Is XRP (Ripple) A Good Investment Under $3?

Table of Contents

XRP, the native cryptocurrency of Ripple Labs, has experienced significant price fluctuations. With its current price under $3, many investors are questioning whether it represents a worthwhile investment. This comprehensive analysis will delve into the factors influencing XRP's value, examining its potential for growth and the associated risks to help you determine if investing in XRP under $3 is a smart move for you.

Ripple's Technology and Use Cases

Understanding the RippleNet and XRP's Role

RippleNet is a real-time gross settlement system, currency exchange, and remittance network created by Ripple. It allows financial institutions to transfer money globally quickly, efficiently, and cost-effectively. XRP plays a crucial role within this network, acting as a bridge currency to facilitate these cross-border transactions.

- Advantages of XRP over traditional banking systems: XRP offers significantly faster transaction speeds compared to traditional banking systems, often settling transactions in a matter of seconds. This speed translates to reduced processing times and improved liquidity.

- Ripple's partnerships with major financial institutions: Ripple has forged partnerships with numerous banks and financial institutions globally, including Santander, SBI Holdings, and many others. These partnerships demonstrate the growing acceptance and adoption of RippleNet and XRP within the traditional financial sector. This institutional adoption is a significant factor contributing to XRP's potential long-term growth.

- Instant settlements and reduced transaction fees: XRP enables near-instant settlements, minimizing delays and reducing the overall cost of transactions. This cost-effectiveness is a key driver for its adoption by financial institutions seeking to optimize their cross-border payment operations.

Beyond Payments: Exploring Other XRP Applications

While primarily known for its role in cross-border payments, XRP's potential extends beyond this core function. Its underlying technology, the XRP Ledger, offers a versatile platform for various applications.

- Potential use in supply chain management and other industries: XRP's speed and transparency can be leveraged to enhance efficiency and traceability in supply chain management, providing real-time tracking of goods and reducing the risk of fraud. Similar applications are being explored in other industries requiring secure and efficient data transfer.

- The XRP Ledger and its features: The XRP Ledger is an open-source, decentralized ledger that provides a robust and scalable platform for various applications beyond payments. Its features, including speed, security, and low transaction fees, make it an attractive alternative to other blockchain platforms.

Market Analysis and Price Prediction

Current Market Sentiment and Price Volatility

XRP's price has shown significant volatility, influenced by several factors. Analyzing historical price data reveals periods of substantial growth followed by corrections. This volatility is characteristic of the cryptocurrency market as a whole.

- Factors influencing XRP's price: Regulatory updates (particularly the ongoing SEC lawsuit), broader market trends affecting the entire cryptocurrency sector, and the rate of adoption by financial institutions all play a significant role in shaping XRP's price.

- Impact of news and announcements: Positive news regarding Ripple's partnerships, technological advancements, or regulatory developments tends to positively impact XRP's price, while negative news, such as setbacks in the SEC case, can lead to price drops.

- Price charts and graphs: [Insert relevant charts and graphs illustrating XRP's price fluctuations over time].

Future Price Projections and Growth Potential

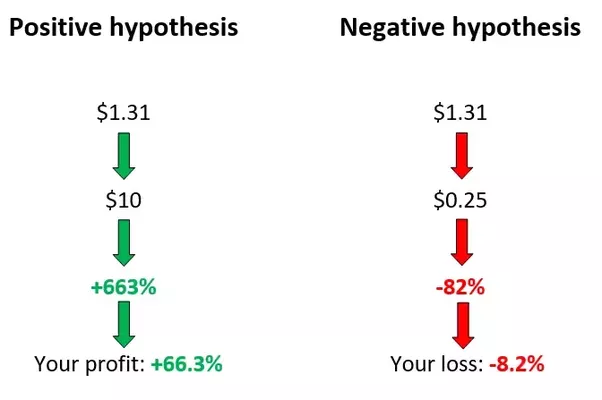

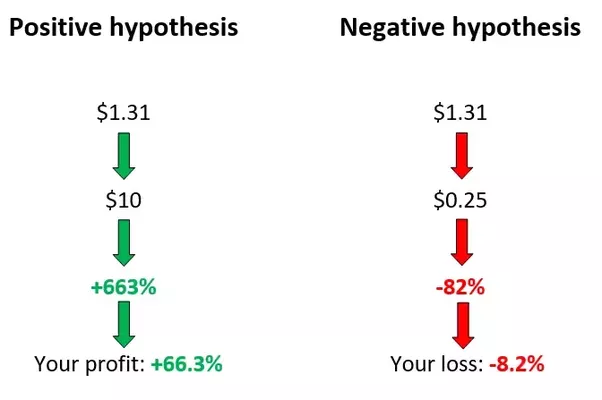

Predicting the future price of any cryptocurrency is inherently speculative. However, based on market analysis and expert opinions, several factors could contribute to XRP's future price growth.

