Is A Trillion-Dollar Valuation For Palantir Realistic By 2030?

Table of Contents

Palantir's Current Market Position and Growth Potential

Analyzing Palantir's Current Revenue Streams and Market Share

Palantir's revenue streams are multifaceted, primarily stemming from its two core platforms: Gotham, focused on government contracts, and Foundry, catering to the commercial sector. Analyzing Palantir's current revenue and market share within the big data analytics and government contracting sectors is crucial to assessing its future potential.

- Key Contracts: Palantir boasts significant contracts with various government agencies (mention specific examples if available and publicly known, citing sources). These contracts provide a stable revenue base and demonstrate the company's ability to secure large-scale projects.

- Revenue Growth: Palantir has demonstrated (insert recent revenue growth figures and sources). This growth reflects increasing demand for its advanced data analytics capabilities.

- Market Projections: Industry analysts project significant growth in the data analytics market (insert market projections and sources), suggesting ample opportunity for Palantir to expand its market share. This growth, coupled with the increasing adoption of cloud-based solutions like Palantir Foundry, contributes to a positive outlook.

Assessing the Scalability of Palantir's Business Model

Palantir's software-as-a-service (SaaS) model offers considerable scalability advantages. The Foundry platform, in particular, facilitates rapid deployment and expansion across diverse industries and geographies.

- SaaS Model Advantages: The SaaS model allows for efficient resource allocation and recurring revenue streams, contributing to enhanced scalability.

- Global Expansion Plans: Palantir's ongoing global expansion efforts (mention specific geographic regions and strategies) are essential to achieving a trillion-dollar valuation. Success in these markets would significantly boost revenue.

- Scalability Challenges: Despite these advantages, challenges remain. Meeting the increasing demand while maintaining operational efficiency and data security will be crucial for sustained growth.

Key Factors Influencing Palantir's Future Valuation

The Role of Technological Advancements

Technological innovation is paramount to Palantir's future growth. Advancements in artificial intelligence (AI), machine learning (ML), and data analytics are vital for maintaining a competitive edge.

- AI and ML Integration: Further integration of AI and ML into Palantir's platforms will enhance their analytical capabilities and attract new customers.

- Data Analytics Innovation: Continuous innovation in data analytics methodologies is essential to improve the accuracy and efficiency of Palantir's solutions.

- Technological Breakthroughs: Potential breakthroughs in areas like quantum computing could significantly disrupt the market and offer Palantir new opportunities.

Competitive Landscape and Potential Threats

The data analytics market is highly competitive. Analyzing the competitive landscape is crucial for evaluating Palantir's long-term prospects.

- Major Competitors: Identifying and assessing the strengths and weaknesses of key competitors (mention specific competitors and their market positions) is critical to understand potential challenges.

- Market Disruptions: Emerging technologies and new market entrants could disrupt Palantir's dominance. Adaptability and innovation are key to mitigating these risks.

- Competitive Analysis: A comprehensive competitive analysis should be conducted regularly to identify emerging threats and opportunities.

Geopolitical Factors and Government Contracts

Geopolitical factors significantly influence Palantir's government contracts, a crucial component of its revenue.

- Government Spending: Changes in government spending on defense and intelligence can directly impact Palantir's revenue.

- International Relations: International relations and political stability in key markets can affect the demand for Palantir's services.

- Geopolitical Risks: Understanding and managing geopolitical risks is essential for Palantir to maintain a stable revenue stream from government contracts.

Financial Projections and Valuation Analysis

Financial Analysts' Predictions

Numerous financial analysts have offered predictions for Palantir's future performance and valuation.

- Forecast Models: Different forecast models (mention specific models and sources) project varying growth rates and valuations.

- Market Capitalization Projections: Analyzing these projections helps understand the range of possible outcomes and the likelihood of a trillion-dollar valuation.

