Jerome Powell On Tariffs: A Threat To Fed Goals

Table of Contents

Powell's Stance on Tariffs and Their Economic Impact

Jerome Powell has consistently expressed his apprehension regarding the economic consequences of tariffs. He understands that tariffs, while intended to protect domestic industries, often have far-reaching and unintended negative repercussions. His public statements and interviews reveal a deep concern about the ripple effects of these trade policies.

- Increased prices for consumers: Import tariffs directly increase the cost of goods for consumers, leading to higher inflation. This erodes purchasing power and can stifle overall consumer spending.

- Uncertainty and reduced investment: The unpredictability associated with tariff implementations creates uncertainty for businesses. This uncertainty discourages investment, as companies hesitate to commit resources in an unstable economic climate.

- Negative impact on global trade and supply chains: Tariffs disrupt global trade flows and complicate international supply chains. This can lead to shortages, delays, and increased costs for businesses reliant on global trade.

- Potential for retaliatory tariffs: The imposition of tariffs often provokes retaliatory measures from other countries, escalating trade tensions and further harming global commerce. This tit-for-tat exchange can significantly impact the US economy.

- Specific instances: Powell's concerns have been voiced in numerous speeches and testimonies before Congress. For example, [cite a specific speech or testimony here, including a link]. These statements consistently emphasize the negative economic ramifications of tariffs.

The Conflict Between Tariffs and the Fed's Dual Mandate

The Federal Reserve operates under a dual mandate: maintaining price stability and achieving maximum employment. Tariffs directly undermine both of these core objectives.

- Inflationary pressures: As previously noted, tariffs lead to higher prices for consumers, directly impacting price stability. The Fed's mandate to control inflation becomes more challenging when faced with external inflationary pressures caused by tariffs.

- Reduced economic growth and job losses: Trade disputes stemming from tariffs can lead to reduced economic growth and job losses in sectors affected by retaliatory tariffs or disrupted supply chains. This contradicts the Fed's goal of maximum employment.

- Limited counteracting ability: The Fed has limited tools to effectively counteract the negative economic effects of tariffs through monetary policy alone. Raising interest rates to combat inflation, for example, might further stifle economic growth and exacerbate job losses.

The Uncertainty Created by Tariffs and its Effect on Monetary Policy

The unpredictability inherent in tariff policies significantly complicates the Fed's ability to conduct effective monetary policy. This uncertainty undermines the Fed's capacity to accurately predict and respond to economic fluctuations.

- Difficulty in forecasting: The imposition of tariffs introduces a major source of uncertainty into economic forecasting, making it difficult to predict inflation and economic growth accurately.

- Challenges in setting interest rates: The uncertainty makes it challenging for the Fed to set appropriate interest rates. Setting rates too high risks stifling growth, while setting them too low could fuel inflation further exacerbated by tariffs.

- Increased financial market risks: Tariff uncertainty can increase risks associated with financial market instability. Investors may become hesitant, leading to market volatility and potentially impacting investment and lending.

- Impact on business investment and consumer spending: Uncertainty surrounding tariffs dampens business investment and consumer spending, creating a negative feedback loop that hinders economic growth.

Alternative Economic Policies to Address Trade Concerns (Without Tariffs)

Instead of relying on tariffs, the government could adopt alternative policies to address trade concerns and protect domestic industries.

- Negotiating trade agreements: Negotiating comprehensive trade agreements that address specific concerns, while promoting fair competition, can be a more effective and predictable way to manage trade relations.

- Investing in domestic industries: Targeted subsidies or infrastructure investments in domestic industries can help them become more competitive without resorting to protectionist measures.

- Strengthening domestic supply chains: Investing in domestic manufacturing and building more resilient supply chains can reduce reliance on foreign imports and mitigate the impact of global disruptions.

- Long-term strategic trade policy: A long-term strategic approach to trade policy, rather than reactive tariff implementations, fosters stability and predictability, improving the overall economic environment.

Jerome Powell and the Peril of Tariffs to Fed Goals

Jerome Powell's consistent warnings regarding the negative impacts of tariffs highlight a fundamental conflict between protectionist trade policies and the Fed's mandate for price stability and maximum employment. Tariffs create uncertainty, fuel inflation, hinder economic growth, and limit the effectiveness of monetary policy. The key takeaway is that tariffs pose a significant threat to the overall health of the US economy. Understanding Jerome Powell's concerns about tariffs is crucial for navigating the complexities of current economic policy. Stay informed on the latest developments by following the Federal Reserve's publications and staying updated on Jerome Powell's public statements regarding tariffs and their impact on Fed goals.

