Is D-Wave Quantum (QBTS) A Smart Quantum Computing Stock Investment?

Table of Contents

H2: D-Wave Quantum's Technology and Competitive Landscape

H3: D-Wave's Quantum Annealing Approach:

D-Wave's approach to quantum computing centers around quantum annealing. Unlike gate-based quantum computing, which manipulates qubits to perform a sequence of logic gates, quantum annealing exploits the principles of quantum mechanics to find the lowest energy state of a problem, effectively solving optimization problems.

- Advantages: Quantum annealing excels at tackling specific optimization problems, such as those encountered in logistics, finance, and materials science. Its architecture is currently more scalable than some gate-based approaches.

- Limitations: Quantum annealing is not a universal quantum computing model. It's less versatile than gate-based approaches, which can theoretically solve a wider range of computational problems. Its solutions are also probabilistic, requiring verification.

H3: Competitive Analysis within the Quantum Computing Market:

D-Wave faces stiff competition from major players like IBM, Google, IonQ, and Rigetti Computing. Each company pursues a different quantum computing strategy, with varying levels of success.

- Comparison: While IBM, Google, and others focus primarily on gate-based quantum computing, D-Wave's specialization in quantum annealing offers a niche market advantage. However, its market share is smaller than that of the gate-based players, who boast greater resources and broader technological applications.

- Strengths and Weaknesses: D-Wave's strength lies in its early-mover advantage and established customer base. However, its reliance on a single technology limits its potential applications compared to more versatile competitors. Funding and ongoing technological advancements are crucial factors in D-Wave's future success.

H2: Financial Performance and Investment Risks of QBTS

H3: Analyzing D-Wave Quantum's Financial Statements:

