Is The U.S. Dollar Headed For Its Worst 100 Days Since Nixon?

Table of Contents

Inflationary Pressures and the Weakening Dollar

The current inflationary environment in the U.S. is significantly impacting the dollar's value. Soaring consumer prices, driven by factors like supply chain disruptions and increased energy costs, are eroding purchasing power and weakening the dollar's exchange rate. The Federal Reserve's monetary policy, aimed at curbing inflation through aggressive interest rate hikes, is walking a tightrope. While higher interest rates can attract foreign investment and bolster the dollar, they also risk triggering a recession, further destabilizing the economy.

The relationship between inflation, interest rates, and the dollar's exchange rate is complex. High inflation typically leads to a weaker dollar as investors seek higher returns in other currencies. However, aggressive interest rate hikes can temporarily strengthen the dollar, but at the cost of potential economic contraction. This delicate balance is a major factor in determining the dollar's future trajectory.

- Rising inflation erodes purchasing power. The value of the dollar decreases as prices rise, reducing its attractiveness to international investors.

- Aggressive interest rate hikes risk recession. While intended to combat inflation, sharply increased interest rates can stifle economic growth and lead to job losses.

- Global economic slowdown impacts dollar demand. A weakening global economy reduces the demand for the dollar, further contributing to its devaluation.

Keywords: inflation, interest rates, Federal Reserve, quantitative easing, exchange rate, dollar devaluation

Geopolitical Risks and Uncertainty

Geopolitical risks are significantly exacerbating the pressure on the U.S. dollar. The ongoing war in Ukraine, strained US-China relations, and escalating tensions in other regions are creating a volatile global landscape. Sanctions imposed on Russia have disrupted global energy markets and supply chains, fueling inflation and contributing to economic uncertainty. The shifting global power dynamics, with the rise of alternative currencies and a push for de-dollarization, further challenge the dollar's hegemony.

The increasing diversification away from the dollar by central banks and investors reflects a growing concern about its long-term stability. The potential for a multi-polar currency system could significantly diminish the dollar's role in international trade and finance.

- Increased global uncertainty reduces investor confidence in the dollar. Investors are seeking safer havens for their assets amidst geopolitical turmoil.

- Diversification away from the dollar is accelerating. Central banks and investors are diversifying their reserves into other currencies, such as the euro, the Chinese yuan, and even cryptocurrencies.

- Geopolitical tensions fuel market volatility. Sudden shifts in geopolitical events can lead to sharp fluctuations in the dollar's value.

Keywords: geopolitical risks, Ukraine war, US-China relations, sanctions, global power, alternative currencies, de-dollarization

Comparison to the Post-Nixon Era

Drawing parallels between the current situation and the period following Nixon's closing of the gold window in 1971 is crucial. Nixon's decision marked the end of the Bretton Woods system, which had pegged the U.S. dollar to gold, ushering in an era of floating exchange rates. This led to significant volatility in currency markets and a period of global economic restructuring.

While the current situation differs in some aspects – the global financial system is more complex and interconnected, and the nature of geopolitical risks has changed – there are striking similarities. Both periods are marked by high inflation, uncertainty about monetary policy, and significant geopolitical instability. The long-term consequences of the Nixon shock, such as increased currency volatility and a shift towards a fiat currency system, offer valuable lessons for understanding the potential impact of current trends.

- Increased volatility in exchange rates. The abandonment of fixed exchange rates led to greater fluctuations in currency values.

- Shift towards a fiat currency system. The U.S. dollar became a fiat currency, its value determined by market forces rather than a fixed gold standard.

- Global economic restructuring. The collapse of the Bretton Woods system triggered a period of significant global economic adjustments.

Keywords: Nixon shock, Bretton Woods system, gold standard, floating exchange rates, currency devaluation, economic consequences

Potential Scenarios for the Next 100 Days

Predicting the U.S. dollar's performance in the next 100 days is challenging, but several potential scenarios exist. A sharp decline is possible if inflation continues to escalate and geopolitical risks intensify, leading to a loss of investor confidence. A more gradual weakening could occur if inflation persists, and global demand for the dollar remains subdued. Alternatively, the dollar could stabilize if the Federal Reserve successfully manages inflation, and geopolitical tensions ease.

The outcome will depend on the interplay of various factors, including the effectiveness of monetary policy, the evolution of geopolitical events, and investor sentiment.

- Scenario 1: Sharp decline due to escalating inflation and geopolitical risks. A sudden loss of confidence in the dollar could lead to a rapid devaluation.

- Scenario 2: Gradual weakening due to persistent inflation and reduced global demand. A slow but steady decline in the dollar's value is also a possibility.

