Is XRP's 400% Rally Sustainable? A Buyer's Guide

Table of Contents

The recent 400% surge in XRP price has captivated investors worldwide, sparking the crucial question: Is this XRP rally sustainable? This buyer's guide delves into the factors driving this dramatic price increase, analyzes potential risks, and offers insights to help you make informed investment decisions in this volatile market. We'll examine market trends, regulatory developments, and technological advancements impacting XRP's future, providing a comprehensive overview for potential XRP investors.

Factors Driving XRP's Recent Price Surge

Several factors have contributed to XRP's impressive price surge. Understanding these elements is crucial for assessing the sustainability of this rally.

Positive Ripple News and Legal Developments

Recent positive developments surrounding Ripple and the ongoing SEC lawsuit have significantly impacted XRP's price.

- Reduced Uncertainty: Recent court filings have shown a more positive trajectory for Ripple's defense against the SEC's claims. A favorable ruling could drastically alter the market perception of XRP.

- Increased Institutional Interest: Despite the ongoing lawsuit, some institutional investors have shown increased interest in XRP, viewing it as a potentially undervalued asset with strong long-term potential. This increased buying pressure contributes to price appreciation.

- Strategic Partnerships: Ripple continues to forge partnerships with financial institutions globally, expanding the reach and utility of its XRP-based payment solutions. These collaborations signal growing confidence in XRP's technology and its future prospects.

The ongoing legal battle with the SEC remains a key factor. A positive outcome could unleash significant pent-up demand, further fueling the XRP price. Conversely, an unfavorable ruling could negatively impact the price, highlighting the inherent risk associated with XRP investment.

Growing Adoption and Utility of XRP

The expanding use of XRP in real-world applications is a key driver of its price appreciation.

- Cross-border Payments: XRP's speed and low transaction costs make it an attractive option for cross-border payments, a market ripe for disruption. RippleNet, Ripple's payment network, is facilitating this adoption.

- Financial Institution Partnerships: Increasing numbers of financial institutions are integrating XRP into their payment infrastructure, indicating growing confidence in its capabilities. This institutional adoption is a strong indicator of future growth.

- New Applications and Use Cases: Beyond payments, XRP is finding applications in other areas like decentralized finance (DeFi) and supply chain management, broadening its utility and appeal.

This expanding ecosystem fosters demand for XRP, creating upward pressure on its price. The broader adoption of XRP as a functional currency is a crucial component of its potential for long-term growth.

Overall Crypto Market Sentiment and Bull Run

The broader cryptocurrency market significantly influences XRP's price.

- Bitcoin's Influence: Bitcoin's price movements often correlate with the performance of altcoins like XRP. A bull run in Bitcoin often leads to increased investor interest in altcoins.

- Market Sentiment: Positive overall market sentiment, fueled by technological advancements and increasing institutional adoption of cryptocurrencies, creates a favorable environment for XRP price appreciation.

- Potential for Further Growth: The cryptocurrency market is still relatively young and shows significant potential for further growth. XRP, with its established network and use cases, is well-positioned to benefit from this broader expansion.

Understanding the interplay between the overall market sentiment and XRP's specific developments is crucial for evaluating the sustainability of the current price rally.

Potential Risks and Challenges Facing XRP

While the recent rally is encouraging, several risks and challenges could impact XRP's future price.

The Ongoing SEC Lawsuit

The SEC lawsuit against Ripple remains a significant risk.

- Uncertain Outcome: The legal battle is complex and the outcome remains uncertain. An unfavorable ruling could significantly depress XRP's price.

- Regulatory Uncertainty: The SEC lawsuit highlights the regulatory uncertainty surrounding cryptocurrencies. Changes in regulatory frameworks could significantly impact XRP's market position.

- Impact on Ripple's Operations: The lawsuit could negatively affect Ripple's operations and ability to expand its network, potentially hindering XRP's growth.

Investors need to carefully assess the potential ramifications of different outcomes in the SEC lawsuit. This legal uncertainty is a major risk factor that should not be overlooked.

Market Volatility and Price Corrections

Cryptocurrency markets are inherently volatile, and XRP is no exception.

- Price Corrections: Sharp price corrections are common in the crypto market, and XRP is susceptible to these fluctuations. Investors should expect significant price swings.

- Risk Management Strategies: Employing risk management strategies such as diversification and stop-loss orders is crucial for mitigating losses during market corrections.

- Emotional Investing: Avoiding emotional decision-making during market downturns is crucial for long-term success in the crypto market.

Investors must be prepared for potential price corrections and have strategies in place to manage risk effectively.

Competition from Other Cryptocurrencies

XRP faces competition from other cryptocurrencies aiming to disrupt the payments space.

- Competing Payment Solutions: Several other cryptocurrencies offer similar functionalities to XRP, creating competitive pressure.

- Technological Advancements: Continuous technological advancements in the crypto space could lead to the emergence of more efficient and innovative payment solutions.

- Market Share Erosion: The competition could lead to a reduction in XRP's market share, impacting its price.

Investors should be aware of the competitive landscape and analyze how XRP's technology and use cases stack up against its competitors.

Making Informed Investment Decisions: A Buyer's Guide

Investing in XRP requires careful consideration and a comprehensive understanding of the risks involved.

Due Diligence and Research

Thorough research is essential before investing in XRP or any other cryptocurrency.

