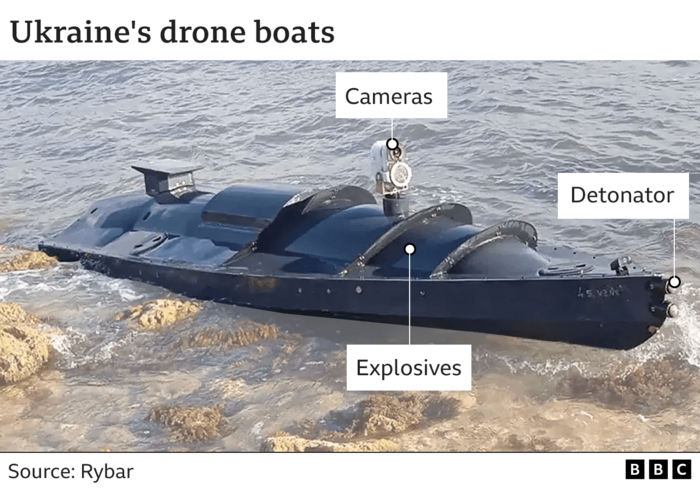

Drone Attack On Gaza Freedom Flotilla Ship Sos Signal Issued Near Malta

May 03, 2025

Drone Attack On Gaza Freedom Flotilla Ship Sos Signal Issued Near Malta

May 03, 2025 -

Malta Coast Gaza Freedom Flotilla Ship Issues Sos After Drone Attack

May 03, 2025

Malta Coast Gaza Freedom Flotilla Ship Issues Sos After Drone Attack

May 03, 2025 -

Gaza Freedom Flotilla Sos Ship Reports Drone Attack Off Malta

May 03, 2025

Gaza Freedom Flotilla Sos Ship Reports Drone Attack Off Malta

May 03, 2025 -

Barrow Afc Fans Take On Sky Bet Every Minute Matters Cycle Relay

May 03, 2025

Barrow Afc Fans Take On Sky Bet Every Minute Matters Cycle Relay

May 03, 2025 -

Barrow Afc Supporters Pedal For Charity In Sky Bet Relay

May 03, 2025

Barrow Afc Supporters Pedal For Charity In Sky Bet Relay

May 03, 2025