Is Microsoft A Safe Bet In The Face Of Rising Tariffs?

Table of Contents

Microsoft's Global Supply Chain and Tariff Exposure

H3: Manufacturing and Production: Microsoft, like many multinational technology companies, relies on a global supply chain for its hardware products. Surface devices, Xbox consoles, and other physical products require components sourced from various countries. Rising tariffs on imported goods directly impact the cost of these components, potentially increasing the final price for consumers and squeezing Microsoft's profit margins. To mitigate these risks, Microsoft likely employs several strategies.

- Sourcing from tariff-exempt countries: Diversifying its supplier base to include countries with favorable trade agreements could help offset tariff impacts.

- Nearshoring: Relocating some manufacturing operations to countries closer to its major markets could reduce transportation costs and tariff exposure.

- Absorbing costs: Given its strong financial position, Microsoft might initially absorb some increased costs to maintain competitiveness, although this strategy is unsustainable long-term.

The potential impact of tariffs on specific products is significant. For instance, tariffs on components sourced from China could affect the price of Surface devices and Xbox consoles sold in the US and other markets. Supply chain disruptions due to trade restrictions are also a potential concern.

H3: Software and Services: Unlike its hardware business, Microsoft's software and cloud services (Azure, Office 365, Microsoft 365) are less directly exposed to tariffs. However, the impact is not entirely negligible. The geographical distribution of Microsoft's data centers plays a crucial role. Data localization regulations in certain countries might necessitate establishing additional data centers, leading to increased infrastructure costs. Moreover, tariffs could indirectly impact the cost of data transfer across borders.

- Increased data transfer costs could eat into profit margins, especially for cloud services heavily reliant on international data exchange.

- The regulatory environment surrounding data sovereignty continues to evolve, presenting both opportunities and challenges for Microsoft's cloud business.

