Is Bitcoin's Rebound Just The Beginning? A Comprehensive Analysis

Table of Contents

Macroeconomic Factors Driving Bitcoin's Rebound

Inflation and the Flight to Safety

High inflation rates globally are pushing investors towards alternative assets perceived as hedges against inflation. Bitcoin, with its fixed supply of 21 million coins, is increasingly viewed as a store of value, similar to gold. The correlation between inflation and Bitcoin's price is becoming increasingly apparent. As fiat currencies lose purchasing power, investors seek assets that retain or increase their value over time.

- Increased demand for Bitcoin as a store of value: As traditional savings accounts offer negligible real returns in high-inflation environments, Bitcoin's appeal as a deflationary asset grows.

- Institutional investment in Bitcoin as an inflation hedge: Major corporations and institutional investors are increasingly allocating a portion of their portfolios to Bitcoin, viewing it as a long-term hedge against inflation.

- Correlation between inflation and Bitcoin price: Studies show a growing positive correlation between inflation rates and Bitcoin's price, suggesting that as inflation rises, so does the demand for Bitcoin. This reinforces the narrative of Bitcoin's rebound being partly driven by macroeconomic instability.

Geopolitical Instability and Bitcoin's Decentralized Nature

Global uncertainty and geopolitical instability often fuel Bitcoin's appeal. Its decentralized and censorship-resistant nature makes it an attractive asset in countries with unstable political or economic environments. Investors seek refuge in Bitcoin's inherent security against government control and manipulation.

- Bitcoin as a safe haven asset during times of geopolitical uncertainty: When traditional financial systems face disruptions, Bitcoin's decentralized structure provides a sense of security and stability.

- Decentralized nature protects against government control: Unlike fiat currencies, Bitcoin is not subject to government manipulation or censorship, making it a compelling alternative in politically unstable regions.

- Increased adoption in regions with unstable currencies: Bitcoin's adoption is particularly high in countries with hyperinflation or weak currencies, where it offers a more reliable store of value and a means of financial freedom.

Technological Advancements Fueling Bitcoin's Growth

The Lightning Network and Scalability

The Lightning Network is a crucial technological advancement that significantly improves Bitcoin's scalability and transaction speed. By enabling off-chain transactions, it addresses the limitations of the base Bitcoin network, making it more suitable for everyday transactions.

- Faster and cheaper transactions: The Lightning Network dramatically reduces transaction fees and processing times, making Bitcoin more practical for everyday purchases.

- Increased adoption of Bitcoin for everyday payments: As transaction speeds and costs decrease, the usability of Bitcoin for everyday payments improves, fostering broader adoption.

- Enhanced scalability to handle increased demand: The Lightning Network's ability to process millions of transactions per second addresses one of Bitcoin's biggest challenges – scalability – and positions it for mass adoption.

Taproot Upgrade and Enhanced Privacy

The Taproot upgrade represents a significant enhancement to Bitcoin's security and privacy. This upgrade simplifies transaction scripts, improves efficiency, and enhances privacy by making it more difficult to distinguish between different types of transactions.

- Improved transaction privacy: Taproot makes it harder to track Bitcoin transactions, enhancing user privacy and security.

- Enhanced security against attacks: The upgrade strengthens Bitcoin's overall security by making it more resistant to various attacks.

- Increased efficiency of smart contracts on Bitcoin: Taproot lays the groundwork for more complex and efficient smart contracts on the Bitcoin network.

The Regulatory Landscape and its Impact on Bitcoin's Rebound

Growing Institutional Adoption and Regulatory Clarity

The increasing acceptance of Bitcoin by institutional investors is significantly boosted by clearer regulatory frameworks in certain jurisdictions. As regulatory clarity improves, institutional investors feel more confident in allocating assets to Bitcoin.

- Growing acceptance by institutional investors like MicroStrategy and Tesla: Large companies are accumulating Bitcoin as a strategic asset, signaling growing institutional confidence.

- Regulatory clarity in certain jurisdictions boosts confidence: Countries with clearer regulatory guidelines for Bitcoin trading and taxation attract more investment.

- Development of clearer guidelines for Bitcoin taxation and compliance: Well-defined regulatory frameworks reduce uncertainty and encourage broader participation.

Challenges and Uncertainties in Regulation

Despite positive developments, regulatory uncertainty remains a significant factor influencing Bitcoin's price. Differing regulatory approaches across countries pose challenges and potential risks.

- Regulatory uncertainty can create volatility: Unclear regulatory landscapes can lead to price volatility as investors react to shifting regulatory environments.

- Differing regulatory approaches across jurisdictions: Inconsistencies in regulatory frameworks across different jurisdictions create complexities for businesses operating in the Bitcoin space.

- Potential for stricter regulations to hinder Bitcoin's growth: Overly strict regulations could potentially stifle Bitcoin's growth and adoption.

Investor Sentiment and Market Speculation

FOMO and the Psychology of Investing

Fear of missing out (FOMO) plays a significant role in driving Bitcoin's price, particularly during periods of rapid price increases. Social media and news coverage amplify this effect, creating cycles of hype and speculation.

