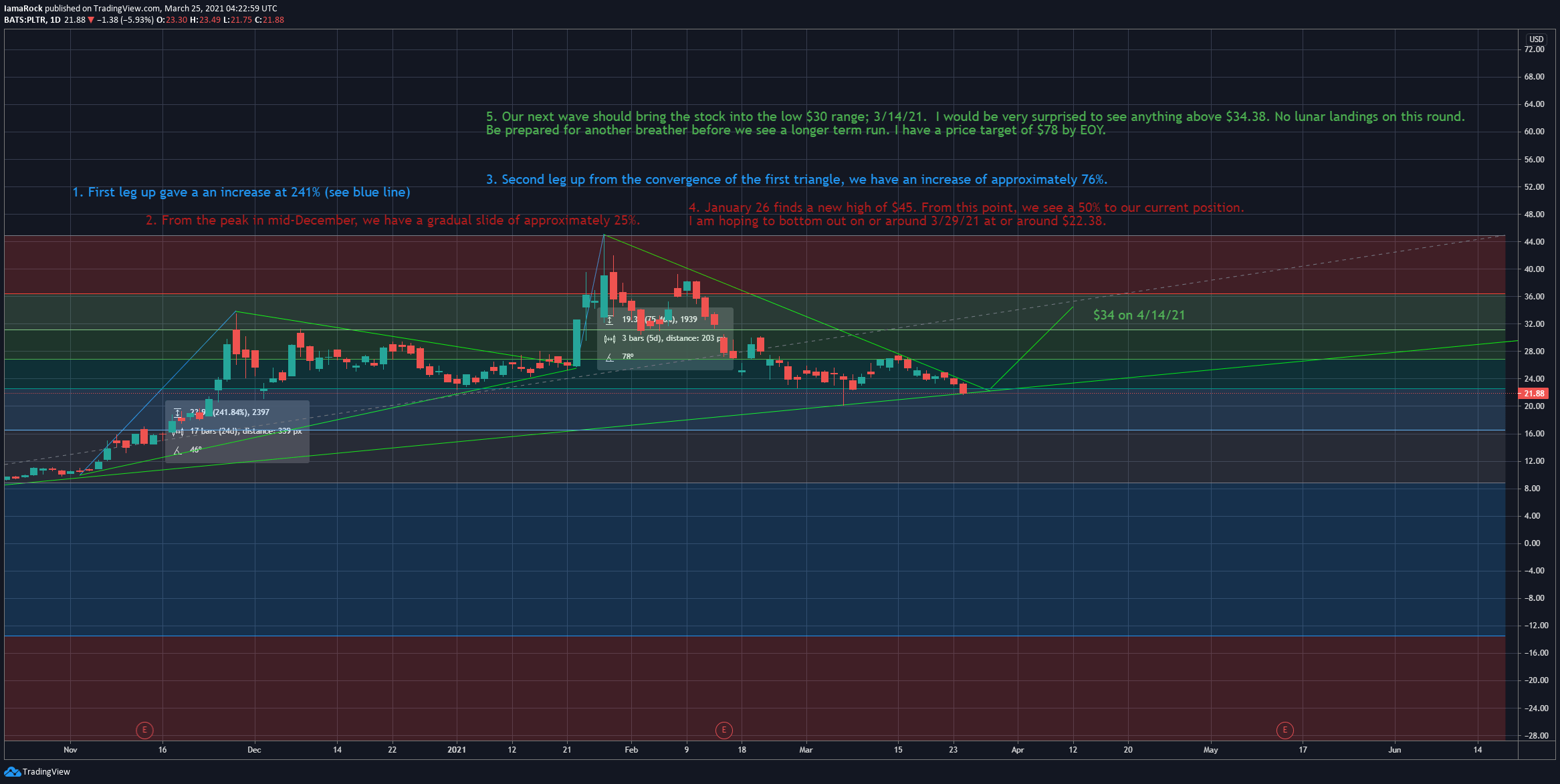

Is Palantir A Buy After A 30% Price Drop?

Table of Contents

Analyzing Palantir's Recent Performance and the Reasons Behind the Drop

Fundamental Analysis of Palantir

Palantir's recent financial performance offers a mixed bag. While the company has shown consistent revenue growth, profitability remains a key focus. Let's delve into the key metrics:

- Revenue Growth: Palantir has demonstrated consistent year-over-year revenue growth, although the rate of growth may have fluctuated in recent quarters. Analyzing the specific numbers and trends in their financial reports is crucial.

- Profitability: Palantir's path to profitability is a major factor in investor sentiment. Examining their operating margins, net income, and free cash flow will provide a clearer picture.

- Customer Acquisition: The number of new customers, particularly large commercial clients, is a critical indicator of future growth. Tracking this metric provides insight into the effectiveness of their sales and marketing strategies.

