Is XRP A Good Investment? A Detailed Analysis

Table of Contents

Understanding XRP and its Technology

XRP is a cryptocurrency designed to facilitate fast and low-cost international payments. Unlike Bitcoin or Ethereum, which operate on decentralized, permissionless blockchains, XRP operates within the Ripple network, a centralized system. This distinction is crucial for understanding its functionality and potential risks.

Ripple's core technology, and XRP's primary use case, lies in enabling cross-border transactions through its On-Demand Liquidity (ODL) system. ODL allows financial institutions to source liquidity directly, reducing reliance on correspondent banks and speeding up transactions significantly.

- Ripple's On-Demand Liquidity (ODL): This technology allows for near-instantaneous transfers of funds across borders, bypassing traditional banking infrastructure.

- XRP's Speed and Low Transaction Fees: XRP transactions are significantly faster and cheaper than many other cryptocurrencies, making it attractive for large-scale payments.

- Potential Scalability Issues: While XRP boasts high transaction speeds, concerns remain about the network's overall scalability as adoption increases. The centralized nature of Ripple also presents potential vulnerabilities.

XRP's consensus mechanism differs from the energy-intensive Proof-of-Work used by Bitcoin. Ripple uses a unique consensus mechanism optimized for speed and efficiency, resulting in a much lower carbon footprint.

XRP's Market Performance and Price Analysis

Analyzing XRP's price history reveals a volatile asset with significant highs and lows. Its price is heavily influenced by regulatory news, market sentiment, and the rate of adoption by financial institutions.

[Insert chart/graph visualizing XRP price history here]

- Key Price Milestones: Highlight key historical price points, both highs and lows, to illustrate the volatility.

- Comparison to Bitcoin and Ethereum: Show a comparative analysis of XRP's performance against Bitcoin (BTC) and Ethereum (ETH) to provide context.

- Future Price Predictions (with caveats): While predicting future prices is speculative, discuss potential scenarios based on adoption rates and regulatory outcomes, emphasizing the uncertainty.

The Legal Landscape and Regulatory Uncertainty

The ongoing SEC lawsuit against Ripple Labs, the company behind XRP, significantly impacts its investment viability. The SEC alleges that XRP is an unregistered security, a claim Ripple vigorously contests. The outcome of this lawsuit could dramatically influence XRP's price and future prospects.

Globally, the regulatory landscape for cryptocurrencies remains uncertain. Different jurisdictions have varying approaches, creating complexities for XRP's international adoption.

- Key Arguments in the SEC Case: Summarize the main points of contention in the SEC vs. Ripple lawsuit.

- Impact of a Positive or Negative Outcome: Analyze the potential consequences of a favorable or unfavorable ruling for XRP investors.

- Regulatory Developments in Other Jurisdictions: Discuss regulatory actions or pronouncements from other key countries regarding XRP or cryptocurrencies in general.

Potential Risks and Rewards of Investing in XRP

Investing in XRP, like any cryptocurrency, carries inherent risks. Its price volatility and the ongoing regulatory uncertainty are major concerns. However, the potential rewards are significant if XRP gains wider adoption in the financial sector.

- Main Risks of Investing in XRP: List the key risks, including price volatility, regulatory uncertainty, and the centralized nature of the Ripple network.

- Potential Rewards if XRP Gains Wider Adoption: Outline potential benefits, such as increased price appreciation and greater utility within the financial industry.

- Importance of Diversification: Emphasize the need to diversify investment portfolios to mitigate risk.

Conclusion

Ultimately, Is XRP a Good Investment? is a question only you can answer. This analysis has explored XRP's technology, market performance, regulatory challenges, and inherent risks and rewards. The ongoing legal battle presents a significant uncertainty, and the centralized nature of Ripple is a point of contention for some investors. While XRP offers potential advantages in terms of speed and cost for cross-border payments, its success is intrinsically tied to regulatory outcomes and market adoption. Remember to conduct thorough research and assess your own risk tolerance before investing in any cryptocurrency, especially one as uniquely situated as XRP. Continue your research and make an informed decision about whether XRP fits into your investment strategy.

