Is The Canadian Condo Market A Good Investment Anymore?

Table of Contents

Current Market Conditions in Major Canadian Cities

The Canadian condo market isn't monolithic; conditions vary significantly across major cities. Let's examine some key areas:

-

Toronto Condo Market: Toronto has seen a slowdown in price growth, with some areas experiencing slight decreases. Increased inventory and higher interest rates have impacted affordability, making it a more buyer-friendly market compared to recent years. However, Toronto's strong economy and continued population growth still support a relatively robust market for Toronto condo investments.

-

Vancouver Condo Investment: Vancouver's condo market, historically known for its high prices, has also seen a cooling trend. While still a desirable location, increased supply and stricter government regulations have tempered price appreciation. Potential investors need to carefully analyze specific neighbourhoods within Vancouver to assess Vancouver condo investment opportunities.

-

Calgary Real Estate: Calgary’s condo market is showing signs of recovery after a period of slower growth. Improved economic conditions and a growing population are boosting demand, though interest rates remain a significant factor.

-

Montreal Condo Prices: Montreal's condo market continues to attract buyers, with relatively affordable prices compared to Toronto and Vancouver. Strong rental demand contributes to positive Montreal condo prices trends, making it an appealing investment for those seeking relatively lower-risk Canadian condo market trends.

Factors influencing these varied market conditions include:

- Interest Rate Hikes: Higher borrowing costs significantly impact affordability, reducing buyer purchasing power and slowing price growth across the board.

- Government Policies: Changes in government policies, such as mortgage stress tests and foreign buyer taxes, directly affect market dynamics and investor sentiment.

- Supply and Demand: New construction projects influence inventory levels. A surplus of new condos can suppress prices, while high demand can drive prices up.

Rental Yields and Investment Potential

Analyzing condo rental yields is crucial for assessing investment potential. While capital appreciation (price increase) is a key factor, rental income provides a stream of passive income.

- Yield Variations: Rental yields vary considerably across cities and even within neighbourhoods. Higher-demand areas typically command higher rents but may also have higher purchase prices, affecting overall yield.

- Capital Appreciation: While past performance isn't indicative of future results, historical data can provide insights into potential Canadian rental market appreciation in different areas.

- Comparison to Other Investments: Condo investment returns should be compared to other investment options, such as stocks, bonds, or GICs, to evaluate their relative risk and reward profiles.

Factors impacting rental yields include:

- Vacancy Rates: High vacancy rates can depress rental income.

- Rental Regulations: Rent control policies influence the rental income potential for landlords.

- Demand for Rental Units: Strong rental demand supports higher rental rates and occupancy.

Risks and Considerations for Condo Investors

Investing in Canadian condos, like any investment, carries risks:

- Market Volatility: Real estate markets are inherently cyclical. Price fluctuations and potential market downturns can impact investment returns.

- Condo Fees and Maintenance Costs: Condo fees, which cover building maintenance and amenities, can be substantial and can increase over time. Unexpected special assessments for major repairs can significantly impact cash flow.

- Property Taxes: Property taxes are another recurring expense that needs to be factored into the investment calculation.

- Potential for Negative Cash Flow: In some cases, the combined costs of mortgage payments, condo fees, property taxes, and potential vacancy can exceed rental income, leading to negative cash flow.

Other crucial aspects include:

- Condo Building Regulations: Regulations regarding building maintenance and renovations can influence costs and potential liabilities.

- Insurance Costs: Insurance premiums can vary depending on factors like building age, location, and risk profile.

- Due Diligence: Thorough due diligence, including professional inspections and legal reviews, is paramount before any Canadian condo investment.

Alternative Investment Strategies in Canadian Real Estate

While condos offer certain advantages, other Canadian real estate alternatives exist:

- Townhouses: Townhouses often offer a balance between condo-style living and the benefits of owning a freehold property.

- Single-Family Homes: Single-family homes provide more space and control but generally require higher upfront capital and ongoing maintenance.

