Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

Palantir's Business Model and Recent Performance

Palantir's success hinges on its powerful data integration and analytics platforms, Gotham and Foundry. These platforms cater to two primary revenue streams: government contracts and commercial clients.

Understanding Palantir's Government and Commercial Contracts

Palantir's government contracts have historically provided a stable, high-revenue base. These long-term agreements, often with significant renewal options, offer predictable revenue streams. However, the commercial sector presents a higher growth potential, albeit with more variability.

- Recent Contract Wins: Palantir has secured substantial contracts with various government agencies, including continued partnerships with the US intelligence community and expanding relationships with international governments. Specific contract details are often confidential due to security concerns.

- Key Government Clients: The US government remains a significant customer, but Palantir is increasingly expanding its global government presence.

- Commercial Client Growth: Palantir's Foundry platform targets commercial sectors, attracting clients in healthcare, finance, and energy. This segment shows considerable promise for future growth.

- Long-Term Contracts: The nature of Palantir's contracts provides revenue visibility, mitigating some of the inherent risks associated with the tech sector.

Revenue Growth and Profitability

Palantir's recent financial reports demonstrate significant revenue growth, although profitability remains a key area of focus. While revenue growth has been impressive, achieving consistent profitability is crucial for long-term investor confidence. Analyzing operating expenses and margin improvement is essential for evaluating Palantir's path to sustainable profitability.

- Revenue Growth Trends: Charts and graphs illustrating Palantir's year-over-year revenue growth would be included here (Note: This would require access to and analysis of financial data, which is beyond the scope of this text-based response).

- Profitability Margins: An analysis of gross profit margin, operating margin, and net profit margin would be crucial here (Note: This would require access to and analysis of financial data, which is beyond the scope of this text-based response).

- Future Revenue Guidance: Palantir's management provides guidance on expected future revenue, which offers insight into their growth projections (Note: This would require access to and analysis of financial data, which is beyond the scope of this text-based response).

- Competitor Comparison: A comparison of Palantir's key financial metrics with those of its competitors in big data analytics, such as Microsoft, Amazon, and Google, would provide context (Note: This would require access to and analysis of financial data, which is beyond the scope of this text-based response).

