Is MicroStrategy Stock A Better Investment Than Bitcoin In 2025?

Table of Contents

MicroStrategy, a business analytics company, has made headlines for its substantial Bitcoin holdings. This bold strategy has significantly impacted its stock price, creating a fascinating case study in the intersection of traditional finance and cryptocurrency investment. However, the future performance of both MicroStrategy stock and Bitcoin remains uncertain, making this a complex investment decision.

MicroStrategy's Business Model and Bitcoin Strategy

Understanding MicroStrategy's Core Business

MicroStrategy's core business revolves around providing enterprise analytics, mobility, and cloud-based services. They cater to a diverse clientele across various industries, establishing themselves as a key player in the business intelligence market. While their Bitcoin holdings have garnered significant attention, their traditional business operations contribute substantially to their overall financial performance. Key clients range from Fortune 500 companies to smaller businesses, demonstrating a broad market reach. Their financial performance, independent of Bitcoin, reveals a history of profitability and growth, albeit with fluctuations typical of the technology sector.

Analyzing MicroStrategy's Bitcoin Holdings

MicroStrategy's Bitcoin strategy is a defining characteristic. The company has amassed a significant amount of Bitcoin, making it one of the largest corporate holders of the cryptocurrency. This strategic move, driven by a belief in Bitcoin's long-term value and potential as a store of value, has dramatically altered its balance sheet. Analyzing the acquisition costs and comparing them to the current market value reveals the impact of Bitcoin's price fluctuations on MicroStrategy's financial health. Their strategy reflects a growing trend of enterprise Bitcoin adoption, highlighting a shift in how some large companies view digital assets. Keywords like "MicroStrategy Bitcoin strategy" and "enterprise Bitcoin adoption" are key to understanding their investment thesis.

- MicroStrategy's financial performance (2020-2024): [Insert data showing revenue, profit margins, etc. Cite sources.]

- Risks of MicroStrategy's Bitcoin strategy: Exposure to Bitcoin price volatility, potential regulatory changes impacting Bitcoin, and the opportunity cost of alternative investments.

- Impact of Bitcoin holdings on stock valuation: Direct correlation between Bitcoin's price and MicroStrategy's stock price, highlighting the inherent risk and reward.

Bitcoin's Price Volatility and Future Predictions

Bitcoin Price Fluctuations and Historical Data

Bitcoin's price history is characterized by extreme volatility. From its inception to its current valuation, Bitcoin has experienced significant highs and lows, demonstrating its inherent risk. Charting its price over time provides valuable insights into its cyclical nature and potential for both massive gains and substantial losses. Historical data serves as a crucial foundation for understanding the risk profile associated with Bitcoin investment.

Future Bitcoin Price Projections

Predicting Bitcoin's price in 2025 is inherently speculative. Various analysts employ different methodologies, including technical analysis (chart patterns, trading volume) and fundamental analysis (adoption rates, regulatory landscape). These projections range widely, highlighting the uncertainty surrounding future price movements. Factors like increased adoption, regulatory clarity (or lack thereof), technological advancements (like the Lightning Network), and macroeconomic conditions all play a significant role in shaping future price trajectories. Using keywords like "Bitcoin price prediction 2025" and "Bitcoin volatility" allows for better SEO optimization.

- Bitcoin price predictions for 2025: [Include a range of predictions from different sources, clearly citing them.]

- Factors impacting Bitcoin's price: Adoption rates, regulatory changes, technological upgrades, macroeconomic factors (inflation, interest rates).

- Risks associated with Bitcoin investment: Extreme price volatility, potential for regulatory crackdowns, security risks (hacks, scams), and the possibility of complete loss of investment.

Comparing Investment Risks and Potential Returns

Risk Assessment for MicroStrategy Stock

Investing in MicroStrategy stock carries risks inherent to both its traditional business operations and its Bitcoin-centric strategy. Its dependence on Bitcoin's price is a significant factor. Market competition, economic downturns, and shifts in business intelligence trends also pose risks. A thorough risk assessment should consider these factors holistically.

Risk Assessment for Bitcoin Investment

Direct Bitcoin investment exposes investors to the cryptocurrency's inherent volatility. Regulatory uncertainty poses a significant threat, with governments worldwide grappling with how to regulate cryptocurrencies. The potential for complete loss of investment is a key risk factor that needs to be carefully considered.

