Johnson Matthey Catalyst Unit Acquisition: A Deep Dive Into Honeywell's (HON) Strategic Move

Table of Contents

Why Honeywell Acquired Johnson Matthey's Catalyst Unit

Honeywell's acquisition of Johnson Matthey's catalyst unit is a multifaceted strategic move driven by several key factors.

Expanding Honeywell's Portfolio in Materials Technology

This acquisition significantly strengthens Honeywell's existing materials science capabilities.

- Strengthening existing materials science capabilities: Honeywell already possesses a strong presence in materials science, but the acquisition adds depth and breadth to its portfolio.

- Access to new technologies and patents: Johnson Matthey holds a substantial intellectual property portfolio in catalyst technology, providing Honeywell with access to cutting-edge innovations and future development pathways.

- Diversification of revenue streams: Integrating Johnson Matthey's catalyst business diversifies Honeywell's revenue streams, reducing reliance on any single sector and mitigating risk.

- Expansion into new markets: Johnson Matthey's strong presence in specific niche markets opens new avenues for Honeywell's growth and market penetration.

The acquisition complements Honeywell's existing offerings, particularly within the performance materials and technologies segment. Specific technologies gained include expertise in advanced automotive catalysts, industrial catalysts, and emission control solutions for various sectors.

Capitalizing on Growing Demand for Emission Control Solutions

The global market for emission control technologies is experiencing robust growth, driven by increasingly stringent environmental regulations worldwide.

- Stringent environmental regulations globally: Governments worldwide are implementing stricter emission standards for vehicles and industrial processes, creating a strong demand for advanced catalyst technologies.

- Increasing demand for automotive catalysts: The automotive industry is a key driver of this demand, with manufacturers needing to meet increasingly stringent emission regulations for gasoline and diesel vehicles. This includes the growth in electric vehicles and the associated need for specialized catalysts.

- Growth opportunities in other sectors (e.g., industrial emissions): Beyond automotive, Johnson Matthey’s expertise extends to industrial emission control, offering Honeywell significant growth potential in sectors like chemicals, energy, and refining.

Johnson Matthey's expertise in developing and manufacturing high-performance catalysts perfectly positions Honeywell to capitalize on this growing market. This acquisition allows Honeywell to capture a larger share of the expanding market for cleaner technologies.

Strategic Synergies and Operational Efficiencies

The integration of Johnson Matthey's operations into Honeywell's existing structure is expected to yield significant synergies and operational efficiencies.

- Potential cost savings through integration: Streamlining operations and leveraging Honeywell's existing infrastructure can lead to substantial cost reductions.

- Improved supply chain management: Combining supply chains can optimize logistics, reduce procurement costs, and improve overall efficiency.

- Cross-selling opportunities within Honeywell's existing customer base: Honeywell can leverage its existing customer relationships to cross-sell Johnson Matthey's catalyst technologies, expanding market penetration and revenue generation.

These synergistic effects will contribute to improved profitability and a stronger competitive position for Honeywell in the long term.

Impact on the Competitive Landscape

The acquisition has significantly altered the competitive landscape within the materials technology and emission control sectors.

Increased Market Share and Competitive Advantage

The acquisition of Johnson Matthey’s catalyst business provides Honeywell with a significant boost in market share.

- Honeywell's enhanced market position: Honeywell now holds a considerably larger market share in the catalyst technology space, strengthening its overall competitive position.

- Potential impact on competitors: Existing competitors will face increased pressure from Honeywell's expanded capabilities and market dominance.

- New competitive dynamics within the industry: The acquisition reshapes the industry dynamics, potentially triggering further consolidation or innovation from other players.

This enhanced market position translates into greater bargaining power with customers and suppliers.

Innovation and Technological Leadership

Access to Johnson Matthey's R&D capabilities is crucial for Honeywell's future innovation.

- Access to Johnson Matthey's R&D capabilities: This acquisition grants Honeywell access to a wealth of research and development expertise in catalyst technologies.

- Potential for accelerated innovation in catalyst technologies: Combining Honeywell’s existing R&D resources with Johnson Matthey's expertise is expected to accelerate innovation in the field.

- Strengthened intellectual property portfolio: The combined intellectual property portfolio enhances Honeywell's technological leadership and competitive advantage.

This strengthened R&D capacity will be vital in developing next-generation catalyst technologies to meet evolving environmental regulations and market demands.

Financial Implications and Future Outlook

The acquisition of Johnson Matthey's catalyst unit has significant financial implications for Honeywell.

Deal Valuation and Financial Projections

The acquisition cost, while not publicly disclosed in detail, represents a substantial investment for Honeywell.

- Acquisition cost: The precise cost remains confidential, but it represents a significant investment reflecting the value of Johnson Matthey's technology and market position.

- Projected revenue growth: Honeywell anticipates significant revenue growth from the integrated catalyst business, driven by market expansion and increased market share.

- Impact on Honeywell's profitability: The acquisition is projected to positively impact Honeywell's profitability in the medium to long term, through increased revenue and improved operational efficiencies.

- Return on investment expectations: Honeywell expects a strong return on investment, driven by the growth potential of the catalyst market and synergistic benefits.

Detailed financial projections are likely to be disclosed in Honeywell's future financial reports.

Long-Term Growth Potential and Risks

The acquisition offers significant long-term growth potential but also presents certain risks.

- Opportunities for growth in emerging markets: Expanding into emerging markets with stricter emission regulations represents a significant growth opportunity for Honeywell.

- Potential challenges related to integration: Integrating two distinct corporate cultures and operations can present challenges and require careful management.

- Risks associated with market fluctuations and regulatory changes: Market fluctuations and changes in environmental regulations could impact the demand for catalyst technologies.

