Is The World's Largest Bond Market About To Collapse? A Posthaste Analysis

Table of Contents

Understanding the Current State of the World's Largest Bond Market

The US Treasury market's dominance in the global bond market is undeniable. Trillions of dollars worth of US Treasury bonds are held by governments, institutions, and individuals worldwide, making it a benchmark for global interest rates and a cornerstone of the international financial system. Current interest rates are a key factor impacting this market. The Federal Reserve's aggressive interest rate hikes, aimed at combating inflation, have significantly increased yields on US Treasury bonds. This, however, has also impacted bond prices inversely. Recent yield curve inversions, where short-term yields exceed long-term yields, are a potential harbinger of an economic slowdown or even a recession, adding to the anxieties surrounding the global bond market.

- Current 10-year Treasury yield: Currently hovering around [insert current 10-year Treasury yield], significantly higher than historical averages over the past decade. This reflects the impact of aggressive monetary policy.

- Impact of inflation on bond prices: High inflation erodes the purchasing power of fixed-income investments like bonds, putting downward pressure on their prices. This is a significant concern for bondholders.

- Role of the Federal Reserve's monetary policy: The Federal Reserve's actions directly influence interest rates and, consequently, the value of US Treasury bonds. Their decisions are closely watched by investors worldwide.

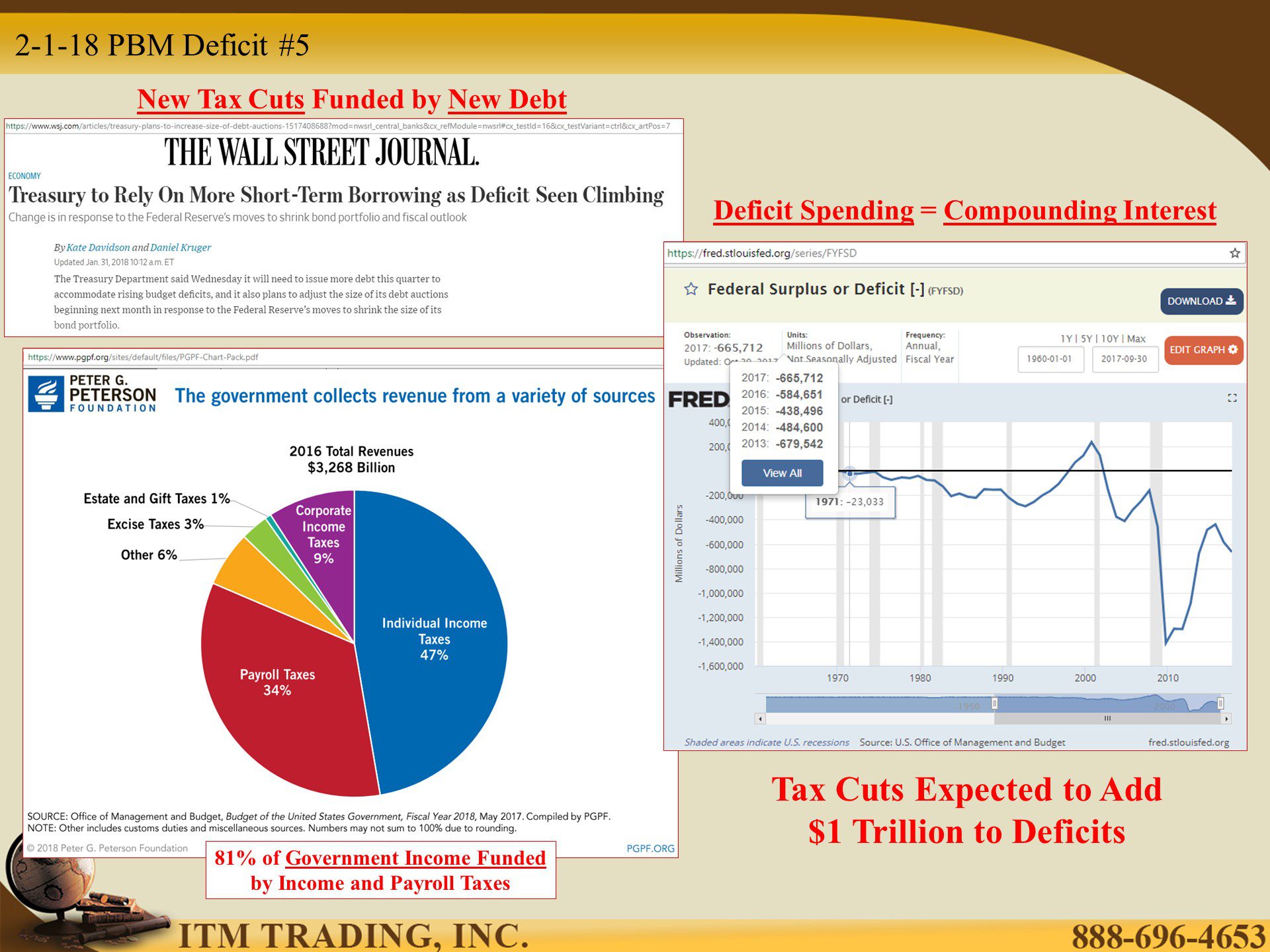

Key Factors Contributing to Potential Collapse Concerns

Several factors fuel concerns about a potential collapse of the world's largest bond market. The rapid rise in interest rates, intended to curb inflation, has increased borrowing costs for governments and corporations, potentially leading to debt defaults. High inflation, coupled with the potential for a recession, creates a challenging economic environment that further strains the bond market. Geopolitical instability, such as the ongoing war in Ukraine, adds another layer of complexity, increasing uncertainty and market volatility.

- Debt levels of major economies: High levels of government and corporate debt increase the vulnerability of the global financial system to a crisis. Many economies are grappling with unsustainable debt burdens.

- Potential for a sovereign debt crisis: The risk of a sovereign debt crisis, especially in countries with high debt-to-GDP ratios, cannot be ignored. This could trigger a domino effect within the global bond market.

- Impact of the war in Ukraine on global markets: The war has disrupted supply chains, fueled inflation, and increased uncertainty in global financial markets, impacting investor sentiment towards bonds.

