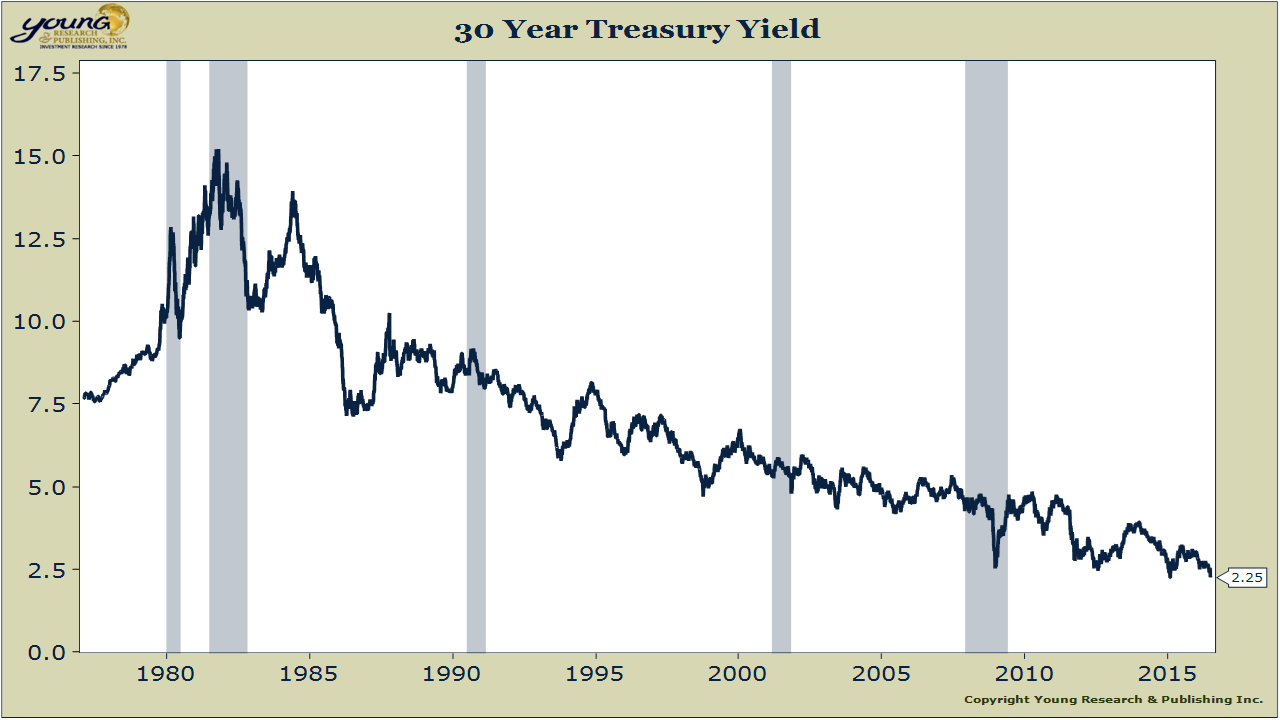

Is The 'Sell America' Trade Resurfacing As 30-Year Treasury Yields Hit 5%?

Table of Contents

The Rise of 30-Year Treasury Yields and its Implications

The sharp increase in 30-year Treasury yields is a multifaceted issue, driven by a confluence of factors. Persistent inflation, despite the Federal Reserve's aggressive interest rate hikes, remains a primary concern. Global economic uncertainty, fueled by geopolitical tensions and the ongoing war in Ukraine, further contributes to the upward pressure on yields. Investors, seeking safe haven assets, initially flocked to US Treasuries, driving up demand. However, the continued rise in yields suggests a shift in sentiment.

- Impact on borrowing costs: Higher yields translate to increased borrowing costs for the US government and corporations, potentially hindering economic growth and investment.

- Attractiveness of US Treasuries: While still considered relatively safe, the increased yields might make US Treasuries less attractive compared to other global assets offering potentially higher returns, especially if the dollar weakens.

- Implications for the US dollar: A sustained rise in yields could strengthen the dollar in the short term, but prolonged capital flight might eventually weaken it.

This complex interplay of factors raises concerns about potential capital outflows from the US, a hallmark of the "Sell America" trade.

Understanding the "Sell America" Trade

The "Sell America" trade refers to a phenomenon where foreign and domestic investors simultaneously sell US assets – stocks, bonds, and real estate – often driven by a combination of factors. Historically, this has been triggered by concerns about US economic policy, geopolitical instability, or the perceived attractiveness of alternative investment opportunities elsewhere.

- Motivations for selling US assets: Investors might seek higher returns in other markets, hedge against currency risk, or react to perceived economic weakness in the US.

- Consequences of a large-scale "Sell America" trade: A significant capital outflow can lead to a weakening US dollar, higher interest rates, decreased investment, and slower economic growth. It can also negatively impact various sectors, particularly those reliant on foreign investment.

