Is Apple Stock A Buy Before Q2 Earnings?

Table of Contents

Apple's Recent Performance and Market Trends

Strong iPhone Sales and Services Growth

Apple's recent performance has been largely positive, driven by strong iPhone sales and continued growth in its services sector. The iPhone 14 lineup proved popular, contributing significantly to Apple's overall revenue. This success, coupled with expansion into new markets, demonstrates the enduring appeal of Apple products. Furthermore, Apple's services revenue (Apple Music, iCloud, App Store, etc.) continues its impressive trajectory, showcasing a diversified and resilient business model.

- Strong iPhone 14 sales: Despite supply chain challenges, the iPhone 14 series exceeded expectations, fueling significant revenue growth.

- Growth in services revenue: Apple's services segment continues to be a key driver of profitability, demonstrating recurring revenue streams and strong customer loyalty.

- Expansion into new markets: Apple continues to penetrate emerging markets, offering further growth potential for the future. Keywords: Apple iPhone sales, Apple services revenue, Apple market share.

Global Economic Uncertainty and Inflationary Pressures

Despite the positive trends, Apple faces headwinds from the broader macroeconomic environment. Global economic uncertainty, persistent inflation, and potential recessions in major markets could impact consumer spending and, consequently, Apple's sales. Supply chain disruptions also remain a concern, potentially affecting production and delivery timelines. Geopolitical instability adds another layer of risk to the outlook for Apple stock.

- Impact of inflation on consumer spending: High inflation erodes purchasing power, potentially reducing demand for Apple's premium-priced products.

- Supply chain disruptions: Ongoing supply chain challenges could continue to impact production and delivery, affecting revenue and profitability.

- Geopolitical risks: Global geopolitical uncertainties can create volatility in the market and impact Apple's operations in certain regions. Keywords: Apple inflation impact, Apple supply chain, global economic outlook.

Q2 Earnings Expectations and Analyst Predictions

Consensus Estimates and Potential Surprises

Analysts' predictions for Apple's Q2 earnings vary, but a general consensus suggests continued growth, albeit at a potentially slower pace than in previous quarters. While revenue projections are generally positive, there's a range of estimates for earnings per share (EPS). This divergence reflects the uncertainty surrounding macroeconomic factors and potential surprises.

- Revenue projections: Analysts anticipate solid revenue growth, though perhaps not at the explosive rates seen in prior periods.

- Earnings per share (EPS) forecasts: EPS forecasts show a range of possibilities, indicating uncertainty in the market's expectations.

- Potential upside/downside surprises: Positive surprises could come from stronger-than-expected iPhone sales or significant growth in services. Downside risks include weaker-than-expected consumer demand or further supply chain disruptions. Keywords: Apple Q2 earnings estimates, Apple EPS forecast, Apple revenue projection.

Key Metrics to Watch

Investors should closely monitor several key metrics when Apple releases its Q2 earnings report. These data points will offer crucial insights into the company's performance and future prospects.

- iPhone sales growth: The growth rate in iPhone sales will be a key indicator of consumer demand and Apple's overall market position.

- Services revenue growth: The continued growth of the services segment is essential for long-term profitability and sustainability.

- Gross margins: Changes in gross margins could signal shifts in pricing strategies, costs, or competition.

- Guidance for future quarters: Apple's guidance will offer valuable insights into its expectations for the remainder of the year, shaping investor sentiment and impacting the Apple stock price. Keywords: Apple gross margin, Apple guidance, key performance indicators (KPIs).

Valuation and Competitive Landscape

Apple's Current Valuation Relative to Peers

Apple's current valuation, relative to its peers in the tech sector, is a critical consideration for potential investors. Comparing metrics like the P/E ratio to companies like Microsoft, Google, and Amazon provides context for determining whether Apple is overvalued or undervalued.

- Comparison with Microsoft, Google, Amazon, etc.: Analyzing Apple's valuation against competitors reveals its relative attractiveness in the market.

- Discussion of whether Apple is overvalued or undervalued: This analysis requires a comprehensive assessment of various financial metrics and growth prospects. Keywords: Apple valuation, Apple P/E ratio, tech stock comparison.

Competitive Threats and Innovation

Apple faces ongoing competition from Android phone manufacturers and other technology companies. The company's ability to innovate and maintain its technological leadership is crucial for its future success. Advancements in AI, augmented reality, and other emerging technologies represent both opportunities and threats.

- Competition from Android phones: The intense competition in the smartphone market necessitates ongoing innovation to maintain market share.

- Advancements in AI and other technologies: Staying ahead of the curve in technological innovation is vital for Apple's continued dominance. Keywords: Apple competition, Apple innovation, technological disruption.