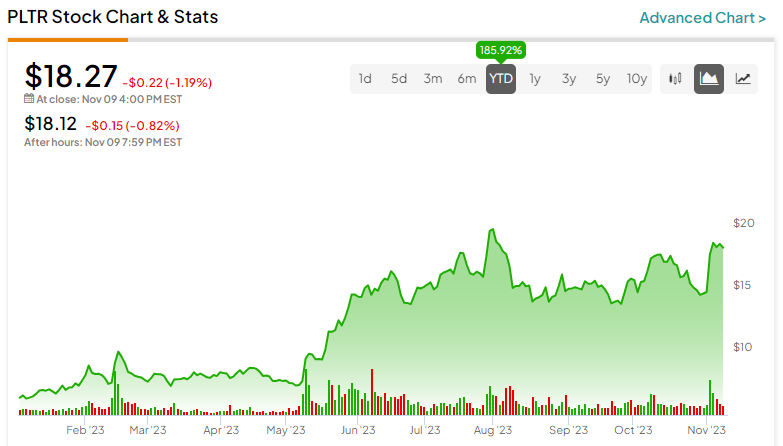

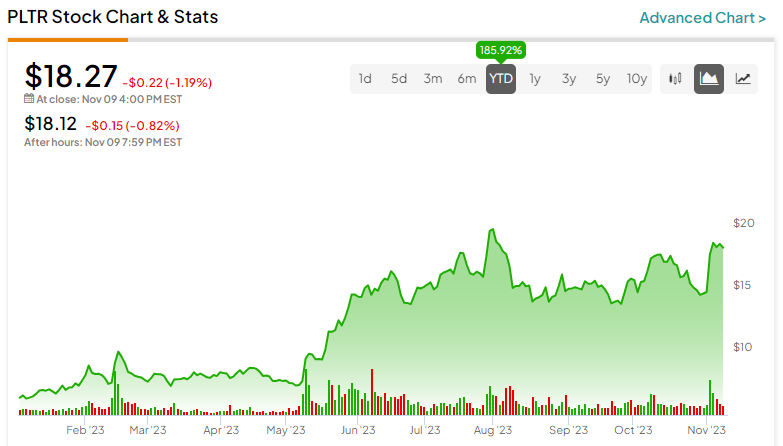

- Stock Price Predictions: Tracking Palantir's stock price and analyst ratings provides valuable insights into market sentiment and expectations.

Macroeconomic Factors

Macroeconomic factors such as inflation, interest rates, and potential economic recessions can significantly influence Palantir's valuation.

- Inflationary Pressures: High inflation can impact both revenue and expenses, potentially affecting profitability and valuation.

- Interest Rate Changes: Changes in interest rates can affect investor sentiment and the overall market valuation of technology companies.

- Economic Recessions: Economic downturns can reduce demand for Palantir's services, especially in the commercial sector.

Conclusion: Is a Trillion-Dollar Palantir Valuation Realistic by 2030?

Reaching a trillion-dollar valuation by 2030 presents significant challenges for Palantir. While the company enjoys a strong position in the data analytics market and demonstrates consistent growth, factors like intense competition, macroeconomic volatility, and geopolitical risks could hinder its progress. The success of its global expansion strategy and its ability to innovate and adapt to technological advancements will be crucial determinants of its future success.

Based on the analysis presented, a trillion-dollar valuation by 2030 appears ambitious but not entirely improbable. Sustained high growth rates, successful expansion into new markets, and the successful execution of its technological roadmap are all necessary for achieving this ambitious goal.

Keep an eye on Palantir's progress as it strives for a trillion-dollar valuation. Continue following the journey to a potential Palantir trillion-dollar valuation and conduct further research through reputable financial news sources and Palantir's investor relations page for a comprehensive understanding.

Featured Posts

-

Harry Styles Debuts A Seventies Style Mustache In London

May 09, 2025

Harry Styles Debuts A Seventies Style Mustache In London

May 09, 2025 -

Beyond The Monkey Anticipation Builds For Stephen Kings 2024 Releases

May 09, 2025

Beyond The Monkey Anticipation Builds For Stephen Kings 2024 Releases

May 09, 2025 -

Nyt Crossword April 6 2025 Hints Clues And Spangram Help

May 09, 2025

Nyt Crossword April 6 2025 Hints Clues And Spangram Help

May 09, 2025 -

Accident Mortel A Dijon Un Ouvrier Chute Du 4e Etage

May 09, 2025

Accident Mortel A Dijon Un Ouvrier Chute Du 4e Etage

May 09, 2025 -

11 Yjet E Psg Se Qe Sunduan Futbollin

May 09, 2025

11 Yjet E Psg Se Qe Sunduan Futbollin

May 09, 2025