Jim Cramer On Foot Locker (FL): Is It A Smart Investment?

Table of Contents

Jim Cramer's Stance on Foot Locker (FL): A Deep Dive

Jim Cramer, the renowned television personality and outspoken investor, holds significant sway over investor sentiment. His opinions, often expressed with characteristic energy on his show "Mad Money," can influence the trading activity of countless individuals. While pinpointing his exact, most recent stance on Foot Locker requires referencing his most current broadcasts, we can analyze his typical approach to evaluating retail stocks to understand his potential perspective on FL. He often focuses on:

- Brand Strength: A strong brand, like Foot Locker's, can provide a competitive advantage, allowing the company to command premium prices and maintain customer loyalty. Cramer likely considers this a positive factor for FL.

- Growth Potential: Opportunities for expansion, both domestically and internationally, are crucial elements in his investment decisions. He would likely assess Foot Locker's potential for growth in e-commerce and international markets.

- Economic Headwinds: Conversely, macroeconomic factors like inflation and consumer spending habits significantly impact retail businesses. Cramer might express concerns about the potential impact of an economic downturn on Foot Locker's sales.

- Competition: The intensely competitive landscape of the athletic footwear and apparel market, with giants like Nike and Adidas, would be a key area of analysis for Cramer. He might highlight the challenges Foot Locker faces in maintaining its market share.

Example (Hypothetical): "In a recent Mad Money segment, Jim Cramer stated, 'Foot Locker faces headwinds, but their strong brand recognition could help them navigate the current economic climate.' This suggests a cautiously optimistic view, highlighting both risks and opportunities."

Fundamental Analysis of Foot Locker (FL): A Contrarian View?

To form a balanced opinion, we must move beyond Jim Cramer's perspective and conduct a fundamental analysis of Foot Locker's financial health. This involves examining several key metrics:

- Revenue Growth: Examining Foot Locker's revenue growth over recent quarters and years provides insight into the company's financial performance and its ability to attract and retain customers.

- Profit Margins: Analyzing profit margins helps gauge Foot Locker's efficiency and pricing strategies. Are they maintaining healthy margins in a competitive market?

- Debt Levels: High debt can significantly impact a company's financial stability and growth prospects. A high debt-to-equity ratio for FL would be a cause for concern.

- Return on Equity (ROE): ROE indicates how effectively Foot Locker is using its shareholders' investments to generate profits.

Key Financial Ratios (Hypothetical):

- P/E Ratio: 15 (This needs to be updated with current data)

- Debt-to-Equity Ratio: 0.7 (This needs to be updated with current data)

Recent Financial Performance (Hypothetical):

- Q3 2023 Revenue: Increased by 5% year-over-year. (This needs to be updated with current data)

- Q3 2023 Net Income: Increased by 3% year-over-year. (This needs to be updated with current data)

Furthermore, Foot Locker's omnichannel strategy and its ability to leverage e-commerce for growth are critical factors in evaluating its long-term prospects.

Alternative Perspectives on Foot Locker Stock (FL)

It's crucial to consider opinions beyond Jim Cramer's. Other financial analysts and experts may offer contrasting viewpoints. These differing perspectives help create a well-rounded picture of the investment opportunity.

Analyst Ratings (Hypothetical):

- Morgan Stanley: Hold

- Goldman Sachs: Buy

- JP Morgan: Neutral

Price Targets (Hypothetical):

- Morgan Stanley: $45

- Goldman Sachs: $55

- JP Morgan: $48

Risk Assessment for Investing in Foot Locker (FL)

Investing in any stock, including Foot Locker (FL), carries inherent risks. Before making an investment decision, carefully consider the following:

- Economic Downturns: Recessions or economic slowdowns could significantly impact consumer spending on discretionary items like athletic footwear.

- Changing Fashion Trends: The athletic apparel industry is subject to shifts in fashion trends. Foot Locker's success depends on adapting to these changes.

- Supply Chain Disruptions: Global supply chain issues can affect the availability of products and impact profitability.

- Geopolitical Instability: Uncertainties in the global political landscape can affect the overall economic climate and investor sentiment.

Conclusion: Is Foot Locker (FL) Right for Your Portfolio?

Determining whether Foot Locker (FL) is a smart investment requires a comprehensive analysis. While Jim Cramer's perspective offers valuable insight, it should be considered alongside fundamental analysis, alternative viewpoints, and a thorough risk assessment. The information presented here suggests that Foot Locker's performance is complex and depends on various interacting factors.

Ultimately, the decision of whether or not to invest in Foot Locker (FL) rests with you. Use this analysis as a starting point for your own due diligence, considering your personal risk tolerance and investment goals. Remember to always consult with a financial advisor before making any significant investment decisions regarding Foot Locker stock (FL). Thorough research is crucial before investing in any stock, including Foot Locker.

