Is A US XRP ETF Imminent? Latest XRP Price Predictions

Table of Contents

The Ripple-SEC Lawsuit and its Impact on XRP's Future

The ongoing legal battle between Ripple Labs and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's future and the potential for an XRP ETF. The outcome of this case will significantly influence investor confidence and the regulatory landscape surrounding XRP.

The Case's Progression and Potential Outcomes

The Ripple-SEC lawsuit centers around the SEC's claim that XRP is an unregistered security. Key milestones include the filing of the lawsuit, various court hearings, and the ongoing discovery process. Potential outcomes include:

- SEC Victory: A ruling in favor of the SEC could severely damage XRP's price and significantly hinder the chances of ETF approval. It might even lead to the classification of XRP as a security, impacting its trading and use.

- Ripple Victory: A favorable ruling for Ripple could dramatically boost XRP's price and pave the way for ETF applications. This would signal a more positive regulatory environment for XRP and potentially other cryptocurrencies.

- Settlement: A settlement between Ripple and the SEC could lead to a range of outcomes, from a partial victory for Ripple to a less severe outcome than a full SEC win. The specifics of any settlement would greatly impact XRP's future.

The positive resolution of this lawsuit is crucial for accelerating ETF approval. A clear win for Ripple would remove a major regulatory hurdle and significantly improve the likelihood of an XRP ETF being approved.

Market Sentiment and Investor Confidence

The Ripple-SEC lawsuit has significantly impacted investor confidence in XRP. During periods of negative news, trading volume decreased, and market capitalization fluctuated.

- Negative Sentiment: Uncertainty surrounding the lawsuit has caused some investors to sell off their XRP holdings, leading to price drops.

- Positive Sentiment: Positive developments in the case, such as favorable court rulings or a settlement in Ripple's favor, often lead to surges in trading volume and price increases.

A positive resolution to the lawsuit is likely to dramatically boost investor confidence, leading to a significant increase in XRP's price and market capitalization. This increased confidence would be a crucial factor in attracting institutional investors and increasing the likelihood of ETF approval.

The Growing Demand for Cryptocurrency ETFs

The appeal of cryptocurrency ETFs is growing rapidly. Investors are drawn to the benefits they offer, particularly in comparison to direct cryptocurrency investment.

The Appeal of ETFs for Investors

ETFs offer several advantages for investors:

- Diversification: ETFs allow investors to diversify their cryptocurrency holdings easily, mitigating risk.

- Ease of Access: Investing in an ETF is typically simpler and more accessible than directly purchasing and storing cryptocurrencies. This lowers the barrier to entry for many investors.

- Regulatory Oversight: ETFs are subject to regulatory oversight, offering a degree of protection and assurance to investors.

For XRP specifically, an ETF would make investing in this cryptocurrency significantly easier and more appealing to a wider range of investors, including institutional investors who often prefer the regulated environment ETFs provide.

Regulatory Landscape and ETF Approval Process

The regulatory landscape for cryptocurrencies in the US is complex and evolving. Securing SEC approval for an XRP ETF involves several steps:

- Filing a comprehensive application: This requires demonstrating the ETF's compliance with all relevant regulations.

- SEC review: The SEC will thoroughly review the application, assessing various aspects of the proposed ETF, including its risk profile and management.

- Meeting regulatory standards: The proposed ETF must meet stringent requirements for market surveillance, investor protection, and regulatory compliance.

Other ETF applications and approvals provide some indication of the hurdles Ripple would need to clear. The SEC's approach to each application is case-specific, with considerations such as the underlying asset's regulatory status being paramount. A positive resolution to the Ripple-SEC lawsuit would significantly enhance the probability of an XRP ETF application gaining approval.

XRP Price Predictions: Bullish vs. Bearish Scenarios

Predicting XRP's price is challenging, but analyzing various factors can offer insights into potential future scenarios.

Factors Influencing Price Predictions

Several key factors influence XRP price predictions:

- Market Sentiment: Overall market sentiment towards cryptocurrencies and XRP specifically has a major impact.

- Regulatory Developments: Positive or negative regulatory developments, such as the outcome of the Ripple-SEC lawsuit, heavily influence the price.

- Technological Advancements: Any improvements to XRP's technology or its underlying blockchain could drive price appreciation.

- Adoption Rates: Increased adoption by businesses and institutions boosts demand and, therefore, price.

Different price prediction models and sources offer varying projections. These vary considerably depending on the assumed regulatory environment and adoption rates.