Assessing the Probability of a Collapse: A Realistic Perspective

While concerns are valid, a complete collapse of the world's largest bond market is unlikely in the near term. The US Treasury market possesses significant resilience, underpinned by the strength of the US dollar and the government's ability to issue debt. However, a significant correction is possible. The market has weathered similar storms in the past, albeit with varying degrees of impact.

- Historical precedents for market corrections: History shows that bond markets experience corrections, but rarely complete collapses. Past crises have provided valuable lessons in risk management.

- Role of government intervention: Governments can intervene to stabilize the market through various measures, including quantitative easing and direct market support. The capacity for intervention is a crucial mitigating factor.

- Strength of the US dollar: The US dollar's status as the world's reserve currency provides a degree of stability to the US Treasury market.

Investment Strategies in a Volatile Bond Market

Navigating the current volatility requires a cautious and diversified approach. Investors should carefully consider their risk tolerance and adjust their portfolios accordingly. Diversification across different asset classes, including stocks, real estate, and alternative investments, is crucial. Short-term bonds may offer more stability than long-term bonds in a rising interest rate environment.

- Short-term vs. long-term bond strategies: Short-term bonds generally offer lower yields but less price volatility than long-term bonds.

- Diversification across asset classes: Spreading investments across different asset classes reduces overall portfolio risk.

- Importance of a well-defined risk tolerance: Investors must understand their own risk tolerance and adjust their investment strategy accordingly.

Conclusion: Navigating the Uncertainties of the World's Largest Bond Market

The world's largest bond market is facing significant challenges, but a complete collapse is unlikely. While the potential for a correction exists, the market's inherent resilience and the possibility of government intervention offer mitigating factors. However, informed decision-making is paramount. Continuous monitoring of developments in the global bond market, specifically the US Treasury market, is essential. Seek professional financial advice before making any investment decisions related to the global bond market or US Treasury bonds. Understanding the nuances of the world's largest bond market and its potential for volatility is crucial for navigating the current climate.