- Social media influence on Bitcoin price: Social media platforms can significantly influence investor sentiment, causing price swings based on hype or negative news.

- The role of news and media coverage in shaping investor sentiment: Positive or negative news coverage can significantly impact investor sentiment and market behaviour.

- Impact of FOMO and hype on market behaviour: FOMO can lead to irrational investment decisions, driving up prices in the short term but potentially creating bubbles.

Long-Term Holders and the Strength of Bitcoin's Foundation

Long-term holders (LTHs) demonstrate unwavering belief in Bitcoin's long-term potential. Their steadfast support contributes to market stability and resilience during periods of volatility.

- Long-term holders' impact on price stability: LTHs tend to weather market fluctuations, preventing extreme price crashes.

- Resilience in the face of market volatility: The unwavering support of LTHs demonstrates the resilience of the Bitcoin ecosystem.

- Confidence in Bitcoin's underlying technology and use case: LTHs represent a strong belief in Bitcoin's long-term value proposition.

Conclusion

Bitcoin's recent rebound is a complex phenomenon driven by a confluence of factors. Macroeconomic instability, technological advancements like the Lightning Network and Taproot, evolving regulatory landscapes, and investor sentiment all play a crucial role. While challenges remain, particularly regarding regulation and market volatility, the factors discussed suggest that Bitcoin's rebound may indeed be more than a temporary surge. The increasing institutional adoption, coupled with the underlying technological improvements and the steadfast belief of long-term holders, indicates a strong foundation for continued growth. Conduct your own thorough research and consider the potential implications of Bitcoin's continued growth. Is Bitcoin’s rebound the start of something big? Only time will tell, but staying informed is crucial to understanding this evolving asset and its potential.

