Is Canada Post Effectively Bankrupt? Analysis Of Its Financial State And Mail Delivery Services

Table of Contents

Canada Post's Financial Performance: A Declining Trend?

Canada Post's financial reports paint a picture of persistent struggle. While parcel delivery has seen growth, the decline in letter mail volume significantly impacts overall revenue. Analyzing Canada Post's financial health requires examining several key indicators. The corporation has reported consistent losses in recent years, raising concerns about its long-term sustainability and fueling the debate around whether Canada Post is facing a financial crisis.

- Year-over-year revenue changes: While parcel volume growth contributes positively, the overall revenue growth is often outpaced by rising operating costs. Several years have shown a net decrease in overall revenue, despite increased parcel delivery.

- Key cost drivers: Labor costs, transportation expenses (fuel costs and fleet maintenance), and the maintenance of aging infrastructure significantly contribute to Canada Post's operational expenses, squeezing profit margins and contributing to the Canada Post financial crisis discussion.

- Debt levels and credit ratings: Canada Post carries a significant debt load, and its credit rating reflects the ongoing financial pressures. This debt burden further complicates the corporation's ability to invest in modernization and adapt to the changing landscape.

- Government subsidies and their impact: Government subsidies have been crucial in mitigating losses and ensuring the continuation of postal services, particularly in rural areas. However, the long-term reliance on government support raises questions about the long-term financial sustainability of Canada Post.

The Impact of E-commerce on Canada Post's Business Model

The rise of e-commerce has created a double-edged sword for Canada Post. While the surge in parcel deliveries has boosted revenue in one area, it has simultaneously accelerated the decline in letter mail volume. This shift underscores the need for adaptation and modernization to remain competitive.

- Growth in parcel delivery volume: E-commerce has undeniably fueled significant growth in parcel delivery, becoming a major revenue source for Canada Post. However, managing this volume effectively presents unique challenges.

- Challenges of handling increased parcel volume: Increased parcel volume requires investments in infrastructure, logistics, and sorting facilities to ensure efficient and timely delivery. This requires considerable capital expenditure, further impacting the company's financial stability.

- Competitive landscape in the courier market: Canada Post faces stiff competition from private courier companies, often offering faster and sometimes cheaper shipping options. This competition puts pressure on Canada Post's pricing strategies and market share.

- Investment in infrastructure to handle increased volume: To meet the demands of the e-commerce boom, Canada Post needs to continuously invest in modernizing its infrastructure, including sorting facilities, transportation networks, and delivery technology. This significant financial commitment adds to its existing financial burden.

The Future of Mail Delivery: Is Canada Post Sustainable?

The long-term viability of Canada Post hinges on its ability to adapt to a rapidly changing landscape. Several scenarios are possible, each with significant implications for the future of mail delivery in Canada. Discussions of Canada Post's insolvency are often intertwined with these potential scenarios.

- Potential scenarios for the future of Canada Post: These include privatization, continued government support with potential restructuring, or a combination of both. Each option carries its own set of economic and social implications.

- Government policy and its role in Canada Post’s future: Government policy will play a pivotal role in shaping Canada Post's future. Decisions regarding subsidies, regulations, and potential privatization will significantly influence its financial health and service delivery.

- Impact on employment and service delivery across Canada: Any significant changes to Canada Post's structure or operations will have wide-ranging impacts on employment and service delivery, particularly in rural and remote communities.

- Long-term sustainability and the need for adaptation: Canada Post's long-term sustainability depends on its ability to effectively adapt to changing market conditions and embrace innovative solutions to optimize operations and diversify revenue streams.

Conclusion: Assessing the Financial Health of Canada Post and its Future

While not technically bankrupt, Canada Post faces significant financial challenges. The decline in letter mail volume, coupled with the rising costs of operation and competition, presents a serious threat to its long-term financial sustainability. The question of whether Canada Post is financially viable in its current form remains a subject of ongoing debate. The future of Canada Post hinges on strategic adaptation, government policy, and a willingness to embrace innovative solutions. To understand the complexities of Canada Post's financial future, further research into its financial statements and active participation in public discussions surrounding Canada Post reform and its viability are crucial. Engage in the conversation; the future of Canada Post's financial health depends on it.