- Historical examples: Periods of significant capital flight from the US, sometimes associated with the "Sell America" narrative, have occurred throughout history, often linked to major economic or geopolitical events.

A resurgence of this trade could significantly impact sectors like technology, heavily reliant on foreign investment, and real estate, sensitive to interest rate changes.

Current Market Conditions and the Potential for a "Sell America" Resurgence

Current global economic conditions are characterized by significant uncertainty. Geopolitical risks, persistent inflation, and the ongoing energy crisis contribute to a nervous investor sentiment. While the US economy remains relatively strong compared to some global peers, concerns about potential recession and the impact of rising interest rates persist.

- Geopolitical risks and global uncertainty: The war in Ukraine, tensions with China, and other global hotspots create an environment of uncertainty, impacting investor confidence in all markets, including the US.

- Competitive landscape of global bond markets: Other countries offer competitive bond yields, making US Treasuries less attractive to some international investors.

- Attractiveness of alternative investments: Emerging markets and other asset classes might offer higher returns, potentially drawing capital away from the US.

Whether the current rise in yields represents a renewed "Sell America" trend or a temporary market adjustment is a key question. The data on capital flows offers crucial insights.

Analyzing Investor Behavior and Capital Flows

Analyzing recent data on capital flows is crucial for determining whether the "Sell America" trade is resurfacing. Data from sources like the US Treasury Department and the Federal Reserve provide insights into foreign investment in US Treasury securities and broader capital flows.

- Data from official sources: Examining official data reveals trends in foreign investment in US assets, providing a quantitative assessment of capital flows.

- Analysis of foreign investment in US Treasury securities: The extent to which foreign central banks and investors are reducing their holdings of US Treasuries is a key indicator.

- Trends in portfolio rebalancing: Observing how global investors adjust their portfolios provides insights into their risk appetite and investment preferences.

Any significant decrease in foreign investment in US assets, coupled with increased domestic selling, could suggest a resurgence of the "Sell America" trade.

Conclusion: The Future of the "Sell America" Trade and What It Means for Investors

Our analysis suggests that while the rise in 30-year Treasury yields doesn't definitively confirm a full-blown "Sell America" resurgence, it does highlight significant risks. The interplay of high yields, global uncertainty, and the competitive global bond market creates a climate where such a scenario is a plausible concern. The scale and duration of any potential capital flight remain uncertain, requiring close monitoring of economic indicators and investor behavior.

The impact of rising 30-year Treasury yields on the potential for a "Sell America" trade underscores the need for vigilance. Monitor the "Sell America" trade closely to protect your investments. Understanding the "Sell America" narrative is crucial for informed investment decisions. Stay informed about developments in the bond market and global economic conditions by consulting reputable financial news sources and seeking professional advice.

Featured Posts

-

Sygklonistiko Epeisodio Tampoy Sto Mega I Sygkroysi Ektora Kai Persas

May 20, 2025

Sygklonistiko Epeisodio Tampoy Sto Mega I Sygkroysi Ektora Kai Persas

May 20, 2025 -

La Cruda Verdad La Conversacion Previa Al Regreso De Schumacher En 2010

May 20, 2025

La Cruda Verdad La Conversacion Previa Al Regreso De Schumacher En 2010

May 20, 2025 -

Atkinsrealis Assistance Juridique Et Conseil En Droit D Affaires

May 20, 2025

Atkinsrealis Assistance Juridique Et Conseil En Droit D Affaires

May 20, 2025 -

March 26 2025 Nyt Mini Crossword Answers And Clues

May 20, 2025

March 26 2025 Nyt Mini Crossword Answers And Clues

May 20, 2025 -

Biarritz Celebre Les Femmes Evenements Autour Du 8 Mars Avec Parcours De Femmes

May 20, 2025

Biarritz Celebre Les Femmes Evenements Autour Du 8 Mars Avec Parcours De Femmes

May 20, 2025

Latest Posts

-

Nova Filmska Adaptacija Reddit Price Sydney Sweeney U Ulozi

May 21, 2025

Nova Filmska Adaptacija Reddit Price Sydney Sweeney U Ulozi

May 21, 2025 -

El Regreso De Javier Baez Salud Productividad Y Expectativas Para La Proxima Temporada

May 21, 2025

El Regreso De Javier Baez Salud Productividad Y Expectativas Para La Proxima Temporada

May 21, 2025 -

Prica S Reddita Postaje Film Sa Sydney Sweeney

May 21, 2025

Prica S Reddita Postaje Film Sa Sydney Sweeney

May 21, 2025 -

Puede Javier Baez Regresar A Su Mejor Nivel Analisis De Su Salud Y Productividad

May 21, 2025

Puede Javier Baez Regresar A Su Mejor Nivel Analisis De Su Salud Y Productividad

May 21, 2025 -

Film Po Reddit Prici Sydney Sweeney U Glavnoj Ulozi

May 21, 2025

Film Po Reddit Prici Sydney Sweeney U Glavnoj Ulozi

May 21, 2025