Jerome Powell On Tariffs: A Threat To Federal Reserve Goals

Table of Contents

Tariffs and Inflation: A Direct Link

Tariffs, essentially taxes on imported goods, directly increase the cost of these products. This increased cost is passed on to consumers, leading to higher consumer prices and fueling inflation. The impact of tariff inflation is widespread, affecting everything from everyday household items to the raw materials used in manufacturing.

For example, tariffs on steel and aluminum have increased the cost of these essential materials, driving up prices for automobiles, construction materials, and countless other products. This ripple effect intensifies tariff inflation, impacting the Consumer Price Index (CPI) and eroding purchasing power.

- Increased cost of imported raw materials: Tariffs significantly increase the cost of essential inputs for numerous industries, leading to higher production costs and subsequent price hikes for consumers.

- Reduced competition, leading to higher prices for domestic goods: While intended to protect domestic industries, tariffs can limit competition, allowing domestic producers to raise prices without facing the pressure of cheaper imports.

- Impact on the consumer price index (CPI): The rise in prices due to tariffs directly contributes to a higher CPI, a key indicator of inflation, impacting the Federal Reserve's mandate for price stability.

Tariffs and Economic Growth: A Stifling Effect

The detrimental effects of tariffs extend beyond inflation. They disrupt global supply chains, creating uncertainty and hindering economic expansion. Businesses, particularly those heavily reliant on imported goods or exporting products, are particularly vulnerable. The uncertainty surrounding tariffs discourages business investment and can lead to job losses as companies struggle to adapt to volatile market conditions.

- Reduced international trade: Tariffs create barriers to international trade, reducing overall economic activity and hindering the efficient allocation of resources.

- Increased uncertainty for businesses: The unpredictability of tariff policies makes it difficult for businesses to plan for the future, reducing investment and potentially leading to job cuts.

- Retaliatory tariffs from other countries: Tariffs often provoke retaliatory measures from other nations, escalating trade disputes and further harming global economic growth.

Jerome Powell's Stance on Tariffs and Monetary Policy

Jerome Powell has repeatedly expressed concerns about the economic consequences of tariffs. In his public statements and testimonies before Congress, he has consistently highlighted the challenges they pose to the Federal Reserve's ability to manage inflation and maintain economic stability. The uncertainty created by tariffs complicates the Fed's forecasting models and makes it harder to implement effective monetary policy.

- Powell's concerns regarding inflation: Powell has explicitly linked tariffs to inflationary pressures, emphasizing the threat they pose to the Fed's price stability mandate.

- The Fed's response to tariff-related economic shocks: The Fed has had to adjust its monetary policy in response to tariff-induced economic volatility, often walking a tightrope between supporting growth and controlling inflation.

- Challenges in forecasting economic growth with tariff uncertainty: The unpredictability of tariff policies makes it extremely difficult for the Fed to accurately forecast economic growth, hindering effective policymaking.

Alternative Solutions and Policy Recommendations

Instead of relying on protectionist measures like tariffs, there are alternative approaches to achieve the desired economic outcomes. These include investments in domestic industries to boost their competitiveness, negotiating fairer and more balanced trade agreements, and addressing underlying trade imbalances through targeted strategies.

- Investment in domestic industries: Investing in research and development, education, and infrastructure can enhance the competitiveness of domestic industries without resorting to protectionist measures.

- Negotiating better trade agreements: Rather than imposing tariffs, the focus should be on negotiating mutually beneficial trade agreements that address concerns about unfair trade practices while fostering greater global cooperation.

- Addressing underlying trade imbalances: Instead of imposing tariffs, policymakers should focus on addressing the root causes of trade imbalances, such as structural issues within specific sectors or economies.

Conclusion: Understanding Jerome Powell's Concerns on Tariffs

Tariffs pose a significant threat to the Federal Reserve's dual mandate of price stability and maximum employment. Their direct impact on inflation, their stifling effect on economic growth, and the challenges they create for monetary policy underscore the importance of understanding Jerome Powell's concerns. The link between tariffs, inflation, and diminished economic growth is undeniable. It is crucial to understand Jerome Powell's perspective on tariffs and their multifaceted impact on the US economy. Stay informed about the ongoing debate surrounding tariffs and their implications for the nation's economic health; a deeper understanding of Jerome Powell's position on this critical issue is paramount. Continue researching and engaging with this topic to foster informed discussions and better policy decisions regarding tariffs and their impact on the US economy.