Microsoft's Diversification and Financial Strength

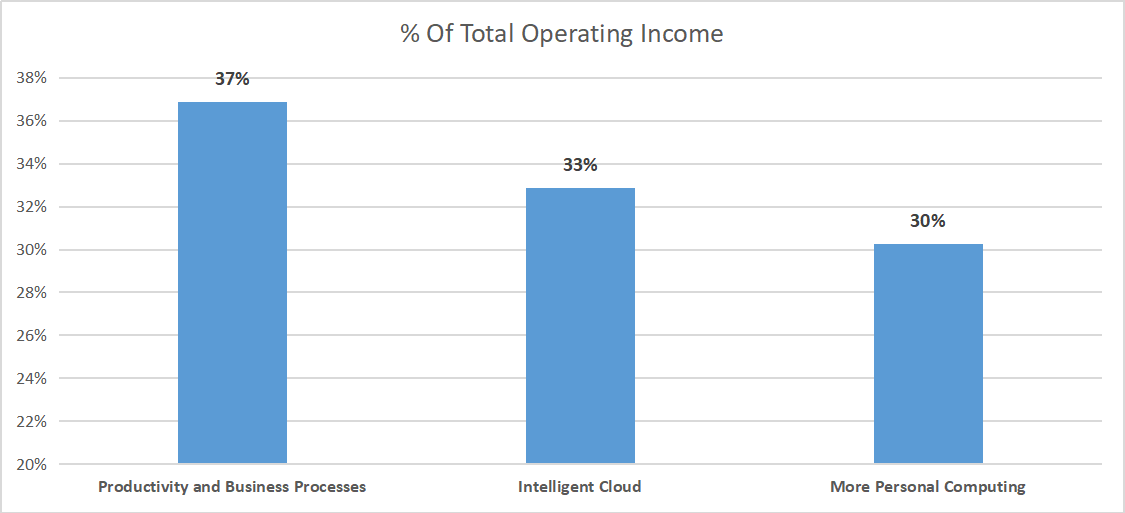

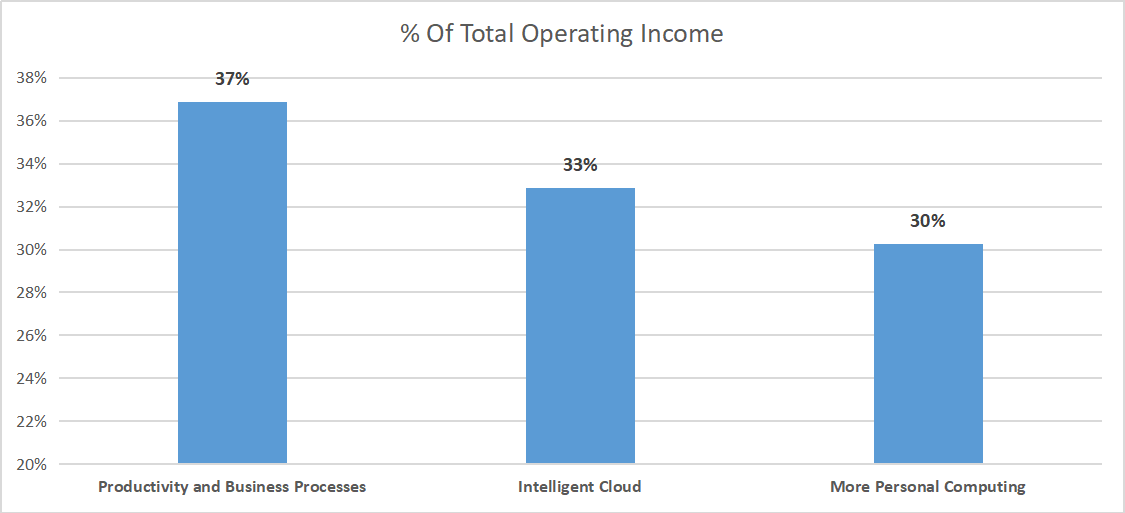

H3: Revenue Streams: Microsoft’s diversified revenue streams are a significant factor in its resilience against tariff-related challenges. The company's revenue is not heavily concentrated in any single product or region. This diversification across various product categories (Windows, Office 365, Azure, gaming, LinkedIn, etc.) acts as a buffer against the impact of tariffs on any specific product line.

- Windows OS: Remains a substantial revenue generator but faces increasing competition.

- Microsoft 365: A rapidly growing subscription-based service contributing significantly to recurring revenue.

- Azure: Microsoft's cloud platform is a key growth driver and less vulnerable to tariffs than hardware.

- Gaming: Xbox and gaming-related services provide another diversified revenue stream.

H3: Financial Stability: Microsoft boasts a robust financial position, characterized by substantial cash reserves, consistent profitability, and a strong balance sheet. This financial strength provides a crucial safety net against potential tariff-related costs and market uncertainties. The company can absorb temporary shortfalls and invest in mitigation strategies without jeopardizing its long-term goals.

- High profit margins allow Microsoft to absorb cost increases more easily than companies with thinner margins.

- Substantial cash reserves provide flexibility to navigate market fluctuations and invest in new opportunities.

- A low debt-to-equity ratio suggests financial stability and a capacity to weather economic storms.

Competitive Landscape and Market Position

H3: Global Competition: Microsoft operates in a highly competitive tech market, facing intense competition from Google, Amazon, Apple, and other tech giants. The impact of tariffs could shift this competitive balance, although the effect is not straightforward. While all companies are affected, some might be more vulnerable depending on their supply chain structure and geographical diversification. Microsoft’s global reach and diversified product portfolio provide a degree of insulation.

- Microsoft's strong brand recognition and established market share provide a competitive advantage.

- Its cloud infrastructure (Azure) is a key battleground against Amazon Web Services (AWS) and Google Cloud Platform (GCP), with the tariff impact potentially varying across these providers.

H3: Adaptability and Innovation: Throughout its history, Microsoft has demonstrated remarkable adaptability to market changes and technological advancements. Its consistent investment in research and development (R&D) fuels innovation and allows the company to develop new products and services to address changing market demands, potentially mitigating the long-term impact of tariffs.

- Microsoft’s ongoing investments in AI, cloud computing, and other emerging technologies position it well for the future.

- A history of strategic acquisitions demonstrates its ability to adapt and expand its capabilities.

Conclusion

Analyzing the impact of Microsoft Tariffs on Microsoft reveals a complex picture. While the company is not immune to the effects of rising tariffs, particularly on its hardware manufacturing, its diversified revenue streams, strong financial position, and significant competitive advantages suggest it is relatively well-positioned to weather the storm. While some cost increases are inevitable, Microsoft’s overall resilience indicates a strong position. However, the situation remains dynamic, and further analysis is warranted. To gain a deeper understanding, we encourage readers to thoroughly review Microsoft's financial reports and investigate its strategic initiatives related to tariff management. By considering the factors discussed in this article, investors can better assess the risks and rewards of investing in Microsoft within the context of global trade uncertainties and the ongoing impact of Microsoft Tariffs.

Featured Posts

-

Hard Fought 2 1 Victory For Maple Leafs Against Avalanche

May 15, 2025

Hard Fought 2 1 Victory For Maple Leafs Against Avalanche

May 15, 2025 -

Aktienmarkt Warnsignal Die Gefahr Der Privatanleger Euphorie

May 15, 2025

Aktienmarkt Warnsignal Die Gefahr Der Privatanleger Euphorie

May 15, 2025 -

5 A Dozen Egg Prices Fall Sharply In The United States

May 15, 2025

5 A Dozen Egg Prices Fall Sharply In The United States

May 15, 2025 -

Bim Aktueel Katalogu 25 26 Subat Tuem Indirimli Ueruenler

May 15, 2025

Bim Aktueel Katalogu 25 26 Subat Tuem Indirimli Ueruenler

May 15, 2025 -

40lbs Heavier Paddy Pimblett Discusses Weight Gain After Ufc 314 Bout

May 15, 2025

40lbs Heavier Paddy Pimblett Discusses Weight Gain After Ufc 314 Bout

May 15, 2025