Is Buy-and-Hold Investing Really The Only Way To Succeed? A Realistic Look

Table of Contents

The Allure of Buy-and-Hold Investing

Buy-and-hold investing's popularity stems from its simplicity and potential for long-term growth. Many investors find it attractive due to its passive nature.

Simplicity and Long-Term Growth

Buy-and-hold offers a straightforward approach to investing. Its core principle is to purchase assets (like stocks or bonds) and hold them for an extended period, typically years or even decades, regardless of short-term market fluctuations.

- Minimal transaction costs: Frequent buying and selling incurs brokerage fees and taxes, eating into potential profits. Buy-and-hold significantly reduces these costs.

- Reduced stress from market fluctuations: The constant ups and downs of the market can be emotionally draining. A buy-and-hold strategy allows investors to ride out short-term volatility, focusing on the long-term trajectory.

- Potential for compounding returns: This is arguably the most significant advantage. Compounding, where investment earnings generate further earnings, creates exponential growth over time. Reinvesting dividends further accelerates this effect.

Consider legendary investors like Warren Buffett, whose success is largely attributed to his long-term buy-and-hold approach. His portfolio, comprised of carefully selected stocks held for many years, exemplifies the potential of this strategy.

The Power of Compounding

The magic of compounding is undeniable in buy-and-hold investing. Imagine investing $10,000 with an average annual return of 7%. After 20 years, without additional contributions, that investment could grow to over $38,000. A simple chart illustrating exponential growth would further highlight this point. Reinvesting dividends further amplifies this compounding effect, accelerating the growth of your investment portfolio.

Limitations of a Pure Buy-and-Hold Approach

While buy-and-hold offers significant advantages, it’s crucial to acknowledge its limitations. A purely passive approach may not always be the optimal strategy.

Market Volatility and Timing

Buy-and-hold's biggest risk is its vulnerability during prolonged market downturns.

- Potential for significant losses before recovery: While markets generally recover, significant losses can occur during bear markets, impacting the overall return.

- Difficulty of predicting market bottoms: Timing the market perfectly is nearly impossible. While buy-and-hold avoids frequent trading, it doesn't eliminate the risk of entering a market just before a significant drop.

Missed Opportunities

Sticking rigidly to buy-and-hold might mean missing opportunities for higher returns.

- Sector rotation: Certain sectors outperform others at different times. A purely passive approach might miss out on these periods of outsized growth.

- Active trading: While risky, active trading strategies can generate significant returns for skilled investors who time the market successfully, though this is difficult to consistently achieve.

- Value investing: Identifying undervalued companies and capitalizing on their potential for appreciation offers another alternative to a strictly passive buy-and-hold strategy.

Inflation's Impact on Long-Term Returns

Inflation erodes the purchasing power of money over time. A significant concern with long-term investment strategies is that the return may not keep pace with inflation.

- Eroding real returns: A 7% annual return may sound impressive, but if inflation is 3%, your real return is only 4%.

- Mitigation strategies: Investing in inflation-protected securities (TIPS) or assets that tend to appreciate during inflationary periods can help mitigate this risk.

Alternative Investment Strategies and Their Role

Buy-and-hold isn't the only game in town. Several alternative strategies can be considered, either independently or in combination with a buy-and-hold approach.

Active Investing and Market Timing

Active investing involves actively managing a portfolio, buying and selling assets based on market analysis and predictions.

- Potential for higher returns: Successful market timing can lead to significantly higher returns compared to passive strategies.

- High risk and expertise required: This approach demands considerable market knowledge, skill, and significant time commitment.

Value Investing

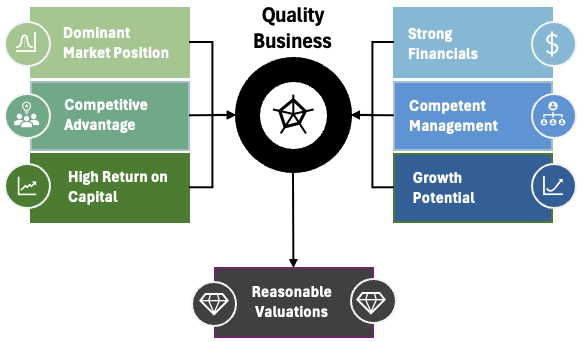

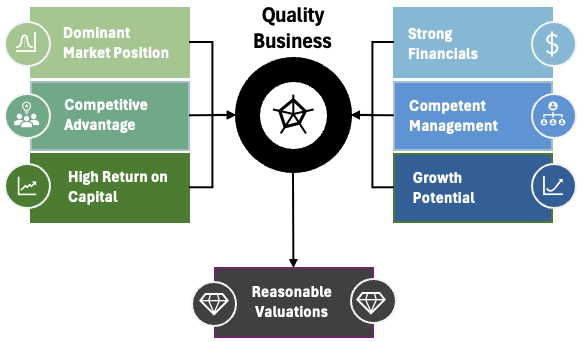

Value investing focuses on identifying undervalued assets with the potential for future growth. This strategy differs significantly from the passive approach of buy-and-hold.

