Is Lack Of Funds Holding You Back? Practical Strategies For Success

Table of Contents

Creating a Realistic Budget and Tracking Expenses

Taking control of your finances starts with understanding where your money is going. Effectively managing your money requires a solid understanding of your current financial situation and the creation of a realistic budget.

Understanding Your Current Financial Situation

Before you can create a budget, you need to know where your money is currently going. This involves a thorough analysis of your income and expenses.

- Use budgeting apps or spreadsheets: Tools like Mint, YNAB (You Need A Budget), Personal Capital, and EveryDollar can automate much of this process. Spreadsheets offer a highly customizable alternative.

- Categorize expenses: Organize your spending into categories such as housing, food, transportation, utilities, entertainment, and debt payments. This helps identify areas where you might be overspending.

- Track spending for at least one month: Accurately track every expense, no matter how small. This provides a clear picture of your spending habits.

- Identify unnecessary expenses: Once you see your spending patterns, you can identify areas where you can cut back. This might involve canceling subscriptions, reducing eating out, or finding cheaper alternatives.

Developing a Realistic Budget

Once you understand your spending habits, you can create a realistic budget that aligns with your income and financial goals.

- Use the 50/30/20 rule: Allocate 50% of your income to essential expenses (housing, food, utilities), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment.

- Consider zero-based budgeting: This method requires you to allocate every dollar of your income to a specific purpose, ensuring that you don't overspend.

- Prioritize needs over wants: Focus on essential expenses first, and then allocate funds to wants only after your needs are met.

- Regularly review and adjust your budget: Your budget shouldn't be static. Review and adjust it regularly to reflect changes in your income or expenses.

Utilizing Budgeting Apps and Tools

Technology can significantly simplify the budgeting process. Many user-friendly apps and tools are available to help you track your spending and manage your money effectively.

- Mint: Offers comprehensive tracking of accounts, spending analysis, and budgeting tools.

- YNAB (You Need A Budget): A popular app emphasizing mindful spending and goal-oriented budgeting.

- Personal Capital: Provides a more advanced platform for investment tracking, budgeting, and retirement planning.

- EveryDollar: A simple and straightforward budgeting app based on the zero-based budgeting method.

- Choose an app that suits your needs and preferences: The best app for you will depend on your individual requirements and tech comfort level.

Strategies for Reducing Debt and Managing Credit

High levels of debt can significantly hinder your financial progress. Developing strategies to reduce and manage your debt is crucial for achieving financial freedom.

Debt Consolidation and Refinancing

Consolidating high-interest debt into lower-interest loans can save you money on interest payments over time.

- Balance transfer credit cards: Transfer balances from high-interest cards to cards with lower introductory APRs. Be aware of balance transfer fees and the duration of the introductory period.

- Debt consolidation loans: A personal loan can consolidate multiple debts into a single monthly payment, often at a lower interest rate.

- Seek professional advice if needed: A financial advisor can help you determine the best approach for your specific situation.

Negotiating with Creditors

Don't be afraid to contact your creditors to discuss your financial situation. They may be willing to work with you to create a more manageable payment plan.

- Be polite and professional: Maintain a respectful tone throughout your communication.

- Document all communication: Keep records of all phone calls, emails, and letters.

- Explore debt settlement options (only as a last resort): Debt settlement involves negotiating with creditors to pay a lump sum less than your total debt. This can negatively impact your credit score.

Building Good Credit

A good credit score is essential for securing loans, mortgages, and credit cards at favorable interest rates.

- Pay bills on time: Timely payments are the most important factor in determining your credit score.

- Keep credit utilization low: Avoid maxing out your credit cards. Aim to keep your credit utilization ratio (the amount of credit you use compared to your total available credit) below 30%.

- Monitor your credit report regularly: Check your credit report for errors and ensure the information is accurate.

Generating Additional Income Streams

Increasing your income is another key strategy for overcoming a lack of funds and accelerating your progress towards financial success.

Exploring Part-Time Jobs and Gig Work

Supplement your income with part-time work or gig jobs that fit your skills and schedule.

- Utilize online platforms: Upwork, Fiverr, and TaskRabbit offer a wide range of freelance opportunities.

- Leverage your skills and talents: Identify your skills (writing, editing, design, tutoring, etc.) and offer your services online or in your community.