Featured Posts

-

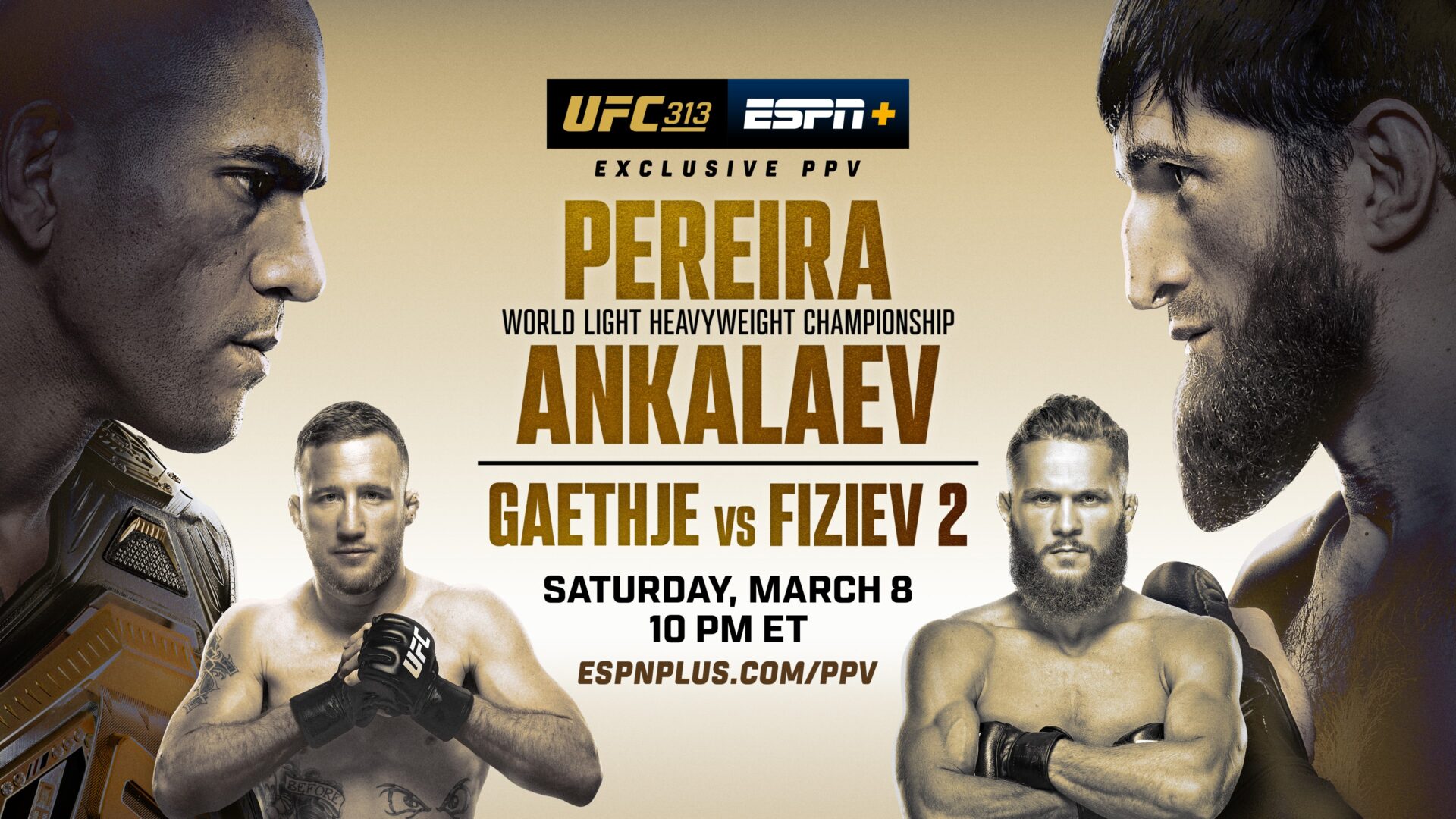

Ufc 313 How To Watch Pereira Vs Ankalaev Online

May 19, 2025

Ufc 313 How To Watch Pereira Vs Ankalaev Online

May 19, 2025 -

U Conn Star Paige Bueckers Wins Hearts With Team Breakfast

May 19, 2025

U Conn Star Paige Bueckers Wins Hearts With Team Breakfast