Featured Posts

-

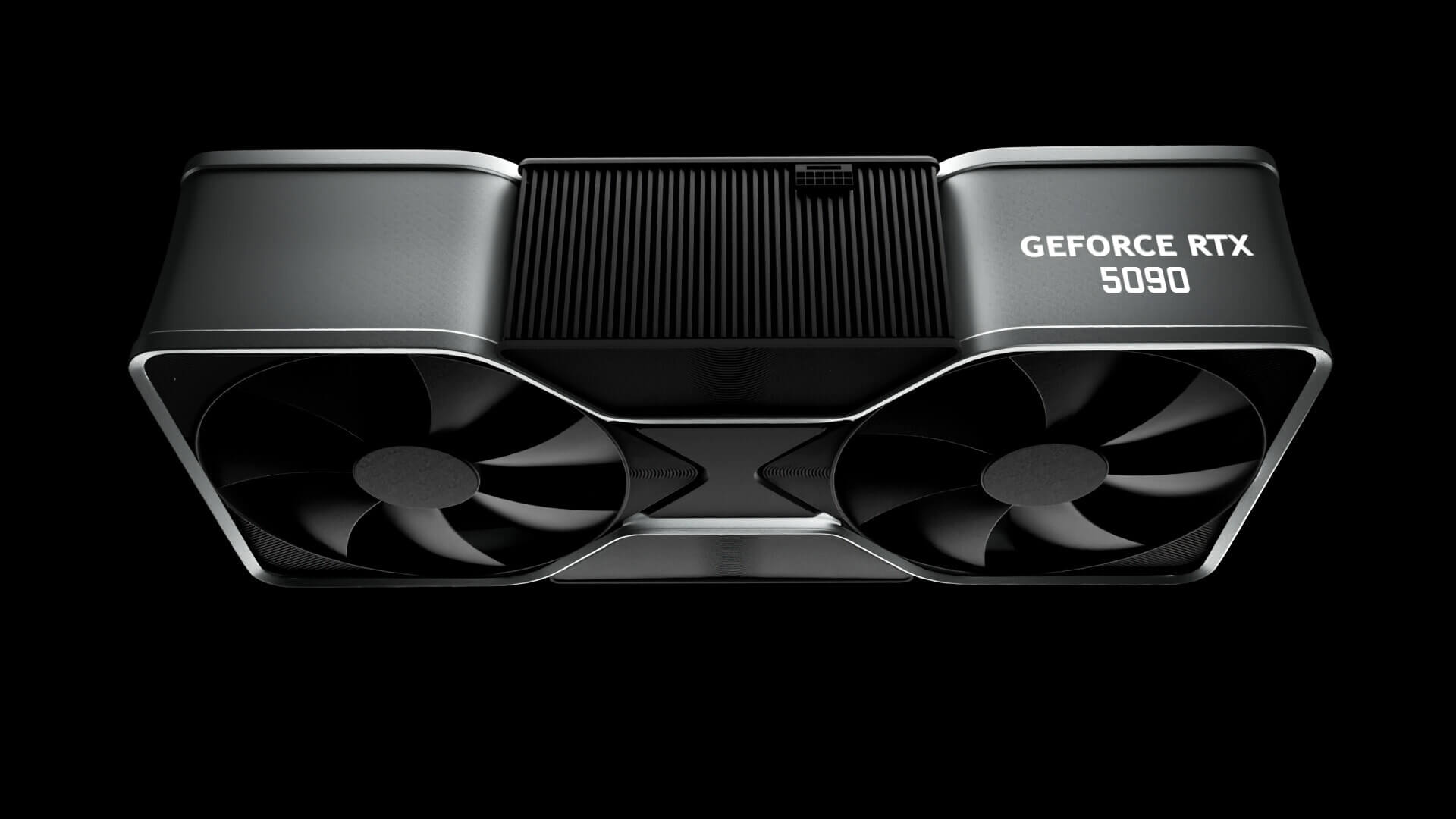

Nvidia Rtx 5060 Expectations Vs Reality A Comprehensive Review

May 26, 2025

Nvidia Rtx 5060 Expectations Vs Reality A Comprehensive Review

May 26, 2025 -

Glasgows Gritty Glamour How A Thriller Transformed The City

May 26, 2025

Glasgows Gritty Glamour How A Thriller Transformed The City

May 26, 2025 -

Martin Compston And The Cinematic Transformation Of Glasgow

May 26, 2025

Martin Compston And The Cinematic Transformation Of Glasgow

May 26, 2025 -

Marc Marquez Di Moto Gp 2025 Analisis Klasemen Dan Peluang Juara

May 26, 2025

Marc Marquez Di Moto Gp 2025 Analisis Klasemen Dan Peluang Juara

May 26, 2025 -

Moto Gp Inggris Fp 1 Marquez Dominasi Insiden Motor Mogok Guncang Sirkuit

May 26, 2025

Moto Gp Inggris Fp 1 Marquez Dominasi Insiden Motor Mogok Guncang Sirkuit

May 26, 2025