Japan's Economy Contracts In Q1 2018: Pre-Tariff Impact Analysis

Table of Contents

Key Indicators of Japan's Q1 2018 Economic Contraction

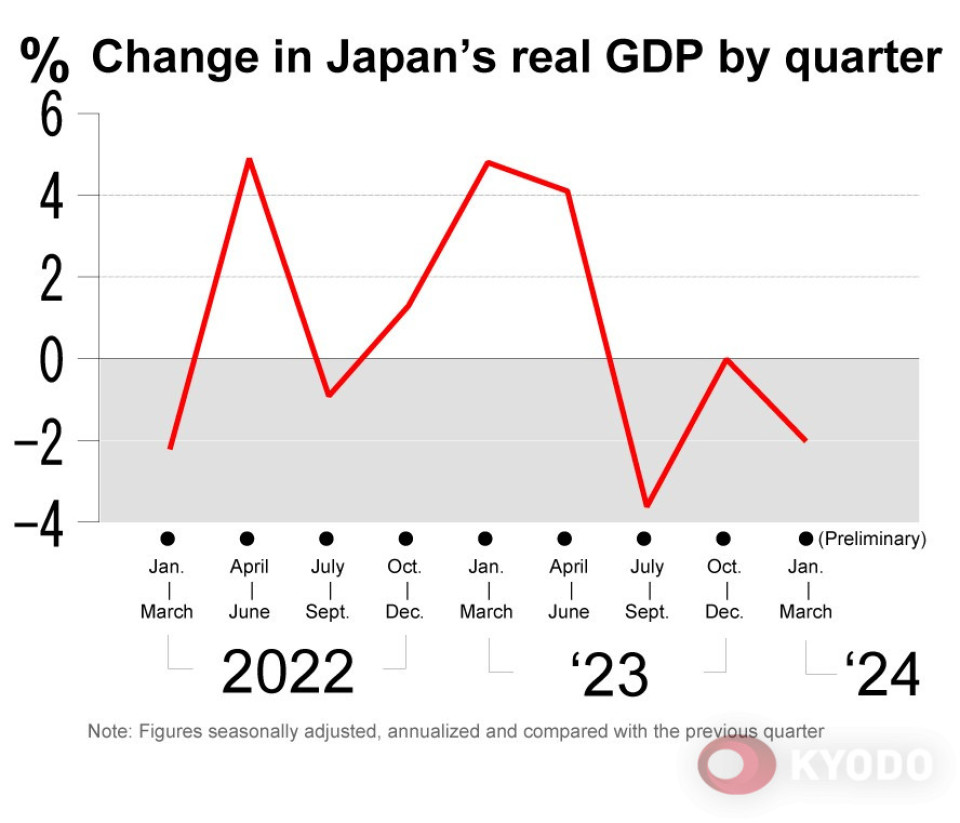

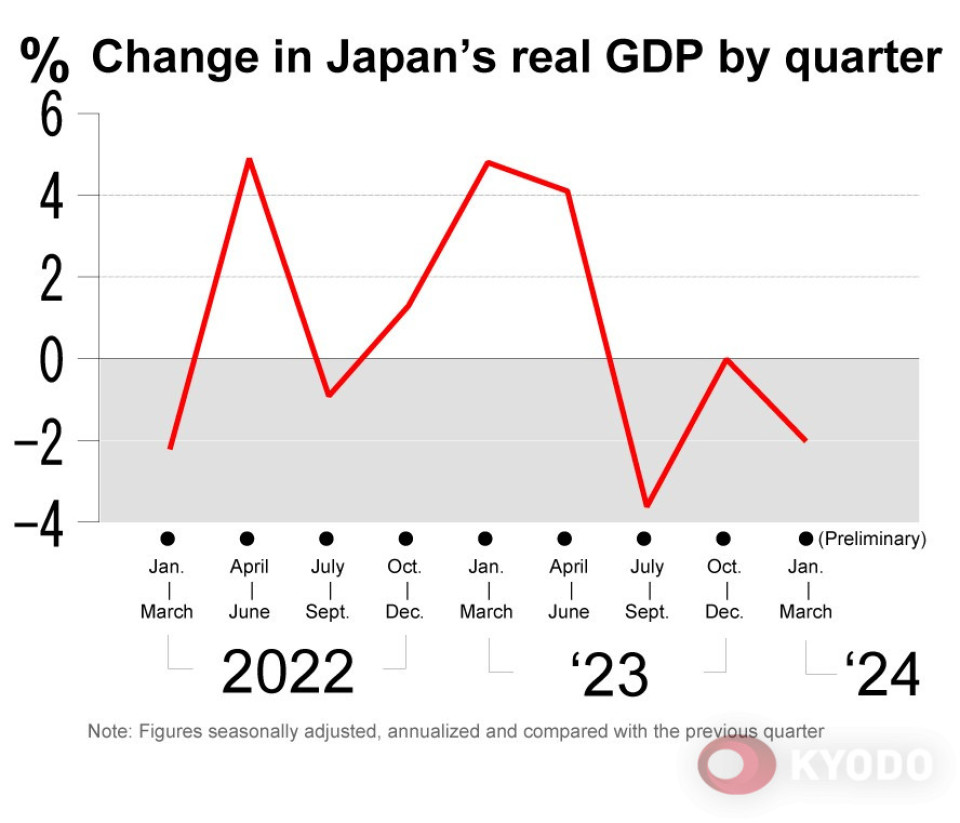

Decline in GDP Growth

Japan's GDP experienced a significant decline in Q1 2018, marking a sharp reversal from previous growth. The precise percentage decrease, readily available from sources like the Cabinet Office of Japan and the OECD, needs to be inserted here. This decline was significant because it shattered expectations for continued economic expansion and raised red flags about the underlying health of the Japanese economy.

- Comparison to previous quarters: The Q1 2018 contraction contrasted sharply with the [Insert percentage and data source] growth observed in the preceding quarter(s). This sudden shift highlighted the fragility of the economic recovery.

- Breakdown of GDP components: The decline wasn't uniform across all sectors. A detailed analysis of the GDP components – consumption, investment, government spending, and net exports – is crucial. For example, a weakening in [Insert specific component(s) and data source] played a particularly significant role.

- Impact on economic forecasts: The unexpected contraction led to downward revisions in economic forecasts for the entire year, underscoring the uncertainty surrounding Japan's economic outlook and highlighting the need for effective policy responses.

Weakening Consumer Spending