May 19, 2025 -

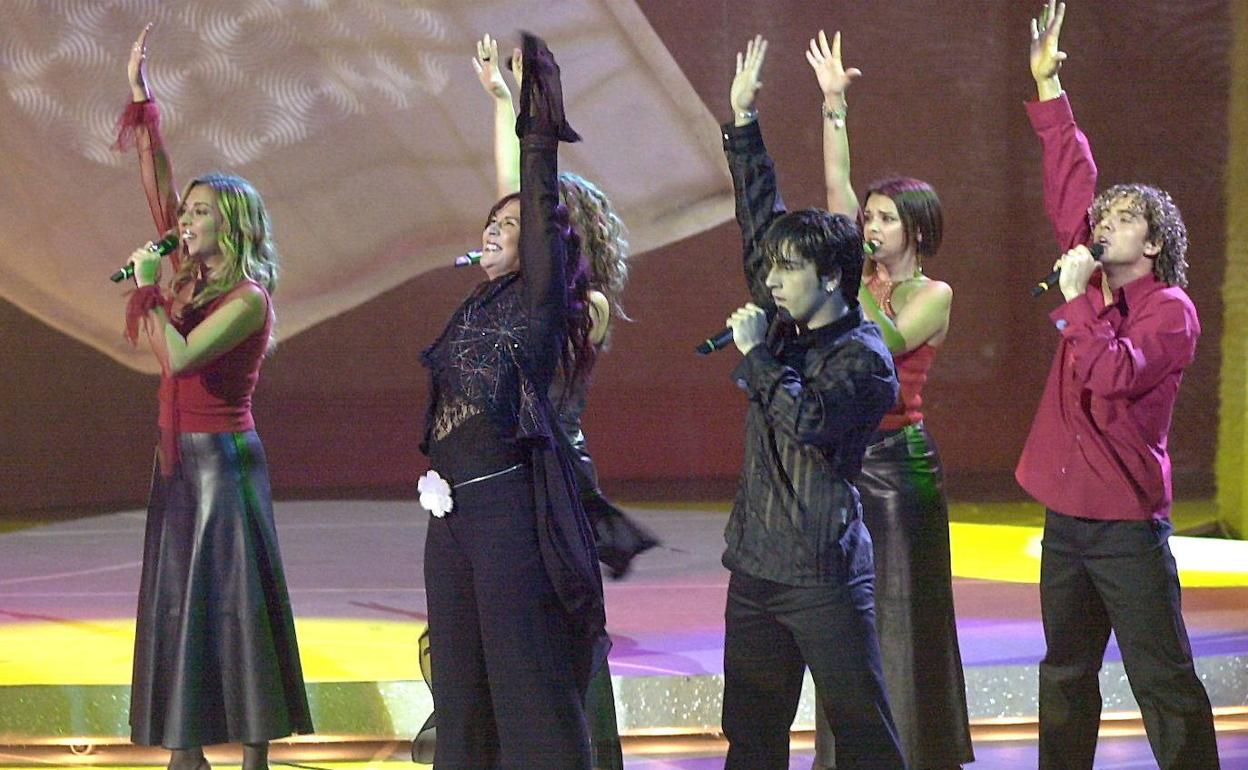

Anos Dorados De Espana En Eurovision Un Analisis De Sus Mejores Participaciones

May 19, 2025

Anos Dorados De Espana En Eurovision Un Analisis De Sus Mejores Participaciones

May 19, 2025 -

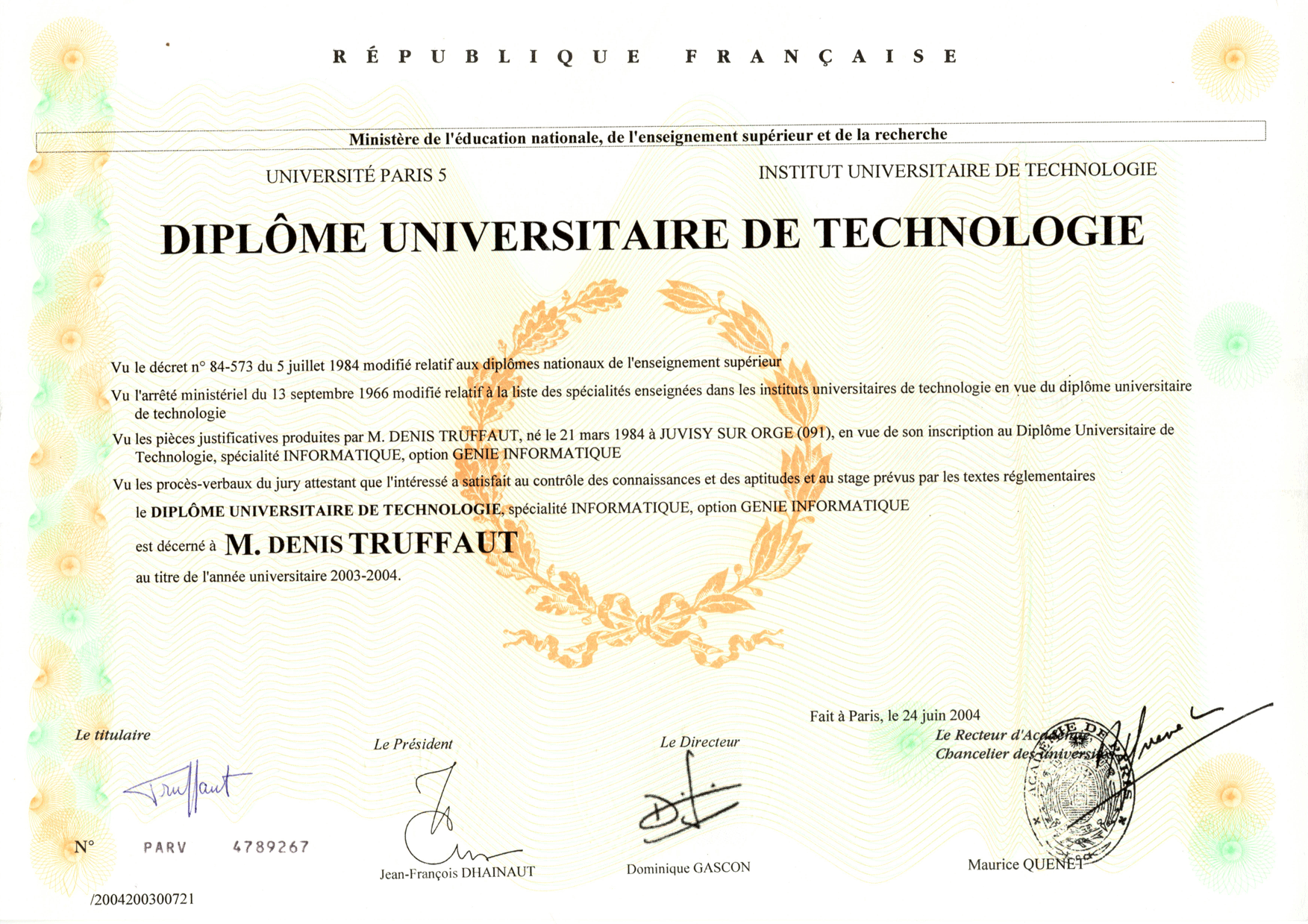

Formation Archiviste Poitiers Diplome Universitaire Et Bases Du Metier