Featured Posts

-

Hsv Aufstieg Zwischen Hafengeburtstag Und Roland Kaiser

May 25, 2025

Hsv Aufstieg Zwischen Hafengeburtstag Und Roland Kaiser

May 25, 2025 -

Zize En Spectacle A Graveson Une Soiree 100 Marseillaise Le 4 Avril

May 25, 2025

Zize En Spectacle A Graveson Une Soiree 100 Marseillaise Le 4 Avril

May 25, 2025 -

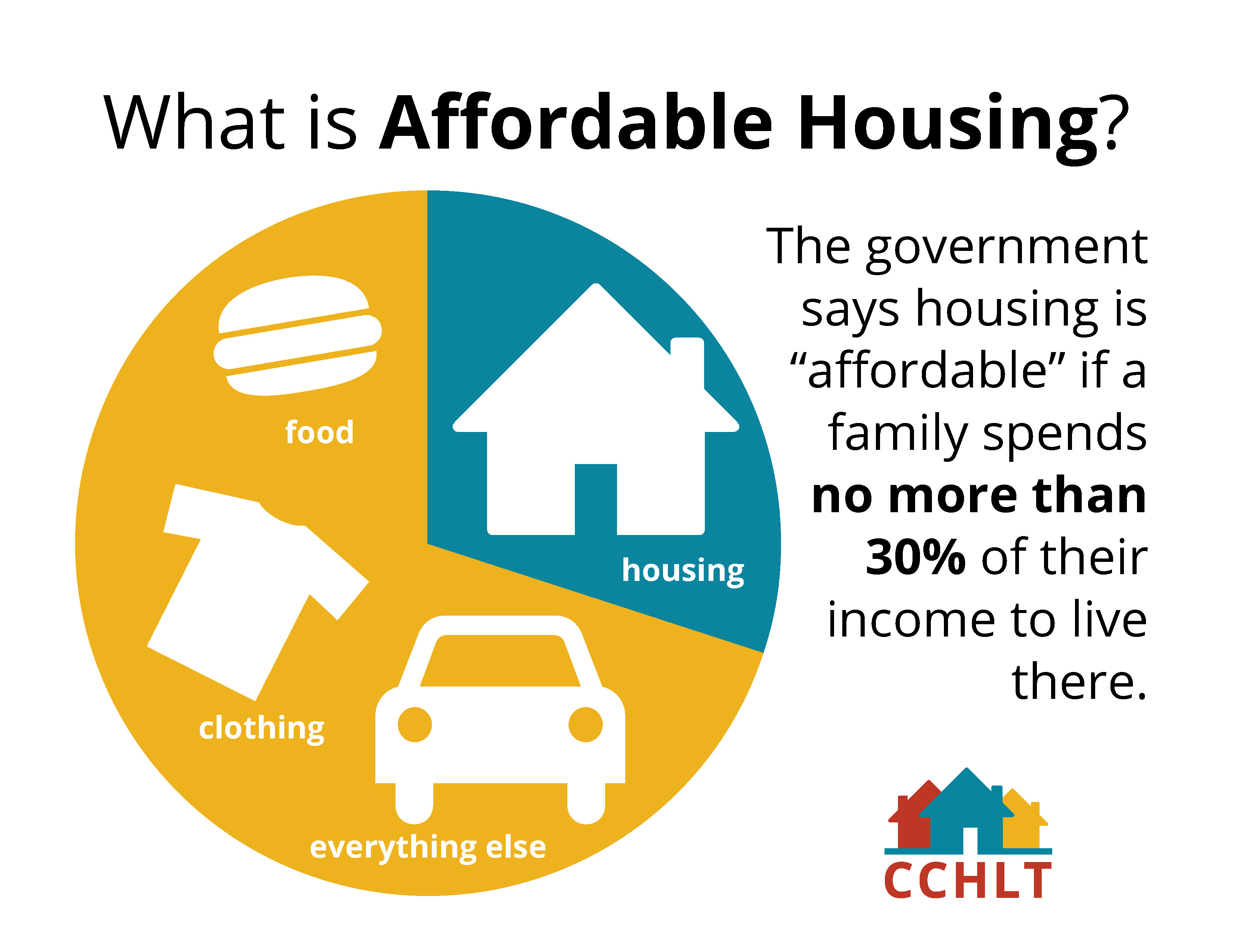

Gregor Robertsons Plan Affordable Housing Without Lowering Home Values

May 25, 2025

Gregor Robertsons Plan Affordable Housing Without Lowering Home Values

May 25, 2025 -

La Langue Francaise Depasser Les Cliches Avec Mathieu Avanzi

May 25, 2025

La Langue Francaise Depasser Les Cliches Avec Mathieu Avanzi

May 25, 2025 -

I Know You D Kill Joy Crookes Latest Musical Offering

May 25, 2025

I Know You D Kill Joy Crookes Latest Musical Offering

May 25, 2025

Latest Posts

-

Pourquoi Ne Pas Debloquer La Rtbf Les Risques A Considerer

May 26, 2025

Pourquoi Ne Pas Debloquer La Rtbf Les Risques A Considerer

May 26, 2025 -

Le Frere D Albert Luthers Thierry En Deuil Suite A Son Deces

May 26, 2025

Le Frere D Albert Luthers Thierry En Deuil Suite A Son Deces

May 26, 2025 -

Debloquer La Rtbf Pourquoi C Est Une Mauvaise Idee

May 26, 2025

Debloquer La Rtbf Pourquoi C Est Une Mauvaise Idee

May 26, 2025 -

Thierry Luthers Pleure La Perte De Son Frere Albert

May 26, 2025

Thierry Luthers Pleure La Perte De Son Frere Albert

May 26, 2025 -

Deces D Albert Luthers Thierry Luthers En Deuil

May 26, 2025

Deces D Albert Luthers Thierry Luthers En Deuil

May 26, 2025