Is Canadian Tire's Pursuit Of Hudson's Bay A Wise Move?

Table of Contents

Synergies and Potential Benefits of the Merger

The potential union of Canadian Tire and Hudson's Bay offers several compelling synergies that could reshape the Canadian retail market. This strategic move could significantly benefit both companies, creating a retail powerhouse unlike any other in Canada.

Expanding Product Portfolio and Market Reach

Canadian Tire's current focus on automotive parts, home improvement, and sporting goods could be dramatically expanded by incorporating Hudson's Bay's extensive offerings in apparel, home furnishings, and luxury goods. This diversification presents a substantial opportunity for growth.

- Increased market share: The combined entity would command a significantly larger share of the Canadian retail market.

- Access to new customer demographics: Canadian Tire would gain access to a broader customer base, including those who currently shop primarily at Hudson's Bay.

- Diversification of revenue streams: Reducing reliance on any single product category mitigates risk and enhances financial stability.

- Potential for cross-selling opportunities: Customers could be seamlessly directed to relevant products across both brands, increasing sales and customer loyalty.

The combined retail footprint would significantly enhance brand visibility and customer reach across Canada, particularly in urban centers where Hudson's Bay has a strong presence. This increased visibility would translate to increased brand recognition and customer loyalty.

Improved Supply Chain and Logistics

Consolidating the logistics and supply chains of both companies holds the potential for substantial cost savings and efficiency improvements. This streamlining would lead to significant operational advantages.

- Streamlined distribution: A unified distribution network would optimize delivery routes and reduce transportation costs.

- Reduced warehousing costs: Consolidating warehouses and inventory would minimize storage expenses and improve inventory management.

- Improved inventory management: Real-time data sharing would lead to more accurate forecasting and reduced stockouts or overstocking.

- Enhanced delivery options: The combined entity could offer more flexible and efficient delivery options to customers, enhancing the overall shopping experience.

Economies of scale would play a significant role in achieving these efficiencies, leading to a more cost-effective and streamlined operation.

Enhanced Brand Loyalty and Customer Engagement

Integrating the loyalty programs and customer data of both companies would allow for a more personalized and engaging shopping experience.

- Unified loyalty program: A single, comprehensive loyalty program could reward customers across both brands.

- Targeted marketing campaigns: Data-driven marketing could personalize offers and promotions, leading to increased sales conversion rates.

- Improved customer service: Streamlined processes and integrated systems would lead to more efficient and responsive customer service.

- Enhanced online and offline shopping experience: A seamless integration of online and offline channels would create a superior customer journey.

This improved customer experience would foster greater brand loyalty and drive repeat business, ensuring long-term success.

Challenges and Risks Associated with the Acquisition

While the potential synergies are substantial, several challenges and risks could hinder the success of the Canadian Tire-Hudson's Bay merger.

Integration Difficulties and Operational Challenges

Merging two large and distinct retail operations presents a complex undertaking fraught with potential pitfalls.

- Cultural clashes: Integrating two vastly different corporate cultures could lead to conflict and decreased employee morale.

- System integration issues: Harmonizing different IT systems, inventory management systems, and point-of-sale systems could be technically challenging and time-consuming.

- Potential employee redundancies: Overlapping roles and responsibilities may necessitate job cuts, leading to potential employee unrest and loss of institutional knowledge.

- Disruptions to existing operations: The integration process could temporarily disrupt existing operations, leading to decreased sales and customer dissatisfaction.

Careful planning and execution are crucial to minimizing these operational challenges and ensuring a smooth transition.

Competition and Market Saturation

The Canadian retail market is fiercely competitive, and the merged entity would face significant pressure from existing players.

- Competition from online retailers: The growth of e-commerce presents a persistent challenge to brick-and-mortar retailers.

- Pressure on pricing: Intense competition could necessitate lower prices, impacting profitability.

- Potential for antitrust scrutiny: Regulatory bodies may scrutinize the merger for potential anti-competitive practices.

- Challenges in maintaining market share: The merged entity would need to effectively compete to retain and grow its market share.

Successfully navigating this competitive landscape will be essential for the long-term success of the merged entity.

Financial Implications and Return on Investment

The acquisition cost and the debt incurred will significantly impact Canadian Tire's financial performance.

- Debt levels: Financing the acquisition could significantly increase Canadian Tire's debt burden.

- Profitability analysis: A thorough analysis of the financial implications is crucial to assess the potential return on investment.

- Shareholder value: The acquisition must demonstrate the potential to enhance shareholder value in the long term.

- Long-term financial projections: Accurate long-term financial projections are necessary to evaluate the viability of the merger.

The financial viability of the acquisition and the expected return on investment will be key factors in determining the overall success of this strategic move.

Conclusion

The potential Canadian Tire and Hudson's Bay merger presents a complex equation of opportunity and risk. While the synergies in expanding product portfolios, improving logistics, and enhancing customer engagement are attractive, the integration difficulties, competitive pressures, and substantial financial implications must be carefully considered. The success of this ambitious undertaking hinges on Canadian Tire's ability to effectively manage these challenges and deliver a smooth and profitable integration. Continued monitoring of the deal's progress will be crucial in assessing whether this represents a wise move for Canadian Tire and a positive development for the Canadian retail landscape. Stay informed on the latest developments regarding the Canadian Tire and Hudson's Bay acquisition – the future of Canadian retail may depend on it.

