Is A Sabic Gas Business IPO On The Horizon For Saudi Arabia?

Table of Contents

The Allure of a Sabic Gas Business IPO for Saudi Arabia

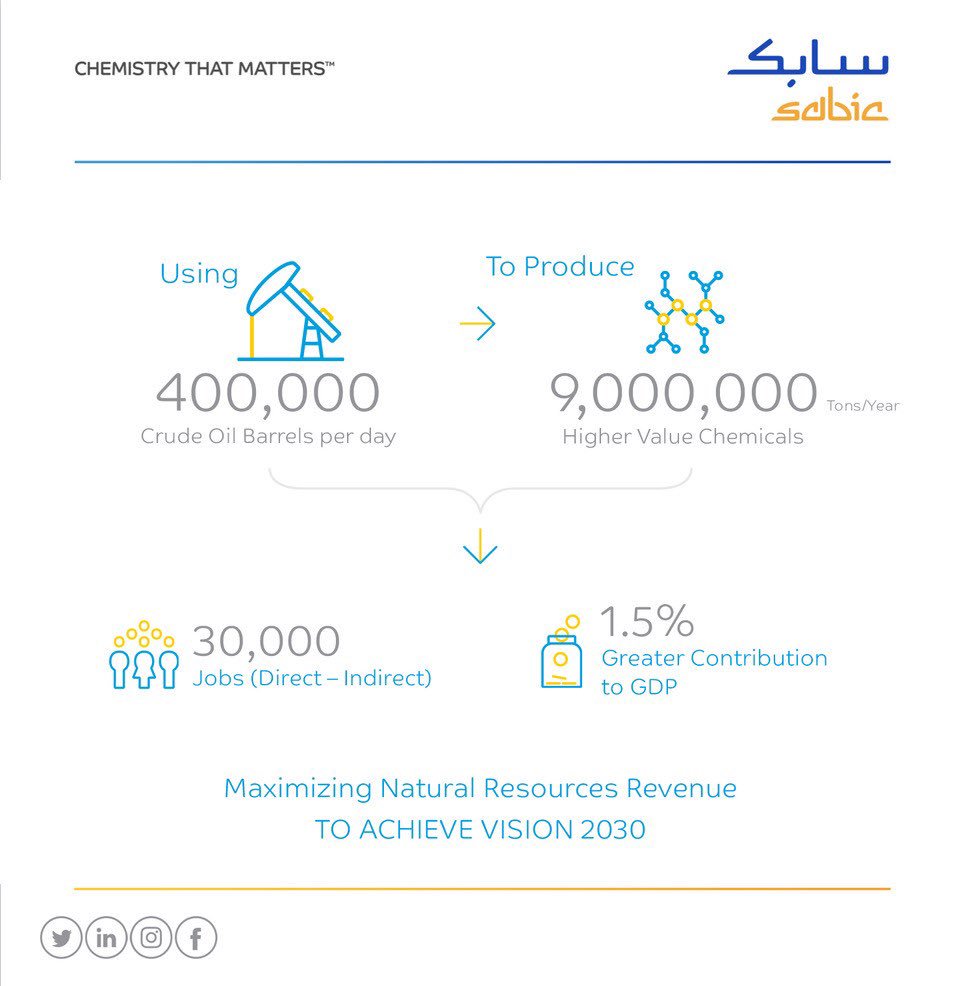

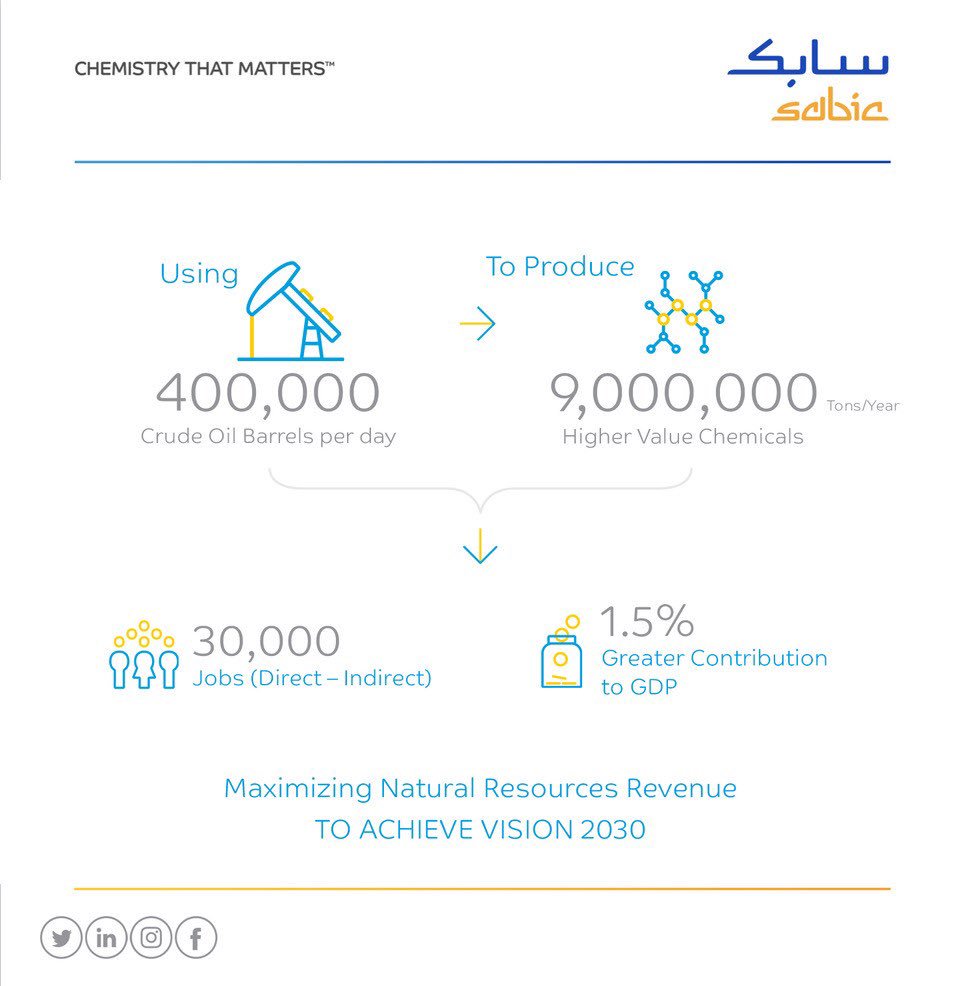

A Sabic gas IPO holds significant appeal for Saudi Arabia, offering a multitude of advantages aligned with its Vision 2030 objectives.

Economic Diversification and Revenue Generation

- Increased government revenue: An IPO would inject substantial capital into the Saudi Arabian government's coffers, reducing reliance on oil revenues and bolstering financial stability.

- Attracting foreign investment: The IPO would attract significant foreign direct investment (FDI) into the Saudi energy sector, bringing in expertise and capital.

- Boosting the Saudi stock market: A large-scale IPO like this would increase trading volume and market liquidity on the Tadawul, enhancing its global standing.

- Creating jobs: The resulting economic activity from the IPO and subsequent investment would stimulate job creation across various sectors.

A successful Sabic gas IPO would directly contribute to Vision 2030's diversification goals, lessening the kingdom's dependence on oil and fostering a more robust, sustainable economy. The substantial revenue generated could then be reinvested in other key sectors, driving further economic growth and development.

Strengthening the Saudi Stock Market

- Increased trading volume: A Sabic gas IPO would undoubtedly bring a surge in trading activity on the Tadawul (Saudi Stock Exchange).

- Attracting international investors: The IPO would attract a wave of international investors seeking exposure to the lucrative Saudi energy sector.

- Enhancing market liquidity: Increased trading would improve market liquidity, making it easier for investors to buy and sell shares.

- Improving market capitalization: The addition of a major player like Sabic's gas business would significantly boost the Tadawul's overall market capitalization.

The impact on the Tadawul would be transformative. By attracting international investors and increasing trading activity, a Sabic gas IPO could elevate the Tadawul's global standing, potentially rivaling other major energy sector exchanges. This success could be compared to other successful energy sector IPOs, providing a benchmark for future growth.

Global Market Positioning and Competitive Advantage

- Increased global visibility for Saudi Arabia's energy sector: The IPO would put the spotlight on Saudi Arabia's capabilities in the gas sector on a global scale.

- Showcasing technological advancements: The IPO would offer an opportunity to showcase Saudi Arabia's technological advancements in gas extraction, processing, and distribution.

