Is Apple Stock Headed To $254? One Analyst's Prediction And Investment Implications

Table of Contents

The Analyst's Rationale Behind the $254 Apple Stock Prediction

The $254 Apple stock prediction originates from [Analyst Name], a prominent analyst at [Analyst Firm], a reputable investment bank known for its in-depth research and accurate market forecasts. Their prediction is not a random guess; it's rooted in a comprehensive analysis of several key factors contributing to Apple's future performance.

The key arguments supporting the $254 prediction include:

- Strong iPhone sales and anticipated demand for upcoming models: Apple consistently demonstrates strong iPhone sales, indicating a loyal customer base and high demand. The anticipation surrounding future iPhone releases, particularly with rumored advancements in [mention specific rumored features like camera technology or processing power], fuels further growth expectations.

- Growth in services revenue (Apple Music, iCloud, etc.): Apple's services segment is a significant revenue driver, exhibiting consistent growth. This recurring revenue stream provides stability and contributes significantly to Apple's overall profitability. Continued expansion into new services and increased user engagement are expected to further boost this revenue stream.

- Expansion into new markets and product categories (e.g., AR/VR): Apple's foray into emerging technologies like augmented reality (AR) and virtual reality (VR) presents significant growth opportunities. Successful product launches in these areas could significantly impact Apple's stock price. The potential Apple Car, though still in development, also holds immense potential for future revenue generation.

- Positive market sentiment and overall economic outlook: A positive market outlook, coupled with a relatively stable global economy (assuming no major unforeseen economic downturn), creates a favorable environment for Apple stock to perform well. Strong investor confidence plays a vital role in driving up stock prices.

[Insert relevant chart/graph illustrating the analyst's projections, clearly labeled and sourced.]

Factors That Could Drive Apple Stock to $254

Several key factors could propel Apple stock towards the $254 prediction:

Innovation and Product Launches

Apple's history of groundbreaking innovations and successful product launches is a major driver of its stock price. Upcoming product releases like:

- New iPhone models with significant upgrades.

- Potential advancements in the Apple Watch, possibly including health monitoring features.

- Further developments in the Apple Car project, leading to potential commercialization.

- New services or significant upgrades to existing services like Apple Music or iCloud.

could all significantly impact investor sentiment and drive up the stock price.

Strong Financial Performance

Apple's consistently strong financial performance fuels investor confidence. Key indicators like:

- Revenue growth year-over-year.

- High profit margins demonstrating strong pricing power and efficient operations.

- Regular dividend payouts rewarding shareholders.

- Aggressive share buyback programs further increasing shareholder value.

contribute to a positive outlook and support a higher stock valuation.

Market Conditions and Economic Outlook

The overall market and economic environment play a crucial role. Factors such as:

- Moderate inflation, ideally controlled by central banks.

- Stable interest rates, avoiding drastic increases that dampen investor enthusiasm.

- A positive geopolitical climate, minimizing global uncertainty and market volatility.

- Healthy consumer spending, ensuring continued demand for Apple products.

all contribute to a positive environment for Apple stock growth.

Potential Risks and Challenges to Reaching $254

Despite the optimistic outlook, several risks could prevent Apple stock from reaching $254:

Supply Chain Disruptions

Apple's reliance on a global supply chain makes it vulnerable to disruptions caused by:

- Geopolitical instability, leading to production halts or logistical challenges.

- Component shortages, delaying product launches and impacting production volumes.

- Manufacturing challenges related to unforeseen circumstances or natural disasters.

These disruptions could significantly impact Apple's production and profitability, potentially affecting the stock price.

Increased Competition

The tech market is fiercely competitive. Growing competition from companies like [mention key competitors like Samsung, Google, etc.] in smartphones, wearables, and services could eat into Apple's market share and impact revenue growth.

Economic Downturn

A significant economic downturn or recession could negatively impact consumer spending, leading to:

- Reduced demand for Apple's premium-priced products.

- Lower overall consumer confidence impacting the entire market, including Apple stock.

This scenario would pose a considerable risk to the $254 prediction.

Investment Implications and Strategies

The $254 Apple stock prediction presents both opportunities and risks. Investors should consider various strategies:

- Long-term investment: If you believe in Apple's long-term growth potential, a long-term investment strategy could be suitable, even if the $254 target is not reached immediately.

- Dollar-cost averaging: Gradually investing over time mitigates the risk associated with market volatility.

- Diversification: Spreading your investments across different asset classes reduces overall portfolio risk.

Remember, this analysis is not financial advice. Before making any investment decisions, conduct thorough research and consult with a qualified financial advisor.

