Is Gold A Safe Haven During Trade Wars? A Price Rally Analysis

Table of Contents

Historical Performance of Gold During Trade Wars

The Impact of Past Trade Wars on Gold Prices

Examining historical data reveals a complex relationship between trade wars and gold prices. While gold doesn't always surge during every trade dispute, several instances show a clear correlation. Let's look at some specific examples:

-

US-China Trade War (2018-2020): Escalations in tariffs between the US and China led to periods of increased gold prices. For example, the announcement of new tariffs in 2018 saw a noticeable gold price rally of approximately 10% within a few months. However, this increase wasn't solely due to the trade war; other factors, like weakening global economic growth, also played a role.

-

The Plaza Accord (1985): While not a traditional trade war, the Plaza Accord, which aimed to devalue the US dollar, significantly impacted currency markets and led to a gold price increase as investors sought a safe haven.

-

Other historical trade disputes: Similar patterns, albeit with varying degrees of impact, can be observed during other periods of significant trade tensions. For instance, fluctuations in gold prices during periods like the Smoot-Hawley Tariff Act (1930) demonstrate the sensitivity of gold to global trade uncertainty.

Charts and Graphs: (Insert relevant charts and graphs visually demonstrating gold price movements during these periods. Clearly label axes and data sources).

It's crucial to acknowledge that gold price movements are rarely caused by a single factor. Inflationary pressures, currency fluctuations (such as dollar devaluation), and overall investor sentiment also significantly influence gold's performance.

Identifying Trends and Correlations

Statistical analysis of historical data can help quantify the relationship between trade war intensity (measured, for example, by the value of tariffs imposed or the frequency of trade disputes) and gold price fluctuations.

-

Statistical Methods: Techniques like regression analysis can be used to determine the correlation between these variables.

-

Findings: While a strong, perfectly linear correlation is unlikely, studies often show a positive correlation between increased trade war intensity and increased gold prices, suggesting a safe haven effect. However, the correlation's strength varies depending on the specific context and other concurrent economic factors.

-

Confidence Levels: It is important to consider the confidence levels associated with any statistical findings to gauge the reliability of the correlation.

Gold's Role as a Safe Haven Asset

Understanding the Safe Haven Concept

A safe haven asset is a store of value that tends to hold or increase in value during times of economic or political uncertainty. Investors seek them to protect their capital from potential losses in riskier assets.

-

Characteristics of a Safe Haven Asset:

- Negative correlation with risky assets (like stocks).

- Relative price stability.

- High liquidity (easily bought and sold).

-

Investor Psychology: During times of uncertainty, investors prioritize capital preservation over growth, driving demand for safe haven assets.

Comparing Gold to Other Safe Havens

Gold isn't the only safe haven asset. Investors also turn to US Treasury bonds and the Swiss Franc during periods of uncertainty. A direct comparison reveals different characteristics and performances:

-

Comparison Table: (Insert a table comparing the performance of gold, US Treasury bonds, and the Swiss Franc during specific trade war periods. Include percentage changes for clarity).

-

Advantages and Disadvantages of Gold: Gold offers a tangible asset, unlike bonds or currencies. It's also less susceptible to central bank manipulation than fiat currencies. However, gold offers no yield, and its price is inherently volatile.

Factors Influencing Gold Price Rallies During Trade Wars

Geopolitical Uncertainty and Investor Sentiment

Trade wars often exacerbate existing geopolitical tensions, leading to increased investor anxiety and a flight to safety.

-

Examples of News Events: Negative headlines about trade negotiations, unexpected tariff announcements, or escalating geopolitical conflicts can trigger a surge in gold demand.

-

Role of Media and Analysts: The media and financial analysts significantly influence investor sentiment, often amplifying fears and expectations around gold's price.

Inflationary Pressures and Currency Devaluation

Trade wars can disrupt global supply chains, leading to inflationary pressures. Furthermore, currency devaluations can occur as a result of trade disputes.

-

Trade Wars and Inflation: Tariffs increase the cost of goods, directly contributing to inflation. This makes gold, a hedge against inflation, more attractive.

-

Currency Devaluation: A weaker currency increases the price of gold denominated in that currency, boosting its relative value for investors in that country.

Investing in Gold During Trade Wars: Strategies and Considerations

Diversification Strategies

Incorporating gold into a diversified portfolio can help mitigate risks associated with trade wars and other market uncertainties.

-

Allocation Percentages: The ideal allocation depends on individual risk tolerance and investment goals. A common suggestion is to allocate 5-10% of a portfolio to gold.

-

Gold Investment Options: Investors can access gold through various instruments:

- Physical Gold: Owning gold bars or coins.

- Gold ETFs (Exchange-Traded Funds): Provides exposure to gold prices without physically holding the metal.

- Gold Mining Stocks: Investing in companies involved in gold exploration and production.

Risk Management and Timing the Market

While gold can act as a safe haven, its price is still subject to volatility.

-

Volatility of Gold Prices: Gold prices are influenced by numerous factors beyond trade wars, making precise market timing difficult.

-

Long-Term Investment Strategies: A long-term perspective is often recommended for gold investments to mitigate the impact of short-term price fluctuations.

-

Potential for Losses: Even during trade wars, gold prices can decline, highlighting the risk involved in any investment.

Conclusion

This analysis demonstrates a complex relationship between gold prices and trade wars. While historical data suggests a positive correlation, gold's price movements are influenced by numerous factors beyond trade disputes. The effectiveness of gold as a "gold safe haven" during trade wars isn't guaranteed, but it often plays a role as part of a broader risk mitigation strategy. Understanding these factors is crucial for making informed investment decisions. Further research into the dynamics of gold as a safe haven asset is recommended for investors aiming to mitigate the risks associated with trade war uncertainties. Consider diversifying your portfolio with strategic gold investments to better navigate the complexities of global trade.