- Understand XRP's Technology: Familiarize yourself with XRP's underlying technology, its use cases, and its strengths and weaknesses.

- Analyze Market Trends and Price History: Examine historical price data and current market trends to understand XRP's price volatility and potential future movements.

- Assess Risk: Conduct a thorough risk assessment to understand the potential for loss and align your investment with your risk tolerance.

Never invest more than you can afford to lose.

Diversification and Risk Management

Diversification and risk management are crucial in the volatile crypto market.

- Diversify Your Crypto Portfolio: Avoid over-exposure to a single asset by diversifying your investments across multiple cryptocurrencies.

- Implement Risk Management Techniques: Use stop-loss orders, limit orders, and other risk management techniques to protect your investments.

- Dollar-Cost Averaging (DCA): Consider using DCA to reduce the impact of market volatility on your investment.

A well-diversified portfolio is better equipped to withstand market downturns.

Understanding the Regulatory Landscape

Stay informed about regulatory developments affecting XRP and the broader crypto market.

- Regulatory Changes: Keep abreast of regulatory changes and their potential impact on XRP's price and legality.

- Legal Ramifications: Understand the legal implications of investing in cryptocurrencies and ensure compliance with all applicable laws and regulations.

- Jurisdictional Differences: Be aware of jurisdictional differences in cryptocurrency regulation.

Understanding the regulatory landscape is crucial for responsible investment in XRP.

Conclusion

The 400% XRP rally is impressive, but its sustainability depends on several factors, including the SEC lawsuit's outcome, continued adoption, and broader market sentiment. While potential rewards are significant, the risks inherent in XRP investment are substantial. This buyer's guide provides a framework for informed decisions. By conducting thorough research, managing risk effectively, and staying updated on market developments, you can navigate the complexities of XRP investment and potentially benefit from its future growth. Remember to always approach XRP investment with caution and conduct your own due diligence before investing. Consider your personal risk tolerance before investing in XRP or any other cryptocurrency.

Featured Posts

-

Manchester United And Bayern Munich Honour Poppy Atkinson

May 02, 2025

Manchester United And Bayern Munich Honour Poppy Atkinson

May 02, 2025 -

Goedkoper Auto Opladen Met Enexis Een Gids Voor Noord Nederland

May 02, 2025

Goedkoper Auto Opladen Met Enexis Een Gids Voor Noord Nederland

May 02, 2025 -

How To Watch England Vs Spain Womens World Cup Final On Tv

May 02, 2025

How To Watch England Vs Spain Womens World Cup Final On Tv

May 02, 2025 -

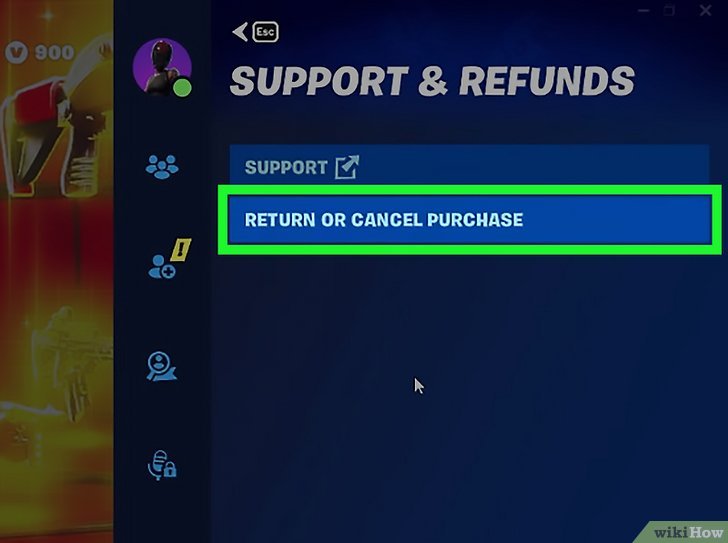

Understanding The Fortnite Refund Situation And Cosmetic Future

May 02, 2025

Understanding The Fortnite Refund Situation And Cosmetic Future

May 02, 2025 -

Lee Andersons Civil War Claim Tory Party Dysfunction Explodes

May 02, 2025

Lee Andersons Civil War Claim Tory Party Dysfunction Explodes

May 02, 2025

Latest Posts

-

Political Row Erupts Farage Faces Off Against Teaching Union Over Far Right Accusations

May 03, 2025

Political Row Erupts Farage Faces Off Against Teaching Union Over Far Right Accusations

May 03, 2025 -

Nuevos Vehiculos Para Mejorar La Operatividad Del Sistema Penitenciario

May 03, 2025

Nuevos Vehiculos Para Mejorar La Operatividad Del Sistema Penitenciario

May 03, 2025 -

Farage Denies Far Right Claims Amidst Union Confrontation

May 03, 2025

Farage Denies Far Right Claims Amidst Union Confrontation

May 03, 2025 -

La Nouvelle Loi Sur Les Partis En Algerie Reactions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025

La Nouvelle Loi Sur Les Partis En Algerie Reactions Du Pt Ffs Rcd Et Jil Jadid

May 03, 2025 -

Mejoras En El Sistema Penitenciario Entrega De Siete Vehiculos

May 03, 2025

Mejoras En El Sistema Penitenciario Entrega De Siete Vehiculos

May 03, 2025