Japan's Bond Market Volatility: Understanding The Steep Yield Curve

Table of Contents

The Mechanics of a Steep Yield Curve in Japan

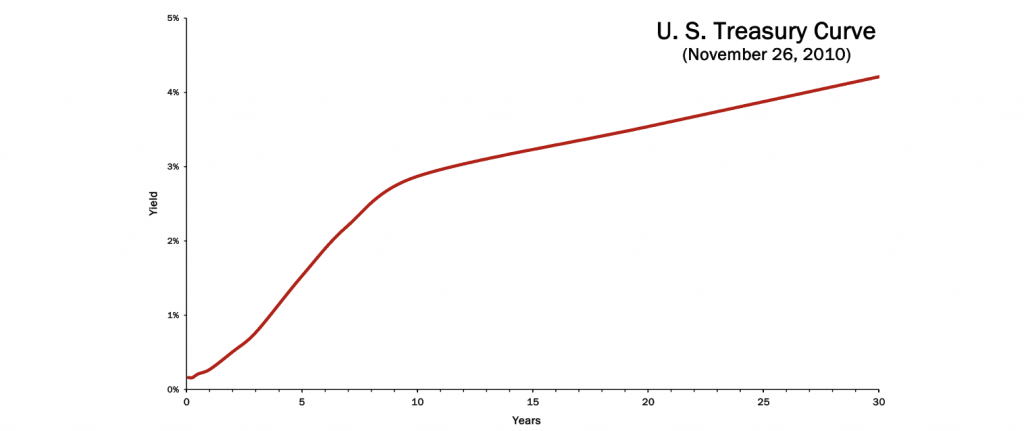

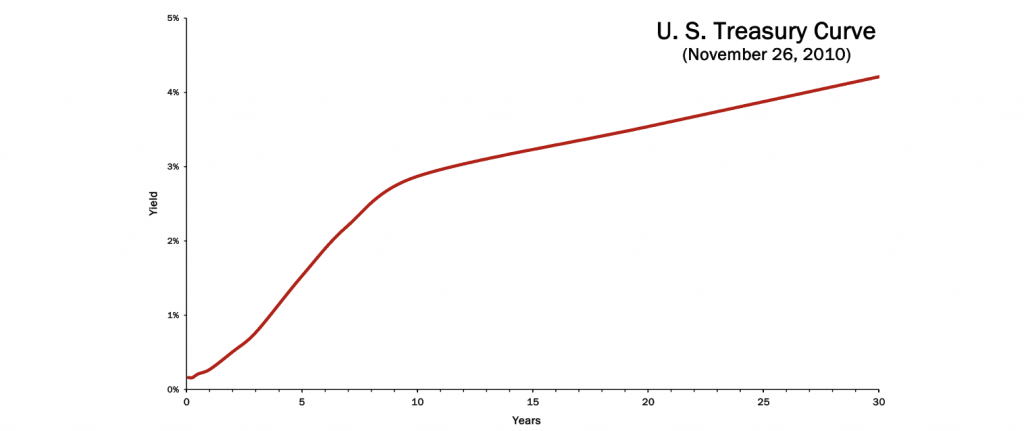

Understanding Japan's bond market volatility requires grasping the concept of the yield curve. The yield curve illustrates the relationship between the interest rates (yields) and the time to maturity of bonds. It's plotted with the maturity on the x-axis and the yield on the y-axis. A "steep" yield curve indicates a significant difference between short-term and long-term bond yields, with long-term yields significantly higher. In the Japanese context, a steep yield curve signifies a considerable gap between the yields of short-term Japanese Government Bonds (JGBs) and their longer-term counterparts.

[Insert chart or graph here illustrating the recent trend of the Japanese yield curve. Source should be clearly cited.]

-

Difference between short-term and long-term JGBs: Short-term JGBs, typically maturing within a year, are less sensitive to long-term economic forecasts and inflation expectations. Long-term JGBs, maturing in several years or decades, are significantly more vulnerable to these factors. The spread between these yields is key to understanding market sentiment.

-

Impact of Bank of Japan (BOJ) policies on JGB yields: The BOJ's monetary policies, particularly its Yield Curve Control (YCC) policy, directly influence JGB yields. Any shifts or anticipated shifts in these policies can significantly impact the shape of the yield curve.

-

Influence of global interest rate movements on Japanese yields: Global interest rate changes, especially those in major economies like the US, indirectly affect Japanese yields. Capital flows in response to these changes can exert upward pressure on Japanese long-term yields.

Factors Contributing to Japan's Bond Market Volatility

Several interconnected factors are fueling the volatility in Japan's bond market and the steepening yield curve.

-

The Role of Inflation Expectations: Rising inflation expectations are a primary driver of increasing long-term JGB yields. Investors demand higher yields to compensate for the erosion of purchasing power caused by inflation. This is particularly relevant given Japan's recent experience with higher inflation after years of deflation.

