Japanese Government Bond Yields: Foreigner Bets And Swap Market Implications

Table of Contents

Foreign Investor Sentiment and JGB Yields

Foreign investor sentiment plays a pivotal role in shaping Japanese Government Bond yields. Two key factors significantly influence this dynamic: the Bank of Japan's (BOJ) monetary policy and global economic conditions.

The Role of Central Bank Policy (BOJ)

The BOJ's monetary policy, particularly its yield curve control (YCC) policy, exerts considerable influence on JGB yields. Recent adjustments and hints of future alterations to the YCC have introduced significant uncertainty, sparking increased speculation from foreign investors.

- Increased volatility: Expectations of future policy changes have led to heightened volatility in JGB yields, creating both opportunities and risks for investors.

- Risk-reward assessment: Foreign investors are rigorously reassessing the risk-reward profile of JGBs in light of the evolving policy environment. The perceived stability of JGBs is being challenged.

- BOJ communication analysis: Close scrutiny of the BOJ's communication regarding its policy intentions is crucial for predicting market movements and informing investment decisions. Any subtle shift in language can have a significant market impact.

Impact of Global Economic Conditions

Global economic factors are inextricably linked to JGB yields. Rising interest rates in other major economies and fluctuations in the US dollar significantly influence the attractiveness of JGBs relative to alternative assets.

- Capital flow shifts: Higher yields in other markets can lead to capital flows shifting away from JGBs, reducing demand and potentially pushing yields higher.

- Yen strength and JGB demand: The strength of the yen directly impacts the attractiveness of JGBs to foreign investors. A weaker yen can reduce the appeal of JGBs to international investors.

- Global uncertainty and risk aversion: Periods of global uncertainty often lead to increased risk aversion, causing investors to seek safe havens, which can temporarily boost demand for JGBs and lower yields.

The Japanese Swap Market and its Linkage to JGB Yields

The Japanese swap market, a vital component of the Japanese financial system, is closely intertwined with the JGB market. Understanding this relationship is crucial for comprehending the dynamics of JGB yields and managing risk effectively.

Swap Market Mechanics and JGB Pricing

The Japanese swap market provides a crucial mechanism for hedging and speculating on interest rate movements, directly reflecting the trends in JGB yields.

- Interest rate swap hedging: Interest rate swaps are widely used by investors to manage the interest rate risk associated with their JGB holdings.

- JGB futures and the swap market: The prices of JGB futures contracts are closely correlated with the prices of swaps, reflecting anticipated future yield movements.

- Foreign investor impact on JGB prices: Foreign investor activity in the swap market significantly influences JGB prices, driving volatility and impacting yield curves.

Volatility Spillovers and Market Risk

Fluctuations in JGB yields immediately translate into changes in swap pricing, creating both opportunities and risks for market participants.

- Increased volatility in JGB yields: Higher volatility in JGB yields translates into greater uncertainty and risk in the swap market.

- Swap-based speculation: Market participants actively use swaps to speculate on future JGB yield movements, contributing to market volatility.

- Risk mitigation strategies: Sophisticated hedging strategies are essential for mitigating the risks associated with both JGB investments and swap transactions.

Conclusion

Foreign investor activity significantly impacts Japanese Government Bond yields, generating a dynamic and frequently volatile market environment. The interplay between BOJ policy, global economic conditions, and the intricate dynamics of the Japanese swap market necessitates a thorough understanding of both the inherent risks and potential opportunities. Successfully navigating this complex landscape requires a keen awareness of the relationship between foreign investment sentiment, JGB yields, and swap market fluctuations. To make informed decisions and effectively manage your portfolio's exposure, continuous monitoring of Japanese Government Bond Yields and their implications is paramount. Stay informed and adapt your strategies accordingly.