Featured Posts

-

Atfaq Washntn Wbkyn Aljmrky Artfae Mwshr Daks Alalmany Ila 24 Alf Nqtt

May 24, 2025

Atfaq Washntn Wbkyn Aljmrky Artfae Mwshr Daks Alalmany Ila 24 Alf Nqtt

May 24, 2025 -

Dar Vienas Porsche Elektromobiliu Ikrovimo Centras Europoje Issami Informacija

May 24, 2025

Dar Vienas Porsche Elektromobiliu Ikrovimo Centras Europoje Issami Informacija

May 24, 2025 -

My Experience Waiting By The Phone

May 24, 2025

My Experience Waiting By The Phone

May 24, 2025 -

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025

Sergey Yurskiy Vecher Pamyati V Teatre Mossoveta

May 24, 2025 -

Todays Update Dylan Dreyers Son Post Operation

May 24, 2025

Todays Update Dylan Dreyers Son Post Operation

May 24, 2025

Latest Posts

-

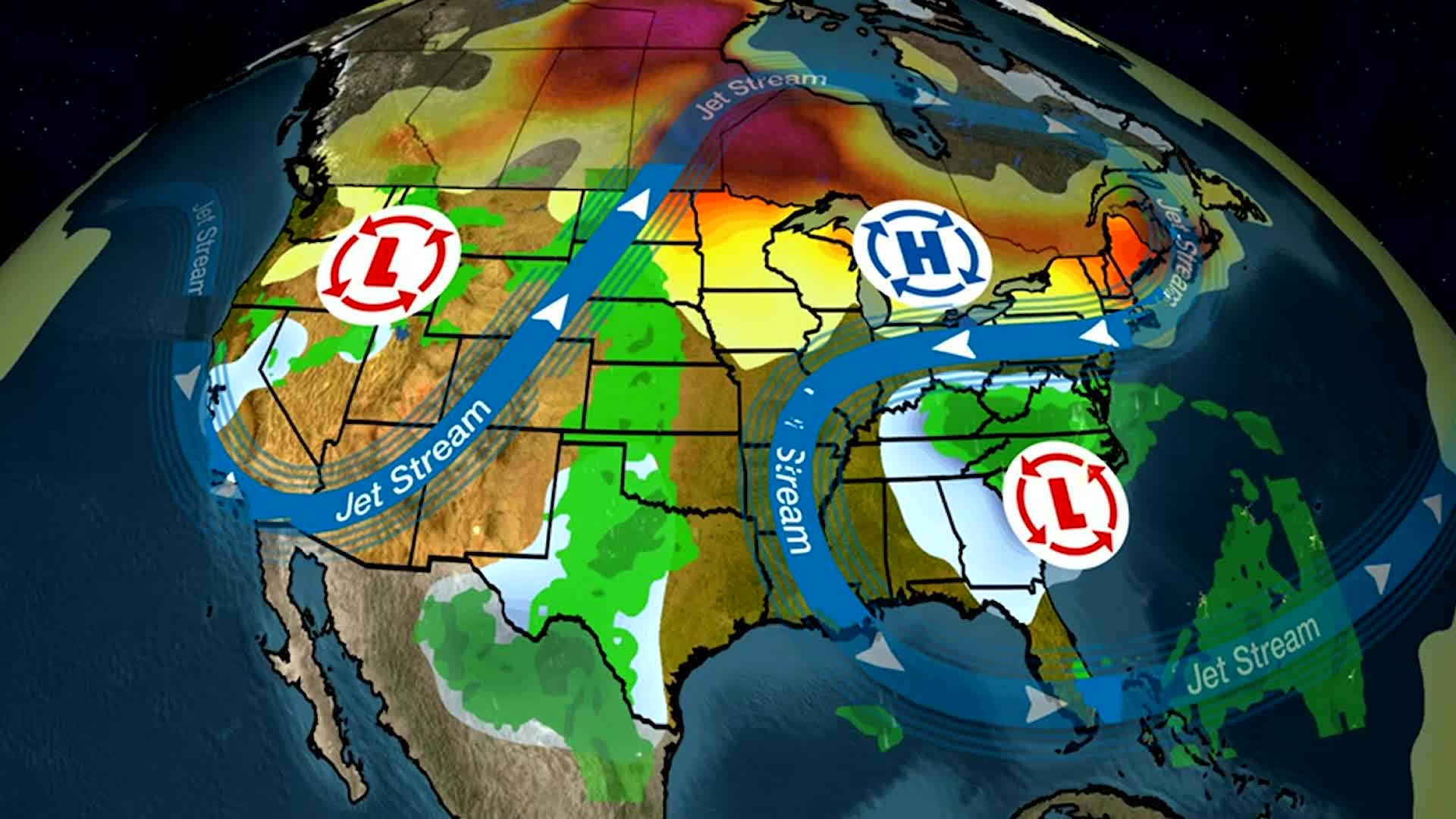

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025

Sandy Point Rehoboth Ocean City Beaches Memorial Day Weekend 2025 Weather Prediction

May 24, 2025 -

2025 Memorial Day Weekend Beach Weather Forecast For Ocean City Rehoboth And Sandy Point

May 24, 2025

2025 Memorial Day Weekend Beach Weather Forecast For Ocean City Rehoboth And Sandy Point

May 24, 2025 -

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025

Memorial Day Weekend 2025 Beach Forecast Ocean City Rehoboth Sandy Point

May 24, 2025 -

Key Moments Kazakhstans Billie Jean King Cup Victory Over Australia

May 24, 2025

Key Moments Kazakhstans Billie Jean King Cup Victory Over Australia

May 24, 2025 -

Kazakhstans Billie Jean King Cup Victory A Detailed Look At The Match Against Australia

May 24, 2025

Kazakhstans Billie Jean King Cup Victory A Detailed Look At The Match Against Australia

May 24, 2025