Conclusion

The prediction of Apple stock reaching $254 is based on a compelling analysis of several positive factors, including strong iPhone sales, growth in services revenue, expansion into new markets, and a generally positive market outlook. However, significant risks remain, including supply chain vulnerabilities, increased competition, and the possibility of an economic downturn. While the $254 price target is ambitious, Apple's consistent track record and innovative spirit suggest potential for significant growth. Therefore, before making any decisions regarding Apple stock or any related investments, conduct thorough due diligence and consider the potential upside and downside risks based on your own investment goals and risk tolerance. Remember, understanding the nuances of Apple stock price prediction is crucial for informed investment decisions.

Featured Posts

-

Your Guide To Buying Bbc Radio 1 Big Weekend Tickets

May 24, 2025

Your Guide To Buying Bbc Radio 1 Big Weekend Tickets

May 24, 2025 -

Investing In Middle Management A Key To Business Success

May 24, 2025

Investing In Middle Management A Key To Business Success

May 24, 2025 -

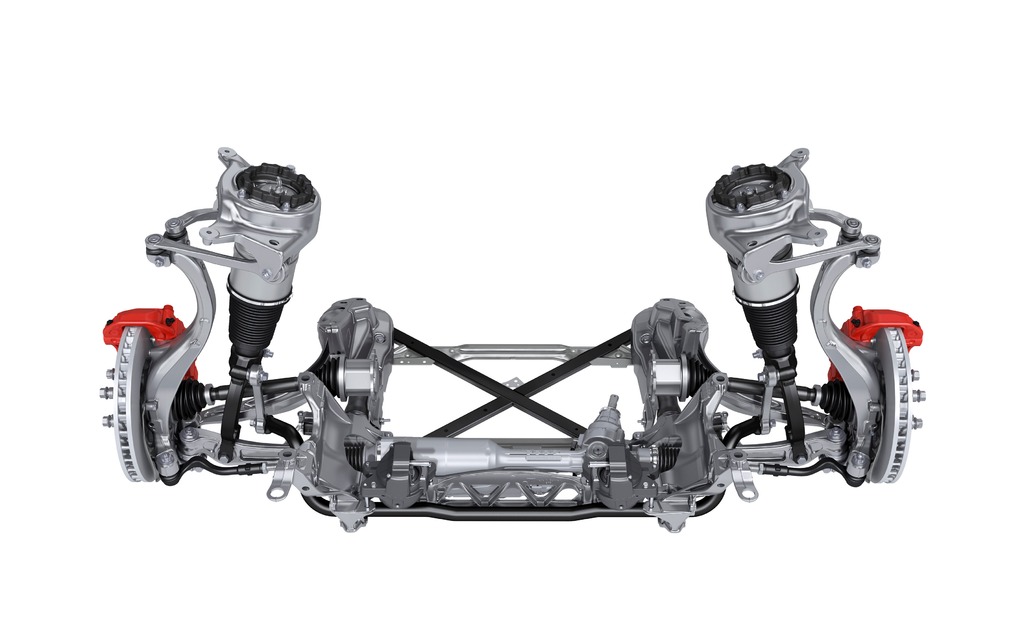

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025

Porsche Macan Buyers Guide Everything You Need To Know

May 24, 2025 -

Crackdown On Gun Trafficking Nets 100 Firearms 18 Brazilian Arrests In Mass

May 24, 2025

Crackdown On Gun Trafficking Nets 100 Firearms 18 Brazilian Arrests In Mass

May 24, 2025 -

Aex Index Over 4 Drop Lowest Point In Over A Year

May 24, 2025

Aex Index Over 4 Drop Lowest Point In Over A Year

May 24, 2025

Latest Posts

-

Senate Resolution Highlights Deepening Canada U S Ties

May 24, 2025

Senate Resolution Highlights Deepening Canada U S Ties

May 24, 2025 -

U S Senate Resolution Strengthening The Canada U S Partnership

May 24, 2025

U S Senate Resolution Strengthening The Canada U S Partnership

May 24, 2025 -

Museum Funding Crisis The Legacy Of Trumps Budgetary Decisions

May 24, 2025

Museum Funding Crisis The Legacy Of Trumps Budgetary Decisions

May 24, 2025 -

How Trumps Budget Cuts Reshape Museum Programming In America

May 24, 2025

How Trumps Budget Cuts Reshape Museum Programming In America

May 24, 2025 -

The Fate Of Museum Programs Post Trump Administration Budget Reductions

May 24, 2025

The Fate Of Museum Programs Post Trump Administration Budget Reductions

May 24, 2025