- Potential for higher returns: Buying undervalued assets can lead to greater gains than buying already-overvalued ones.

- Requires significant research and analysis: Identifying truly undervalued assets requires thorough research and a deep understanding of financial statements.

Diversification and Asset Allocation

Regardless of your chosen investment strategy (buy-and-hold or otherwise), diversification is paramount.

- Reducing overall risk: Spreading investments across various asset classes (stocks, bonds, real estate, commodities) reduces the impact of poor performance in any single asset.

- Asset allocation strategies: Determining the optimal allocation of assets depends on factors such as risk tolerance, time horizon, and financial goals.

Finding the Right Balance: A Hybrid Approach

Many investors find that a blended approach—combining elements of buy-and-hold with strategic adjustments—works best.

Combining Buy-and-Hold with Strategic Adjustments

A flexible strategy allows investors to leverage the benefits of buy-and-hold while addressing its limitations.

- Rebalancing: Periodically rebalancing your portfolio to maintain your desired asset allocation can help mitigate risk.

- Tax-loss harvesting: Selling losing investments to offset capital gains can reduce your tax burden.

- Adjusting asset allocation: Based on market conditions and economic forecasts, you might adjust your asset allocation to align with your risk tolerance and goals.

Conclusion

Buy-and-hold investing offers simplicity and the potential for long-term growth through compounding. However, it's not without limitations, including vulnerability to market downturns and the potential for missing out on opportunities. Alternative investment strategies exist, and a hybrid approach—combining elements of buy-and-hold with strategic adjustments—might be optimal for many investors. Ultimately, the 'best' approach depends on you. Carefully consider your individual risk tolerance, financial goals, and time horizon before deciding whether buy-and-hold investing, or a blend of strategies, aligns with your needs. Explore further resources on investment planning to make informed decisions.

Featured Posts

-

Container Ship Aground On Mans Lawn The Cnn Story

May 26, 2025

Container Ship Aground On Mans Lawn The Cnn Story

May 26, 2025 -

La Querelle Ardisson Baffie Cons Et Machos Une Animosite Tenace

May 26, 2025

La Querelle Ardisson Baffie Cons Et Machos Une Animosite Tenace

May 26, 2025 -

Florentino Perez Es A Real Madrid A Modern Korszak

May 26, 2025

Florentino Perez Es A Real Madrid A Modern Korszak

May 26, 2025 -

La Semaine Des 5 Heures L Avenir Incertain De L Emission Sur La Premiere

May 26, 2025

La Semaine Des 5 Heures L Avenir Incertain De L Emission Sur La Premiere

May 26, 2025 -

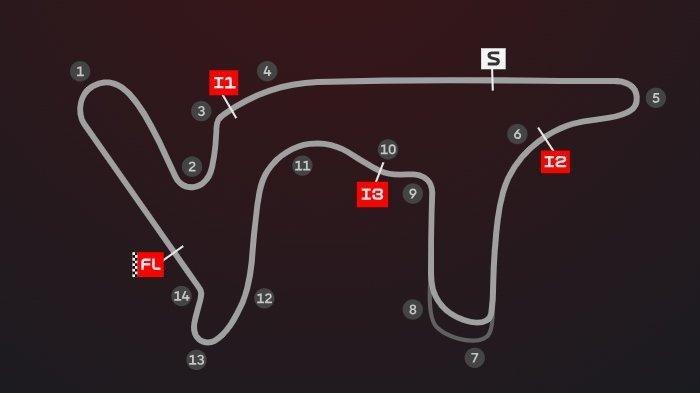

Jadwal Moto Gp Argentina 2025 Sprint Race Minggu Dini Hari

May 26, 2025

Jadwal Moto Gp Argentina 2025 Sprint Race Minggu Dini Hari

May 26, 2025