A notable decrease in consumer spending further contributed to the Q1 2018 contraction. This reflected a decline in consumer confidence, which is a critical driver of economic growth in Japan.

- Reasons for decreased spending: Several factors likely contributed to this weakening, including rising prices (inflation), an uncertain economic outlook, and potential anxieties related to global trade tensions.

- Data on consumer sentiment indices: Data from consumer sentiment indices, such as the consumer confidence index (CCI) published by the Cabinet Office, would provide quantitative evidence of the decline. [Insert data and source here]

- Link to broader global economic trends: The decrease in Japanese consumer spending wasn't isolated. It reflected broader global economic anxieties impacting consumer behavior worldwide.

Sluggish Business Investment

The slowdown in capital expenditure by Japanese businesses also played a role in the Q1 2018 economic contraction. This indicated a lack of confidence in future economic prospects.

- Reasons for reduced investment: Uncertainty about future demand, particularly in export markets, and rising input costs, including energy and raw materials, likely discouraged businesses from investing.

- Data on business investment trends: Data on business investment trends, often available from the Bank of Japan or the Cabinet Office, needs to be included here. [Insert data and source here]

- Potential impact on future economic growth: Reduced business investment has long-term implications for productivity and future economic growth, indicating that the Q1 2018 contraction could be a harbinger of further challenges.