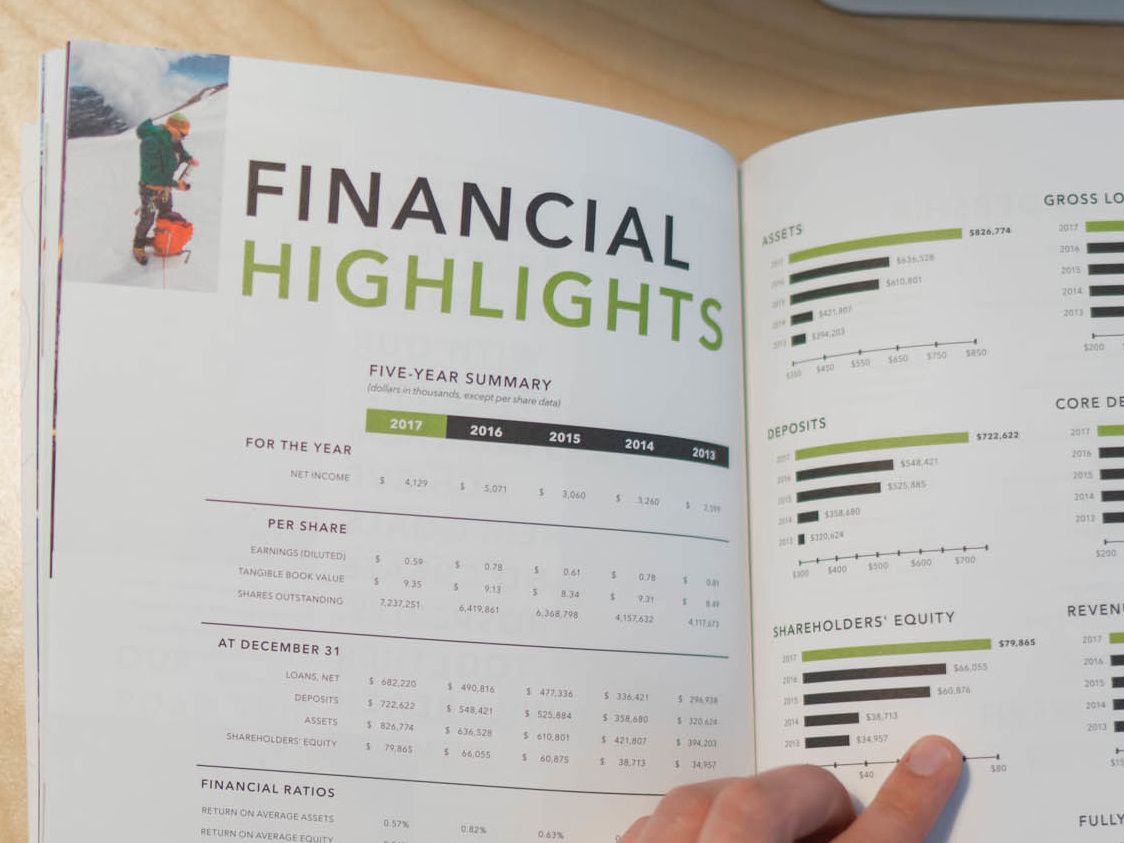

A thorough review of QBTS's financial statements is crucial for assessing its investment viability. Analyzing key metrics such as revenue growth, operating margin, cash flow, and debt-to-equity ratio provides insights into the company's financial health and stability. Publicly available financial data, along with analyst reports, should be consulted for a comprehensive understanding of QBTS's financial performance. The QBTS stock price is, of course, highly sensitive to these factors.

- Key Metrics: Investors need to closely monitor QBTS's revenue growth trajectory, assess its profitability, and carefully evaluate its debt levels to gauge its long-term financial sustainability.

- Financial Health: A detailed examination of the company's balance sheet, income statement, and cash flow statement is essential for assessing its financial strength and resilience.

H3: Identifying and Evaluating the Investment Risks:

Investing in QBTS, or any quantum computing stock, carries significant risks.

- Market Volatility: The quantum computing market is exceptionally volatile, with rapid technological advancements, changing competitive landscapes, and unpredictable market trends influencing QBTS's stock price.

- Technological and Market Risks: Technological hurdles, slower-than-expected adoption, and intensifying competition from other quantum computing companies pose substantial threats. Regulatory changes could also impact the company's trajectory. Thorough due diligence is a must.

H2: Future Growth Potential and Long-Term Outlook for QBTS

H3: Potential Applications and Market Opportunities:

D-Wave's quantum annealing technology holds significant promise across various industries.

- Market Growth: The potential for growth is substantial across sectors, including logistics optimization, financial modeling (portfolio optimization, fraud detection), drug discovery, and materials science. The expanding application of quantum computing suggests a positive long-term outlook for D-Wave.

- Partnerships and Collaborations: Strategic partnerships and collaborations with industry leaders can accelerate D-Wave's growth and market penetration.

H3: Long-Term Growth Projections and Valuation:

Analyzing various growth scenarios and comparing QBTS's valuation against competitors is vital for determining its long-term investment potential.

- Growth Rate Scenarios: Considering different growth rates and their impact on the stock price helps investors assess the potential returns and risks associated with QBTS.

- Comparative Valuation: Comparing QBTS's valuation to other companies in the quantum computing sector offers insights into its relative attractiveness and investment prospects. Understanding the future outlook is key.

Conclusion: Is D-Wave Quantum (QBTS) a Smart Quantum Computing Stock Investment? A Final Verdict

D-Wave Quantum (QBTS) presents a complex investment proposition. While its pioneering technology in quantum annealing holds unique advantages for specific applications, it faces strong competition from companies pursuing alternative quantum computing approaches. The company's financial performance, while showing promise, warrants ongoing monitoring, and the inherent volatility of the quantum computing market demands careful risk assessment. Whether QBTS is a "smart" investment depends heavily on an individual's risk tolerance and investment horizon.

Investing in QBTS or any quantum computing stock requires thorough due diligence. Conduct your own in-depth research, carefully consider your individual financial goals and risk tolerance, and consult with a financial advisor before making any investment decisions related to D-Wave Quantum (QBTS) or other quantum computing stocks. Remember that a balanced investment strategy, incorporating diversification and risk management, is crucial for long-term financial success.

Featured Posts

-

Abn Amro Voorspelt Stijging Huizenprijzen Ondanks Hogere Rente

May 21, 2025

Abn Amro Voorspelt Stijging Huizenprijzen Ondanks Hogere Rente

May 21, 2025 -

Understanding The Appeal Of The Love Monster

May 21, 2025

Understanding The Appeal Of The Love Monster

May 21, 2025 -

Echo Valley Images Reveal Tense Atmosphere Of Sweeney Moore Thriller

May 21, 2025

Echo Valley Images Reveal Tense Atmosphere Of Sweeney Moore Thriller

May 21, 2025 -

Ings 2024 Form 20 F Key Highlights From The Annual Report

May 21, 2025

Ings 2024 Form 20 F Key Highlights From The Annual Report

May 21, 2025 -

Us Couple Arrested After Bbc Antiques Roadshow Appearance

May 21, 2025

Us Couple Arrested After Bbc Antiques Roadshow Appearance

May 21, 2025