Johnson Matthey's Sale To Honeywell: Positive Impact On BT's Financial Performance

Table of Contents

Johnson Matthey, a global leader in specialty chemicals and sustainable technologies, divested its precious metal refining arm. Honeywell, a Fortune 100 technology and manufacturing conglomerate, acquired this business. BT Group, a major telecommunications company, is indirectly connected through shared industry trends and potentially overlapping supplier networks. This analysis aims to determine if Johnson Matthey’s strategic move positively impacted BT's financial performance.

Understanding the Transaction's Context

Johnson Matthey's Restructuring Strategy

Johnson Matthey's decision to sell its precious metal refining business was a key component of a broader restructuring strategy. The company aimed to:

- Improved profitability: Focusing on higher-margin businesses.

- Debt reduction: Freeing up capital and strengthening the balance sheet.

- Focus on core competencies: Concentrating resources on its key growth areas, such as battery materials and emission control technologies.

This strategic refocusing allowed Johnson Matthey to streamline operations and enhance shareholder value by concentrating on sectors offering stronger growth potential and higher profit margins.

Honeywell's Acquisition Rationale

Honeywell's acquisition of Johnson Matthey's precious metal refining business served several strategic objectives:

- Strengthening market position: Expanding Honeywell's presence in the precious metals market.

- Access to new technologies: Acquiring Johnson Matthey's advanced refining capabilities.

- Diversification: Reducing reliance on existing business segments.

The acquisition allowed Honeywell to expand its portfolio, enhancing its capabilities in a crucial sector and achieving diversification benefits.

The Role of BT Group

The connection between Johnson Matthey, Honeywell, and BT Group is indirect, primarily through shared industry trends and potentially overlapping supplier networks. While there's no direct financial link, several indirect influences are worth noting:

- Indirect market influence: Changes in the precious metals market can indirectly influence the broader economy impacting BT's performance.

- Potential for supply chain optimization: Honeywell's acquisition might lead to efficiencies within the supply chains of companies like BT, albeit indirectly.

- Shared technological advancements: Innovations in materials science from both Johnson Matthey and Honeywell could indirectly benefit the technological advancements within the telecommunications sector, impacting BT's long-term competitiveness.

While not directly transactional, the interplay of these large corporations within the wider market suggests a potential for indirect influence.

Analyzing BT's Financial Performance Post-Sale

Key Financial Indicators

Analyzing BT Group's financial performance post-Johnson Matthey's sale to Honeywell requires examining key indicators:

- Stock performance comparison: A comparative analysis of BT's stock price before and after the sale, considering market fluctuations.

- Revenue growth analysis: Examining BT's revenue streams to identify any discernible changes following the transaction.

- Profit margin changes: Assessing whether BT's profit margins experienced any significant alteration in the period after the sale. (Charts and graphs would ideally be included here).

A thorough quantitative analysis is crucial to determine any correlation between the sale and BT's financial health.

Impact on Investment Strategies

The sale's impact on investor sentiment toward BT Group is vital to consider:

- Changes in investor confidence: The sale might have affected investor perceptions of BT’s future prospects, influencing investment decisions.

- Impact on stock valuations: The market's response to the sale might have impacted BT's overall valuation.

- Increased or decreased investment: Analyzing investment flows into BT Group post-sale reveals investor confidence levels.

Long-Term Implications

Looking ahead, the long-term effects on BT's financial health warrant consideration:

- Future growth prospects: How might the broader market changes influenced by the transaction influence BT’s future growth trajectory?

- Potential for collaboration: Could there be future collaborative opportunities between BT and either Honeywell or a reshaped Johnson Matthey?

- Risk mitigation: Did the sale reduce any indirect risks previously associated with Johnson Matthey's operations for BT?

Alternative Perspectives and Potential Counterarguments

Unrelated Market Factors

Several other factors might influence BT's financial performance, independent of the Honeywell acquisition:

- Overall economic conditions: Broad economic trends and macroeconomic factors can significantly impact BT's performance.

- Industry-specific trends: Changes in the telecommunications sector itself might overshadow the effects of the Johnson Matthey sale.

- Competitor actions: Competitor strategies and market dynamics in the telecom sector can heavily influence BT’s financial standing.

It's essential to isolate the impact of the sale from these other market forces.

Delayed Impact

The full impact of Johnson Matthey's sale on BT's performance may not be immediately apparent:

- Long-term effects: The sale's effects might be felt over a longer period, requiring extended analysis.

- Need for further data analysis: More time and data are needed to draw definitive conclusions.

- Potential future scenarios: Considering various potential future scenarios could provide a broader understanding of the long-term effects.

Conclusion: Johnson Matthey's Sale and its Ripple Effect on BT's Financial Health

In conclusion, determining whether Johnson Matthey's sale to Honeywell had a definitively positive impact on BT's financial performance requires a comprehensive analysis of various financial indicators and a careful consideration of confounding market forces. While an indirect link exists through shared industry trends and potential supply chain connections, a direct causal relationship remains inconclusive based on currently available data. Further research and analysis are needed to fully understand the long-term consequences of this significant transaction. Share your thoughts on how this significant transaction might reshape the future of these companies and the wider impact of the Johnson Matthey's Sale to Honeywell on related sectors.

