Is Palantir's High P/E Ratio Justified? A Deep Dive Into Its History

Table of Contents

Palantir's Historical Context: From Government Contractor to Commercial Expansion

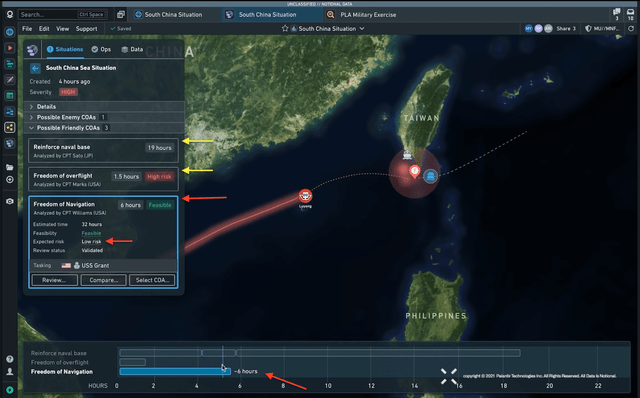

Palantir's origins lie in its early partnerships with US intelligence agencies like the CIA, providing data analytics solutions for national security purposes. Its initial success was largely built on its proprietary platforms, Gotham and Foundry, which helped analyze vast datasets to identify patterns and insights. This focus on government contracts established a strong foundation but also presented challenges. The transition to the commercial market required adapting technology originally designed for highly secure government environments to the needs of diverse private sector clients. This transition hasn't been without its hurdles.

- Early partnerships: Strong initial relationships with the CIA and other government agencies fueled early growth.

- Platform development: Gotham and Foundry, Palantir's core platforms, are crucial for its data analytics capabilities.

- Commercial adaptation challenges: Shifting from government to commercial clients demanded significant changes in technology and sales strategies.

- Commercial sector milestones: Securing major commercial contracts marked pivotal steps in Palantir's diversification.

Analyzing Palantir's Revenue Growth and Profitability

Examining Palantir's financial performance is crucial for understanding its high P/E ratio. While the company has demonstrated significant year-over-year revenue growth, profitability has been a more complex issue. Analyzing the sources of revenue growth – government contracts versus commercial sales – provides valuable insight. A significant portion of its early revenue stemmed from government contracts, leading to questions about its long-term growth potential and dependence on government spending.

- Year-over-year revenue growth: Consistent growth, though the rate has fluctuated, is a key factor influencing investor perceptions.

- Profit margins and trends: Understanding the trend of profit margins is vital for evaluating the sustainability of its business model.

- Government vs. commercial revenue: The proportion of revenue from each sector reveals the balance and future trajectory of Palantir's business.

- Impact of key contracts: Specific large contracts can significantly impact Palantir's financial performance, leading to volatility in earnings.

The Role of Innovation and Technological Advantage in Justifying the P/E Ratio

Palantir's technological prowess is often cited as a justification for its high P/E ratio. Its platforms offer unique capabilities in data integration, analysis, and visualization, providing a competitive advantage in the crowded data analytics market. However, the long-term sustainability of this advantage and the potential for disruptive technologies must be considered. The value of its intellectual property and patents also contributes to its overall valuation.

- Unique technological aspects: Palantir's ability to integrate disparate data sources and provide actionable insights sets it apart.

- Competitive landscape: The data analytics market is highly competitive, with established players and emerging startups posing challenges.

- Future innovation potential: Palantir's capacity for ongoing innovation and adaptation is crucial for maintaining its competitive edge.

- Patents and intellectual property: Strong intellectual property protection contributes significantly to the company's perceived long-term value.

Investor Sentiment and Market Expectations: Impact on Palantir's Valuation

Market sentiment and expectations play a significant role in determining Palantir's stock price and, consequently, its P/E ratio. Positive news, strong earnings reports, and optimistic analyst forecasts can inflate the stock price, leading to a higher P/E ratio. Conversely, negative news or economic downturns can exert downward pressure. Comparing Palantir's valuation to its peers in the data analytics sector also offers valuable context.

- Historical stock price performance: Examining past stock performance helps understand market reactions to Palantir's announcements and achievements.

- Analyst ratings and price targets: Analyst opinions and predicted price targets influence investor sentiment and trading activity.

- Impact of news and events: Significant events and news releases (both positive and negative) can significantly affect Palantir's stock valuation.

- Comparison to peer company valuations: Benchmarking Palantir against competitors provides a relative perspective on its valuation.

Conclusion: Is Palantir's High P/E Ratio Justified? A Final Verdict

Whether Palantir's high P/E ratio is justified is a complex question. While the company shows promise in terms of revenue growth and technological innovation, its profitability remains a concern. The transition from a government-focused business model to a broader commercial one continues to present challenges. Ultimately, the valuation reflects a blend of its demonstrated growth potential, technological advantages, investor sentiment, and market expectations. However, investors should proceed with caution, considering the inherent risks associated with a high-growth, high-P/E stock.

Conduct further research into Palantir's financial statements and consider consulting a financial advisor before making any investment decisions regarding Palantir's high P/E ratio. A thorough understanding of its historical context and the complexities of its valuation is crucial for making informed investment choices.

Featured Posts

-

Turning Trash To Treasure An Ai Powered Podcast From Scatological Documents

May 07, 2025

Turning Trash To Treasure An Ai Powered Podcast From Scatological Documents

May 07, 2025 -

Commerce Advisor Highlights Governments Role In Ldc Graduation

May 07, 2025

Commerce Advisor Highlights Governments Role In Ldc Graduation

May 07, 2025 -

Minnesota Timberwolves Analyzing Their Surprising Playoff Success

May 07, 2025

Minnesota Timberwolves Analyzing Their Surprising Playoff Success

May 07, 2025 -

Rihanna Expecting Details On Her Third Pregnancy

May 07, 2025

Rihanna Expecting Details On Her Third Pregnancy

May 07, 2025 -

Eastern Conference Semifinals Cavaliers Vs Pacers Betting Analysis

May 07, 2025

Eastern Conference Semifinals Cavaliers Vs Pacers Betting Analysis

May 07, 2025

Latest Posts

-

Miras Planlamasi Kripto Varliklarinizi Guevence Altina Alin

May 08, 2025

Miras Planlamasi Kripto Varliklarinizi Guevence Altina Alin

May 08, 2025 -

Kripto Para Yatirimi Wall Street Kurumlarinin Degisen Perspektifi

May 08, 2025

Kripto Para Yatirimi Wall Street Kurumlarinin Degisen Perspektifi

May 08, 2025 -

Rusya Merkez Bankasi Nin Kripto Para Hakkindaki Son Uyarisi Ve Oenemli Detaylar

May 08, 2025

Rusya Merkez Bankasi Nin Kripto Para Hakkindaki Son Uyarisi Ve Oenemli Detaylar

May 08, 2025 -

Kriptoda Yeni Doenem Spk Nin Son Aciklamasi Ve Etkileri

May 08, 2025

Kriptoda Yeni Doenem Spk Nin Son Aciklamasi Ve Etkileri

May 08, 2025 -

Kripto Para Mirasi Sifresiz Kalanlar Ne Yapmali

May 08, 2025

Kripto Para Mirasi Sifresiz Kalanlar Ne Yapmali

May 08, 2025