Successful integration and navigating these risks will be crucial for realizing the full potential of this acquisition.

Conclusion

The Honeywell (HON) acquisition of Johnson Matthey's catalyst unit is a strategically significant move that positions Honeywell for robust growth in the expanding emission control solutions market. The acquisition bolsters Honeywell's materials technology portfolio, fortifies its competitive position, and provides substantial opportunities for innovation and enhanced profitability. The synergistic benefits, access to cutting-edge technology, and expansion into new markets make this a compelling strategic decision.

Call to Action: To remain informed about the latest developments in the catalyst technology market and the impact of this pivotal acquisition, continue to follow our in-depth analyses of Honeywell's (HON) strategic maneuvers and the Johnson Matthey catalyst unit integration. Learn more about the dynamic evolution of the Johnson Matthey and Honeywell strategic partnership and its implications for the future of emission control.

Featured Posts

-

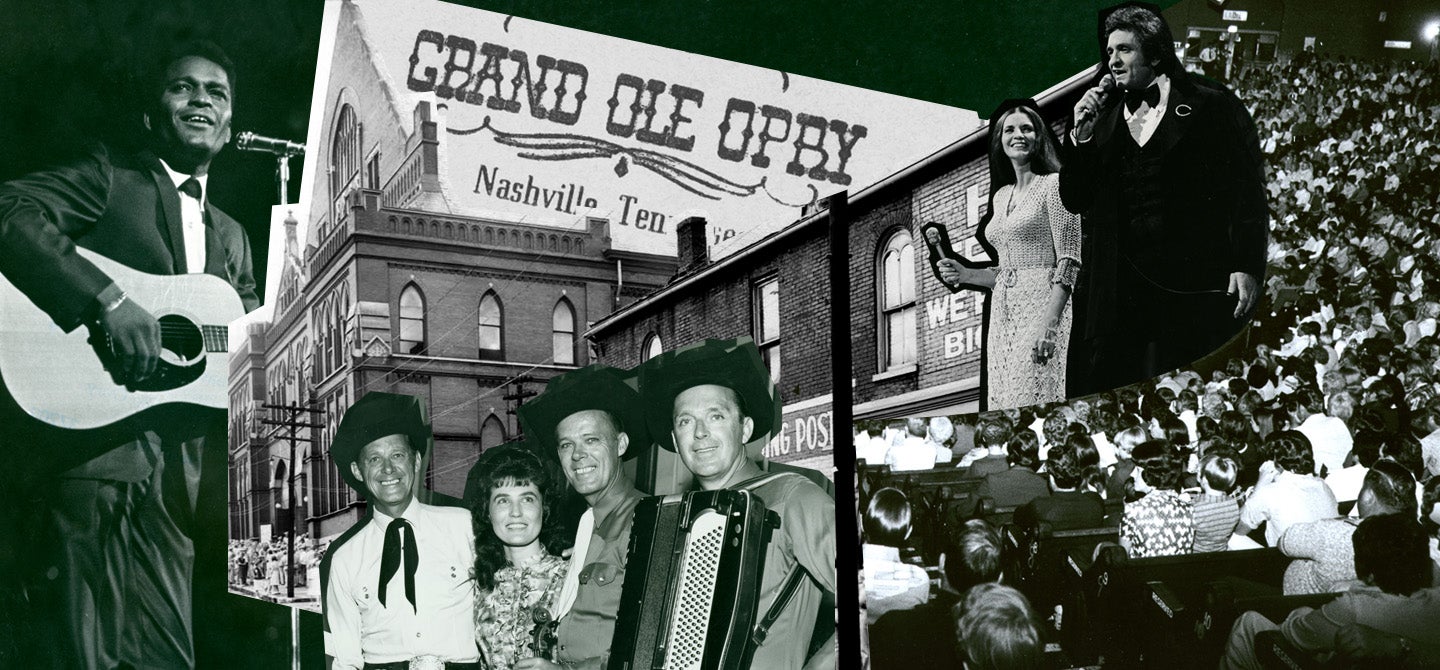

Grand Ole Opry Londons Royal Albert Hall To Stage Historic Broadcast

May 23, 2025

Grand Ole Opry Londons Royal Albert Hall To Stage Historic Broadcast

May 23, 2025 -

The Karate Kid And Its Impact On The Martial Arts Community

May 23, 2025

The Karate Kid And Its Impact On The Martial Arts Community

May 23, 2025 -

Crawleys Late Innings Deny Gloucestershire County Victory

May 23, 2025

Crawleys Late Innings Deny Gloucestershire County Victory

May 23, 2025 -

10 Best Pete Townshend Songs Of All Time

May 23, 2025

10 Best Pete Townshend Songs Of All Time

May 23, 2025 -

Mercedes F1 Wolff Upbeat Following Encouraging Early Performances

May 23, 2025

Mercedes F1 Wolff Upbeat Following Encouraging Early Performances

May 23, 2025

Latest Posts

-

Emissary Claims Hamas Deception The Witkoff Story

May 23, 2025

Emissary Claims Hamas Deception The Witkoff Story

May 23, 2025 -

Hamas Deception Witkoff The Emissary Speaks Out

May 23, 2025

Hamas Deception Witkoff The Emissary Speaks Out

May 23, 2025 -

Witkoff Alleges Hamas Deception A Key Emissarys Story

May 23, 2025

Witkoff Alleges Hamas Deception A Key Emissarys Story

May 23, 2025 -

Witkoffs Claim Duped By Hamas Emissary Reveals Allegation

May 23, 2025

Witkoffs Claim Duped By Hamas Emissary Reveals Allegation

May 23, 2025 -

Emissarys Account Was Witkoff Duped By Hamas

May 23, 2025

Emissarys Account Was Witkoff Duped By Hamas

May 23, 2025