- REITs (Real Estate Investment Trusts): REITs allow investors to access a diversified portfolio of real estate assets without directly owning properties. REITs Canada offer various options for exposure to the Canadian real estate market.

Each option has advantages and disadvantages, requiring careful consideration based on individual investment goals and risk tolerance.

Conclusion: Is Investing in Canadian Condos Still a Viable Option?

The Canadian condo market presents both opportunities and challenges. While some cities offer strong rental markets and potential for capital appreciation, others face slower growth or even price declines due to several factors, including increased interest rates and inventory. The viability of a Canadian condo investment depends significantly on location, specific property characteristics, and the investor's risk tolerance.

Potential benefits include relatively lower entry costs compared to other property types and the potential for passive income through rental income. However, risks such as market volatility, condo fees, and potential negative cash flow must be carefully considered.

Before making any investment decisions related to the Canadian condo market, conduct thorough research, compare different investment strategies, and seek professional advice from real estate agents or financial advisors. Explore available resources and understand the nuances of the local market before making any Canadian condo investments.

Featured Posts

-

Linda Evangelista And Cool Sculpting A Cautionary Tale Of Cosmetic Procedure Damage

Apr 25, 2025

Linda Evangelista And Cool Sculpting A Cautionary Tale Of Cosmetic Procedure Damage

