Is Investing In Uber's Autonomous Vehicle Future Through ETFs A Good Idea?

Table of Contents

Understanding the Autonomous Vehicle Market and Uber's Role

The autonomous vehicle (AV) market is poised for explosive growth, projected to reach hundreds of billions of dollars in the coming decades. However, significant challenges remain. Developing safe, reliable, and legally compliant self-driving technology requires massive investment and overcoming complex engineering hurdles. Regulations are still evolving, and public acceptance is a crucial factor in widespread adoption.

Uber, through its Advanced Technologies Group (ATG), has been a significant investor in autonomous driving technology. While facing setbacks and ultimately exiting the fully autonomous ride-hailing market, Uber's advancements in mapping, sensor technology, and software algorithms have contributed significantly to the field. Key competitors include Waymo (Alphabet's self-driving division), Tesla, and several other tech companies and automotive manufacturers vying for market dominance.

- Market size projections: Estimates vary widely, but many analysts predict substantial growth in the AV market, driven by increasing demand for ride-sharing services and the potential for significant efficiency improvements in logistics and transportation.

- Technological hurdles: Ensuring safety and reliability in various weather conditions and traffic scenarios is a major challenge. Regulatory frameworks and public trust need to catch up with technological advancements. Infrastructure improvements, such as dedicated AV lanes, might be necessary for optimal performance.

- Uber's market share and competitive positioning: While Uber has shifted its strategy, its technological contributions and data sets remain valuable assets in the broader AV ecosystem. Its expertise in ride-hailing and logistics could still give it a competitive edge in the future of autonomous transportation.

Investing in Autonomous Vehicle Technology Through ETFs

Exchange Traded Funds (ETFs) offer a diversified way to gain exposure to the autonomous vehicle sector without directly investing in individual companies like Uber. ETFs pool investments from multiple investors, allowing for broader diversification across various companies involved in the AV supply chain – from sensor manufacturers to software developers to automotive companies integrating autonomous technology.

Identifying specific ETFs focused solely on autonomous vehicles can be tricky, as many technology-focused ETFs will have some exposure to this rapidly developing field. Research is key. You'll need to check the ETF's holdings carefully to see how much weight they give to autonomous vehicle companies. Look for ETFs with holdings in companies developing related technology (e.g., lidar sensors, AI software, mapping solutions), as well as those involved in manufacturing autonomous vehicles themselves.

- Examples of relevant ETFs: (Note: Always verify current holdings before investing. Specific ETF examples are omitted here due to the dynamic nature of financial markets and the potential for outdated information.)

- Expense ratios and management fees: Consider the fees charged by different ETFs, as they can impact overall returns. Compare expense ratios to find the most cost-effective option.

- Risk tolerance: Investing in the autonomous vehicle sector is inherently risky, given the developmental stage of the technology. Only invest an amount you are comfortable potentially losing.

Potential Risks and Rewards of Investing in Uber's Autonomous Future via ETFs

Investing in any developing technology sector, including autonomous vehicles, carries significant risk. While the potential for high returns exists, significant losses are also possible due to technological setbacks, regulatory changes, or shifting market dynamics.

Regulatory uncertainty poses a substantial challenge. Governments worldwide are still grappling with the legal and safety implications of self-driving cars, and changes in legislation could significantly impact the industry.

- Technological risks: Unforeseen technical challenges, development delays, and competition could lead to disappointing results for companies in the AV space.

- Market risks: Investor sentiment can be highly volatile, leading to fluctuations in the value of ETFs focused on this sector. Competition is fierce, and only a few players are likely to emerge as dominant forces.

- Regulatory risks: Changes in safety standards, licensing requirements, and liability laws could dramatically affect the profitability and viability of autonomous vehicle companies.

- Potential for high returns: If the technology matures and gains widespread adoption, investments in the AV sector could yield substantial profits.

