Is The DAX Rally Sustainable Amidst A Potential Wall Street Recovery?

Table of Contents

Analyzing the Current DAX Performance

Recent DAX Gains and Contributing Factors

The DAX index has experienced significant growth in recent months. Several factors contribute to this positive DAX performance:

- Easing Inflation Concerns: Lower-than-expected inflation figures in Germany and the Eurozone have boosted investor confidence, leading to increased investment in the DAX.

- Strong Corporate Earnings: Many DAX-listed companies have reported robust earnings, exceeding analyst expectations, signaling a healthy corporate sector and contributing to DAX growth. Examples include [insert examples of strong performing companies and their sectors].

- Positive Economic Indicators: Recent data suggests improving economic indicators in Germany, including a rise in industrial production and a stabilization of consumer spending. This positive German economic outlook supports the DAX rally.

These factors collectively point towards a strong, albeit potentially short-term, positive DAX performance.

Assessing the Underlying Economic Strength of Germany

While the DAX performance is encouraging, a thorough assessment of the underlying German economy is crucial for understanding the sustainability of this growth.

- Industrial Production: While showing recent improvement, German industrial production remains vulnerable to global economic downturns and energy price volatility.

- Exports: Germany's export-oriented economy is susceptible to global trade tensions and weakening international demand. Any significant downturn in global markets could negatively impact German exports and, subsequently, the DAX.

- Consumer Spending: While consumer spending has shown some resilience, persistent inflation and rising interest rates could dampen consumer confidence and spending in the coming months, affecting the German market's overall health.

A comprehensive analysis of these factors is necessary to gauge the true strength and resilience of the German economy and its implications for the DAX's long-term trajectory.

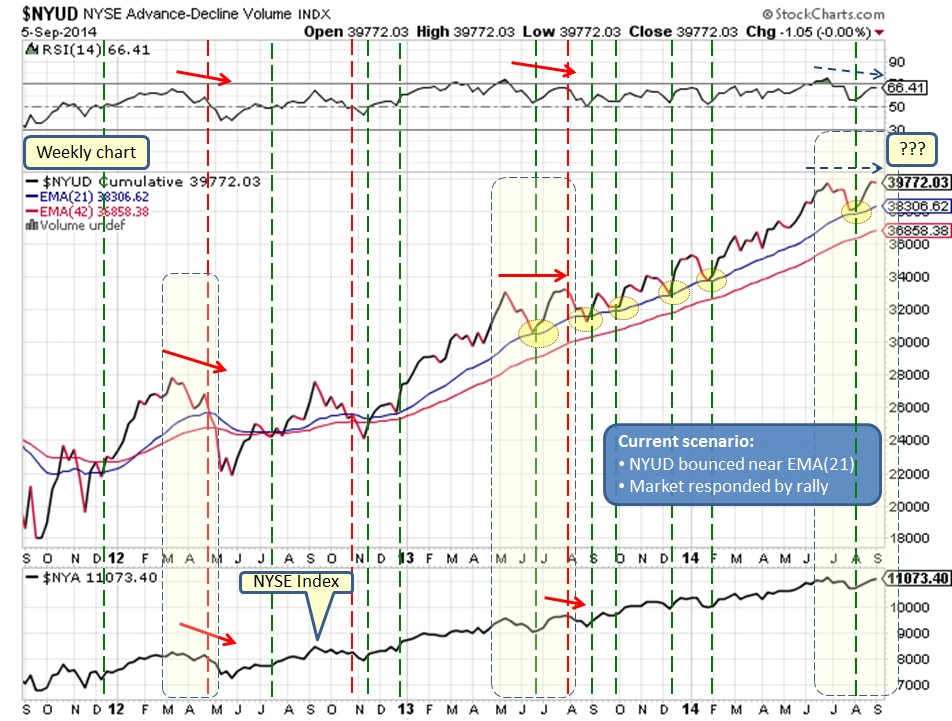

The Impact of a Potential Wall Street Recovery

The Interdependence of Global Markets

The DAX and Wall Street are inextricably linked within the global financial system. A US market recovery would likely have a significant positive impact on the German market.

- Increased Investor Confidence: A strong Wall Street performance typically boosts global investor sentiment, encouraging investment in other major markets, including the DAX.

- Capital Flows: A Wall Street recovery can attract international capital flows, some of which could find their way into the German market, further bolstering the DAX.

- Supply Chain Improvements: A US recovery could potentially lead to smoother global supply chains, benefiting German exporters and boosting the DAX.

Potential Risks and Challenges

However, several challenges could hinder both a sustained Wall Street recovery and the continuation of the DAX rally:

- Geopolitical Risks: Ongoing geopolitical instability, such as the war in Ukraine, poses a significant threat to global economic growth and could trigger market volatility, impacting both Wall Street and the DAX.

- Inflation Persistence: If inflation remains stubbornly high, central banks may continue raising interest rates, potentially triggering a recession and negatively affecting both markets.

- Interest Rate Hikes: Aggressive interest rate hikes by central banks aim to curb inflation but can also slow economic growth, impacting corporate earnings and investor sentiment, thereby affecting both the DAX and Wall Street.

Long-Term Outlook and Sustainability of the DAX Rally

Factors Favoring Continued Growth

Several factors could support the continuation of the DAX rally:

- Strong Corporate Profits: Continued strong corporate earnings from German companies would reinforce investor confidence and support further DAX growth.

