JBS And Banco Master: Asset Acquisition Negotiations Terminated

Table of Contents

Reasons Behind the Negotiation Termination

Several factors likely contributed to the termination of the JBS and Banco Master asset acquisition negotiations. Understanding these complexities provides a clearer picture of the challenges involved in such large-scale transactions.

Lack of Agreement on Valuation

- Discrepancies in Asset Valuations: The core of the disagreement likely stemmed from differing perspectives on the financial worth of the assets involved. Banco Master may have sought a higher valuation reflecting anticipated future growth, while JBS, perhaps prioritizing cost efficiency, aimed for a lower price.

- Differing Perspectives on Future Profitability: Projections about the future profitability of the acquired assets played a significant role. Disagreements on market forecasts and anticipated returns on investment inevitably impacted the valuation negotiations.

- Impact of Market Conditions: The overall economic climate and prevailing market conditions significantly influence asset valuations. Uncertainties in the Brazilian economy and global financial markets may have widened the gap between the two companies' expectations.

The failure to reach a consensus on valuation underscores the critical importance of thorough due diligence and independent valuations in any significant acquisition. Both JBS and Banco Master would have employed teams of financial experts to assess the value of the assets, and the divergence of these assessments ultimately proved insurmountable.

Regulatory Hurdles and Antitrust Concerns

- Antitrust Scrutiny: Given the size and scope of both JBS and Banco Master, regulatory approval from Brazilian competition authorities would have been required. Any potential overlap in markets or business activities could have triggered concerns about reduced competition.

- Regulatory Approvals and Permits: Securing the necessary permits and approvals from Brazilian regulatory bodies can be a lengthy and complex process. Delays or uncertainties in obtaining these approvals could have contributed to the termination of negotiations.

- Compliance Requirements: Meeting stringent compliance standards in Brazil's regulatory framework is critical for any major transaction. Failure to comply with any aspect of these regulations could have resulted in the deal being abandoned.

Navigating Brazil's regulatory landscape is complex, requiring significant expertise and resources. The potential for delays and unexpected roadblocks significantly impact the viability of such acquisitions.

Strategic Shift in JBS's Business Plan

- Changes in JBS's Overall Strategy: JBS might have experienced a shift in its overall corporate strategy, leading to a reassessment of acquisition targets. Internal restructuring or changes in leadership could have influenced the decision to withdraw from the deal.

- Shifting Priorities: JBS might have re-evaluated its investment priorities, deciding to allocate capital to other areas deemed more strategically important for long-term growth.

- Impact on Acquisition Targets: This strategic shift may have caused JBS to reconsider the alignment of Banco Master's assets with its revised business objectives, leading to the termination of the acquisition talks.

Internal factors within JBS played a significant role. A change in leadership, a reassessment of core business objectives, or an unforeseen opportunity elsewhere could have influenced the decision to halt the acquisition process.

Impact on JBS and Banco Master

The termination of negotiations has significant implications for both companies. The future strategies of both JBS and Banco Master will likely be impacted by this development.

JBS's Future Acquisition Strategies

- Pursuit of Other Acquisition Opportunities: JBS is likely to continue exploring other acquisition opportunities in the Brazilian market and internationally. The failed negotiations may lead to a refined approach, focusing on targets more aligned with their revised strategic priorities.

- Adjustments to Investment Plans: The termination of the deal may require JBS to adjust its investment plans, potentially reallocating resources to different projects or initiatives.

- Revised Mergers and Acquisitions (M&A) Approach: JBS may refine its M&A strategy to mitigate similar issues in future deals, focusing on improved due diligence and a clearer understanding of regulatory hurdles.

The experience will inform JBS’s future M&A endeavors, emphasizing a more thorough evaluation process.

Banco Master's Next Steps

- Alternative Strategies for Asset Disposition: Banco Master may explore alternative strategies to dispose of the assets involved, potentially seeking other buyers or adopting internal restructuring measures.

- Internal Restructuring and Optimization: The bank might focus on internal restructuring to optimize its operations and improve the value of the assets in question.