Alternative Investment Strategies for the Autonomous Vehicle Sector

Besides investing in ETFs, you could consider investing directly in Uber's stock (if you believe in their future in the AV space, despite their shift in strategy), or other individual companies involved in the autonomous vehicle supply chain (e.g., sensor manufacturers, chip makers).

- Risks and rewards of direct stock investments: Direct investments offer higher potential returns but come with significantly higher risk. Individual company performance is more volatile than ETF performance.

- Diversification strategies for reducing risk: Diversifying your portfolio across multiple companies and asset classes helps reduce the overall risk.

- Comparison of potential returns and volatility: Direct stock investments offer greater potential upside but also greater potential downside compared to ETFs.

Conclusion

Investing in Uber's autonomous vehicle future through ETFs offers a pathway to participate in this potentially transformative technology, but it's not without risk. While ETFs provide diversification, the inherent volatility of the autonomous vehicle sector remains a significant factor. High potential rewards coexist with the possibility of substantial losses. Careful consideration of your risk tolerance, thorough research, and perhaps consultation with a financial advisor are crucial steps before committing your capital. Before making any investment decisions regarding Uber's autonomous vehicle future or other related ETFs, conduct further research and consider consulting a financial advisor. Keywords: Uber, autonomous vehicle ETFs, investment strategy, self-driving car investment, risk assessment.

Featured Posts

-

Dendam Israel Pada Paus Fransiskus Analisis Penghinaan Dan Konsekuensinya

May 18, 2025

Dendam Israel Pada Paus Fransiskus Analisis Penghinaan Dan Konsekuensinya

May 18, 2025 -

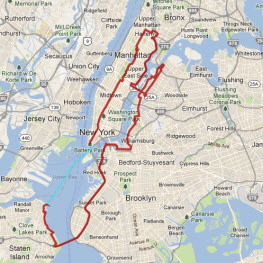

Five Boro Bike Tour A Cyclists Guide To Nycs Main Thoroughfares

May 18, 2025

Five Boro Bike Tour A Cyclists Guide To Nycs Main Thoroughfares

May 18, 2025 -

Novak Djokovic Miami Acik Finalinde Yerini Aldi

May 18, 2025

Novak Djokovic Miami Acik Finalinde Yerini Aldi

May 18, 2025 -

Mlb History Riley Greenes Double Home Run Ninth Inning Performance

May 18, 2025

Mlb History Riley Greenes Double Home Run Ninth Inning Performance

May 18, 2025 -

Remembering Emily Warren Roeblings Contributions To The Brooklyn Bridge

May 18, 2025

Remembering Emily Warren Roeblings Contributions To The Brooklyn Bridge

May 18, 2025

Latest Posts

-

Jusuf Kalla Momen Ulang Tahun Dan Harapan Perdamaian Israel Palestina Dari Gaza

May 18, 2025

Jusuf Kalla Momen Ulang Tahun Dan Harapan Perdamaian Israel Palestina Dari Gaza

May 18, 2025 -

Israel Dan Paus Fransiskus Konflik Dan Dampaknya Pada Hubungan Diplomatik

May 18, 2025

Israel Dan Paus Fransiskus Konflik Dan Dampaknya Pada Hubungan Diplomatik

May 18, 2025 -

Ucapan Selamat Ulang Tahun Untuk Jusuf Kalla Dari Gaza Harapan Perdamaian Israel Palestina

May 18, 2025

Ucapan Selamat Ulang Tahun Untuk Jusuf Kalla Dari Gaza Harapan Perdamaian Israel Palestina

May 18, 2025 -

3 Faktor Yang Mempengaruhi Sikap Israel Terhadap Pemakaman Paus Fransiskus

May 18, 2025

3 Faktor Yang Mempengaruhi Sikap Israel Terhadap Pemakaman Paus Fransiskus

May 18, 2025 -

Misir In Gazze Yoenetimi Teklifini Reddetmesi Boelgesel Etkileri

May 18, 2025

Misir In Gazze Yoenetimi Teklifini Reddetmesi Boelgesel Etkileri

May 18, 2025