Is Palantir Stock A Good Investment Right Now? Pros And Cons Considered

Table of Contents

Palantir's Strengths: Why Some Investors are Bullish

Palantir's bullish case rests on several key pillars: substantial government contracts, cutting-edge technology, and growing commercial market penetration.

Government Contracts and Stable Revenue Streams

Palantir's revenue significantly relies on government contracts, providing a degree of predictable income. This reliance on government partnerships offers a stable base for the company's financials. For example, the company secured a multi-year contract with the U.S. Army valued at hundreds of millions of dollars. These contracts not only contribute significantly to Palantir's financial performance but also help validate its technology and expertise in handling sensitive data. The long-term implications of these partnerships are significant, suggesting a stable revenue stream for years to come.

- Example 1: Multi-year contract with the U.S. Army (Value: Hundreds of millions of dollars).

- Example 2: Significant contracts with various intelligence agencies (Value: Confidential, but substantial).

- Projected Future Contracts: Palantir actively pursues new government contracts, indicating continued growth in this sector.

Cutting-Edge Data Analytics Technology

Palantir's core strength lies in its sophisticated data analytics platform, Foundry and Gotham, which offer a significant competitive advantage. Its ability to integrate and analyze vast amounts of data from diverse sources is unmatched by many competitors, enabling its clients to solve complex problems across various industries. The company constantly innovates, integrating new AI and machine learning capabilities into its platform.

- Key Technological Features: Data integration, advanced analytics, AI/ML capabilities, secure data management.

- Successful Implementations: Successful deployments in various sectors, including healthcare, finance, and defense.

- Future Technology Roadmap: Ongoing development of new AI-powered features and expanding the platform's functionalities.

