Is A 40% Increase In Palantir Stock By 2025 Realistic?

Table of Contents

Palantir's Current Financial Performance and Growth Trajectory

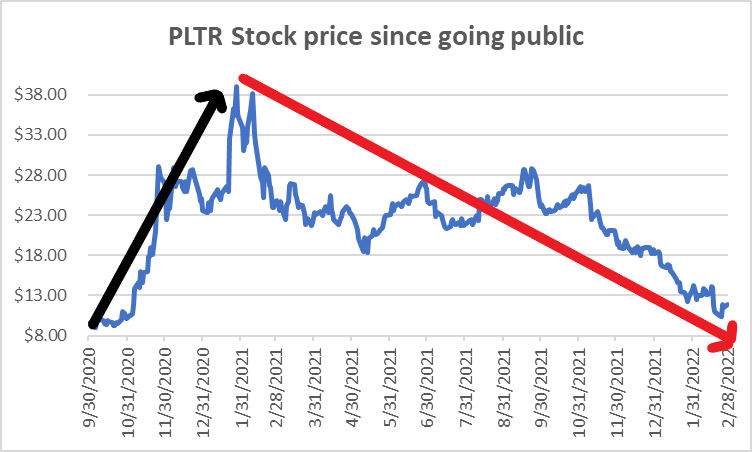

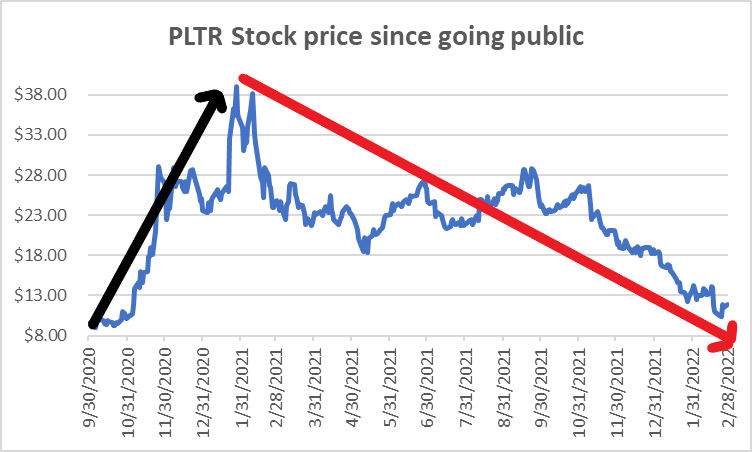

Analyzing Palantir's recent financial performance is crucial to predicting its future stock price. Examining quarterly and annual earnings reports reveals valuable insights into its growth trajectory. Key metrics like revenue growth rates, profitability trends, and the impact of key contracts and partnerships provide a comprehensive picture.

-

Review of PLTR's recent revenue figures and year-over-year growth: Consistent year-over-year revenue growth is a positive indicator. Analyzing the rate of this growth, and whether it's accelerating or decelerating, paints a clearer picture of Palantir's financial health. A significant jump in revenue often correlates with positive stock market movement.

-

Analysis of profit margins and operating expenses: Profitability is a critical factor. High profit margins suggest strong operational efficiency and pricing power. Conversely, high operating expenses could indicate inefficiencies and pressure on profitability. Monitoring these trends helps assess the sustainability of Palantir's growth.

-

Discussion of the company's cash flow and debt levels: A healthy cash flow is essential for future investments and expansion. High levels of debt can increase financial risk. Analyzing Palantir's cash flow statements and debt-to-equity ratio offers insights into its financial stability.

