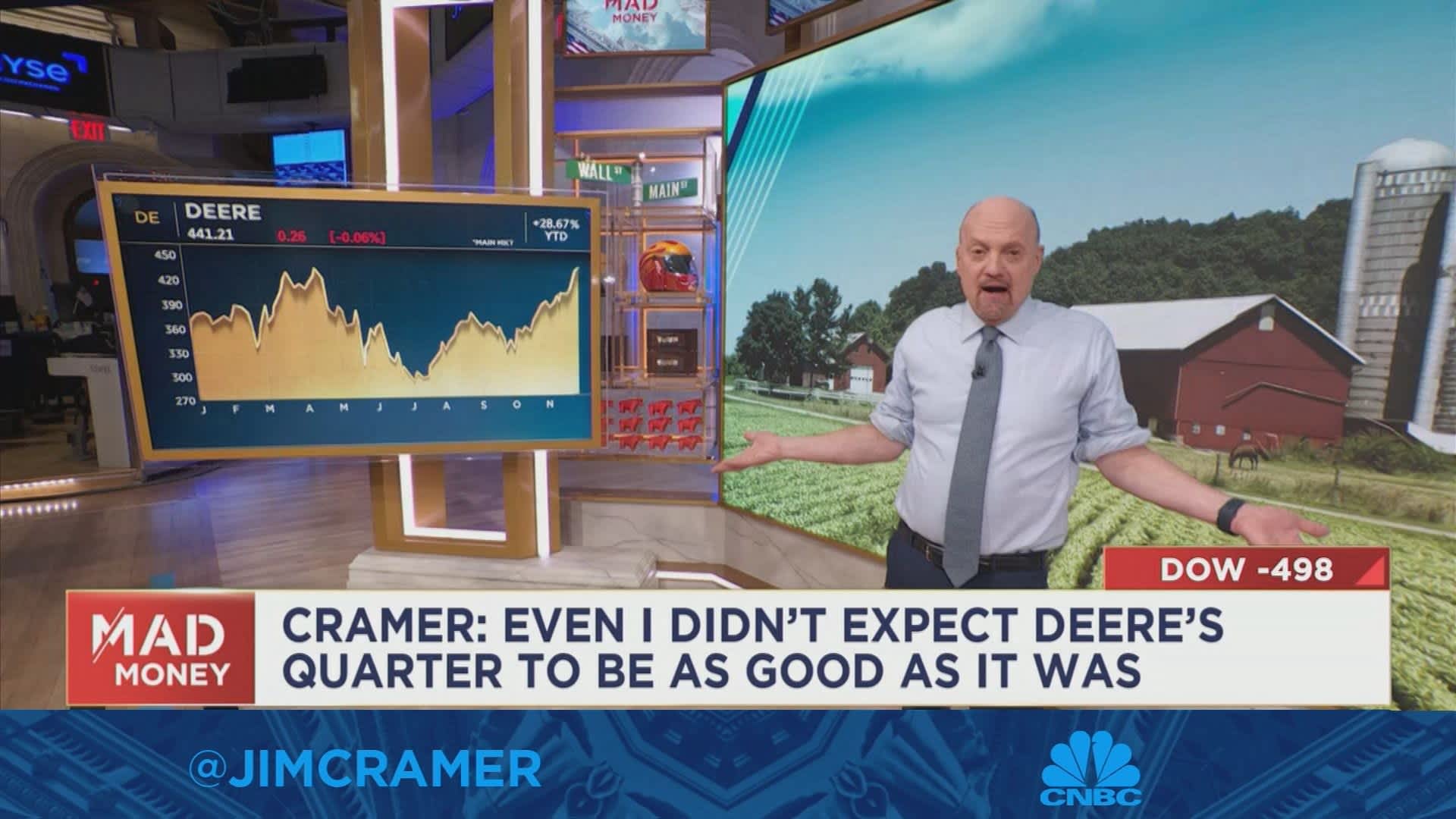

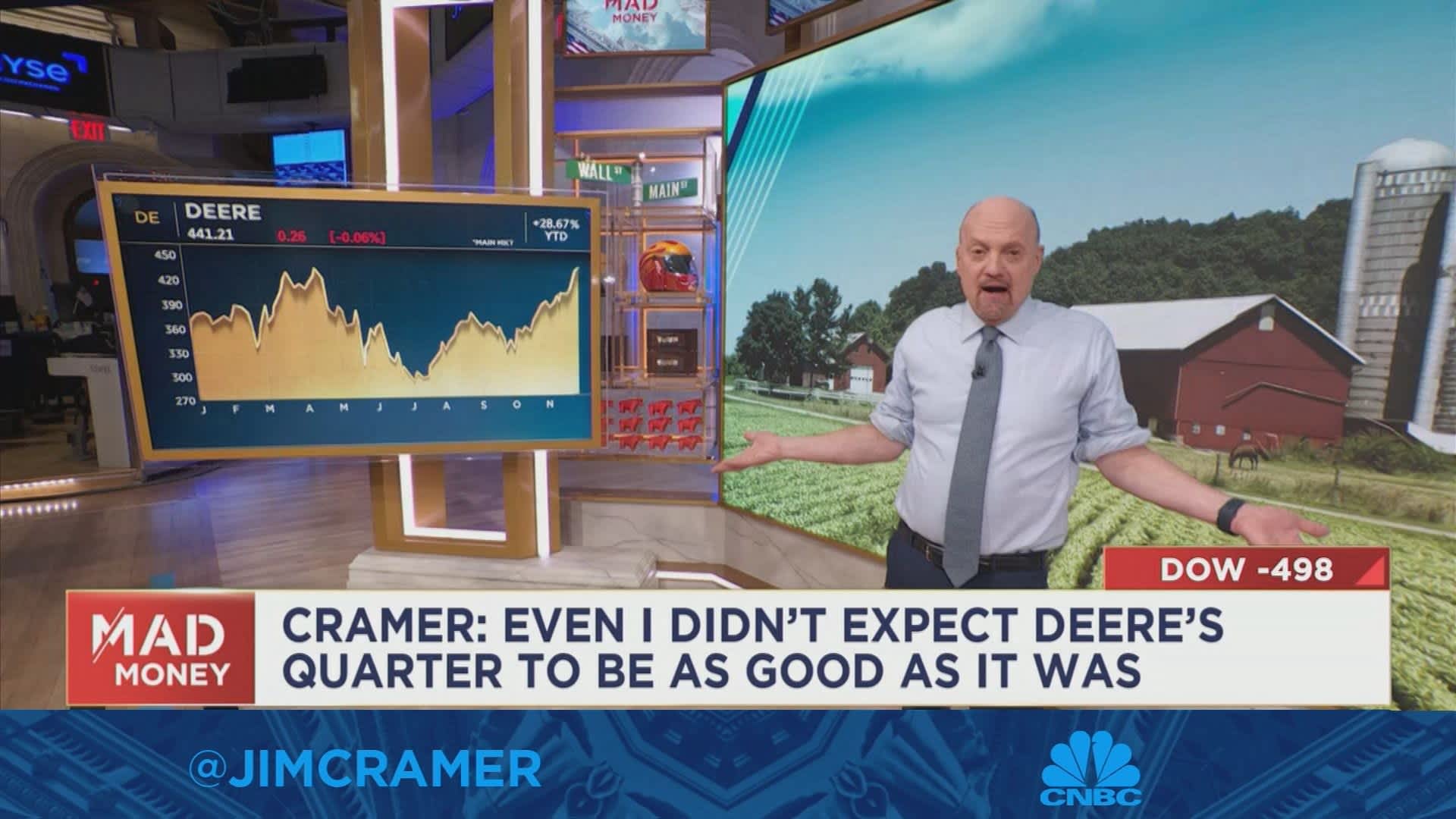

Is Jim Cramer Right About CoreWeave (CRWV)? Analyzing His AI Infrastructure Claim

Table of Contents

Jim Cramer's CoreWeave (CRWV) Thesis: A Deep Dive

To understand the investment implications, we must first dissect Jim Cramer's specific statements regarding CoreWeave. While pinpointing exact quotes requires accessing specific broadcasts or transcripts (which are beyond the scope of this article), the general sentiment often revolves around CoreWeave's positioning within the rapidly expanding AI infrastructure market. Cramer likely highlighted CoreWeave's access to vast computing resources, its focus on serving the demanding needs of AI development, and its potential for significant growth as AI adoption accelerates.

- Specific features of CoreWeave's infrastructure mentioned by Cramer: Likely, Cramer emphasized CoreWeave's NVIDIA GPU-powered infrastructure, its focus on high-performance computing (HPC), and its specialized solutions tailored for AI workloads.

- Cramer's predicted growth trajectory for CRWV: The predicted growth trajectory likely reflects the overall expansion of the AI sector and CoreWeave’s potential to capture a significant market share.

- Any potential risks or downsides mentioned by Cramer (if any): Cramer might have alluded to the inherent risks associated with a relatively young company operating in a competitive landscape, potential regulatory hurdles, or the volatility of the tech sector.