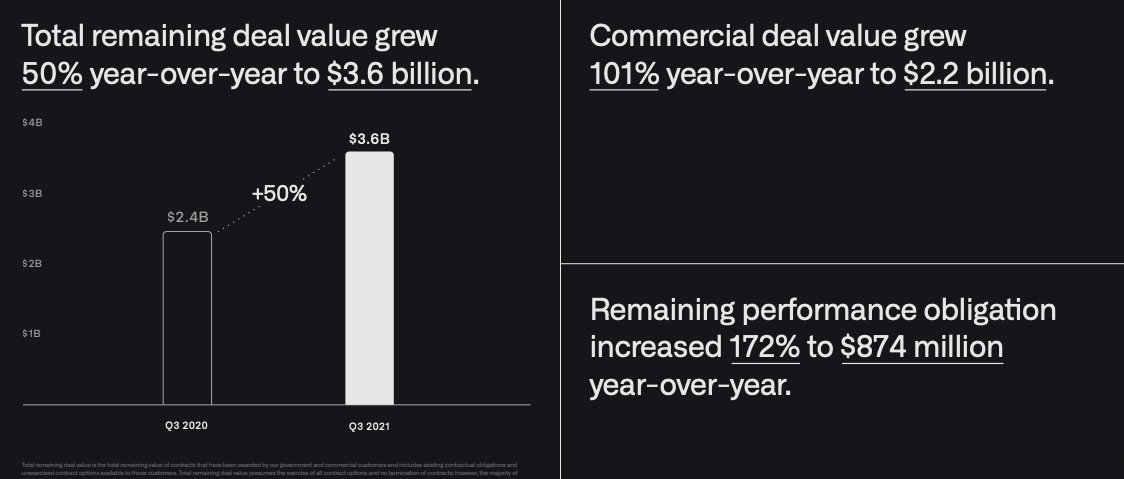

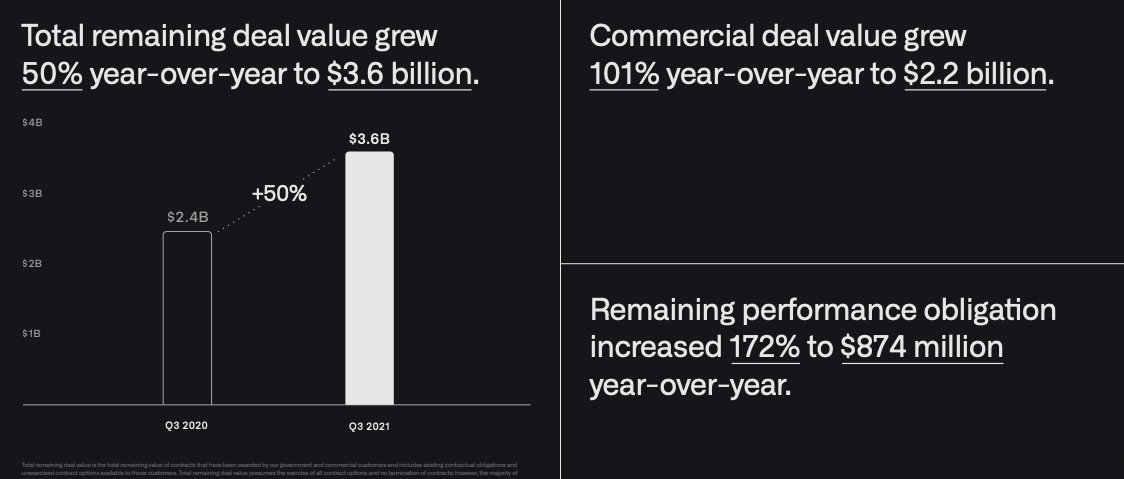

Growing Commercial Market Penetration

While government contracts form a cornerstone of Palantir's business, its expansion into the commercial sector represents a significant growth opportunity. Palantir is aggressively targeting private companies, seeking to leverage its platform for operational efficiency and decision-making. This diversification reduces the risk associated with dependence on government funding and opens the door for substantial revenue increases. While competition is fierce, Palantir's cutting-edge technology and proven track record provide a strong competitive edge.

- Examples of Commercial Clients: Various Fortune 500 companies across diverse sectors.

- Case Studies of Successful Implementations: Demonstrable improvements in operational efficiency and decision-making for commercial clients.

- Market Projections: Analysts project significant market growth for Palantir's commercial offerings.

Palantir's Weaknesses: Reasons for Caution

Despite its strengths, several factors warrant caution before investing in Palantir stock.

High Valuation and Stock Price Volatility

Palantir's stock valuation remains a significant concern for some investors. The stock price has demonstrated significant volatility, influenced by factors such as earnings reports, market sentiment, and news regarding its contracts. Comparing its valuation to competitors reveals a premium reflecting investor expectations of future growth. However, this premium also signifies a higher risk.

- Key Valuation Metrics (P/E Ratio, Market Capitalization): These should be compared to industry averages and competitor data.

- Historical Stock Price Performance: Analyze the stock's volatility and track its performance over time.

- Comparison to Competitors: Benchmark Palantir's valuation against those of its competitors in the data analytics space.

Dependence on a Few Key Clients

Palantir's reliance on a relatively small number of large clients, particularly in the government sector, presents a risk. Losing a key contract could significantly impact its revenue and profitability. While Palantir is actively diversifying its client base, this concentration remains a potential vulnerability.

- List of Top Clients: Identify Palantir's largest clients and their respective contributions to revenue.

- Percentage of Revenue from Top Clients: Assess the proportion of revenue derived from each top client.

- Mitigation Strategies: Analyze the measures Palantir is implementing to reduce its dependence on a few key clients.

Profitability Concerns and Path to Sustained Profitability

Palantir's path to sustained profitability remains a key concern. While the company has shown revenue growth, its profitability has been inconsistent. Achieving consistent profitability will be crucial for justifying its current valuation. The company's strategy to address this involves expanding its commercial business and increasing operational efficiencies.

- Key Profitability Metrics: Analyze metrics such as net income margins and operating cash flow.

- Projected Future Profitability: Examine analyst projections and the company's own guidance regarding future profitability.

- Analysis of Key Challenges: Identify the major hurdles Palantir must overcome to achieve consistent profitability.

Conclusion: Is Palantir Stock Right for Your Portfolio?

Investing in Palantir presents a compelling but risky proposition. The company boasts cutting-edge technology and significant government contracts, providing a foundation for future growth. However, concerns about valuation, client concentration, and profitability must be carefully considered. Palantir's success hinges on its ability to further penetrate the commercial market, maintain its strong government relationships, and achieve sustained profitability.

Ultimately, the decision of whether Palantir stock is a good investment for you right now depends on your individual circumstances. Conduct thorough due diligence, including a careful review of financial statements, industry analysis, and independent research, before making any investment decisions related to Palantir stock.

