Japan's Yield Curve: Foreign Investors' Bets And Swap Market Signals

Table of Contents

Foreign Investor Behavior and Japan's Yield Curve

The relationship between foreign investment flows and the shape of Japan's yield curve is deeply intertwined. Foreign investors, particularly large institutional players, significantly influence the demand for Japanese Government Bonds (JGBs), directly impacting bond yields and the overall curve.

Impact of JGB Purchases/Sales

Foreign purchases and sales of JGBs exert considerable pressure on both short-term and long-term yields.

- Increased JGB demand: Pushes down long-term yields, flattening the yield curve. This indicates a flight to safety, often seen during periods of global uncertainty.

- Reduced JGB demand: Leads to higher long-term yields, potentially steepening the curve. This suggests a shift in investor sentiment, possibly driven by expectations of higher future interest rates or a stronger domestic currency.

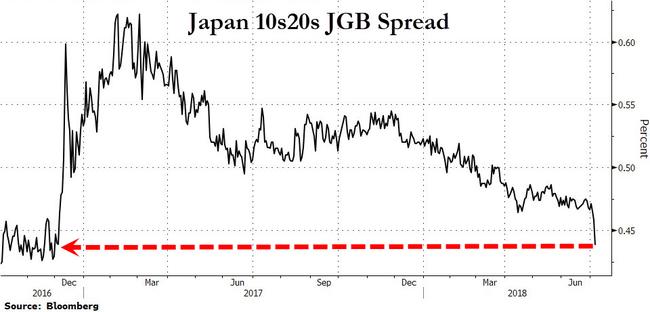

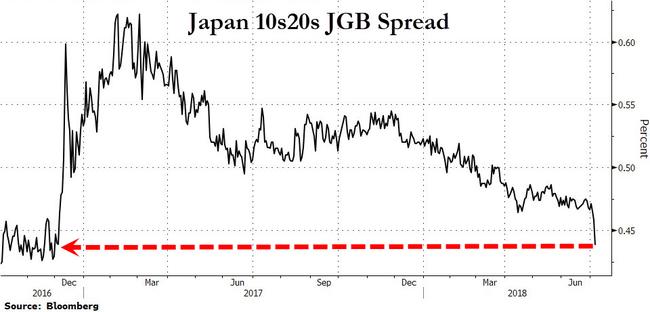

- Impact on the slope of the yield curve: The slope reflects the difference between long-term and short-term yields. Changes in foreign investment directly influence this slope, providing valuable insights into market expectations.

Influence of Global Economic Factors

Global economic events and interest rate adjustments in other major economies significantly influence foreign investors' decisions regarding JGBs.

- Flight to safety: During times of global uncertainty, JGBs, perceived as a safe haven asset, experience increased demand, driving down yields.

- Impact of US interest rate hikes: Increases in US interest rates can reduce the attractiveness of JGBs relative to US Treasuries, potentially leading to decreased foreign demand and higher Japanese yields.

- Correlation with other major bond markets: Japan's yield curve is not an isolated entity; it exhibits correlations with other major bond markets, reflecting global macroeconomic trends and investor sentiment.

The Japanese Swap Market as a Leading Indicator

The Japanese swap market plays a vital role in predicting changes in the yield curve, often acting as a leading indicator of future movements. By analyzing swap rates, investors gain valuable insights into market expectations and potential shifts in JGB yields.

Understanding Swap Rates and Their Implications

Swap rates represent the agreed-upon interest rate exchange between two parties for a specified period. They are closely tied to JGB yields, reflecting market expectations of future interest rate changes.

- Swap spreads: The difference between swap rates and JGB yields. Wider spreads often signal increased risk aversion and potential future yield increases.

- Basis swaps: Swaps involving different currencies, offering opportunities for hedging and arbitrage, adding another layer of information about market sentiment.

- Use of swaps for hedging and speculation: Market participants utilize swaps extensively for hedging against interest rate risk and for speculative purposes, further influencing the overall market dynamics.

Analyzing Swap Market Signals

Changes in swap rates provide valuable clues about anticipated shifts in the JGB yield curve.

- Steepening/flattening of the swap curve: A steepening curve suggests expectations of rising interest rates, while a flattening curve indicates the opposite.

- Unusual activity in specific maturities: Increased trading volume or unusual price movements in specific maturities can signal upcoming changes in those segments of the JGB yield curve.

- Relationship between swap rates and implied volatility: Higher implied volatility in the swap market often signals increased uncertainty and potential for greater yield curve fluctuations.

Interpreting the Combined Signals: Foreign Investment and Swap Market Data

Combining data from foreign investment flows and the Japanese swap market provides a more comprehensive understanding of Japan's yield curve dynamics. Analyzing both offers a more nuanced perspective than relying on either data source alone.

Case Studies

Historical examples illustrate the predictive power of combining these signals.

- Example 1: Periods of significant foreign buying of JGBs often coincided with falling swap rates and a flattening yield curve, indicating a flight to safety.