Featured Posts

-

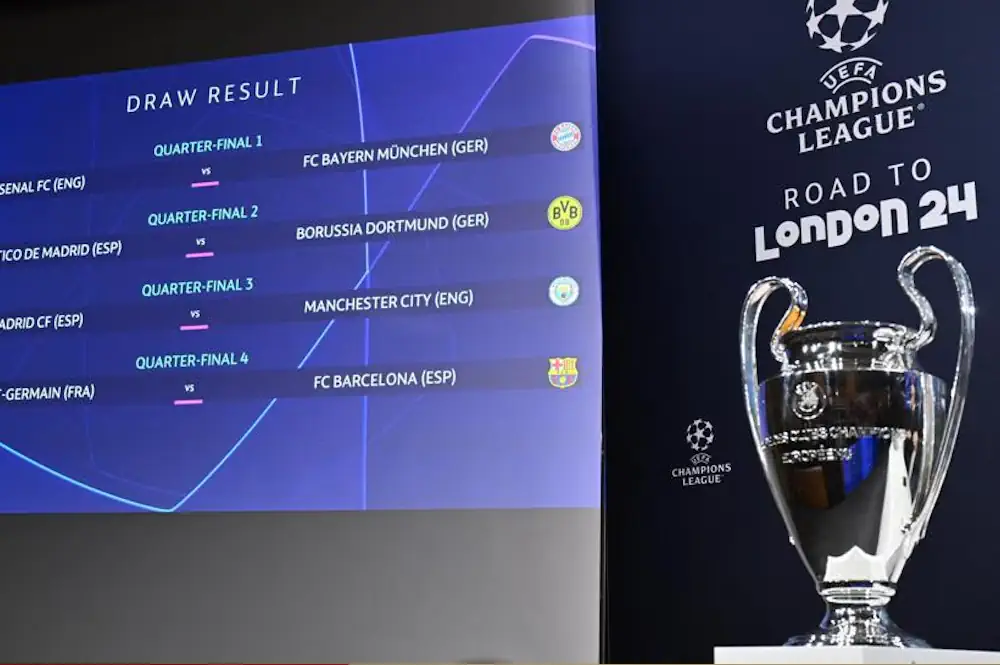

Arsenal V Psg Champions League Semi Final Preview

May 08, 2025

Arsenal V Psg Champions League Semi Final Preview

May 08, 2025 -

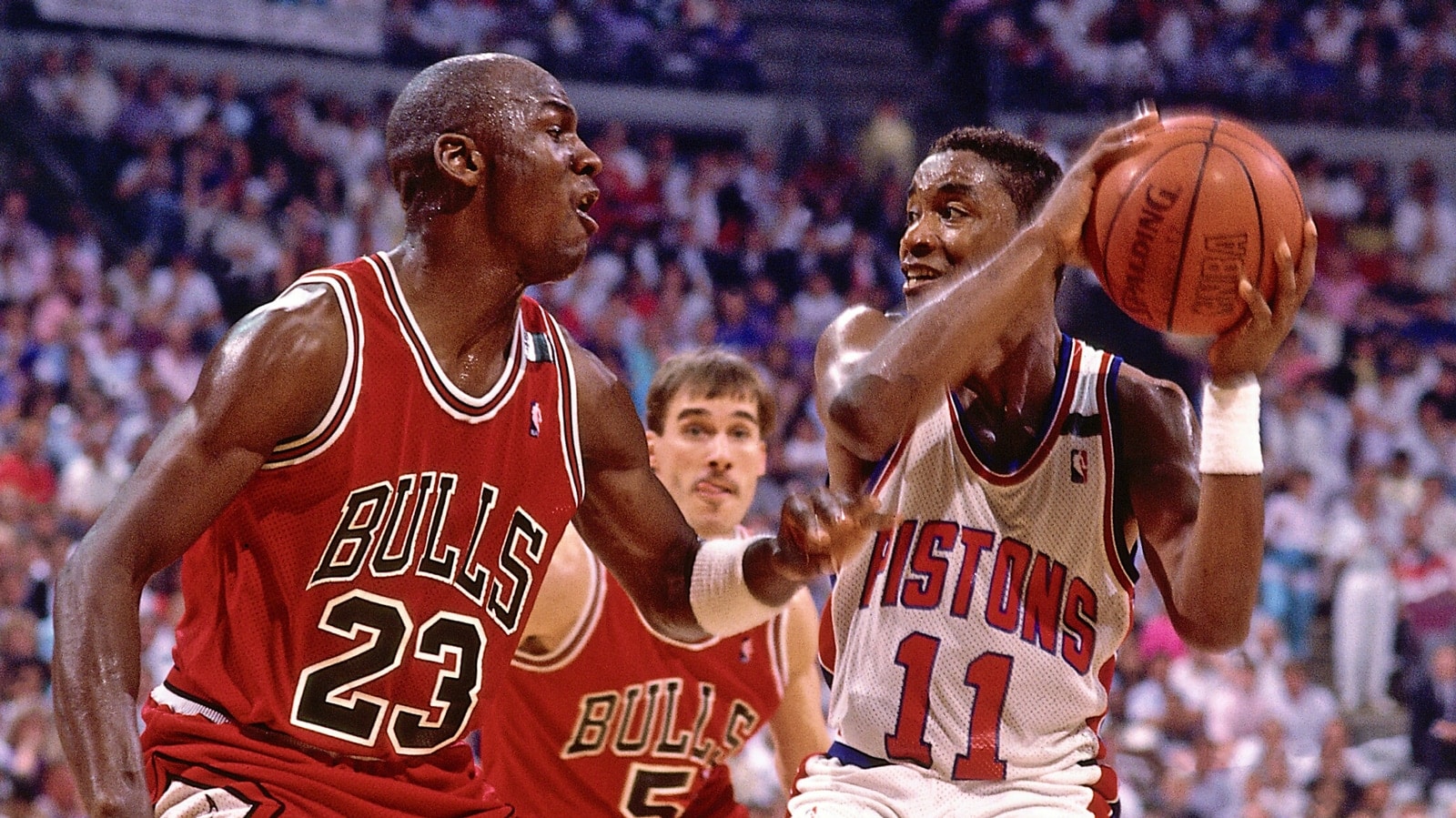

Nuggets Vs Bulls De Andre Jordans Record Breaking Performance

May 08, 2025

Nuggets Vs Bulls De Andre Jordans Record Breaking Performance

May 08, 2025 -

Liga Chempionov 2024 2025 Predvaritelniy Obzor Polufinalnykh Matchey Arsenal Ps Zh I Barselona Inter

May 08, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Polufinalnykh Matchey Arsenal Ps Zh I Barselona Inter

May 08, 2025 -

Psg Ve Nantes Heyecan Dolu Bir Beraberelik

May 08, 2025

Psg Ve Nantes Heyecan Dolu Bir Beraberelik

May 08, 2025 -

Sonos And Ikea End Symfonisk Speaker Partnership What This Means For Consumers

May 08, 2025

Sonos And Ikea End Symfonisk Speaker Partnership What This Means For Consumers

May 08, 2025

Latest Posts

-

Kripto Yatirimlarina Yeni Kurallar Spk Nin Sermaye Ve Guevenlik Odakli Duezenlemesi

May 08, 2025

Kripto Yatirimlarina Yeni Kurallar Spk Nin Sermaye Ve Guevenlik Odakli Duezenlemesi

May 08, 2025 -

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025

Kripto Varlik Piyasasinda Yeni Bir Doenem Spk Nin Getirdigi Duezenlemeler

May 08, 2025 -

Counting Crows Snl Appearance A Turning Point In Their Success

May 08, 2025

Counting Crows Snl Appearance A Turning Point In Their Success

May 08, 2025 -

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sartlari

May 08, 2025

Spk Dan Kripto Platformlarina Yeni Duezenleme Sermaye Ve Guevenlik Sartlari

May 08, 2025 -

Saturday Night Live A Pivotal Point In Counting Crows History

May 08, 2025

Saturday Night Live A Pivotal Point In Counting Crows History

May 08, 2025