- Exploring Other Growth Avenues: Banco Master may explore alternative growth avenues, focusing on different strategic initiatives that better align with its current capabilities.

Banco Master will need to adapt and develop a plan to navigate this setback, which could involve different strategies for utilizing the assets.

Market Reaction and Analysis

The announcement of the terminated negotiations has resulted in observable market reactions and analysis.

Stock Market Performance

- JBS Stock Price Movement: The market's reaction to the news is evident in the performance of JBS's stock price. Any changes in stock valuation reflect investor sentiment concerning the long-term impact of the failed acquisition.

- Banco Master Stock Price Movement: Similarly, Banco Master's stock price movements reveal how investors perceive the implications of the deal's collapse.

- Investor Sentiment and Market Reactions: Overall investor sentiment towards both companies reflects the perception of the long-term effects of this unexpected turn of events.

Monitoring stock prices provides insights into market sentiment and helps assess investor confidence in the future prospects of both firms.

Expert Opinions and Analyst Forecasts

- Financial Analyst Commentary: Financial analysts have offered commentary on the long-term implications of the failed acquisition for both JBS and Banco Master.

- Industry Expert Insights: Leading experts in the Brazilian business sector may have offered insights into the reasons behind the failed negotiations and their potential impact.

- Long-Term Implications: Analyst forecasts offer projections about the long-term impact on the financial performance, strategic direction, and competitive positioning of both companies.

Expert opinions and analyst forecasts provide valuable context and help assess the broader implications of this major development in the Brazilian business world.

Conclusion

The termination of asset acquisition negotiations between JBS and Banco Master marks a significant development in the Brazilian business landscape. Disagreements over valuation, regulatory hurdles, and potential shifts in JBS's business strategy all played a role in the deal's collapse. The impact on both companies remains to be seen, but this outcome highlights the complexities and challenges of large-scale mergers and acquisitions. Understanding the intricacies of this failed asset acquisition offers important lessons for both businesses and investors.

Call to Action: Stay informed about future developments in the JBS and Banco Master story by subscribing to our newsletter for the latest updates on this and other significant asset acquisition negotiations and Brazilian business news. Learn more about the intricacies of JBS's acquisition strategy and the challenges faced in this deal.