CoreWeave's (CRWV) AI Infrastructure: Strengths and Weaknesses

CoreWeave's competitive advantages stem from its specialized infrastructure designed to handle the intense computational demands of AI.

- Technology leadership and innovation: CoreWeave leverages cutting-edge technologies, primarily NVIDIA GPUs, to provide high-performance computing solutions optimized for AI and machine learning tasks.

- Market position and potential for growth: The company is well-positioned to benefit from the explosive growth of the AI industry, providing crucial infrastructure for training and deploying AI models.

- Client base and partnerships: CoreWeave’s client portfolio and partnerships are key indicators of market acceptance and future growth potential. Analyzing these relationships is crucial.

- Financial health and sustainability: A solid financial foundation, including profitability and sustainable growth, is essential for long-term investment viability.

However, CoreWeave faces significant challenges:

- Competition from established players (e.g., AWS, Google Cloud, Azure): The competition in the cloud computing and AI infrastructure space is fierce, with established giants possessing significant resources and market share.

- Dependence on specific technologies or clients: Reliance on a limited number of technologies or a concentrated client base exposes CoreWeave to significant risks.

- Scalability and expansion challenges: Meeting the growing demands of the AI market requires significant investment in infrastructure and workforce expansion, presenting scalability challenges.

- Economic factors impacting the AI infrastructure market: Economic downturns or shifts in technological preferences could negatively impact demand for CoreWeave's services.

Analyzing the Investment Potential of CoreWeave (CRWV) Stock

Evaluating the investment potential of CRWV stock requires a thorough assessment of various factors.

- Current CRWV stock price and recent trends: Monitoring the stock's price movements and identifying underlying trends is essential for understanding market sentiment.

- Analyst ratings and price targets for CRWV: Consulting financial analyst reports can offer insights into the expected future performance of the stock.

- Key financial metrics (revenue, earnings, etc.) to consider: Examining key financial indicators such as revenue growth, profitability, and debt levels is crucial for evaluating the company's financial health.

- Comparison to competitor stocks in the same sector: Comparing CRWV's performance and valuation to those of its competitors allows for a better understanding of its relative position in the market.

Determining whether CRWV stock is currently overvalued or undervalued is complex and depends on various factors, including future growth projections and market conditions. A detailed financial analysis is necessary for a conclusive assessment.

Is Jim Cramer Right About CoreWeave (CRWV)? A Final Verdict and Investment Recommendations

While Jim Cramer's optimistic outlook on CoreWeave might be justified by the company's potential within the rapidly growing AI infrastructure sector, it's crucial to consider the inherent risks and challenges. CoreWeave possesses significant strengths in its specialized infrastructure and its position in a booming market. However, stiff competition, technological dependence, and economic headwinds pose considerable threats. Therefore, a definitive "yes" or "no" to Cramer's prediction is premature.

Ultimately, the investment potential of CoreWeave (CRWV) stock is a complex equation. While the company's future prospects in the AI infrastructure market look promising, investors must carefully weigh the potential rewards against the significant risks involved.

While Jim Cramer's insights are valuable, remember to conduct your own due diligence before investing in CoreWeave (CRWV) or any AI infrastructure stock. Thoroughly research the company's financials, competitive landscape, and future prospects to make an informed decision. Consider diversifying your portfolio and only invest what you can afford to lose. Remember to consult with a qualified financial advisor before making any investment decisions related to CoreWeave stock or other AI infrastructure investments.

Featured Posts

-

Bbc Breakfast Guest Interrupts Live Broadcast Are You Still There

May 22, 2025

Bbc Breakfast Guest Interrupts Live Broadcast Are You Still There

May 22, 2025 -

Posthaste Are Canadian Home Prices Crashing A Market Correction Analysis

May 22, 2025

Posthaste Are Canadian Home Prices Crashing A Market Correction Analysis

May 22, 2025 -

Bbc Antiques Roadshow Leads To Arrest Of American Couple In The Uk

May 22, 2025

Bbc Antiques Roadshow Leads To Arrest Of American Couple In The Uk

May 22, 2025 -

Volodimir Putin Poshkoduye Chi Obdurit Vin Donalda Trampa

May 22, 2025

Volodimir Putin Poshkoduye Chi Obdurit Vin Donalda Trampa

May 22, 2025 -

New Wyoming Law Game And Fish To Manage Otter Populations

May 22, 2025

New Wyoming Law Game And Fish To Manage Otter Populations

May 22, 2025