-

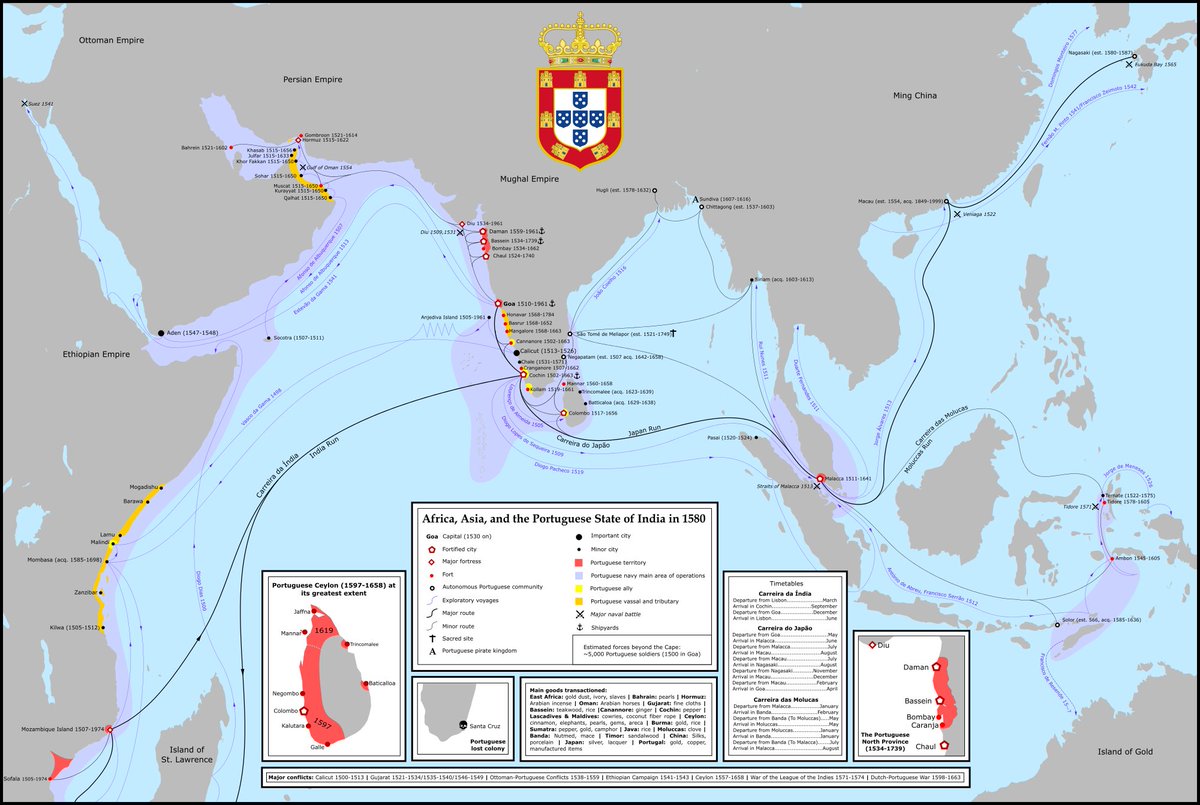

Evaluation of the impact of government and commercial contracts: Palantir's revenue is heavily influenced by government contracts. Analyzing the size, duration, and renewal rates of these contracts is vital. Expansion into the commercial sector also plays a crucial role in diversifying revenue streams and mitigating risk associated with government dependence.

Market Position and Competitive Landscape

Palantir operates in the highly competitive big data analytics and government contracting sectors. Understanding its market share and competitive landscape is essential for assessing its growth potential.

-

Discussion of Palantir's position in the data analytics market: Palantir's market share within the broader data analytics market provides context. This needs to be evaluated against the overall market growth rate and its position amongst its competitors.

-

Comparison with competitors such as Databricks, Snowflake, and others: A direct comparison with key competitors like Databricks and Snowflake reveals Palantir's relative strengths and weaknesses. This analysis should focus on technology, market reach, and customer base.

-

Analysis of Palantir's unique selling propositions (USPs): Identifying Palantir's unique selling propositions – whether it's its advanced algorithms, specialized data sets, or strong government relationships – helps understand its competitive advantage.

-

Assessment of the potential for market disruption and innovation: The data analytics landscape is constantly evolving. Palantir's ability to innovate and adapt to emerging technologies is critical for maintaining its competitive edge and driving future growth.

Future Growth Drivers and Potential Challenges

Predicting Palantir's future requires identifying both potential growth drivers and challenges.

-

Discussion of potential new product launches and market expansions: New product launches and expansion into new markets are significant catalysts for growth. This includes assessing the potential market size and the company's ability to successfully penetrate these new markets.

-

Analysis of the impact of geopolitical events on Palantir's business: Geopolitical instability and international relations can significantly impact government contracts. Assessing the risks and opportunities associated with geopolitical events is vital.

-

Assessment of the risk of increased competition and technological disruption: Increased competition from established players and disruptive startups poses a risk. Analyzing the competitive landscape and Palantir's ability to adapt to technological advancements is crucial.

-

Examination of the impact of macroeconomic factors on the company's growth: Economic downturns can negatively impact government spending and corporate investment in data analytics. Evaluating the sensitivity of Palantir's business to macroeconomic factors is necessary.

Analyst Predictions and Investor Sentiment

Understanding analyst predictions and investor sentiment provides valuable context for evaluating the plausibility of a 40% stock increase.

-

Summary of price targets set by major financial analysts: Analyzing price targets from reputable financial analysts provides insights into the market's expectations for Palantir's future performance. The range and consistency of these predictions are important considerations.

-

Analysis of recent trading volume and investor sentiment: High trading volume and positive investor sentiment often correlate with rising stock prices. Analyzing trading data and investor sentiment provides valuable clues.

-

Discussion of any recent press releases or news affecting the stock price: Significant news events, such as new contracts, product launches, or regulatory changes, can significantly impact Palantir's stock price. Staying informed about such news is crucial.

-

Review of social media sentiment and discussions around PLTR: Monitoring social media sentiment can offer insights into public opinion and investor confidence.

Conclusion

This analysis explored the plausibility of a 40% increase in Palantir stock by 2025. While Palantir possesses significant potential driven by its innovative technology and strong government contracts, significant challenges remain, including intense competition and economic uncertainties. A 40% increase is possible but depends on the successful execution of its growth strategy and favorable market conditions.

Call to Action: Stay informed on Palantir's progress and continue researching the Palantir stock forecast to make informed investment decisions. Understanding the factors influencing Palantir stock price is crucial for navigating the complexities of this dynamic market. Regularly reviewing Palantir's financial reports and industry news will help you assess the likelihood of a 40% increase in Palantir stock by 2025 and make sound investment choices.

Featured Posts

-

Vintervaer I Sor Norge Sno Og Vanskelige Kjoreforhold I Fjellet

May 09, 2025

Vintervaer I Sor Norge Sno Og Vanskelige Kjoreforhold I Fjellet

May 09, 2025 -

Jeanine Pirro Trumps Choice For Top Dc Prosecutor

May 09, 2025

Jeanine Pirro Trumps Choice For Top Dc Prosecutor

May 09, 2025 -

New Report Details Potential Uk Visa Application Restrictions

May 09, 2025

New Report Details Potential Uk Visa Application Restrictions

May 09, 2025 -

Fqdan Alasnan Fy Marakana Tfasyl Isabt Barbwza

May 09, 2025

Fqdan Alasnan Fy Marakana Tfasyl Isabt Barbwza

May 09, 2025 -

Altryq Ila Almjd Barys San Jyrman Fy Dwry Abtal Awrwba

May 09, 2025

Altryq Ila Almjd Barys San Jyrman Fy Dwry Abtal Awrwba

May 09, 2025