May 19, 2025

Formation Archiviste Poitiers Diplome Universitaire Et Bases Du Metier

May 19, 2025 -

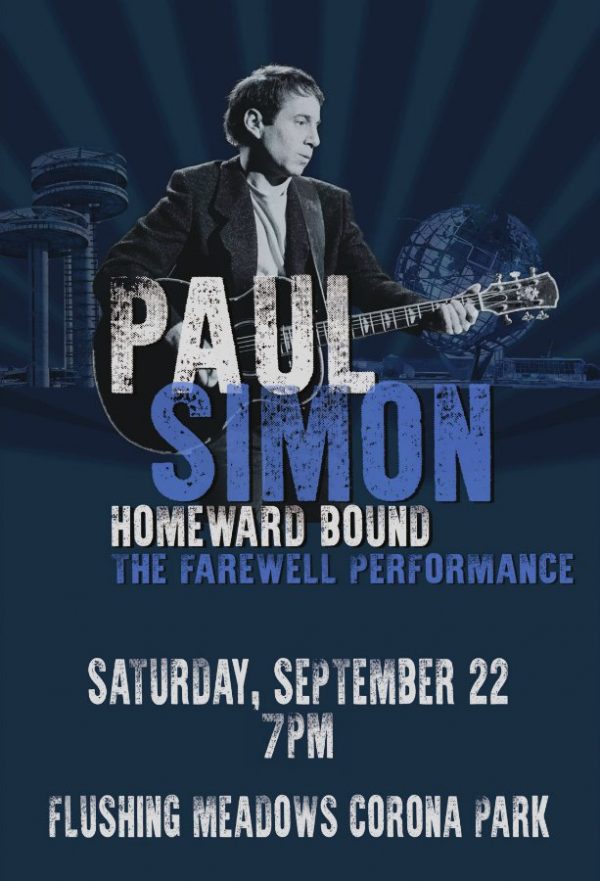

Legendary Singers Farewell Performance Nj Concert To Be His Last

May 19, 2025

Legendary Singers Farewell Performance Nj Concert To Be His Last

May 19, 2025