Featured Posts

-

Cubs At Mets A Battle Of Baseballs Best Pitching Vs Offense

May 19, 2025

Cubs At Mets A Battle Of Baseballs Best Pitching Vs Offense

May 19, 2025 -

Brett Goldsteins Hbo Comedy Special April Air Date Announced

May 19, 2025

Brett Goldsteins Hbo Comedy Special April Air Date Announced

May 19, 2025 -

The China Factor Challenges And Opportunities For Premium Car Brands

May 19, 2025

The China Factor Challenges And Opportunities For Premium Car Brands

May 19, 2025 -

Eurowizja 2024 Ocena Fanow Dla Steczkowskiej Czy Ma Powody Do Radosci

May 19, 2025

Eurowizja 2024 Ocena Fanow Dla Steczkowskiej Czy Ma Powody Do Radosci

May 19, 2025 -

Suncoast Searchlight Resource Constraints In Mental Health Care Amidst Growing Demand

May 19, 2025

Suncoast Searchlight Resource Constraints In Mental Health Care Amidst Growing Demand

May 19, 2025

Latest Posts

-

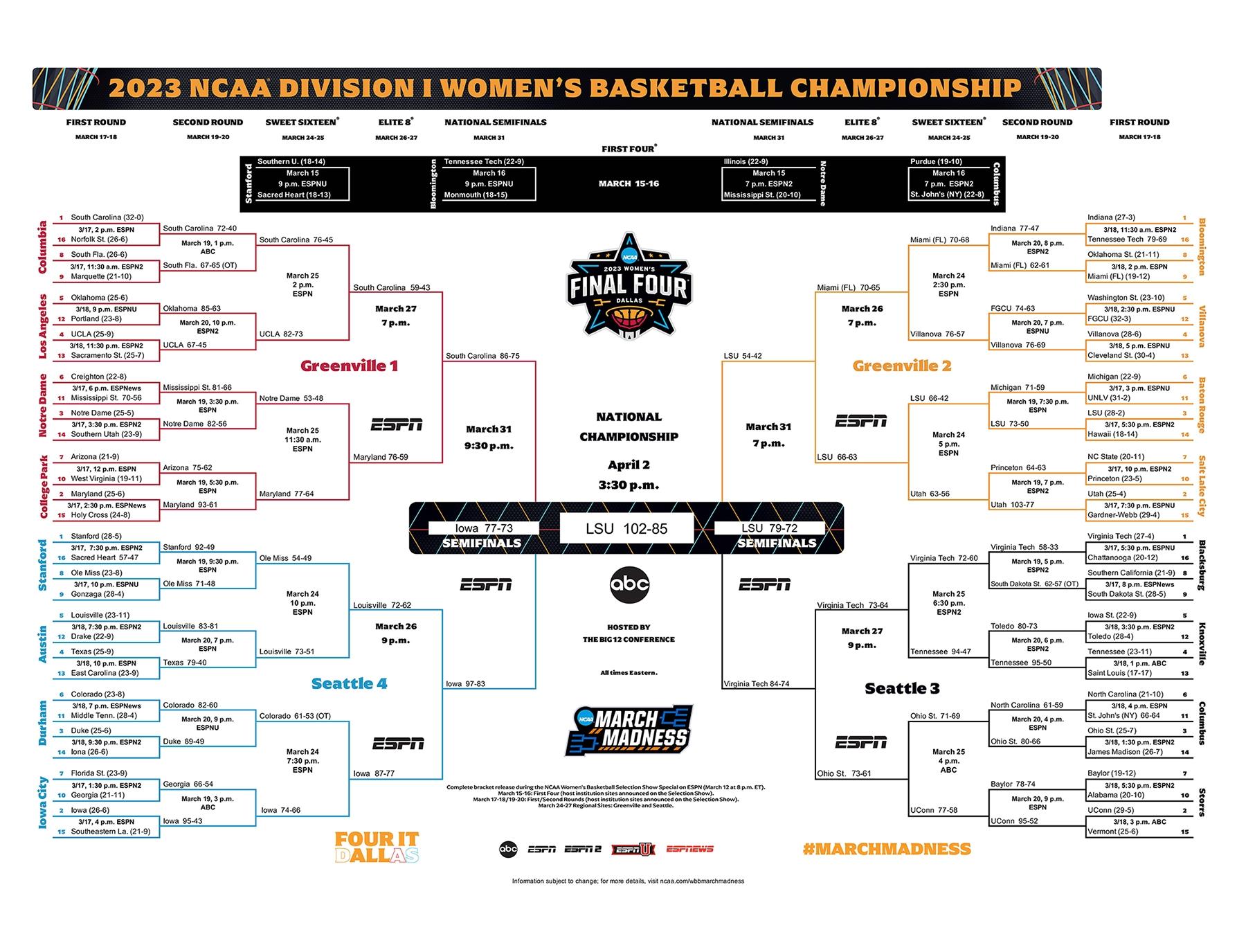

Lipscombs Ncaa Tournament Performance Past Results And Future Predictions

May 19, 2025

Lipscombs Ncaa Tournament Performance Past Results And Future Predictions

May 19, 2025 -

Where Is Lipscomb In The Ncaa Tournament A Look At Their History And Bracket Chances