Conclusion

Deciding whether to buy Apple stock before Q2 earnings hinges on several key factors. Strong recent performance, particularly in iPhone sales and services, points towards positive momentum. However, macroeconomic headwinds, including inflation and global economic uncertainty, present potential challenges. Analyst predictions offer a mixed outlook, highlighting the need to carefully assess the various estimates. Finally, Apple's valuation relative to its competitors and the intensity of competition in the tech sector must be considered. Considering the strong fundamentals and positive outlook, Apple stock could be a worthwhile addition to your portfolio before Q2 earnings. However, always conduct thorough research before making any investment decisions. Is Apple stock right for you? Consider buying Apple stock and remember to perform your own due diligence using reliable financial sources.

Featured Posts

-

Memorial Day 2025 Travel Predicting The Crowded Flight Days

May 24, 2025

Memorial Day 2025 Travel Predicting The Crowded Flight Days

May 24, 2025 -

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 24, 2025

Imcd N V Annual General Meeting A Successful Outcome For Shareholders

May 24, 2025 -

Neal Mc Donough A Leading Role In The Last Rodeo

May 24, 2025

Neal Mc Donough A Leading Role In The Last Rodeo

May 24, 2025 -

M62 Westbound Road Closure Resurfacing Works Manchester To Warrington

May 24, 2025

M62 Westbound Road Closure Resurfacing Works Manchester To Warrington

May 24, 2025 -

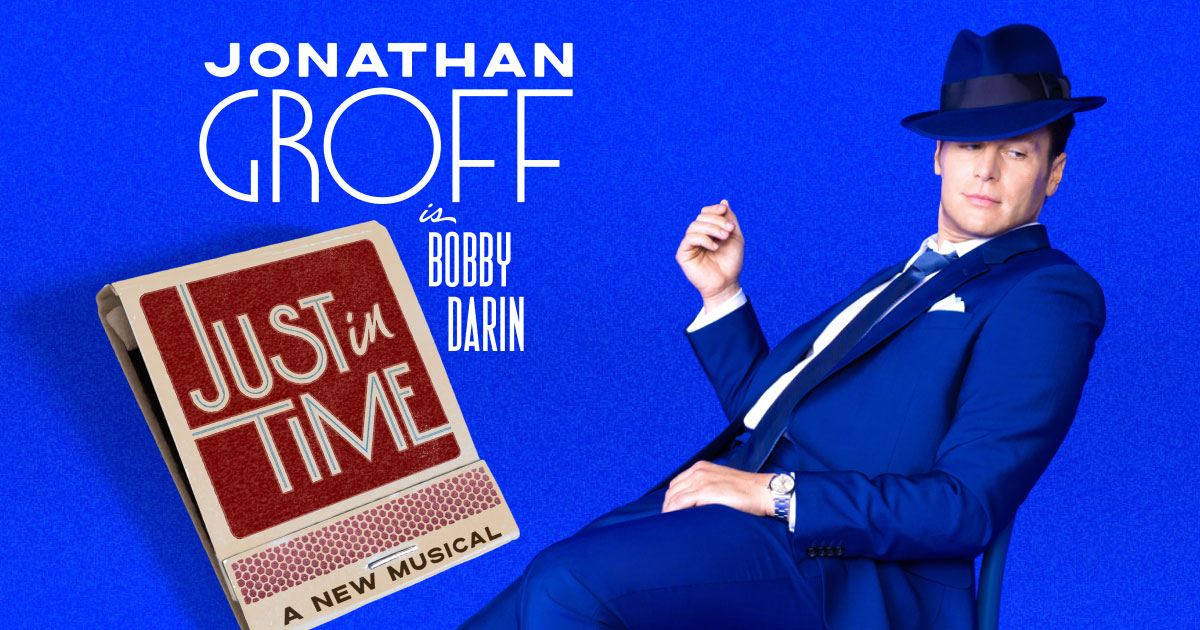

Broadways Just In Time Star Studded Opening Night For Jonathan Groff

May 24, 2025

Broadways Just In Time Star Studded Opening Night For Jonathan Groff

May 24, 2025

Latest Posts

-

Just In Time Musical Review Groffs Performance And The 60s Vibe

May 24, 2025

Just In Time Musical Review Groffs Performance And The 60s Vibe

May 24, 2025 -

Joe Jonas The Unlikely Center Of A Marital Dispute

May 24, 2025

Joe Jonas The Unlikely Center Of A Marital Dispute

May 24, 2025 -

The Jonas Brothers Drama A Married Couples Unexpected Feud

May 24, 2025

The Jonas Brothers Drama A Married Couples Unexpected Feud

May 24, 2025 -

Jonathan Groffs Just In Time Broadway Performance A Tony Contender

May 24, 2025

Jonathan Groffs Just In Time Broadway Performance A Tony Contender

May 24, 2025 -

How Joe Jonas Deftly Defused A Couples Fight Over Him

May 24, 2025

How Joe Jonas Deftly Defused A Couples Fight Over Him

May 24, 2025