Analyzing Short-Term and Long-Term Price Projections

Short-term predictions often focus on immediate market trends and the impact of current events, such as the Ripple-SEC lawsuit. Long-term predictions consider broader market trends and the potential for significant growth.

- Short-Term (1-year): Short-term projections are highly variable, depending on the outcome of the Ripple-SEC case. A positive outcome could lead to significant price increases, while a negative outcome might result in further price drops.

- Long-Term (5-10 years): Long-term projections often assume increased cryptocurrency adoption and a more favorable regulatory environment. The successful launch of an XRP ETF could significantly boost the long-term price. However, this is highly speculative and depends on multiple external factors.

Conclusion

The potential for a US XRP ETF hinges heavily on the outcome of the Ripple-SEC lawsuit. A positive resolution could dramatically increase investor confidence, leading to higher XRP prices and a greatly increased likelihood of ETF approval. Conversely, a negative resolution could severely dampen investor enthusiasm. While predicting the future price of XRP is inherently speculative, the impact of an XRP ETF on its long-term prospects is undeniable.

Call to Action: Stay informed about the latest developments regarding the Ripple-SEC lawsuit and the potential approval of an XRP ETF. Continue researching the XRP market and consider carefully if XRP investments align with your personal risk tolerance. Conduct thorough due diligence before investing in any cryptocurrency, including XRP, and remember that the cryptocurrency market is inherently volatile. Stay updated on the latest news concerning the imminent possibility of a US XRP ETF.

Featured Posts

-

Zdravkove Prve Ljubavi Prica O Pjesmi Kad Sam Se Vratio

May 01, 2025

Zdravkove Prve Ljubavi Prica O Pjesmi Kad Sam Se Vratio

May 01, 2025 -

Atff Stuttgart Bueyuek Futbol Yetenegi Avi Basliyor

May 01, 2025

Atff Stuttgart Bueyuek Futbol Yetenegi Avi Basliyor

May 01, 2025 -

Stroomvoorziening Kampen In Gevaar Kort Geding Tegen Enexis

May 01, 2025

Stroomvoorziening Kampen In Gevaar Kort Geding Tegen Enexis

May 01, 2025 -

Canadian Dollars Fate Tied To Federal Election Outcome

May 01, 2025

Canadian Dollars Fate Tied To Federal Election Outcome

May 01, 2025 -

De Komst Van Het Verdeelstation In Oostwold Een Onherroepelijk Besluit

May 01, 2025

De Komst Van Het Verdeelstation In Oostwold Een Onherroepelijk Besluit

May 01, 2025

Latest Posts

-

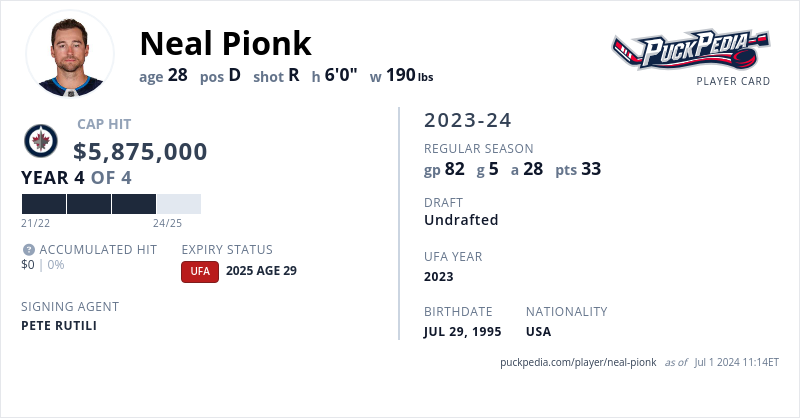

Neal Pionk Contract Status And Future Outlook

May 01, 2025

Neal Pionk Contract Status And Future Outlook

May 01, 2025 -

Neal Pionk Injury Updates And Performance Highlights

May 01, 2025

Neal Pionk Injury Updates And Performance Highlights

May 01, 2025 -

Neal Pionk Breaking News And Trade Rumors

May 01, 2025

Neal Pionk Breaking News And Trade Rumors

May 01, 2025 -

Anaheim Ducks Vs Dallas Stars Carlssons Two Goals In Overtime Defeat

May 01, 2025

Anaheim Ducks Vs Dallas Stars Carlssons Two Goals In Overtime Defeat

May 01, 2025 -

Kevin Fiala Leads Kings To Shootout Win Against Stars

May 01, 2025

Kevin Fiala Leads Kings To Shootout Win Against Stars

May 01, 2025