Return Potential Comparison

Comparing the potential returns of both investments requires considering various Bitcoin price scenarios. A bull market could significantly boost both MicroStrategy's stock price and the value of directly held Bitcoin. However, a bear market would pose significant challenges to both investments.

- Risk/Return Comparison Table: [Create a table summarizing the risks and potential returns of each investment option under different market scenarios.]

- Diversification Strategies: Discuss diversification as a risk mitigation tool, suggesting ways to balance risk and potential reward within a broader investment portfolio.

- Importance of Risk Tolerance: Emphasize the role of individual risk tolerance in making informed investment decisions. Keywords such as "investment risk," "return on investment," and "risk tolerance" are crucial here.

Alternative Investment Options

While MicroStrategy and Bitcoin are prominent options, investors should also consider other opportunities within the technology sector and the broader cryptocurrency market. Exploring alternative tech stocks or investing in a diversified cryptocurrency portfolio provides alternative routes to potentially high returns. This broader perspective helps contextualize MicroStrategy and Bitcoin within a wider investment landscape.

Conclusion: MicroStrategy Stock vs. Bitcoin: Making the Right Investment Choice in 2025

This analysis reveals that both MicroStrategy stock and Bitcoin present unique risks and potential rewards. MicroStrategy's success is intertwined with Bitcoin's price, exposing investors to its volatility. Direct Bitcoin investment carries even greater risk due to its inherent price fluctuations and regulatory uncertainties. The key factors influencing investment decisions are MicroStrategy's core business performance, Bitcoin's price volatility, and individual risk tolerance.

The optimal choice depends entirely on your individual investment goals, risk tolerance, and investment timeline. Before making any investment decisions related to MicroStrategy Stock vs Bitcoin Investment, thorough research is crucial. We strongly recommend reviewing MicroStrategy's financial reports and conducting in-depth analysis of Bitcoin market trends and predictions. Remember, informed choices are key to successful investing.

Featured Posts

-

Netflix I Stivn King Ochakvaniya Za Noviya Film

May 09, 2025

Netflix I Stivn King Ochakvaniya Za Noviya Film

May 09, 2025 -

Conservative Pundit Jeanine Pirros North Idaho Visit What To Expect

May 09, 2025

Conservative Pundit Jeanine Pirros North Idaho Visit What To Expect

May 09, 2025 -

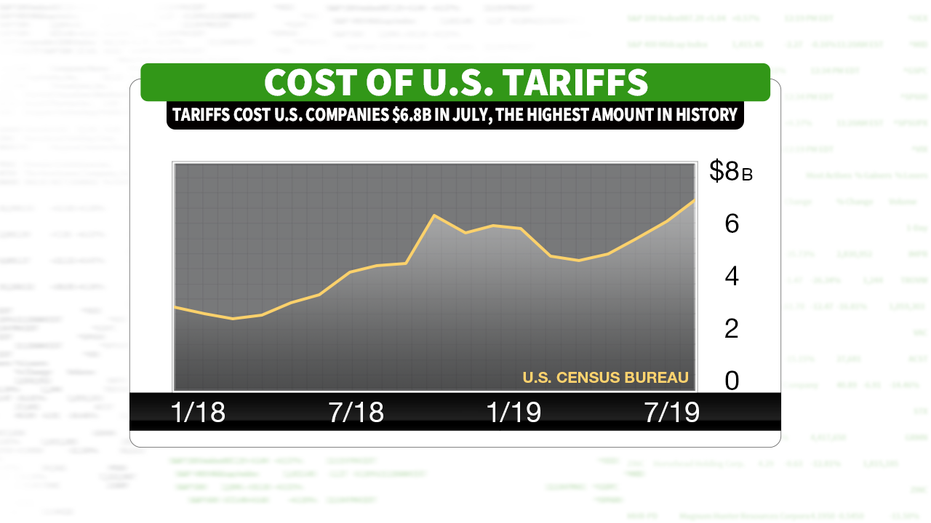

Analysis Trump Tariffs Cost Top 10 Billionaires 174 Billion

May 09, 2025

Analysis Trump Tariffs Cost Top 10 Billionaires 174 Billion

May 09, 2025 -

Madeleine Mc Cann Investigation Receives 108 000 Boost

May 09, 2025

Madeleine Mc Cann Investigation Receives 108 000 Boost

May 09, 2025 -

Obilnye Snegopady Yaroslavskaya Oblast Pod Snegom

May 09, 2025

Obilnye Snegopady Yaroslavskaya Oblast Pod Snegom

May 09, 2025