-

Impact of Potential BOJ Policy Shifts: Market sentiment is heavily influenced by speculation surrounding potential adjustments to the BOJ's YCC policy. Any hint of a shift towards less accommodative monetary policy can trigger significant upward pressure on long-term JGB yields.

-

Global Economic Uncertainty and Geopolitical Risks: Global economic uncertainty, such as the impact of the war in Ukraine or rising energy prices, can influence investor risk aversion and lead to increased demand for safe-haven assets like Japanese government bonds. However, this demand can shift rapidly, causing market volatility.

-

Bullet points summarizing contributing factors:

- Rising inflation rates: Higher inflation directly impacts long-term bond yields, as investors demand higher returns to offset the loss in purchasing power.

- Speculation surrounding BOJ's YCC policy: Anticipation of changes to the YCC policy creates uncertainty and volatility in the market.

- Global events (e.g., US interest rate hikes, war in Ukraine): External shocks can significantly impact investor sentiment and capital flows, affecting Japanese bond prices.

Implications of the Steep Yield Curve for the Japanese Economy

The steepening yield curve has several significant consequences for the Japanese economy.

-

Impact on Borrowing Costs: Higher long-term yields translate into increased borrowing costs for businesses and consumers. This can stifle investment and hinder economic growth.

-

Effect on the Japanese Yen's Exchange Rate: Changes in Japanese bond yields influence the attractiveness of the yen to foreign investors. A steepening yield curve, especially if perceived as a sign of tightening monetary policy, could strengthen the yen.

-

Consequences for Japanese Government Finances: Increased long-term yields raise the cost of servicing Japan's substantial public debt. This places a greater burden on government finances and may limit the government's ability to undertake fiscal stimulus measures.

-

Bullet points summarizing economic implications:

- Increased borrowing costs for corporations: Higher interest rates make it more expensive for companies to borrow money for investment, potentially slowing economic growth.

- Impact on household spending: Higher mortgage rates and other borrowing costs can reduce consumer spending and overall economic activity.

- Increased debt servicing costs for the Japanese government: Rising yields increase the cost of servicing Japan's substantial national debt, potentially impacting government budgets and fiscal policy.

Global Implications of Japanese Bond Market Volatility

The volatility in Japan's bond market extends beyond its borders.

-

Impact on Global Capital Flows: Changes in Japanese bond yields can significantly impact global capital flows. Investors may shift their investments based on yield differentials between Japanese and other countries' bonds.

-

Potential Contagion Effects: The volatility in the Japanese bond market could have contagion effects on other Asian bond markets, especially those with close economic ties to Japan.

-

Implications for Global Investors: Global investors holding substantial positions in JGBs face significant risks associated with the market's volatility. Changes in yields can significantly impact their portfolio returns.

-

Bullet points summarizing global implications:

- Impact on international portfolio rebalancing: Global investors may adjust their portfolios in response to changes in Japanese bond yields, leading to significant capital flows.

- Potential spillover effects to other Asian economies: Volatility in Japan's bond market can trigger similar movements in other Asian markets.

- Risk assessment for global investors with exposure to JGBs: Global investors need to carefully assess the risks associated with holding Japanese government bonds in a volatile market.

Conclusion

This article has explored the complexities of Japan's bond market volatility, focusing on the steepening yield curve and its multifaceted contributing factors. We analyzed the mechanics of the yield curve, the influence of BOJ policies, global economic conditions, and their consequential impact on the Japanese economy and the global markets. Understanding the dynamics of Japan's bond market is crucial for investors and policymakers alike.

Call to Action: To stay abreast of the evolving dynamics of Japan's bond market volatility and the implications of its steep yield curve, consistently monitor financial news and analysis related to the Bank of Japan's policies, global economic indicators, and shifts in inflation expectations. Further investigation into the intricacies of Japanese government bond trading is strongly recommended for a comprehensive understanding of this complex and crucial market.

Featured Posts

-

Pehar Za Mensika Zahvalnost Dokovicu Za Podrsku U Novom Sadu

May 17, 2025

Pehar Za Mensika Zahvalnost Dokovicu Za Podrsku U Novom Sadu

May 17, 2025 -

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025

Mariners Vs Reds Prediction Picks And Odds For Todays Mlb Game

May 17, 2025 -

Former Mariners Infielder Criticizes Seattles Quiet Offseason

May 17, 2025

Former Mariners Infielder Criticizes Seattles Quiet Offseason

May 17, 2025 -

15 Day Il For Mariners Bryce Miller Elbow Injury Confirmed

May 17, 2025

15 Day Il For Mariners Bryce Miller Elbow Injury Confirmed

May 17, 2025 -

1 Thing Holding Back Each Top 10 Nba Contender

May 17, 2025

1 Thing Holding Back Each Top 10 Nba Contender

May 17, 2025