- Technological Advancements: Investments in technological innovation and digitalization within the German economy could drive future growth and enhance the DAX's long-term prospects.

- Government Policies: Supportive government policies aimed at stimulating economic growth and fostering innovation could contribute to the DAX's sustainable growth.

Factors that Could Undermine the Rally

Despite the positive aspects, several threats could undermine the DAX rally's sustainability:

- Recessionary Fears: Growing concerns about a potential global recession could trigger a market correction, impacting the DAX negatively.

- Energy Crisis: The ongoing energy crisis in Europe could significantly impact the German economy and lead to a DAX downturn.

- Supply Chain Disruptions: Persistent supply chain disruptions could hamper economic growth and negatively affect corporate profitability, impacting the DAX.

Conclusion: Is the DAX Rally Sustainable Amidst a Potential Wall Street Recovery? A Final Verdict

The sustainability of the current DAX rally is a complex issue dependent on a confluence of factors. While recent gains are driven by positive economic indicators, easing inflation, and strong corporate performance, risks remain. The interconnectedness with Wall Street means that a US recovery could provide a significant boost, but geopolitical uncertainty, persistent inflation, and potential recessionary pressures pose significant threats. A balanced perspective suggests that while the DAX rally might continue for some time, its sustainability hinges on successfully navigating these challenges. Careful monitoring of economic indicators, geopolitical developments, and corporate performance is crucial.

Stay informed about the DAX rally's progress and the unfolding Wall Street recovery by regularly checking our market analysis updates. Understanding DAX rally sustainability is key to informed investment decisions.

Featured Posts

-

Philips Convenes Annual General Meeting What To Expect

May 24, 2025

Philips Convenes Annual General Meeting What To Expect

May 24, 2025 -

13 Vuotias F1 Lupaus Ferrarin Uusi Taehti

May 24, 2025

13 Vuotias F1 Lupaus Ferrarin Uusi Taehti

May 24, 2025 -

Guccis Massimo Vian Departs Supply Chain Leadership Change

May 24, 2025

Guccis Massimo Vian Departs Supply Chain Leadership Change

May 24, 2025 -

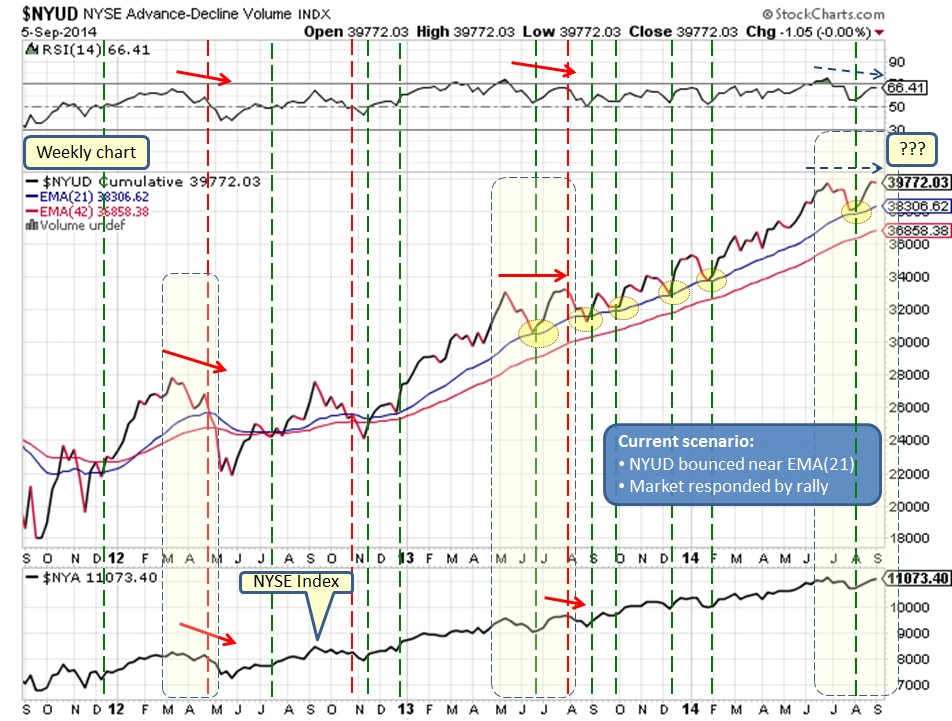

News Corps Undervalued Assets A Comprehensive Analysis

May 24, 2025

News Corps Undervalued Assets A Comprehensive Analysis

May 24, 2025 -

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Glastonbury 2025 Announced Lineup Sparks Outrage Among Fans

May 24, 2025

Latest Posts

-

Michael Caines Unexpected On Set Encounter Recalling A Sex Scene With Mia Farrow

May 24, 2025

Michael Caines Unexpected On Set Encounter Recalling A Sex Scene With Mia Farrow

May 24, 2025 -

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 24, 2025

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 24, 2025 -

Sadie Sink And Mia Farrow Fellow Tony Nominees Connect

May 24, 2025

Sadie Sink And Mia Farrow Fellow Tony Nominees Connect

May 24, 2025 -

Buffetts Apple Stake Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Stake Impact Of Trump Era Tariffs

May 24, 2025 -

Mia Farrow And Sadie Sink A Broadway Photo Opportunity

May 24, 2025

Mia Farrow And Sadie Sink A Broadway Photo Opportunity

May 24, 2025