Is BBAI Stock A Good Investment? Analyzing BigBear.ai's Penny Stock Potential

Table of Contents

BigBear.ai's Business Model and Competitive Landscape

BigBear.ai is a leading provider of AI-powered solutions targeting several key sectors. Understanding its business model is crucial to assessing its investment potential.

AI Solutions and Target Markets:

BigBear.ai's core offerings leverage cutting-edge artificial intelligence, machine learning, and data analytics to deliver sophisticated solutions. Its primary target markets include:

- Defense and Intelligence: Providing advanced analytics and AI-driven insights to support national security initiatives. Keywords: defense contracting, national security, intelligence analysis, AI in defense.

- Cybersecurity: Developing AI-powered threat detection and response systems for critical infrastructure protection. Keywords: cybersecurity solutions, threat intelligence, AI-driven security.

- Commercial Markets: Expanding its reach into commercial sectors with data analytics and AI solutions for various industries. Keywords: data analytics solutions, AI consulting, commercial applications of AI.

Competitive Advantages and Disadvantages:

BigBear.ai faces stiff competition from established players in the AI market. Let's examine its strengths and weaknesses:

- Strengths:

- Unique technology with a focus on solving complex problems.

- Strong presence in government contracting, providing a stable revenue stream (although this can also be a risk).

- Experienced team with deep expertise in AI and data analytics.

- Weaknesses:

- Relatively small market share compared to larger, more established competitors.

- Potential for financial instability given its current market capitalization and reliance on specific contracts.

- Heavy dependence on government contracts, making it vulnerable to changes in government spending.

Financial Performance and Key Metrics:

Analyzing BigBear.ai's financial performance requires a thorough review of its recent financial reports, focusing on key metrics like:

- Revenue growth: Examining the trend of revenue increase over time.

- Profitability: Assessing profit margins and identifying areas for improvement.

- Debt-to-equity ratio: Determining its financial leverage and solvency.

- Cash flow: Understanding its ability to generate cash from operations.

Investors should consult recent SEC filings and financial news sources to gather the latest data.

Risk Assessment of Investing in BBAI Stock

Investing in BBAI stock, like any penny stock, comes with substantial risks. A careful risk assessment is essential before making any investment decisions.

Penny Stock Volatility:

Penny stocks are notorious for their extreme price volatility. BBAI's share price can fluctuate wildly in response to news, market sentiment, and even speculation. This inherent volatility significantly increases the risk of substantial losses.

Financial Risks:

BigBear.ai faces several financial risks, including:

- Potential for bankruptcy or significant share price decline due to operational challenges or market downturns.

- Dilution of existing shares through future stock offerings, potentially decreasing the value of current holdings.

Market Sentiment and News Impact:

BBAI's stock price is highly sensitive to news events and overall market sentiment. Positive news releases can trigger price surges, while negative news can lead to sharp declines. Thorough due diligence, including monitoring news and financial reports, is crucial.

Valuation and Potential for Growth

Assessing BBAI's potential requires evaluating its valuation relative to its growth prospects within the broader AI industry.

Growth Prospects in the AI Industry:

The artificial intelligence industry is expected to experience significant growth in the coming years. BigBear.ai's position within this rapidly expanding market presents a potential catalyst for future growth. Keywords: AI market growth, future of AI, AI investment.

Valuation Methods and Comparison:

Investors should employ various valuation methods such as:

- Price-to-earnings ratio (P/E ratio): Comparing its earnings relative to its share price.

- Discounted cash flow (DCF) analysis: Projecting future cash flows to determine present value.

Comparing BBAI's valuation metrics to those of its competitors is essential for determining its relative attractiveness.

Potential Catalysts for Stock Price Increase:

Several factors could drive BBAI's stock price higher, including:

- Securing large government contracts or expanding into commercial markets.

- Successful product launches or technological breakthroughs.

- Demonstrating improved financial performance and profitability.

Conclusion:

Investing in BBAI stock presents a high-risk, high-reward proposition. While the company operates in a promising sector with significant growth potential, the inherent volatility of penny stocks and the specific financial risks associated with BigBear.ai cannot be overlooked. The key strengths of BigBear.ai lie in its unique technology and government contracts, but its weaknesses include a smaller market share and potential financial instability. This analysis highlights the importance of thorough due diligence before considering a BigBear.ai investment. Ultimately, the decision of whether BBAI stock is a good investment for you depends on your risk tolerance and investment goals. Conduct your own due diligence before investing in this volatile penny stock. Consider seeking advice from a qualified financial advisor before making any investment decisions regarding BBAI stock analysis or other penny stock investments.