Impact of the Rising Yen

The strengthening of the Japanese yen against other major currencies negatively impacted Japan's exports, adding to the economic downturn.

- Relationship between currency strength and export competitiveness: A stronger yen makes Japanese goods more expensive for foreign buyers, reducing their competitiveness in international markets.

- Data on yen exchange rates: Data on yen exchange rates against major currencies (USD, EUR) during Q1 2018 needs to be included. [Insert data and source here]

- Implications for Japan's trade balance: The rising yen directly affected Japan's trade balance, potentially worsening its trade surplus or even creating a deficit.

Potential Pre-Tariff Impacts on the Japanese Economy

Vulnerability to Trade Wars

Japan's significant reliance on exports makes its economy highly vulnerable to trade disputes and the imposition of tariffs.

- Key export markets and potential disruptions from tariffs: Identify Japan's key export markets (e.g., US, China, EU) and analyze the potential impact of tariffs on those trade relationships.

- Potential impact on specific industries: Detail the potential effects on key export-oriented industries like automobiles, electronics, and machinery.

- Expert opinions and forecasts: Involve opinions from economists and financial analysts specializing in the Japanese economy.

Anticipated Effects of Tariffs on Key Sectors

The imposition of tariffs on Japanese goods could have severe consequences for several key sectors.

- Specific industries and projected losses: Quantify, using expert projections and available data, the anticipated losses due to tariffs for specific industries.

- Possible responses by Japanese businesses: Discuss potential responses, such as relocating production to countries with more favorable trade agreements or diversifying markets to reduce reliance on tariff-affected regions.

Government Response and Policy Implications

The Japanese government responded to the economic contraction and trade tensions through various fiscal and monetary policy measures.

- Fiscal and monetary policy measures: Detail the specific measures implemented, including any stimulus packages, tax cuts, or changes to interest rates.

- Effectiveness of these policies: Assess the effectiveness of the government's response in mitigating the economic downturn.

- Potential future policy adjustments: Discuss potential future adjustments to economic policies based on the evolving global trade landscape.

Conclusion

Japan's Q1 2018 economic contraction was a complex event stemming from a confluence of factors, including weakening consumer spending, sluggish business investment, and the impact of a strengthening yen. The contraction served as a warning sign of the Japanese economy’s vulnerability to external shocks, particularly in the context of escalating global trade tensions. The potential impact of tariffs on key export sectors could further exacerbate economic challenges. The interconnectedness of the global economy highlights how even a robust economy like Japan's is susceptible to shifts in global trade dynamics.

Call to Action: Stay informed about developments in the Japanese economy and the impact of global trade policies. Continue monitoring the situation regarding Japan’s economic performance and the evolving dynamics of global trade to better understand the long-term implications of the Q1 2018 contraction and potential tariff impacts on the Japanese economy. Regularly check for updates on the Japanese economy and the ongoing trade negotiations. Understanding these dynamics is crucial for investors and businesses alike.

Featured Posts

-

10 Fantastic Tv Shows Cut Short Before Their Time

May 17, 2025

10 Fantastic Tv Shows Cut Short Before Their Time

May 17, 2025 -

Bolee 200 Raket I Dronov Rossiya Nanesla Udar Po Ukraine

May 17, 2025

Bolee 200 Raket I Dronov Rossiya Nanesla Udar Po Ukraine

May 17, 2025 -

7 Bit Casino Best Online Casino Canada For Canadian Players

May 17, 2025

7 Bit Casino Best Online Casino Canada For Canadian Players

May 17, 2025 -

Fortnite Tmnt Skins Locations Release Dates And Acquisition Methods

May 17, 2025

Fortnite Tmnt Skins Locations Release Dates And Acquisition Methods

May 17, 2025 -

75 Million Gift Fuels U Of Us West Valley Hospital And Health Campus Expansion

May 17, 2025

75 Million Gift Fuels U Of Us West Valley Hospital And Health Campus Expansion

May 17, 2025