Featured Posts

-

Rick Astley On Liverpool Scouse Crowds And First Place

Apr 25, 2025

Rick Astley On Liverpool Scouse Crowds And First Place

Apr 25, 2025 -

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 25, 2025

Metas Future Under The Trump Administration Zuckerbergs Challenges

Apr 25, 2025 -

2025 Canakkale Zaferi Nin Yildoenuemue Ve Anma Etkinlikleri

Apr 25, 2025

2025 Canakkale Zaferi Nin Yildoenuemue Ve Anma Etkinlikleri

Apr 25, 2025 -

The Ethics Of Wildfire Betting A Case Study Of Los Angeles

Apr 25, 2025

The Ethics Of Wildfire Betting A Case Study Of Los Angeles

Apr 25, 2025 -

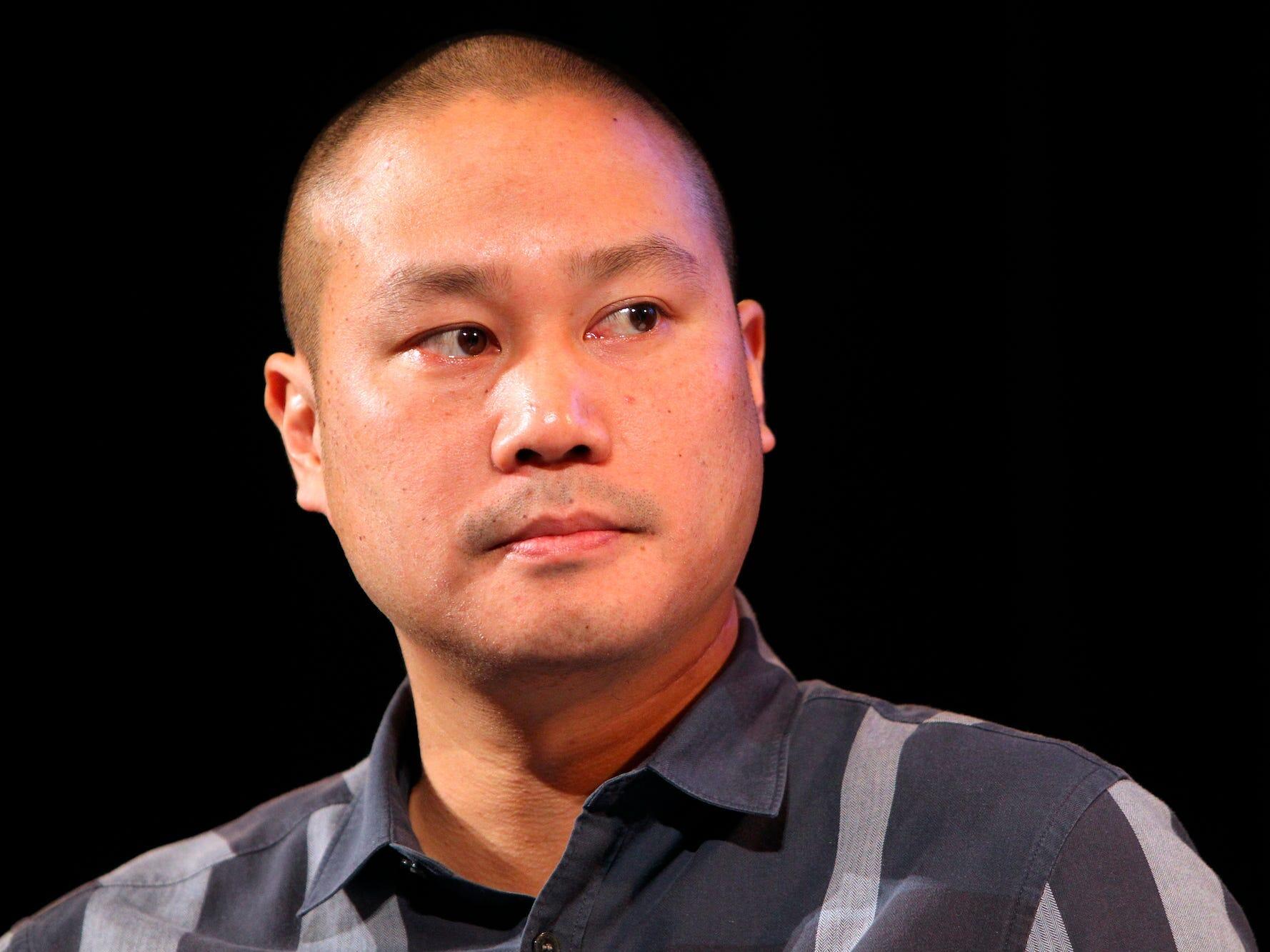

Tony Hsiehs Unexpected Will A New Chapter In The Zappos Ceos Estate

Apr 25, 2025

Tony Hsiehs Unexpected Will A New Chapter In The Zappos Ceos Estate

Apr 25, 2025

Latest Posts

-

2025 12

Apr 30, 2025

2025 12

Apr 30, 2025 -

23 2025 12

Apr 30, 2025

23 2025 12

Apr 30, 2025 -

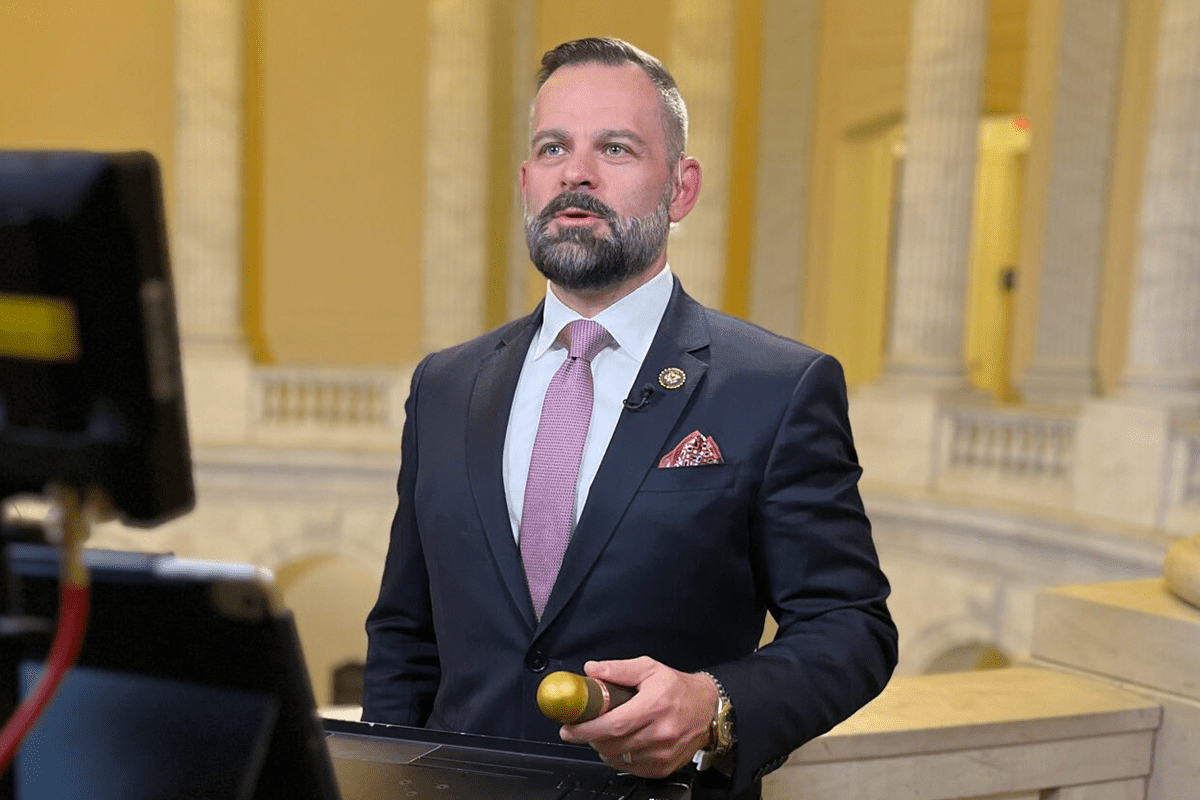

Police Leader Investigated Over Chris Rock Tweet Free Speech Concerns

Apr 30, 2025

Police Leader Investigated Over Chris Rock Tweet Free Speech Concerns

Apr 30, 2025 -

23 2025

Apr 30, 2025

23 2025

Apr 30, 2025 -

6 2025

Apr 30, 2025

6 2025

Apr 30, 2025