- Example 2: Conversely, periods of JGB selling pressure have historically corresponded to rising swap rates and a steepening yield curve, reflecting increased risk aversion.

- Analysis: By analyzing these combined signals, analysts can often more accurately predict future movements in the JGB yield curve, providing valuable insights for investment strategies.

Limitations and Cautions

Interpreting the data requires careful consideration of limitations.

- Challenges in isolating the specific impact of foreign investment: Other factors, like domestic monetary policy or unexpected global events, can influence the yield curve independently of foreign investment.

- Influence of domestic factors: Domestic factors, not always fully reflected in swap market data, can affect JGB yields and the shape of the yield curve.

- Unforeseen global events: Geopolitical events or unexpected economic shocks can dramatically alter the relationship between foreign investment, swap rates, and the yield curve.

Conclusion: Navigating Japan's Yield Curve: Actionable Insights for Investors

Monitoring both foreign investor activity and the Japanese swap market is crucial for understanding Japan's yield curve and predicting future yield movements. The interplay between these factors offers valuable insights for informed investment decisions. By carefully analyzing these signals – understanding the dynamics of JGBs, the nuances of the Japanese swap market, and acknowledging potential limitations – investors can develop more robust and effective investment strategies related to Japan's yield curve. Continue researching and monitoring Japan's yield curve, delving deeper into the intricacies of Japanese Government Bonds (JGBs) and the Japanese swap market for a comprehensive understanding. Mastering the analysis of Japan's yield curve will empower you to make better-informed investment decisions.

