JM Financial Targets ₹400 For Baazar Style Retail Stock

Table of Contents

JM Financial's Rationale Behind the ₹400 Target

JM Financial's ₹400 price target for this Baazar-style retail stock is based on a thorough fundamental analysis of the company's performance and future prospects within the evolving Indian retail landscape. Their assessment considers several key factors:

-

Strong Financial Performance: JM Financial's analysis likely highlights robust revenue growth, improving profitability margins, and manageable debt levels. The company's consistent financial performance suggests a strong foundation for future expansion. Specific details regarding revenue figures, profit margins, and debt-to-equity ratios would be crucial components of their complete report.

-

Positive Growth Projections: The prediction incorporates projections for continued growth based on current market trends and the company's strategic expansion plans. This likely includes analysis of factors like planned store openings, successful marketing campaigns, or anticipated increases in customer acquisition. The projection model used by JM Financial is key to understanding the basis of their ₹400 target.

-

Key Growth Drivers: JM Financial's bullish outlook is likely fueled by several key factors. These could include increasing market share within the Baazar-style retail segment, successful new product introductions catering to specific consumer needs, or strategic acquisitions enhancing the company's reach and product offerings. Understanding these drivers is essential for assessing the validity of the prediction.

-

Valuation Methodology: The ₹400 target price is derived using a specific valuation methodology, likely incorporating discounted cash flow (DCF) analysis or comparable company analysis. Transparency in this methodology is crucial for investors to evaluate the validity of the target.

-

Identified Risks: While optimistic, JM Financial's analysis likely also identifies potential risks and challenges. These could include increased competition from established players or emerging e-commerce platforms, potential supply chain disruptions, or regulatory changes impacting the retail sector. Understanding these risks is crucial for informed investment decisions.

The Baazar-Style Retail Sector's Growth Potential

The Baazar-style retail sector in India presents significant growth potential, driven by several factors:

-

Expanding Middle Class: The rapidly expanding Indian middle class, with increasing disposable incomes, fuels demand for affordable and accessible retail options. Baazar-style retail perfectly caters to this demographic.

-

Urbanization and Population Growth: India's ongoing urbanization and substantial population growth contribute to the increasing demand for retail spaces and consumer goods.

-

Evolving Consumer Preferences: Changing consumer preferences towards convenience, value, and a wider selection of products drive the growth of this sector.

-

Competitive Landscape: While the sector shows strong growth potential, competition exists from both traditional and e-commerce players. Understanding the competitive dynamics is critical. This includes analyzing the strengths and weaknesses of major competitors.

-

Challenges and Opportunities: The sector also faces challenges, such as supply chain inefficiencies, logistical complexities, and regulatory hurdles. However, companies that successfully navigate these challenges are poised for significant growth.

Investment Implications and Considerations for Investors

JM Financial's prediction presents a potentially lucrative investment opportunity, but careful consideration is essential:

-

Investment Strategy: Investors should align their investment strategy with their risk tolerance and long-term financial goals. A long-term investment approach might be suitable given the growth potential of the sector.

-

Due Diligence: Thorough due diligence is paramount before investing in any stock. This includes independently researching the company's financial statements, competitive landscape, and future plans.

-

Risk Assessment: Investors need to understand and assess the inherent risks associated with investing in the stock market, particularly in a sector as dynamic as Baazar-style retail.

-

Portfolio Diversification: Diversifying one's investment portfolio across different asset classes and sectors is a crucial risk mitigation strategy.

Conclusion

JM Financial's ₹400 price target for the Baazar-style retail stock presents a compelling investment opportunity. The strong growth potential of the sector, coupled with the company's apparent robust financial performance (as per JM Financial’s analysis), is attractive. However, investors must conduct their own in-depth research, understand the associated risks, and consider their individual risk tolerance before investing. Remember, this analysis is just one perspective; independent due diligence is essential.

Call to Action: Learn more about the exciting potential of Baazar-style retail stocks and JM Financial's analysis to inform your investment decisions. Consider consulting with a qualified financial advisor before investing. Don't miss out on potentially lucrative investment opportunities in this dynamic sector – explore Baazar-style retail stocks today!

Featured Posts

-

The Gsw Lockdown Examining Potential Issues And Student Responses

May 15, 2025

The Gsw Lockdown Examining Potential Issues And Student Responses

May 15, 2025 -

0 3

May 15, 2025

0 3

May 15, 2025 -

Microsofts Significant Job Cuts Details On The 6 000 Layoffs

May 15, 2025

Microsofts Significant Job Cuts Details On The 6 000 Layoffs

May 15, 2025 -

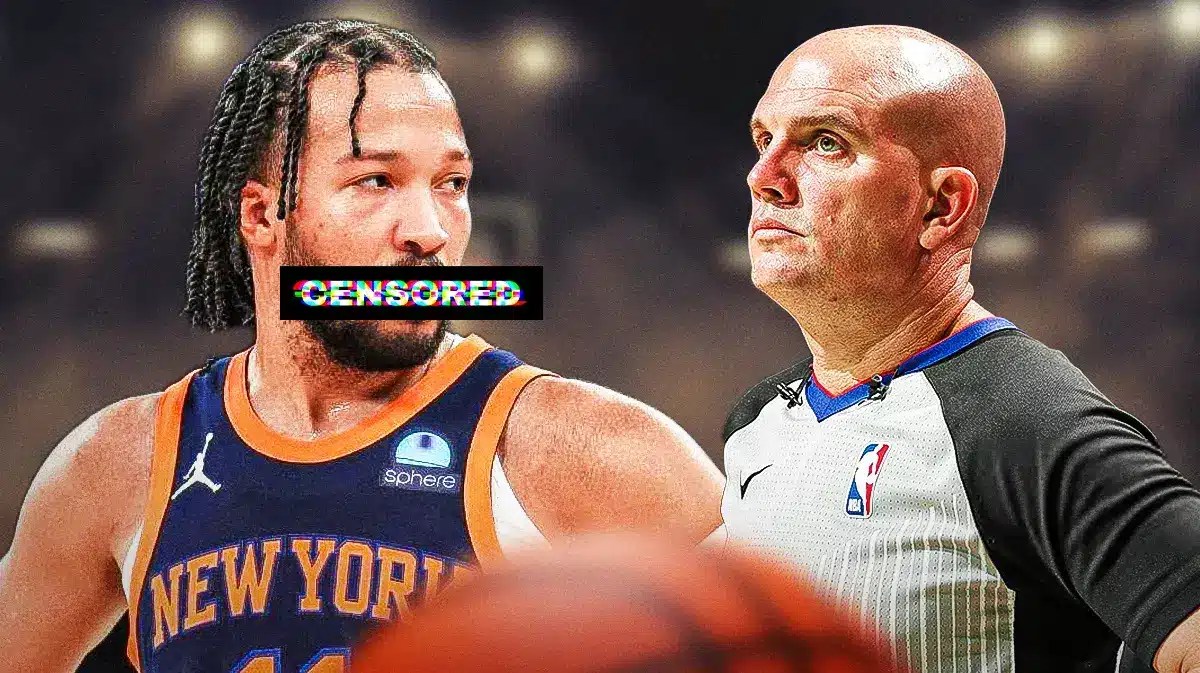

Pistons Vs Knicks Brunsons Potential Return Impacts Playoff Race

May 15, 2025

Pistons Vs Knicks Brunsons Potential Return Impacts Playoff Race

May 15, 2025 -

San Jose Earthquakes Defeat Portland Timbers 4 1

May 15, 2025

San Jose Earthquakes Defeat Portland Timbers 4 1

May 15, 2025