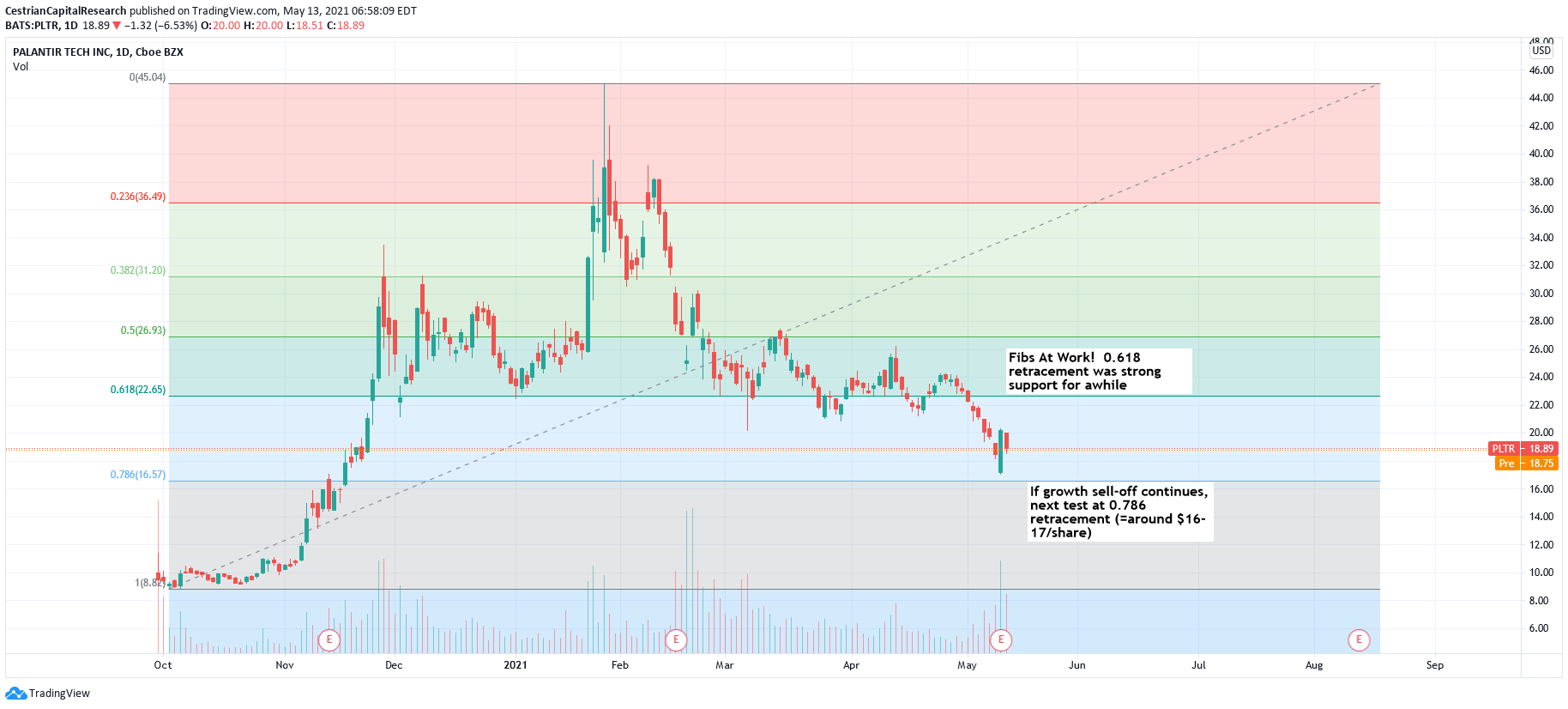

Analyzing Palantir's Valuation and Stock Price

Evaluating Palantir's stock requires a careful assessment of its valuation and potential risks.

Price-to-Sales Ratio and Future Growth Projections

The Price-to-Sales (P/S) ratio is a key metric for valuing high-growth companies like Palantir. A comparison of Palantir's P/S ratio to its peers and industry benchmarks is essential. Analyst forecasts and projections for future revenue and earnings growth will heavily influence the stock price.

- Peer Comparison: Comparing Palantir's P/S ratio to competitors offers a relative valuation benchmark. (Note: This requires market data.)

- Market Sentiment: Investor sentiment and market trends significantly impact Palantir's stock price. News events and broader market conditions can cause fluctuations.

- Recent Price Changes: Tracking recent price movements and identifying the underlying causes (e.g., earnings reports, news announcements, market shifts) is vital (Note: This requires real-time market data).

Risk Assessment for Palantir Investors

Investing in Palantir carries inherent risks. Understanding these risks is crucial for informed investment decisions.

- Competition: The data analytics market is highly competitive, with established players and emerging startups vying for market share.

- Government Contract Dependence: Over-reliance on government contracts could expose Palantir to shifts in government spending or policy.

- Economic Downturns: Economic slowdowns can reduce spending on data analytics solutions, impacting Palantir's revenue.

- Geopolitical Risks: International events and geopolitical instability can affect Palantir's government contracts and global operations.

- Financial Stability: Analyzing Palantir's debt levels and cash flow is crucial for assessing its financial health.

- Legal and Regulatory Risks: Compliance with data privacy regulations and potential legal challenges are considerations.

Comparing Palantir to its Competitors

Palantir faces stiff competition from established tech giants and nimble startups. Direct competitors include companies like Microsoft, Amazon Web Services (AWS), Google Cloud Platform (GCP), and smaller, specialized data analytics firms. A comparative analysis of their strengths, weaknesses, and market share would inform a more complete picture. (Note: This would require extensive market research and analysis, beyond the scope of this text-based response).

Conclusion

Determining whether Palantir stock is a buy right now necessitates a holistic assessment of its business model, financial performance, valuation, and competitive environment. While Palantir exhibits strong revenue growth and operates in a high-growth market, significant risks remain. The company's reliance on government contracts, intense competition, and its path to consistent profitability must be carefully considered. This analysis does not provide a definitive "buy" or "sell" recommendation; the decision rests solely on your individual investment strategy and risk tolerance.

Call to Action: Before buying Palantir stock, always conduct your own due diligence. Consult with a qualified financial advisor, thoroughly research Palantir's financial reports, and analyze industry trends. Consider exploring resources like the SEC's EDGAR database and financial news websites for additional information. Is Palantir stock a buy right now? The decision is ultimately yours.

Featured Posts

-

Young Thugs Reaction To Not Like U Name Drop Post Prison Release

May 10, 2025

Young Thugs Reaction To Not Like U Name Drop Post Prison Release

May 10, 2025 -

International Transgender Day Of Visibility Three Steps Towards Meaningful Allyship

May 10, 2025

International Transgender Day Of Visibility Three Steps Towards Meaningful Allyship

May 10, 2025 -

Pandemic Fraud Lab Owner Convicted For Falsified Covid Test Results

May 10, 2025

Pandemic Fraud Lab Owner Convicted For Falsified Covid Test Results

May 10, 2025 -

Nl Federal Election Get To Know Your Candidates

May 10, 2025

Nl Federal Election Get To Know Your Candidates

May 10, 2025 -

La Wildfires Exploitative Rent Increases Spark Outrage

May 10, 2025

La Wildfires Exploitative Rent Increases Spark Outrage

May 10, 2025