Featured Posts

-

Angels Collapse Late Lead Lost To Tatis Jr S Walk Off Hit

May 18, 2025

Angels Collapse Late Lead Lost To Tatis Jr S Walk Off Hit

May 18, 2025 -

Where To Invest A Map Of The Countrys Hottest Business Locations

May 18, 2025

Where To Invest A Map Of The Countrys Hottest Business Locations

May 18, 2025 -

Snls Cold Open Republican Senators Crash A Teen Group Chat

May 18, 2025

Snls Cold Open Republican Senators Crash A Teen Group Chat

May 18, 2025 -

Suicide Suspected In Dam Square Car Explosion Driver Fatally Injured

May 18, 2025

Suicide Suspected In Dam Square Car Explosion Driver Fatally Injured

May 18, 2025 -

Voyager Technologies Ipo A New Era For Space Defense

May 18, 2025

Voyager Technologies Ipo A New Era For Space Defense

May 18, 2025

Latest Posts

-

Man Stabbed At Brooklyn Bridge City Hall Subway Station Nyc Rush Hour Attack

May 18, 2025

Man Stabbed At Brooklyn Bridge City Hall Subway Station Nyc Rush Hour Attack

May 18, 2025 -

Jacek Harlukowicz Najwiekszy Zasieg W Publikacjach Onetu W 2024 Roku

May 18, 2025

Jacek Harlukowicz Najwiekszy Zasieg W Publikacjach Onetu W 2024 Roku

May 18, 2025 -

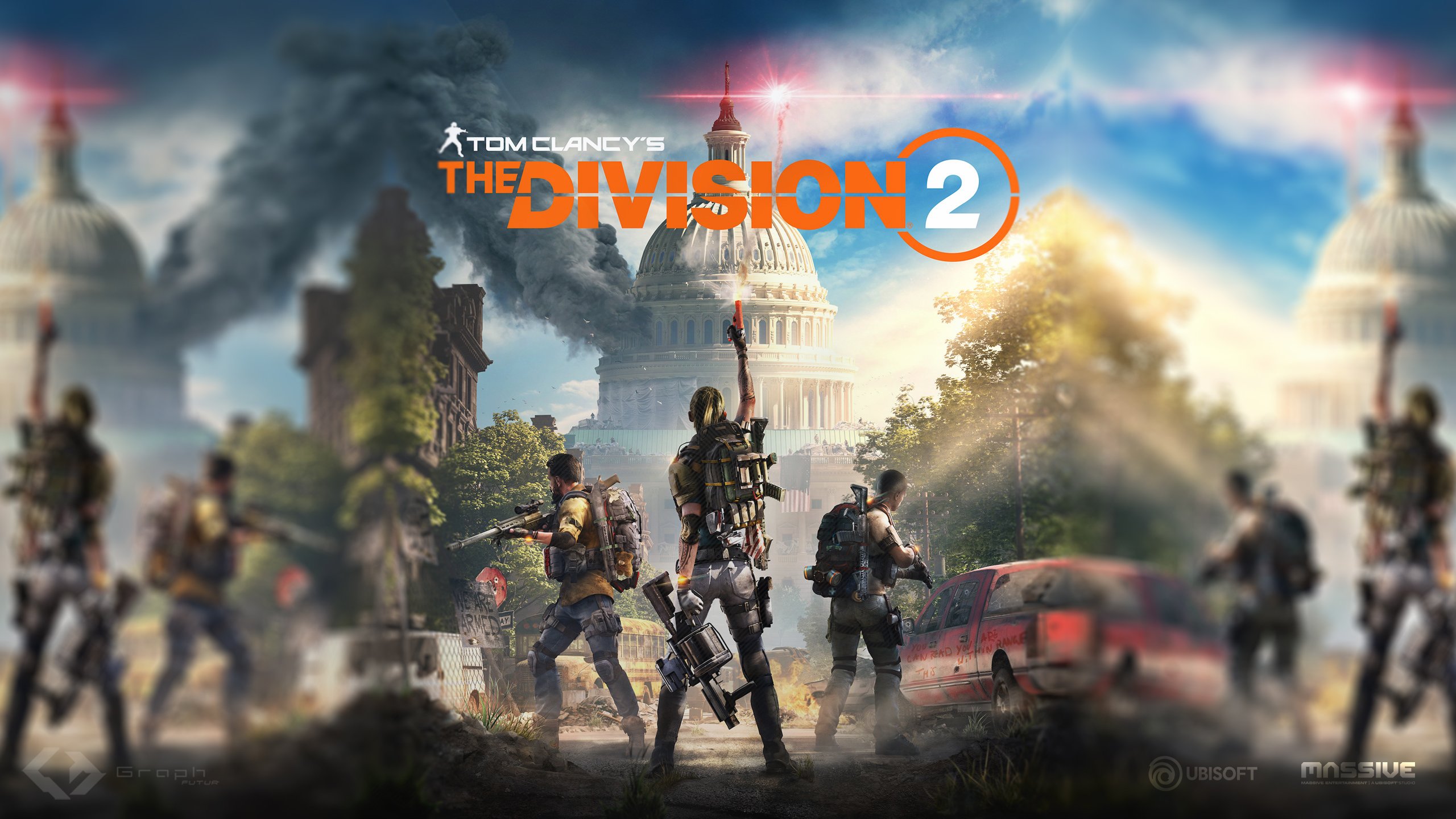

The Division 2 Sixth Anniversary Remembering The Past Embracing The Future

May 18, 2025

The Division 2 Sixth Anniversary Remembering The Past Embracing The Future

May 18, 2025 -

Six Years Of The Division 2 A Celebration Of Community And Gameplay

May 18, 2025

Six Years Of The Division 2 A Celebration Of Community And Gameplay

May 18, 2025 -

Tom Clancys The Division 2 Celebrating Six Years Of Post Apocalyptic Warfare

May 18, 2025

Tom Clancys The Division 2 Celebrating Six Years Of Post Apocalyptic Warfare

May 18, 2025