Apr 25, 2025 -

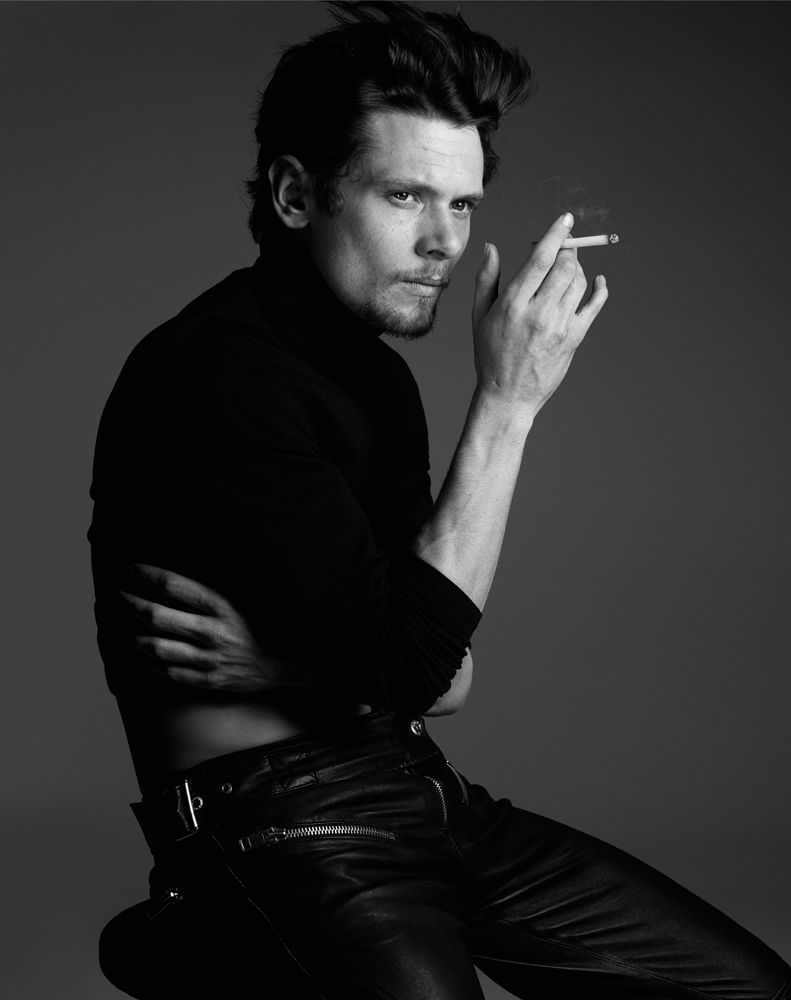

Jack O Connell On Michael Caine The Daunted Spitting Experience

Apr 25, 2025

Jack O Connell On Michael Caine The Daunted Spitting Experience

Apr 25, 2025 -

Exploring Jack O Connells Sinners Scene A Cultural Analysis

Apr 25, 2025

Exploring Jack O Connells Sinners Scene A Cultural Analysis

Apr 25, 2025 -

St Pauli Vs Bayern Six Point Lead Secured But Room For Improvement

Apr 25, 2025

St Pauli Vs Bayern Six Point Lead Secured But Room For Improvement

Apr 25, 2025 -

Meme Coin Millionaires Dine With President Trump A Look Inside

Apr 25, 2025

Meme Coin Millionaires Dine With President Trump A Look Inside

Apr 25, 2025

Latest Posts

-

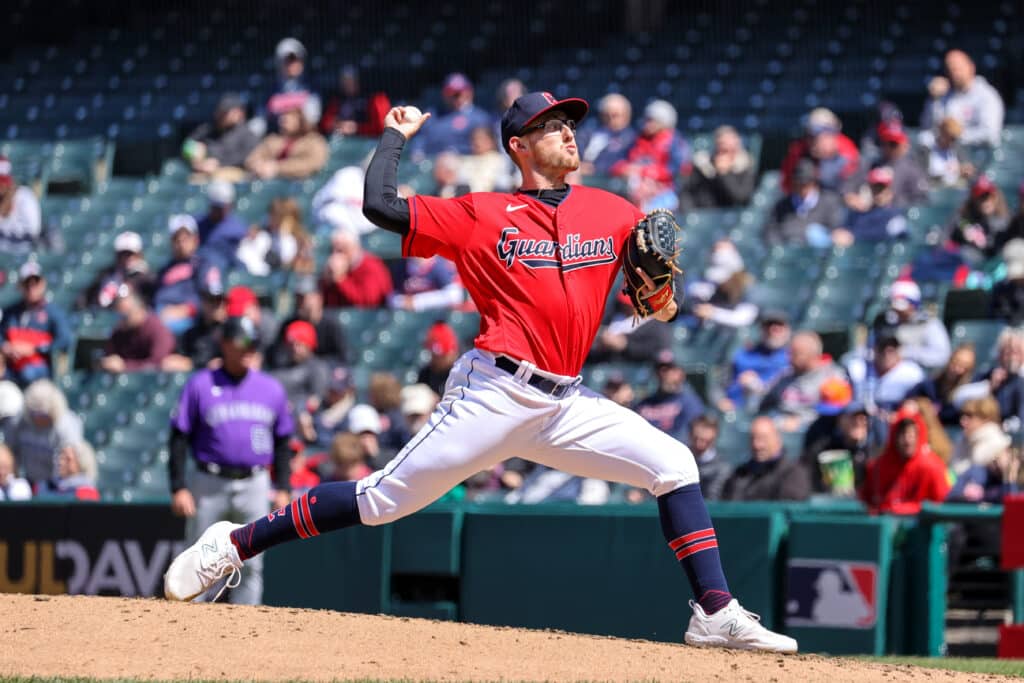

Close Game Guardians Defeat Royals In Extra Innings

Apr 30, 2025

Close Game Guardians Defeat Royals In Extra Innings

Apr 30, 2025 -

Bibee Guardians Bounce Back From Early Homer Beat Yankees

Apr 30, 2025

Bibee Guardians Bounce Back From Early Homer Beat Yankees

Apr 30, 2025 -

Guardians Win Season Opener With Extra Inning Rally Against Royals

Apr 30, 2025

Guardians Win Season Opener With Extra Inning Rally Against Royals

Apr 30, 2025 -

Yankees Fall To Guardians Despite Early Lead Bibees Strong Performance

Apr 30, 2025

Yankees Fall To Guardians Despite Early Lead Bibees Strong Performance

Apr 30, 2025 -

Kansas City Royals Win Thriller Against Cleveland Guardians

Apr 30, 2025

Kansas City Royals Win Thriller Against Cleveland Guardians

Apr 30, 2025