Featured Posts

-

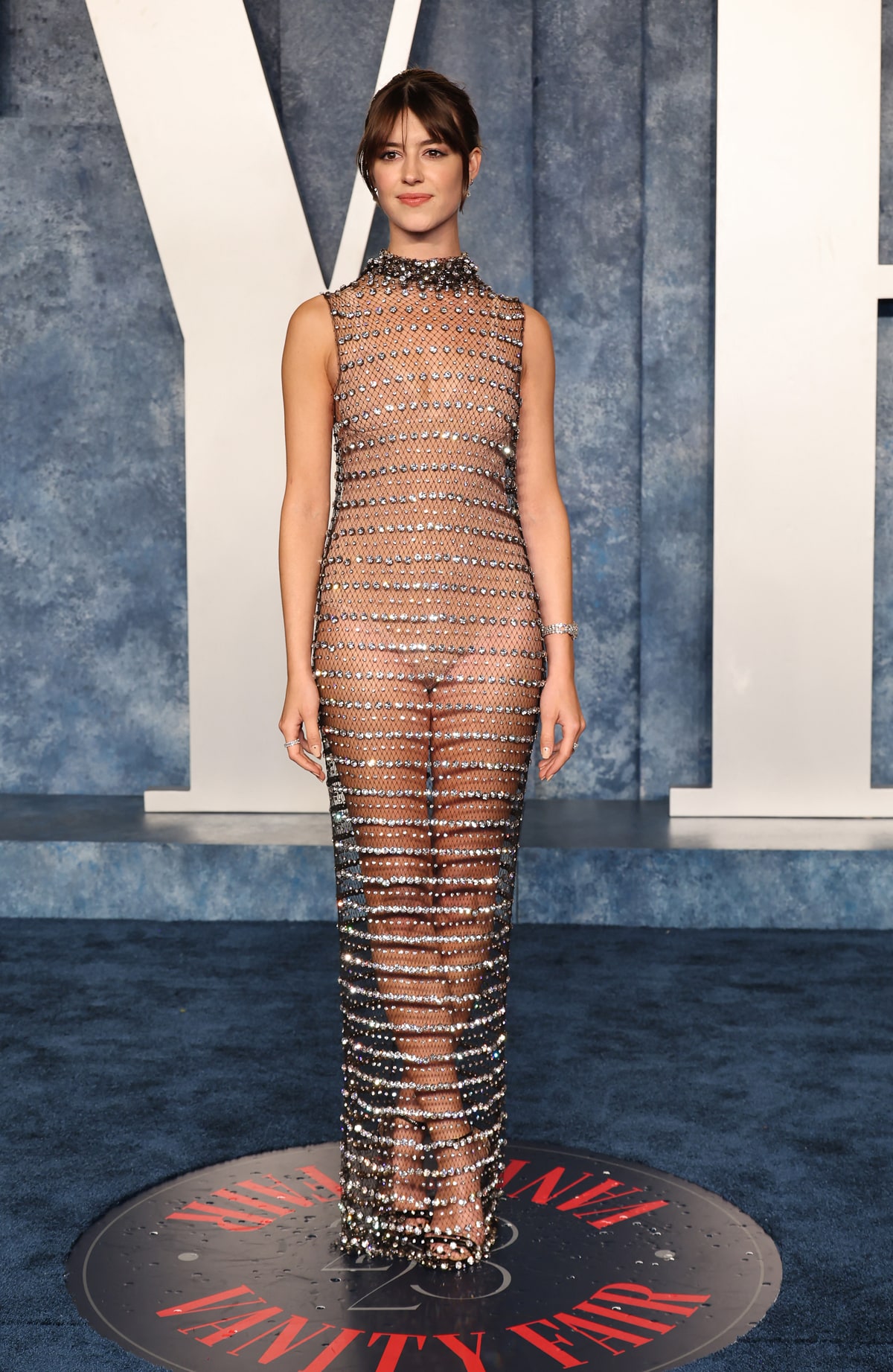

Were In Nepo Hell Oscars After Party Highlights Nepotism Fury

Apr 26, 2025

Were In Nepo Hell Oscars After Party Highlights Nepotism Fury

Apr 26, 2025 -

Navigate The Private Credit Boom 5 Key Dos And Don Ts For Job Seekers

Apr 26, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts For Job Seekers

Apr 26, 2025 -

Investigating Claims Of Drug Use At Chelsea Handlers Oscars Party

Apr 26, 2025

Investigating Claims Of Drug Use At Chelsea Handlers Oscars Party

Apr 26, 2025 -

Trumps Pressure On Ukraine For Peace A Russian Obstacle

Apr 26, 2025

Trumps Pressure On Ukraine For Peace A Russian Obstacle

Apr 26, 2025 -

Mission Impossible 7 Svalbard Filming Locations And Bts Footage

Apr 26, 2025

Mission Impossible 7 Svalbard Filming Locations And Bts Footage

Apr 26, 2025

Latest Posts

-

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025

German Politics Crumbachs Resignation And Its Implications For The Spd

Apr 27, 2025 -

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025

Bsw Leader Crumbachs Resignation Impact On The Spd Coalition

Apr 27, 2025 -

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025

Concerns Raised Over Hhss Appointment Of Anti Vaccine Activist To Study Debunked Autism Vaccine Theories

Apr 27, 2025 -

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025

Hhs Under Fire For Selecting Anti Vaccine Advocate To Investigate Autism Vaccine Link

Apr 27, 2025 -

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025

Hhss Controversial Choice Anti Vaccine Advocate To Examine Debunked Autism Vaccine Claims

Apr 27, 2025