Featured Posts

-

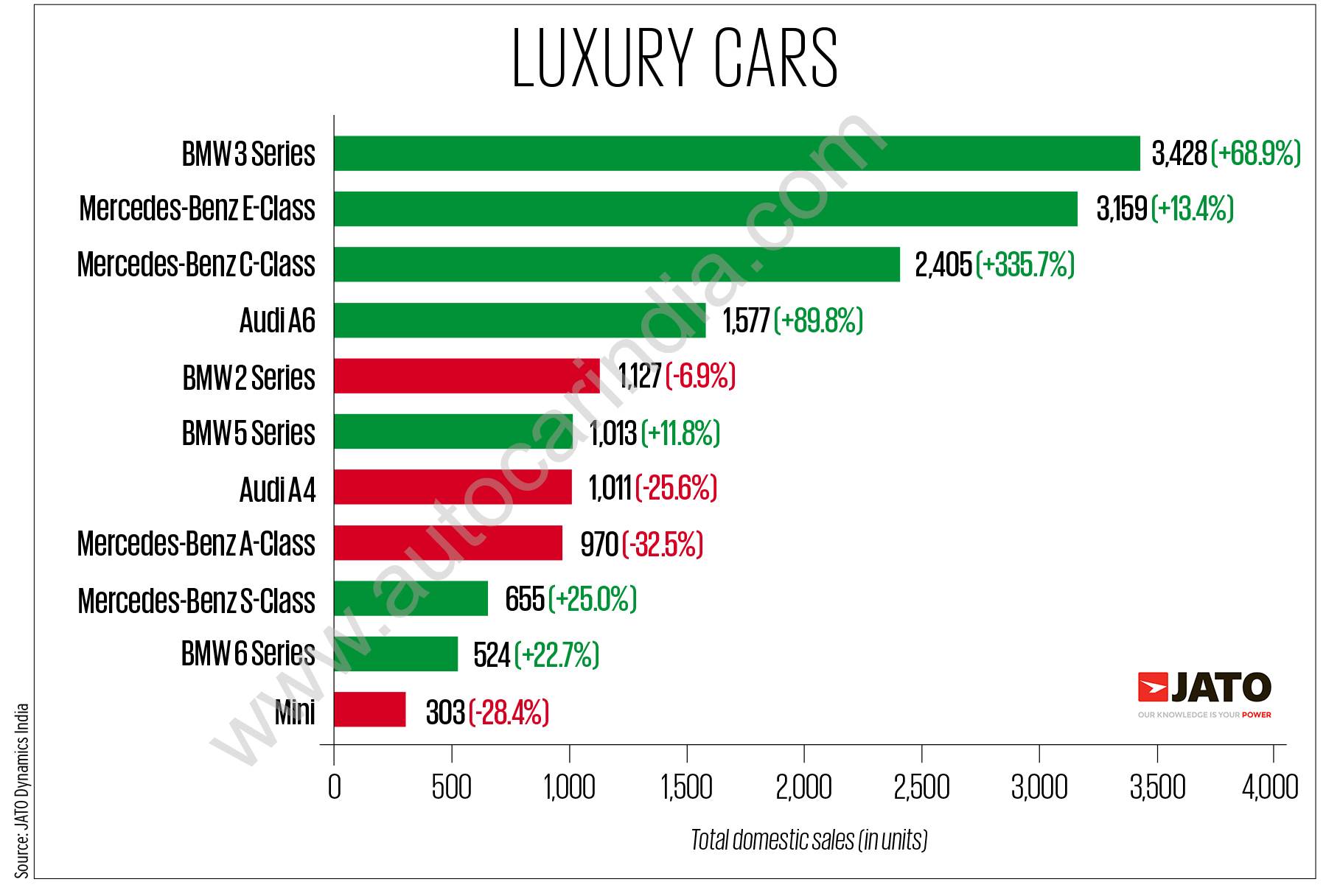

Luxury Car Sales In China Case Studies Of Bmw Porsche And Competitors

Apr 25, 2025

Luxury Car Sales In China Case Studies Of Bmw Porsche And Competitors

Apr 25, 2025 -

Denver Broncos Is Ashton Jeanty The Missing Piece To A Super Bowl Run

Apr 25, 2025

Denver Broncos Is Ashton Jeanty The Missing Piece To A Super Bowl Run

Apr 25, 2025 -

Trump Blames Zelensky For Ukraine Peace Talks Failure

Apr 25, 2025

Trump Blames Zelensky For Ukraine Peace Talks Failure

Apr 25, 2025 -

You Tube The Center Of Online Video And Beyond

Apr 25, 2025

You Tube The Center Of Online Video And Beyond

Apr 25, 2025 -

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 25, 2025

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 25, 2025

Latest Posts

-

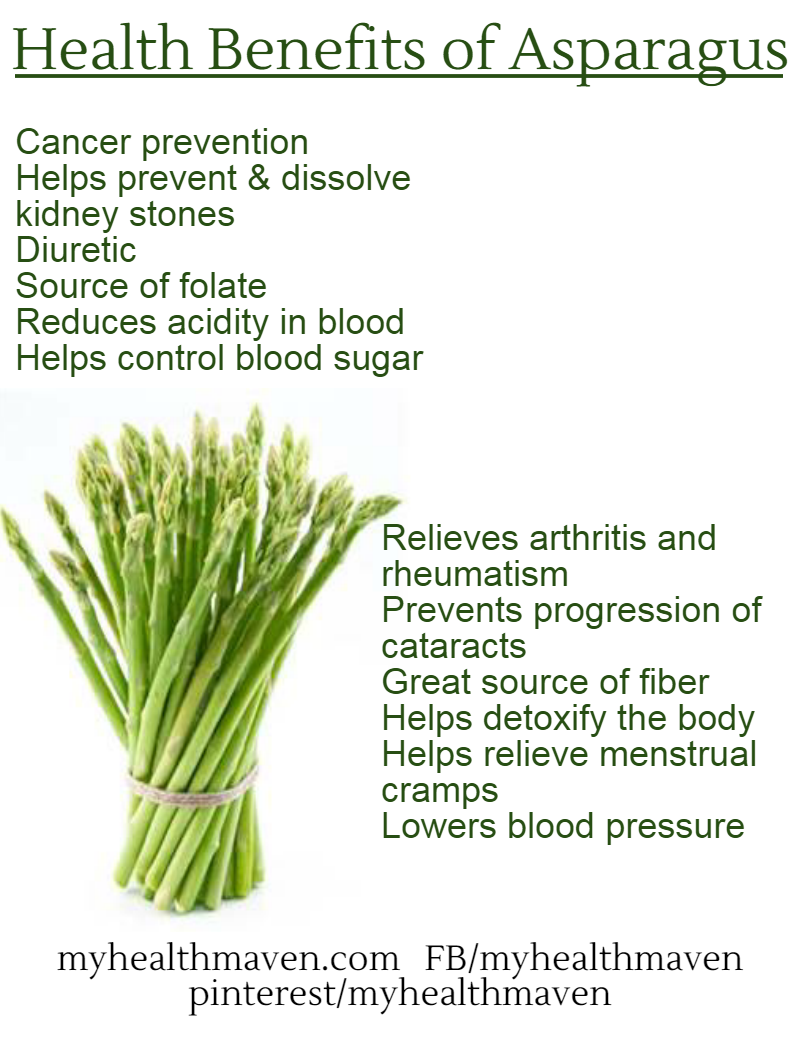

Asparagus Nutrition How This Vegetable Supports Your Well Being

Apr 30, 2025

Asparagus Nutrition How This Vegetable Supports Your Well Being

Apr 30, 2025 -

Cdu Spd Coalition Talks Key Issues And Potential Outcomes

Apr 30, 2025

Cdu Spd Coalition Talks Key Issues And Potential Outcomes

Apr 30, 2025 -

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025

German Conservatives And Social Democrats Begin Coalition Talks

Apr 30, 2025 -

Is Asparagus Good For You Exploring The Health Advantages Of Asparagus

Apr 30, 2025

Is Asparagus Good For You Exploring The Health Advantages Of Asparagus

Apr 30, 2025 -

How Healthy Is Asparagus Nutritional Benefits And Health Effects

Apr 30, 2025

How Healthy Is Asparagus Nutritional Benefits And Health Effects

Apr 30, 2025