Featured Posts

-

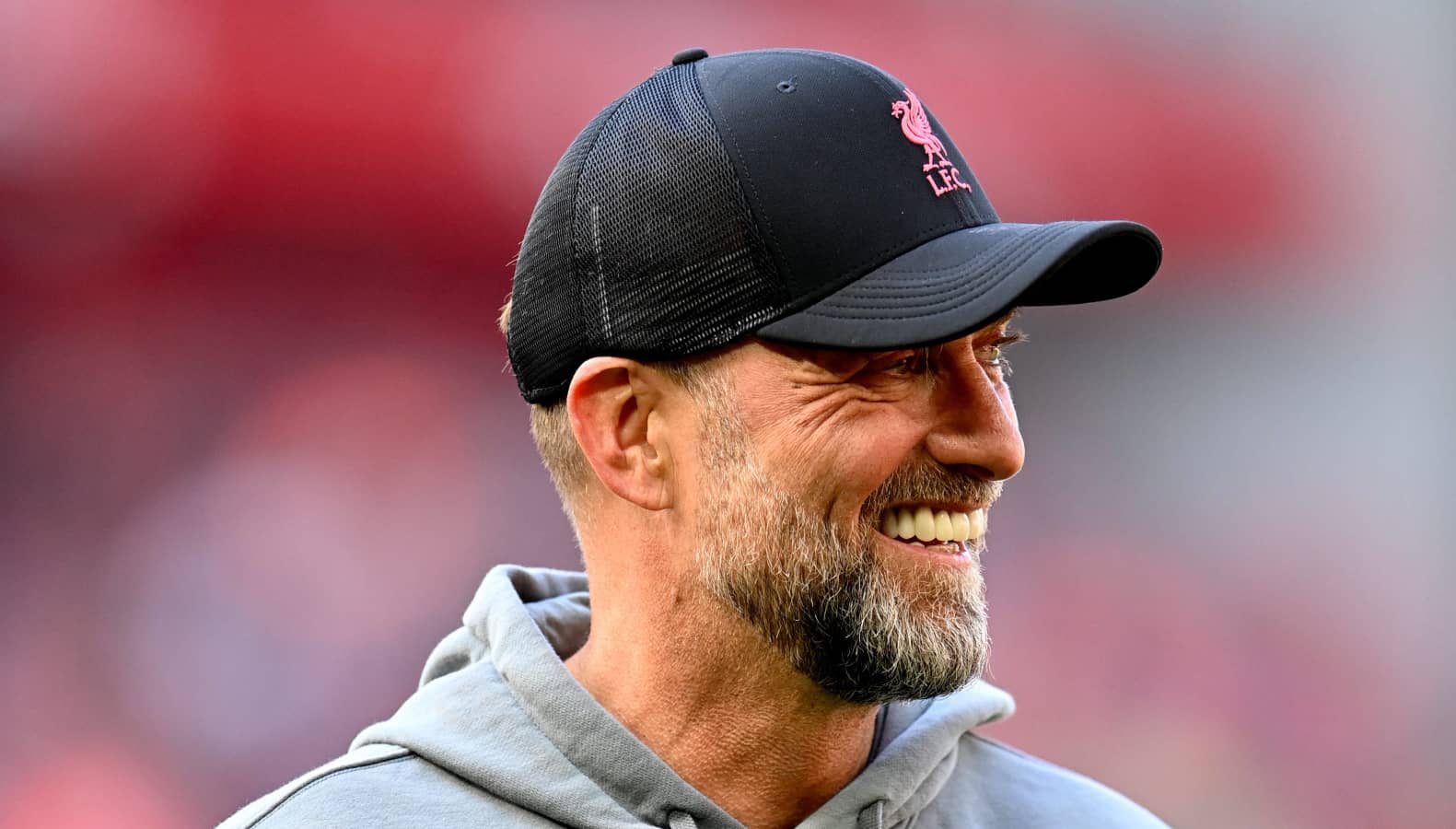

The Klopp Revolution Transforming Liverpool Fc A Nostalgic Review

May 21, 2025

The Klopp Revolution Transforming Liverpool Fc A Nostalgic Review

May 21, 2025 -

Bbai Stock Analyzing The Analyst Downgrade And Its Impact On Growth

May 21, 2025

Bbai Stock Analyzing The Analyst Downgrade And Its Impact On Growth

May 21, 2025 -

Understanding The Billionaire Boy Phenomenon Wealth Influence And Legacy

May 21, 2025

Understanding The Billionaire Boy Phenomenon Wealth Influence And Legacy

May 21, 2025 -

Exploring The Uses Of Cassis Blackcurrant In Cuisine And Cocktails

May 21, 2025

Exploring The Uses Of Cassis Blackcurrant In Cuisine And Cocktails

May 21, 2025 -

Vybz Kartel Speaks Out Prison Life Freedom Family And New Music

May 21, 2025

Vybz Kartel Speaks Out Prison Life Freedom Family And New Music

May 21, 2025