- Scenario 3: Stabilization due to effective Fed intervention and easing geopolitical tensions. Successful policy responses could prevent a major decline in the dollar's value.

Keywords: dollar forecast, currency prediction, market outlook, economic scenarios, risk assessment

Conclusion: Navigating the Uncertain Future of the U.S. Dollar

The U.S. dollar faces significant challenges in the coming months. While the current situation differs from the post-Nixon era in some key aspects, the parallels in terms of inflationary pressures and geopolitical uncertainty are striking. The potential for significant volatility in the U.S. dollar's value cannot be ignored. Individuals and investors must carefully consider their exposure to currency risk and diversify their portfolios to mitigate potential losses. Understanding the factors affecting the U.S. dollar is crucial for navigating these uncertain times. Stay informed on the latest news concerning the U.S. dollar and its potential for volatility. Careful monitoring of the U.S. dollar's trajectory is essential for making sound financial decisions.

Featured Posts

-

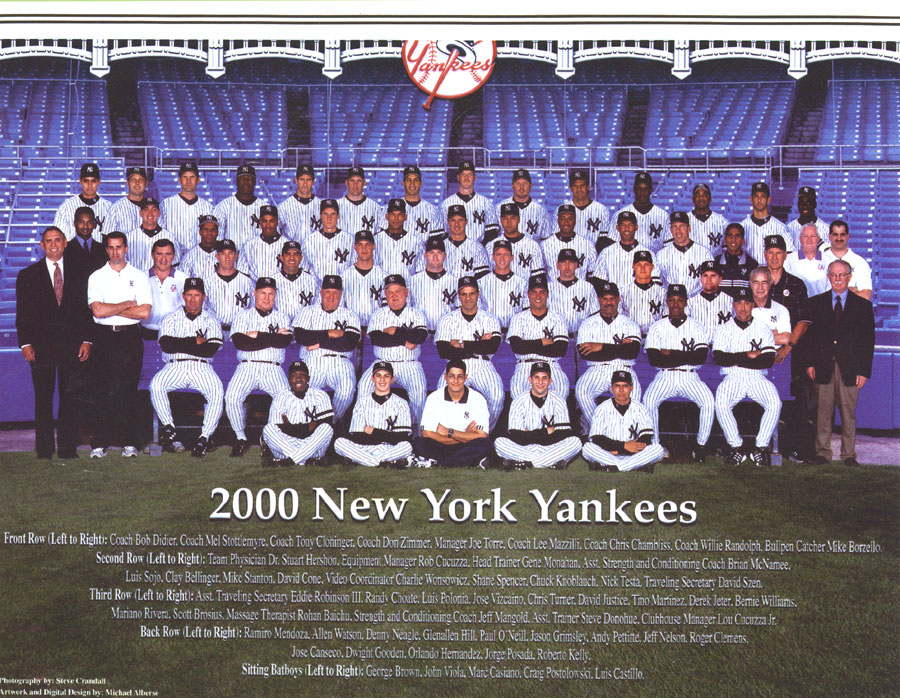

New York Yankees 2000 Diary Of A Victory Against Kansas City

Apr 28, 2025

New York Yankees 2000 Diary Of A Victory Against Kansas City

Apr 28, 2025 -

A Guide To Driving The Florida Keys Overseas Highway

Apr 28, 2025

A Guide To Driving The Florida Keys Overseas Highway

Apr 28, 2025 -

A Comprehensive Guide To The Countrys Fastest Growing Business Areas

Apr 28, 2025

A Comprehensive Guide To The Countrys Fastest Growing Business Areas

Apr 28, 2025 -

2 Year Old U S Citizens Deportation Federal Judge Sets Hearing

Apr 28, 2025

2 Year Old U S Citizens Deportation Federal Judge Sets Hearing

Apr 28, 2025 -

Max Frieds Yankee Debut 12 3 Win Over Pirates Fueled By Strong Offense

Apr 28, 2025

Max Frieds Yankee Debut 12 3 Win Over Pirates Fueled By Strong Offense

Apr 28, 2025

Latest Posts

-

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025

Updated Red Sox Lineup Casas Moved Down Outfielder Returns From Injury

Apr 28, 2025 -

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025

Red Sox Starting Lineup Casas Position Shift Outfielders Comeback

Apr 28, 2025 -

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025

Red Sox Lineup Shakeup Casas Demoted Struggling Outfielder Returns

Apr 28, 2025 -

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025

Jarren Duran 2 0 This Red Sox Outfielders Potential For A Breakout Season

Apr 28, 2025 -

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025

The Curse Is Broken Orioles Announcer And The 160 Game Hit Streak

Apr 28, 2025