May 19, 2025

Where Is Lipscomb In The Ncaa Tournament A Look At Their History And Bracket Chances

May 19, 2025 -

Lipscomb University Ncaa Tournament History A Complete Bracketology Update

May 19, 2025

Lipscomb University Ncaa Tournament History A Complete Bracketology Update

May 19, 2025 -

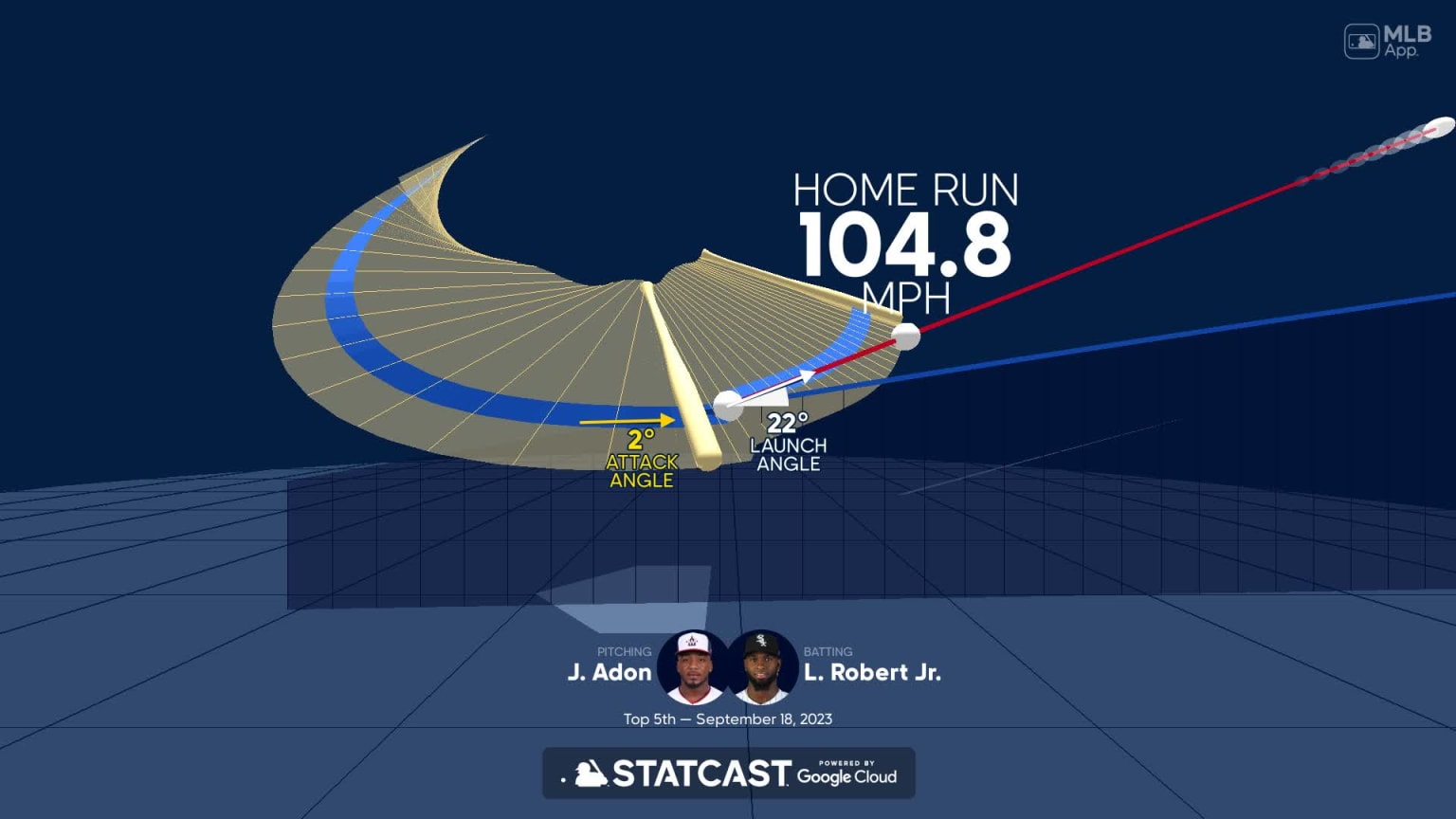

Analyzing The Mlb Rumors Luis Robert Jr S Future Pirates Strategy And Arenados Contract

May 19, 2025

Analyzing The Mlb Rumors Luis Robert Jr S Future Pirates Strategy And Arenados Contract

May 19, 2025 -

Arenado Robert Jr And The Pirates Dissecting The Latest Mlb Trade Rumors

May 19, 2025

Arenado Robert Jr And The Pirates Dissecting The Latest Mlb Trade Rumors

May 19, 2025