- Attracting partnerships with international energy companies: A successful IPO would increase the attractiveness of partnerships and collaborations with global energy giants.

Strategically, a Sabic gas IPO would enhance Saudi Arabia's standing in the global energy market. Attracting foreign investment and partnerships would not only boost revenue but also foster technological exchange and collaboration, accelerating innovation within the Saudi energy sector.

Challenges and Considerations for a Sabic Gas IPO

While the potential benefits are significant, a Sabic gas IPO faces several challenges.

Valuation and Market Conditions

- Determining a fair market value for Sabic's gas assets: Accurately valuing such a large and complex asset is a critical challenge, requiring rigorous due diligence.

- Fluctuating global energy prices: Global energy markets are volatile; pricing the IPO correctly in the face of price fluctuations is crucial.

- Geopolitical instability: Geopolitical events can significantly impact investor sentiment and market conditions.

- Investor sentiment: Overall investor confidence in the global economy and the Saudi market will play a significant role in the IPO's success.

Transparency and reliable financial disclosures will be vital to attracting investors. A thorough assessment of market conditions and potential risks is crucial for determining a fair and attractive valuation.

Regulatory and Legal Framework

- Compliance with Saudi regulatory requirements: Navigating Saudi Arabia's regulatory landscape is essential for a smooth IPO process.

- International regulatory standards: Meeting international regulatory standards is crucial for attracting global investors.

- Transparency and disclosure: Maintaining complete transparency and accurate disclosures throughout the process is non-negotiable.

- Potential legal challenges: Potential legal challenges and disputes must be anticipated and mitigated.

The legal and regulatory aspects of the IPO process must be meticulously managed to ensure compliance and avoid delays or complications. Effective communication and collaboration with relevant authorities are key.

Strategic Partnerships and Future Growth

- Maintaining existing partnerships: The IPO should not negatively impact Sabic's valuable existing partnerships.

- Attracting new strategic investors: The IPO presents an opportunity to attract new strategic investors who can contribute to long-term growth.

- Balancing short-term gains with long-term strategic goals: The IPO's strategy must balance short-term financial benefits with Sabic's long-term strategic objectives for its gas business.

Careful consideration of the impact on Sabic's existing relationships and long-term strategic plans is critical. A well-structured IPO can strengthen these partnerships and attract new ones, ensuring continued growth and innovation.

Conclusion

A Sabic gas business IPO presents a significant opportunity for Saudi Arabia to advance its Vision 2030 goals, strengthen its stock market, and bolster its position in the global energy sector. While challenges related to valuation, regulation, and market conditions exist, the potential benefits are considerable. The success of such an IPO would significantly contribute to the diversification of the Saudi Arabian economy and enhance its standing on the global stage.

Call to Action: The possibility of a Sabic gas IPO is a developing story. Stay tuned for further updates and analysis on this pivotal development in Saudi Arabia's economic transformation. Continue to follow our coverage for the latest insights on the Sabic IPO and its implications for the Saudi energy sector and the global market. Learn more about the evolving landscape of Saudi Arabian IPOs and their impact on the global economy.

Featured Posts

-

Indian You Tuber Jyoti Malhotra Detained Espionage Accusations Related To Pakistan Trip

May 19, 2025

Indian You Tuber Jyoti Malhotra Detained Espionage Accusations Related To Pakistan Trip

May 19, 2025 -

You Tuber Jyoti Malhotras Contact With Pakistani Agents Before Pahalgam Terror Attack Full Story

May 19, 2025

You Tuber Jyoti Malhotras Contact With Pakistani Agents Before Pahalgam Terror Attack Full Story

May 19, 2025 -

Cne Establece Plazo Final Para Candidaturas Sin Primarias

May 19, 2025

Cne Establece Plazo Final Para Candidaturas Sin Primarias

May 19, 2025 -

Reaccion De Alfonso Arus A La Eleccion De Melody Para Eurovision 2025 En Arusero

May 19, 2025

Reaccion De Alfonso Arus A La Eleccion De Melody Para Eurovision 2025 En Arusero

May 19, 2025 -

Czy Eurowizja 2024 Dla Justyny Steczkowskiej Jest Zagrozona

May 19, 2025

Czy Eurowizja 2024 Dla Justyny Steczkowskiej Jest Zagrozona

May 19, 2025