- Contract Value: The value of new contracts, especially long-term government and commercial agreements, is a significant factor impacting Palantir's long-term prospects. High-value contracts signal confidence in their technology and services.

- Government Contracts: Palantir's reliance on government contracts has been a point of discussion. Understanding the proportion of revenue derived from government versus commercial sources, and the stability of these contracts, is vital for assessing risk.

Analyzing these Palantir financials (and the accompanying PLTR financials) alongside their Palantir revenue figures gives a comprehensive view of their Palantir growth prospects.

Macroeconomic Factors Impacting Palantir's Stock Price

The recent price drop in PLTR stock isn't solely attributable to company-specific factors. Broader macroeconomic trends have significantly impacted the tech sector:

- Interest Rate Hikes: Rising interest rates increase borrowing costs, impacting growth stocks like Palantir that are valued based on future earnings potential. This interest rate impact on stocks has affected the entire sector.

- Inflation: High inflation erodes purchasing power and impacts consumer and business spending, potentially slowing down Palantir's growth.

- Tech Stock Performance: The overall performance of tech stocks has been volatile, and Palantir, as a growth-oriented tech company, is susceptible to these broader market trends. The impact of market volatility on investor sentiment can significantly affect tech stock performance.

- Investor Sentiment towards Growth Stocks: A shift in investor sentiment towards value stocks can lead to a decline in the valuation of growth stocks, even if the underlying fundamentals remain strong. The growth stock outlook remains a key factor to consider.

Evaluating the Risk and Reward of Investing in Palantir After the Price Drop

Assessing the Risks

Investing in Palantir involves considerable risk:

- High Valuation: Palantir's stock has historically traded at a premium valuation compared to its peers, making it vulnerable to price corrections if growth expectations aren't met.

- Competition: The big data and analytics market is highly competitive, with established players and emerging startups vying for market share. Increased data analytics competition adds to the risk.

- Dependence on Government Contracts: Palantir's significant reliance on government contracts exposes it to geopolitical risks and potential changes in government spending.

- Potential for Further Price Declines: Given the recent volatility, there's a possibility of further price declines before a sustained recovery. A comprehensive PLTR risk assessment and understanding of investing risks and stock market risk is crucial.

- Diversification: It's crucial to remember that diversification is essential for managing risk in any investment portfolio. Don't put all your eggs in one basket.

Weighing the Potential Rewards

Despite the risks, investing in Palantir also presents substantial potential rewards:

- Future Revenue Growth: Palantir's continued expansion into new markets and its focus on developing innovative products could drive significant future revenue growth.

- Long-Term Potential: Palantir's technology has long-term potential to disrupt various sectors, offering considerable upside if its growth trajectory remains positive. The potential for high investment returns and strong long-term growth is substantial.

- Palantir Potential: The company's ability to effectively leverage its advanced data analytics capabilities across diverse sectors remains a major source of Palantir potential for investors who are willing to accept the inherent risks. Understanding the PLTR upside is critical to a comprehensive risk-reward assessment.

Comparing Palantir to Competitors in the Big Data and Analytics Market

Palantir faces stiff competition from established players like Microsoft, Amazon Web Services (AWS), and Google Cloud Platform (GCP), as well as numerous smaller, specialized firms. Analyzing Palantir competitors within the big data analytics market is essential.

Palantir's strengths include its proprietary technology, strong government relationships, and focus on complex data analytics solutions. However, its weaknesses include its high valuation, dependence on large contracts, and potential challenges in scaling its operations to compete effectively with larger, more diversified players. Understanding Palantir's unique value proposition and its ability to differentiate itself in this intensely competitive landscape is key.

Conclusion: Should You Buy Palantir Stock Now?

The decision of whether to buy Palantir stock after its recent price drop is complex and depends on several factors. While the 30% drop presents a potentially attractive entry point for some investors, the inherent risks associated with Palantir must be carefully considered. This Palantir stock analysis highlights both the potential upsides and downsides.

Thorough due diligence, including a deep dive into the company's financials, competitive landscape, and broader macroeconomic conditions, is crucial before making any investment decisions. Remember to consider your own risk tolerance and investment goals. Is Palantir a buy for you after this price drop? Research further and make an informed decision. Consider consulting additional resources, such as financial news sites and Palantir's investor relations page, to inform your PLTR investment decision before investing in Palantir stock. Learn more about how to invest in Palantir and weigh the decision carefully. Remember, buy Palantir only if it aligns with your individual financial strategy.