Featured Posts

-

The Mystery Of Amber Heards Twins And Elon Musks Involvement

May 15, 2025

The Mystery Of Amber Heards Twins And Elon Musks Involvement

May 15, 2025 -

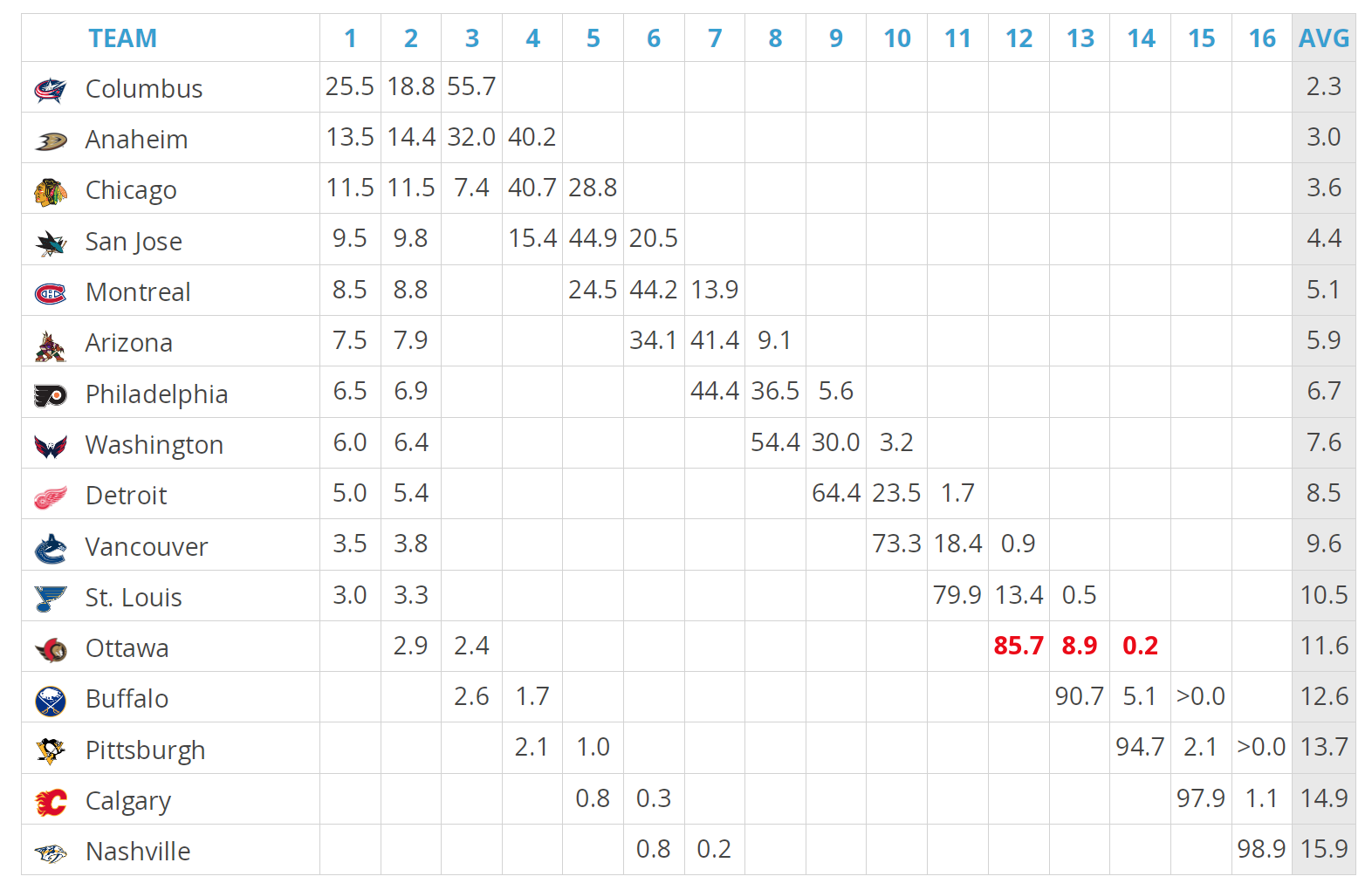

Nhl Draft Lottery Rules Explained Addressing Fan Frustration

May 15, 2025

Nhl Draft Lottery Rules Explained Addressing Fan Frustration

May 15, 2025 -

Chinas Xi Taps Top Advisors For Crucial Us Deal

May 15, 2025

Chinas Xi Taps Top Advisors For Crucial Us Deal

May 15, 2025 -

Vont Weekend 2025 April 4 6 96 1 Kissfm Highlights In Pictures

May 15, 2025

Vont Weekend 2025 April 4 6 96 1 Kissfm Highlights In Pictures

May 15, 2025 -

Bayden Na Vistavi Ta Inavguratsiyi Analiz Zovnishnogo Viglyadu

May 15, 2025

Bayden Na Vistavi Ta Inavguratsiyi Analiz Zovnishnogo Viglyadu

May 15, 2025