Is Your Crypto Exchange Compliant In India? A Practical Guide For 2025

Table of Contents

1. Understanding Indian Cryptocurrency Regulations in 2025

The regulatory framework surrounding cryptocurrencies in India remains fluid. While not explicitly banned, cryptocurrencies occupy an ambiguous legal space, lacking clear classification as a legal tender, security, or commodity. This article will outline the key aspects you need to be aware of to ensure your crypto exchange operates within the bounds of the law.

1.1 The Current Regulatory Landscape:

Several government bodies influence the cryptocurrency landscape in India. The Reserve Bank of India (RBI) has expressed concerns about the risks associated with cryptocurrencies, while the government is actively exploring ways to regulate the space. The lack of specific legislation leaves a gray area that demands careful navigation.

- Key Laws and Guidelines: Currently, there's no overarching crypto law. However, existing laws such as the Prevention of Money Laundering Act (PMLA), the Foreign Exchange Management Act (FEMA), and the Income Tax Act apply to cryptocurrency transactions.

- Ongoing Legislative Developments: The Indian government is actively working on a comprehensive cryptocurrency bill, potentially introducing clearer regulations and licensing frameworks in the coming years. Staying updated on these developments is crucial.

- Potential Future Regulations: Expect stricter KYC/AML norms, clearer tax guidelines, and potentially licensing requirements for crypto exchanges operating in India.

1.2 Key Legal Requirements for Crypto Exchanges:

Operating a compliant crypto exchange in India necessitates adherence to several crucial legal obligations.

- KYC/AML Compliance: Strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures are paramount. This involves thorough verification of customer identities and meticulous monitoring of transactions to prevent illicit activities.

- Taxation Requirements: Crypto transactions are subject to Goods and Services Tax (GST) and income tax on profits. Accurate tax reporting is crucial to avoid penalties. Capital gains tax also applies to profits from cryptocurrency trading.

- Data Protection Regulations: The Information Technology Act, 2000, and its amendments govern data protection. Crypto exchanges must ensure compliance with data security and privacy requirements, including data localization norms if applicable.

- Anti-Money Laundering Measures: Implementing robust AML measures is essential, including suspicious activity reporting and collaboration with financial intelligence units.

1.3 Licensing and Registration:

Currently, there's no specific licensing framework for crypto exchanges in India. However, the government may introduce such requirements in the future.

- Potential Future Licensing Requirements: Expect licensing frameworks to emerge, potentially requiring exchanges to obtain specific permits or registrations to operate legally.

- Requirements for Obtaining Licenses (if applicable): Future licensing requirements might involve meeting strict capital adequacy norms, demonstrating robust compliance programs, and undergoing thorough background checks.

- Importance of Adhering to Existing Registration Procedures: While specific licenses are absent, adhering to all existing registration procedures and maintaining transparent business practices is crucial for demonstrating good faith.

2. Practical Steps to Ensure Compliance

Proactive measures are vital to ensure your crypto exchange’s ongoing compliance.

2.1 Implementing Robust KYC/AML Procedures:

Thorough KYC/AML compliance is non-negotiable.

- Thorough Customer Due Diligence: Verify customer identities through multiple sources, using advanced verification tools to minimize fraud.

- Transaction Monitoring: Implement real-time monitoring systems to identify suspicious activities and potential money laundering attempts.

- Suspicious Activity Reporting: Establish clear procedures for reporting suspicious transactions to the relevant authorities.

- Use of AML Software: Leverage specialized software to automate KYC/AML processes and enhance compliance efficiency.

2.2 Data Security and Privacy:

Protecting user data is paramount.

- Data Encryption: Employ strong encryption techniques to safeguard sensitive user data both in transit and at rest.

- Regular Security Audits: Conduct regular security assessments to identify vulnerabilities and proactively address potential threats.

- Incident Response Plans: Develop comprehensive incident response plans to handle data breaches and other security incidents effectively.

- Compliance with Data Localization Laws: Adhere to any applicable data localization requirements, ensuring user data is stored within India if mandated.

2.3 Tax Compliance Strategies:

Accurate tax reporting is essential for avoiding penalties.

- GST on Crypto Transactions: Understand and correctly apply GST to all relevant crypto transactions.

- Income Tax on Profits: Accurately report all income generated from crypto exchange operations.

- Capital Gains Tax: Ensure proper calculation and reporting of capital gains tax on profits from trading.

- Record-Keeping Best Practices: Maintain meticulous records of all transactions and financial activities.

2.4 Seeking Legal Counsel:

Navigating the evolving regulatory landscape requires expert guidance.

- Benefits of Legal Advice: Legal counsel specializing in Indian cryptocurrency law can provide valuable insights and ensure compliance with all applicable regulations.

- Avoiding Legal Pitfalls: Proactive legal advice can help prevent costly mistakes and potential legal challenges.

- Staying Updated on Regulatory Changes: Legal experts can keep your exchange informed about the latest regulatory developments and their impact.

3. Consequences of Non-Compliance

Operating a non-compliant crypto exchange carries significant risks.

3.1 Legal Penalties and Sanctions:

Non-compliance can lead to severe repercussions.

- Fines: Expect substantial financial penalties for violating relevant laws and regulations.