- Potential catalysts for price increases: Increased adoption by financial institutions, regulatory clarity regarding XRP's classification, and significant technological advancements within the Ripple ecosystem could all potentially drive XRP's price upwards.

- Uncertainty in cryptocurrency markets: It's crucial to remember that the cryptocurrency market is highly volatile and unpredictable. Factors outside of Ripple's control, such as macroeconomic conditions and overall market sentiment, can significantly affect XRP's price.

- Potential risks to price growth: Continued regulatory uncertainty, increased competition from other cryptocurrencies, and unforeseen technological disruptions could hinder XRP's price growth.

Risks and Considerations

Regulatory Uncertainty and Legal Battles

The ongoing legal battle between Ripple and the SEC presents a significant risk to XRP investors. The SEC's claim that XRP is an unregistered security could have major consequences for the cryptocurrency's future.

- Implications of a potential SEC ruling: A ruling against Ripple could negatively impact XRP's price and limit its use within the United States, potentially hindering its broader adoption.

- Risks to investors resulting from regulatory uncertainty: The uncertain regulatory landscape surrounding XRP introduces significant risk for investors, making it crucial to carefully assess your risk tolerance before investing.

Market Competition and Technological Advancements

XRP faces competition from other cryptocurrencies and blockchain technologies aiming to solve similar problems within the financial sector.

- Competing cryptocurrencies: Other cryptocurrencies, such as Stellar Lumens (XLM) and others, offer similar functionalities, posing a challenge to XRP's dominance in the cross-border payments space.

- Potential technological disruptions: Advancements in blockchain technology could render XRP's current technology obsolete, impacting its long-term viability.

Conclusion

This analysis explored the potential of XRP as an investment opportunity under $3, considering its technology, market position, future prospects, and inherent risks. While XRP offers promising features and use cases within the Ripple ecosystem, significant uncertainty remains, particularly concerning regulatory challenges and market competition.

Call to Action: Ultimately, the decision of whether or not to invest in XRP under $3 is a personal one that should be based on your individual risk tolerance, investment goals, and thorough research. Do your due diligence and consider all aspects before investing in XRP or any cryptocurrency. Remember, investing in cryptocurrencies, including XRP, involves substantial risks.

Featured Posts

-

Securing Funding On Dragons Den Tips For Entrepreneurs

May 01, 2025

Securing Funding On Dragons Den Tips For Entrepreneurs

May 01, 2025 -

Preview Colorado At Texas Tech Toppins Impact

May 01, 2025

Preview Colorado At Texas Tech Toppins Impact

May 01, 2025 -

Kort Geding Kampen Vs Enexis Probleem Met Stroomnetaansluiting

May 01, 2025

Kort Geding Kampen Vs Enexis Probleem Met Stroomnetaansluiting

May 01, 2025 -

Ripple Xrp 15 000 Surge Millionaire Potential

May 01, 2025

Ripple Xrp 15 000 Surge Millionaire Potential

May 01, 2025 -

Love Lifts Arizona Past Texas Tech In Big 12 Semifinals

May 01, 2025

Love Lifts Arizona Past Texas Tech In Big 12 Semifinals

May 01, 2025

Latest Posts

-

Local Dallas Star Dies At 100

May 01, 2025

Local Dallas Star Dies At 100

May 01, 2025 -

Veteran Dallas Star Passes Away Aged 100

May 01, 2025

Veteran Dallas Star Passes Away Aged 100

May 01, 2025 -

Dallas Stars Passing At Age 100

May 01, 2025

Dallas Stars Passing At Age 100

May 01, 2025 -

100 Year Old Dallas Star Dead

May 01, 2025

100 Year Old Dallas Star Dead

May 01, 2025 -

Legendary Dallas Figure Dies At 100

May 01, 2025

Legendary Dallas Figure Dies At 100

May 01, 2025