Featured Posts

-

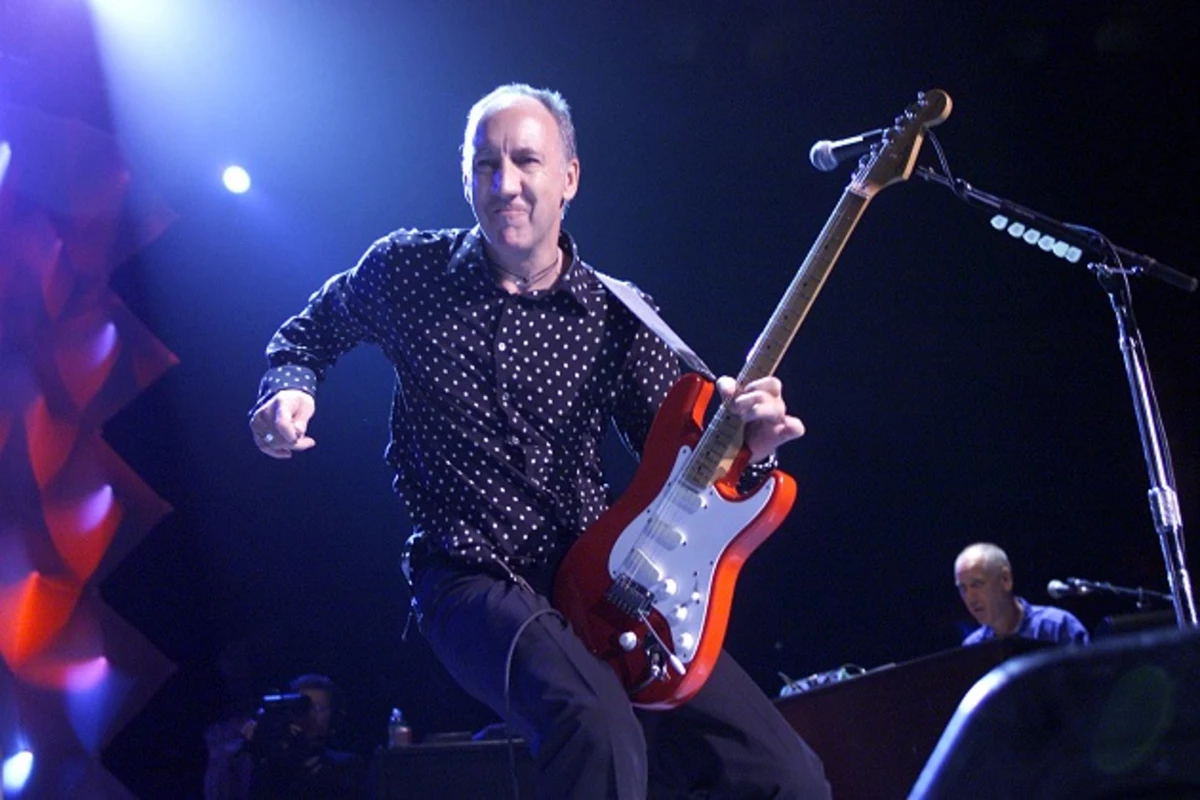

The 10 Greatest Pete Townshend Tracks Ever Recorded

May 23, 2025

The 10 Greatest Pete Townshend Tracks Ever Recorded

May 23, 2025 -

Examining Presidential Power Clintons Budget Veto Threats

May 23, 2025

Examining Presidential Power Clintons Budget Veto Threats

May 23, 2025 -

Emissary Claims Hamas Deception The Witkoff Story

May 23, 2025

Emissary Claims Hamas Deception The Witkoff Story

May 23, 2025 -

Facing Tomorrow With Self Assurance The Maxine Transformation

May 23, 2025

Facing Tomorrow With Self Assurance The Maxine Transformation

May 23, 2025 -

Guia Para Ver La Final Concacaf Mexico Vs Panama

May 23, 2025

Guia Para Ver La Final Concacaf Mexico Vs Panama

May 23, 2025

Latest Posts

-

Msharkt Ebd Alqadr Fy Hzymt Qtr Amam Alkhwr Tfasyl Almbarat

May 23, 2025

Msharkt Ebd Alqadr Fy Hzymt Qtr Amam Alkhwr Tfasyl Almbarat

May 23, 2025 -

Qtr Thzm Amam Alkhwr Thlyl Dwr Ebd Alqadr Fy Almbarat

May 23, 2025

Qtr Thzm Amam Alkhwr Thlyl Dwr Ebd Alqadr Fy Almbarat

May 23, 2025 -

The Kieran Culkin Michael Jackson Connection Fact Or Fiction

May 23, 2025

The Kieran Culkin Michael Jackson Connection Fact Or Fiction

May 23, 2025 -

Adae Ebd Alqadr Fy Khsart Qtr Amam Alkhwr Baldwry Alqtry

May 23, 2025

Adae Ebd Alqadr Fy Khsart Qtr Amam Alkhwr Baldwry Alqtry

May 23, 2025 -

Thlyl Mbarat Qtr Walkhwr Adae Ebd Alqadr Fy Alhzymt

May 23, 2025

Thlyl Mbarat Qtr Walkhwr Adae Ebd Alqadr Fy Alhzymt

May 23, 2025