Featured Posts

-

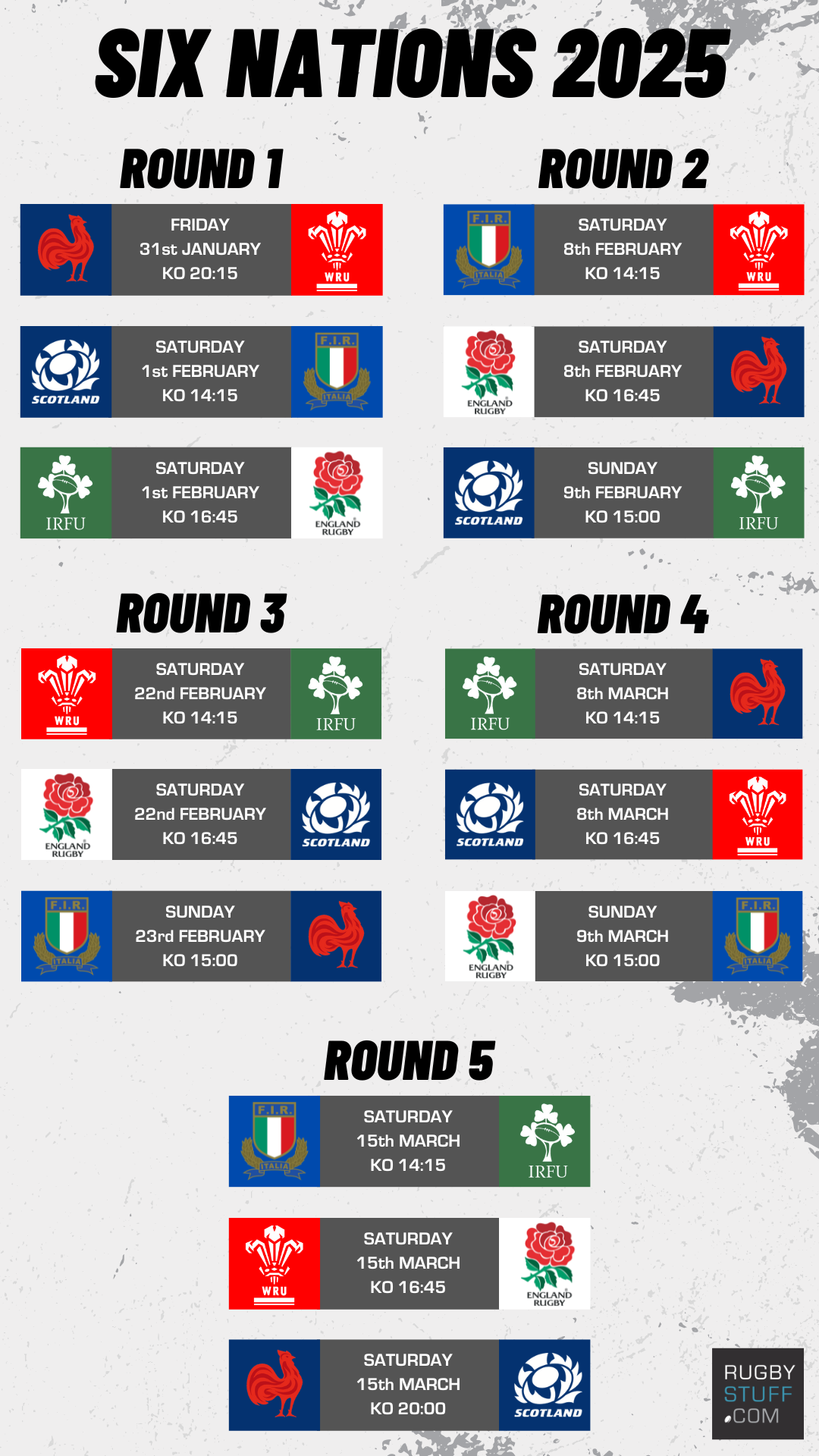

Post Italy Victory Frances Six Nations Warning To Ireland

May 02, 2025

Post Italy Victory Frances Six Nations Warning To Ireland

May 02, 2025 -

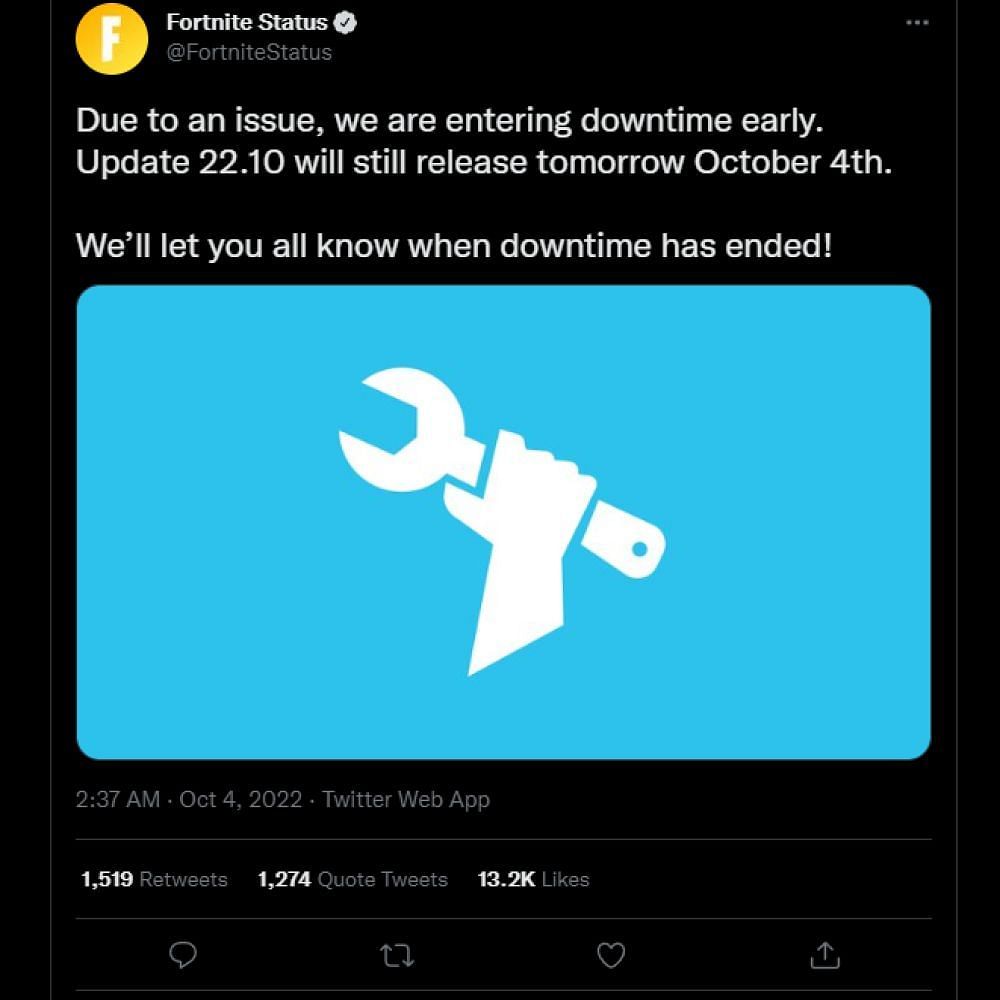

Fortnite Down Check Server Status Update 34 21 And Downtime

May 02, 2025

Fortnite Down Check Server Status Update 34 21 And Downtime

May 02, 2025 -

Justice Departments Decision The Future Of School Desegregation

May 02, 2025

Justice Departments Decision The Future Of School Desegregation

May 02, 2025 -

Enexis Noord Nederland Optimaliseer Uw Elektrische Auto Oplaadkosten

May 02, 2025

Enexis Noord Nederland Optimaliseer Uw Elektrische Auto Oplaadkosten

May 02, 2025 -

Cadeau Gourmand Une Boulangerie Normande Recompense Le Premier Bebe De L Annee

May 02, 2025

Cadeau Gourmand Une Boulangerie Normande Recompense Le Premier Bebe De L Annee

May 02, 2025

Latest Posts

-

Nigel Farages Reform Party A Crucial Test In Uk Local Elections

May 03, 2025

Nigel Farages Reform Party A Crucial Test In Uk Local Elections

May 03, 2025 -

Lee Anderson Celebrates Councillors Move To Reform

May 03, 2025

Lee Anderson Celebrates Councillors Move To Reform

May 03, 2025 -

Councillors Defection To Reform A Major Blow For Labour

May 03, 2025

Councillors Defection To Reform A Major Blow For Labour

May 03, 2025 -

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025

Reform Party Gains Momentum Councillor Switches From Labour

May 03, 2025 -

Labour Councillor Defects To Reform A Seismic Shift In Politics

May 03, 2025

Labour Councillor Defects To Reform A Seismic Shift In Politics

May 03, 2025