- Legal Action: Face legal action, including potential criminal charges, depending on the severity of the non-compliance.

- Reputational Damage: Non-compliance can severely damage your exchange’s reputation, leading to loss of trust and market share.

- Operational Restrictions: Authorities may impose operational restrictions or even shut down non-compliant exchanges.

3.2 Reputational Risks:

The impact on your exchange's reputation can be devastating.

- Loss of Customer Trust: Non-compliance erodes customer trust, leading to decreased user base and trading volume.

- Negative Media Coverage: Non-compliance attracts negative media attention, further damaging your reputation.

- Difficulty Attracting Investors: Investors are hesitant to associate with non-compliant businesses, hindering your growth potential.

3. Conclusion:

Ensuring your crypto exchange remains compliant in India requires a proactive and comprehensive approach. Adhering to KYC/AML regulations, data protection laws, and tax compliance is crucial. The evolving regulatory landscape necessitates a commitment to staying informed and seeking expert legal counsel. Don't wait – start assessing your crypto exchange compliance in India today! Understanding Indian crypto regulations and implementing robust compliance measures is key to the long-term success and sustainability of your cryptocurrency exchange in India. Take proactive steps to ensure you're prepared for the future of cryptocurrency compliance in India.

Featured Posts

-

Hondas Ev Project In Ontario A 15 Billion Pause Due To Market Conditions

May 15, 2025

Hondas Ev Project In Ontario A 15 Billion Pause Due To Market Conditions

May 15, 2025 -

Rebels In Andor Season 2 Examining The Timeline For Connections

May 15, 2025

Rebels In Andor Season 2 Examining The Timeline For Connections

May 15, 2025 -

Reciprocal Tariffs And The Indian Economy A Sectoral Impact Analysis

May 15, 2025

Reciprocal Tariffs And The Indian Economy A Sectoral Impact Analysis

May 15, 2025 -

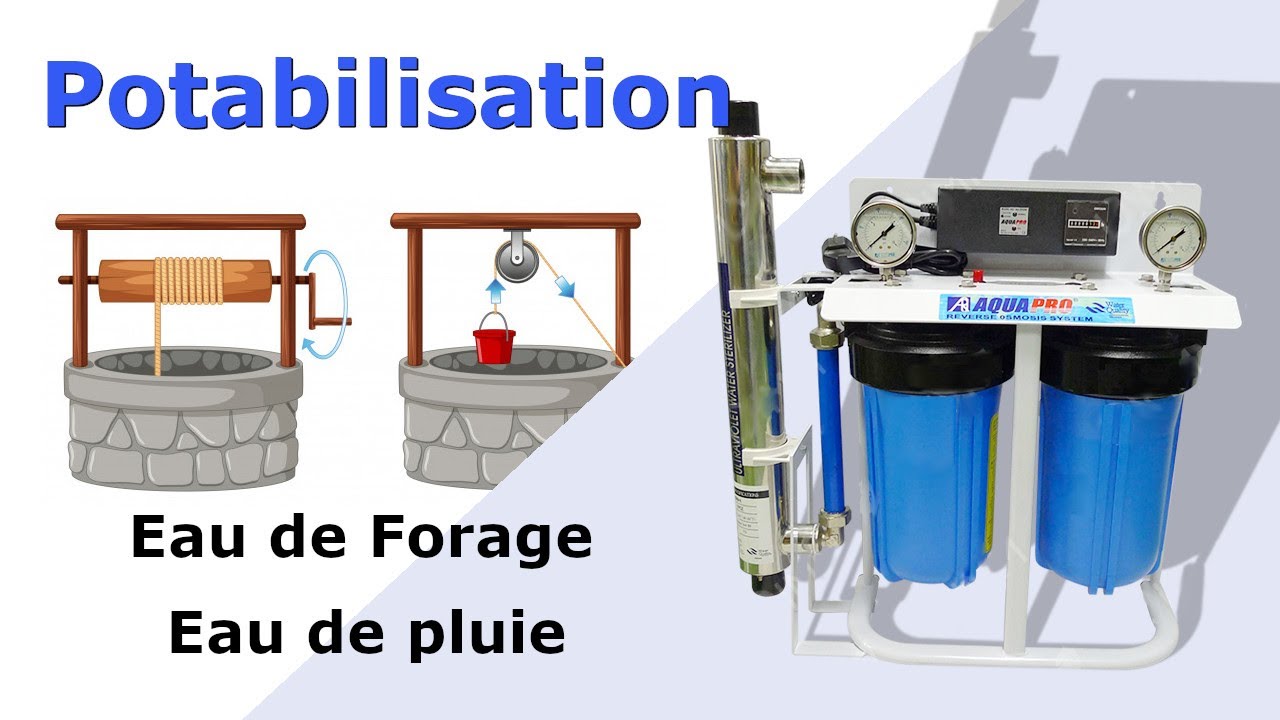

Pollution De L Eau Solutions De Filtration Pour L Eau Du Robinet

May 15, 2025

Pollution De L Eau Solutions De Filtration Pour L Eau Du Robinet

May 15, 2025 -

Torrent Piracy And La Liga Google Faces Criminal Liability Demand

May 15, 2025

Torrent Piracy And La Liga Google Faces Criminal Liability Demand

May 15, 2025