Featured Posts

-

Harassment Case Polish Woman And Friend Deny Targeting Mc Cann Family Residence

May 09, 2025

Harassment Case Polish Woman And Friend Deny Targeting Mc Cann Family Residence

May 09, 2025 -

Extension Viticole A Dijon 2500 M Aux Valendons

May 09, 2025

Extension Viticole A Dijon 2500 M Aux Valendons

May 09, 2025 -

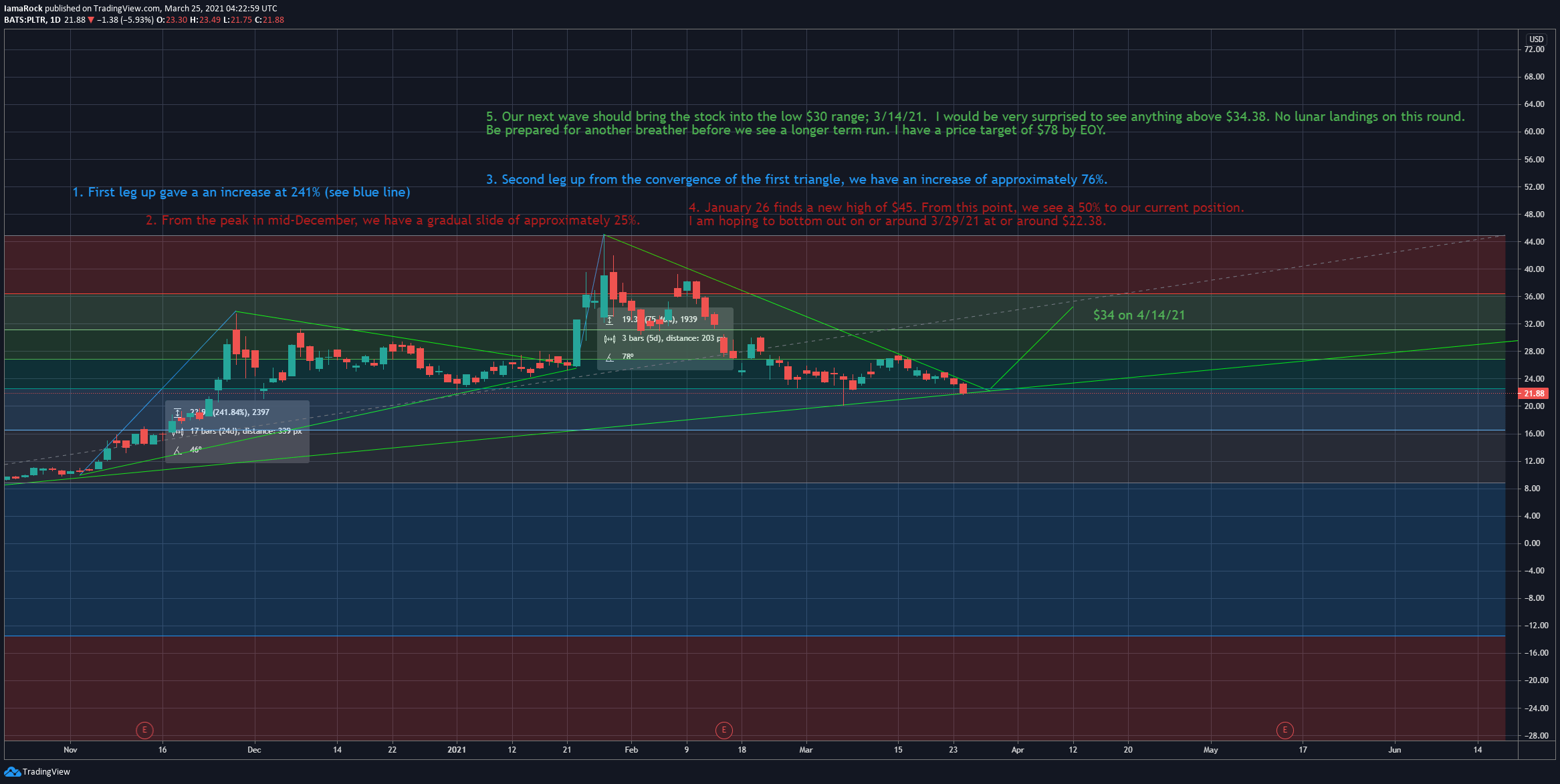

Benson Boone Addresses Harry Styles Comparison A Direct Response

May 09, 2025

Benson Boone Addresses Harry Styles Comparison A Direct Response

May 09, 2025 -

Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 09, 2025

Dijon Vehicule Percute Un Mur Rue Michel Servet Le Conducteur Se Denonce

May 09, 2025 -

Police Misconduct Meeting Scheduled Following Nottingham Attacks Investigation

May 09, 2025

Police Misconduct Meeting Scheduled Following Nottingham Attacks Investigation

May 09, 2025