- Be realistic about time commitment: Don't take on more than you can handle.

Selling Unused Items

Decluttering your home can generate extra cash while freeing up space.

- Use online platforms: eBay, Craigslist, Facebook Marketplace, and other online marketplaces provide easy ways to sell unwanted items.

- Consider consignment shops: Consignment shops are a good option for selling clothing, furniture, and other higher-value items.

Investing Wisely (Long-Term Strategies)

Investing is a crucial long-term strategy for building wealth and achieving financial freedom.

- Index funds: Offer diversified exposure to a broad range of stocks or bonds at low cost.

- Bonds: Generally considered less risky than stocks, offering a fixed income stream.

- High-yield savings accounts: Provide a higher interest rate than regular savings accounts, allowing your savings to grow faster.

- Consult a financial advisor before making any significant investment decisions: A financial advisor can help you develop a personalized investment plan tailored to your goals and risk tolerance.

Seeking Professional Financial Advice

Navigating complex financial situations can be challenging. Don't hesitate to seek help from qualified professionals.

Financial Advisors and Credit Counselors

Professionals can provide valuable guidance and support.

- Financial advisors: Can help you create a long-term financial plan, manage investments, and achieve your financial goals.

- Credit counselors: Can help you manage debt, create a budget, and improve your credit score.

- Research and choose reputable professionals: Ensure they are properly licensed and have a good track record.

Conclusion

Overcoming financial hardship requires a proactive and multifaceted approach. By implementing these practical strategies – creating a realistic budget, managing debt effectively, generating additional income, and seeking professional help when needed – you can break free from the limitations of a lack of funds and work towards achieving your financial goals. Don't let a lack of funds define your future; take control of your finances and build the financial freedom you deserve. Start planning your financial future today, and remember that even small steps toward better money management can lead to significant long-term success. Take action and start building a brighter financial future.

Featured Posts

-

Experience Live Bundesliga The Ultimate Fan Guide

May 21, 2025

Experience Live Bundesliga The Ultimate Fan Guide

May 21, 2025 -

Factors Contributing To Big Bear Ai Bbai S 2025 Stock Price Decrease

May 21, 2025

Factors Contributing To Big Bear Ai Bbai S 2025 Stock Price Decrease

May 21, 2025 -

Wayne Gretzkys Loyalty A Divided Public Opinion Following Trump Association

May 21, 2025

Wayne Gretzkys Loyalty A Divided Public Opinion Following Trump Association

May 21, 2025 -

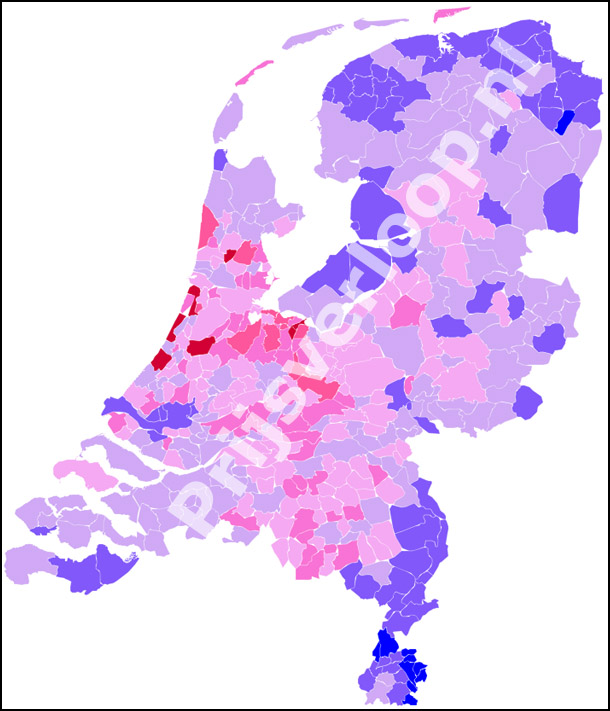

Huizenprijzen Nederland Analyse Geen Stijl En Abn Amro

May 21, 2025

Huizenprijzen Nederland Analyse Geen Stijl En Abn Amro

May 21, 2025 -

Atp Bucharest Cobollis Breakthrough Victory

May 21, 2025

Atp Bucharest Cobollis Breakthrough Victory

May 21, 2025