Featured Posts

-

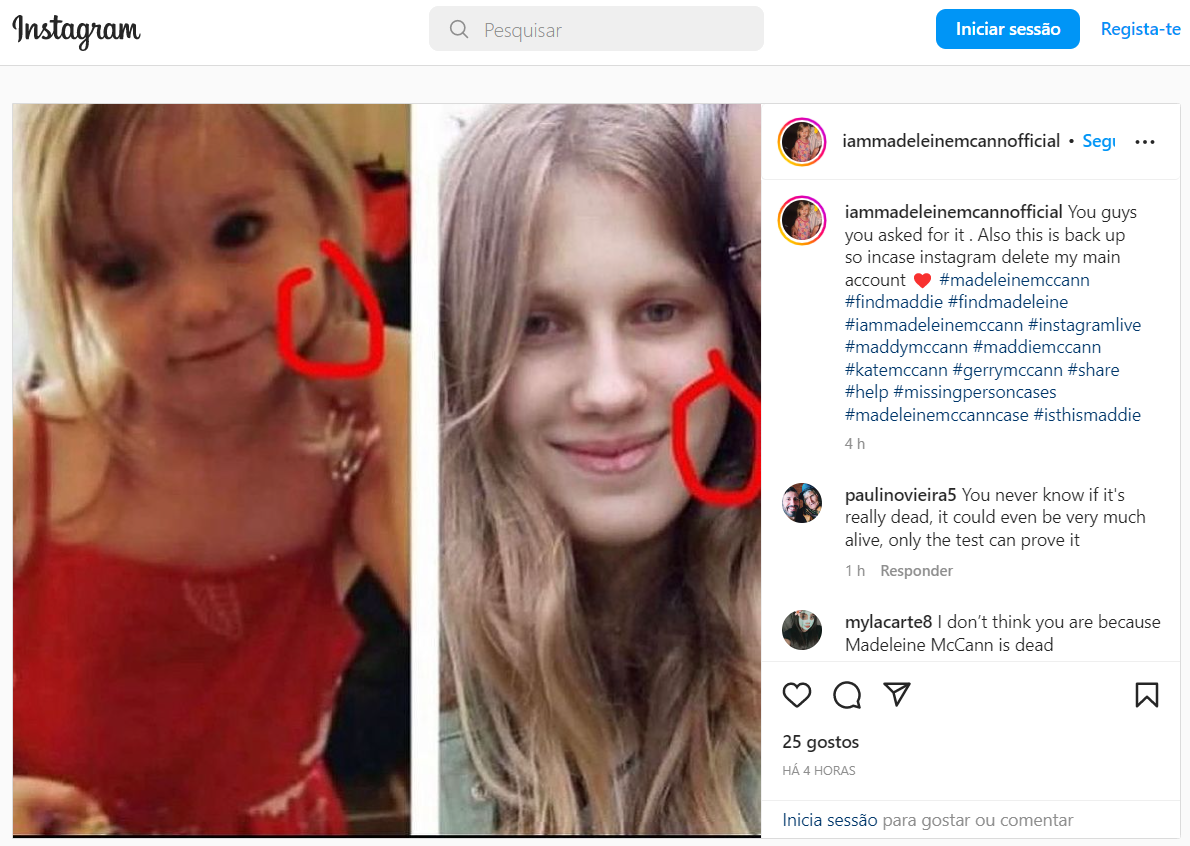

Investigacao Polonesa Detida Apos Alegar Ser Maddie Mc Cann

May 09, 2025

Investigacao Polonesa Detida Apos Alegar Ser Maddie Mc Cann

May 09, 2025 -

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 09, 2025

Nyt Strands Hints And Answers Sunday February 23 Game 357

May 09, 2025 -

Skisesongen Rammes Tidlig Stenging Av Skisentre Pa Grunn Av Varm Vinter

May 09, 2025

Skisesongen Rammes Tidlig Stenging Av Skisentre Pa Grunn Av Varm Vinter

May 09, 2025 -

Wynne And Joanna All At Sea A Comprehensive Guide

May 09, 2025

Wynne And Joanna All At Sea A Comprehensive Guide

May 09, 2025 -

Broadcoms V Mware Deal A 1050 Price Hike Threatens At And T

May 09, 2025

Broadcoms V Mware Deal A 1050 Price Hike Threatens At And T

May 09, 2025