Key Deutsche Bank Executive Moves To Morgan Stanley: Distressed Sales Head's Departure

Table of Contents

The Executive's Role at Deutsche Bank

The executive in question, whose name is being withheld pending official announcements, held a pivotal role within Deutsche Bank's distressed sales team. Their responsibilities encompassed a wide range of activities crucial to the bank's success in the distressed debt market. They were instrumental in navigating complex restructuring processes, executing crucial debt trading strategies, and contributing significantly to the bank's overall investment banking activities.

- Specific contributions to Deutsche Bank's distressed asset portfolio: The executive oversaw the successful management and sale of several high-profile distressed asset portfolios, generating significant returns for the bank.

- Key deals or transactions overseen by the executive: Their involvement included advising on major corporate restructurings and the negotiation of complex debt transactions, consistently demonstrating expertise in navigating challenging financial situations.

- Tenure at Deutsche Bank and career progression: With a tenure spanning several years, they steadily climbed the ranks, showcasing a proven track record of success and leadership within Deutsche Bank's investment banking division. Their departure represents a significant loss of institutional knowledge and expertise in distressed debt and restructuring. Keywords: Distressed debt, restructuring, debt trading, investment banking, Deutsche Bank, senior executive.

Reasons Behind the Move to Morgan Stanley

While the exact reasons behind the executive's move remain unconfirmed, several factors likely contributed to their decision. The lure of career advancement and a potentially more lucrative compensation package at Morgan Stanley are strong possibilities. Morgan Stanley's aggressive strategic focus on expanding its presence in the distressed asset markets also played a significant role.

- Potential for higher compensation or a more senior role at Morgan Stanley: Morgan Stanley may have offered a more substantial compensation package and a more senior position with greater responsibility and influence.

- Morgan Stanley's strategic focus on distressed asset markets: Morgan Stanley's ambitions to become a leading player in distressed asset trading likely factored into the decision, offering the executive a chance to work at the forefront of this dynamic market.

- Possible internal conflicts or restructuring within Deutsche Bank's distressed sales division: While speculative, internal changes or restructuring within Deutsche Bank's investment banking arm could have influenced the executive's decision to seek opportunities elsewhere. Keywords: Career advancement, compensation, strategic direction, investment banking, Morgan Stanley, acquisition.

Impact on Deutsche Bank

The departure of such a seasoned executive will undoubtedly have repercussions for Deutsche Bank. The short-term impact will involve disruptions in ongoing projects and a potential slowdown in deal flow. Long-term effects could include a loss of market share in the competitive distressed asset trading landscape. The bank now faces a significant challenge: finding a suitable replacement with equivalent experience and expertise.

- Potential impact on Deutsche Bank's market share in distressed asset trading: The loss of this key individual could affect Deutsche Bank's competitiveness and ability to secure lucrative deals.

- Challenges in recruiting a replacement with comparable experience: Finding an executive with the same level of experience and network in the distressed asset market will be a considerable challenge for Deutsche Bank.

- Potential disruption to ongoing deals and projects: The immediate impact will be felt in the short term as current projects and deals may experience delays or setbacks. Keywords: Deutsche Bank, market share, distressed assets, talent acquisition, competitive advantage, financial performance.

Implications for Morgan Stanley

For Morgan Stanley, this acquisition represents a significant coup. The addition of such a highly skilled executive strengthens their distressed sales team considerably, enhancing their expertise and competitive position in the market. This strategic hire positions Morgan Stanley to potentially capture a larger market share and increase deal flow.

- Enhancement of Morgan Stanley's distressed sales team expertise: The executive's extensive experience and network immediately bolster Morgan Stanley's capabilities in handling complex distressed asset transactions.

- Potential for increased market share and deal flow: The hire is likely to lead to increased market share and a greater volume of successful deals for Morgan Stanley.

- Strategic advantages gained through the executive's network and experience: The executive's extensive network of contacts within the financial industry will provide Morgan Stanley with a considerable competitive edge. Keywords: Morgan Stanley, competitive landscape, distressed asset trading, market share, strategic advantage, talent acquisition.

Conclusion

The move of this key Deutsche Bank executive to Morgan Stanley represents a significant development in the financial landscape. This transition highlights the ongoing competition for top talent in the distressed asset trading sector and carries significant implications for both institutions. Deutsche Bank faces the challenge of replacing a highly skilled professional, while Morgan Stanley gains a valuable asset. The long-term consequences of this move will undoubtedly be closely watched by market analysts and investors alike.

Call to Action: Stay informed about further developments in this high-stakes executive move and the shifting dynamics within the distressed asset trading world. Follow our coverage for the latest news on key Deutsche Bank and Morgan Stanley developments, and learn more about the intricacies of distressed asset trading and its impact on the global financial market.

Featured Posts

-

Jacobelli Rn Marine Le Pen Ni Au Dessus Ni En Dessous De La Loi

May 30, 2025

Jacobelli Rn Marine Le Pen Ni Au Dessus Ni En Dessous De La Loi

May 30, 2025 -

Alterya Acquired By Chainalysis A Strategic Move In The Blockchain And Ai Space

May 30, 2025

Alterya Acquired By Chainalysis A Strategic Move In The Blockchain And Ai Space

May 30, 2025 -

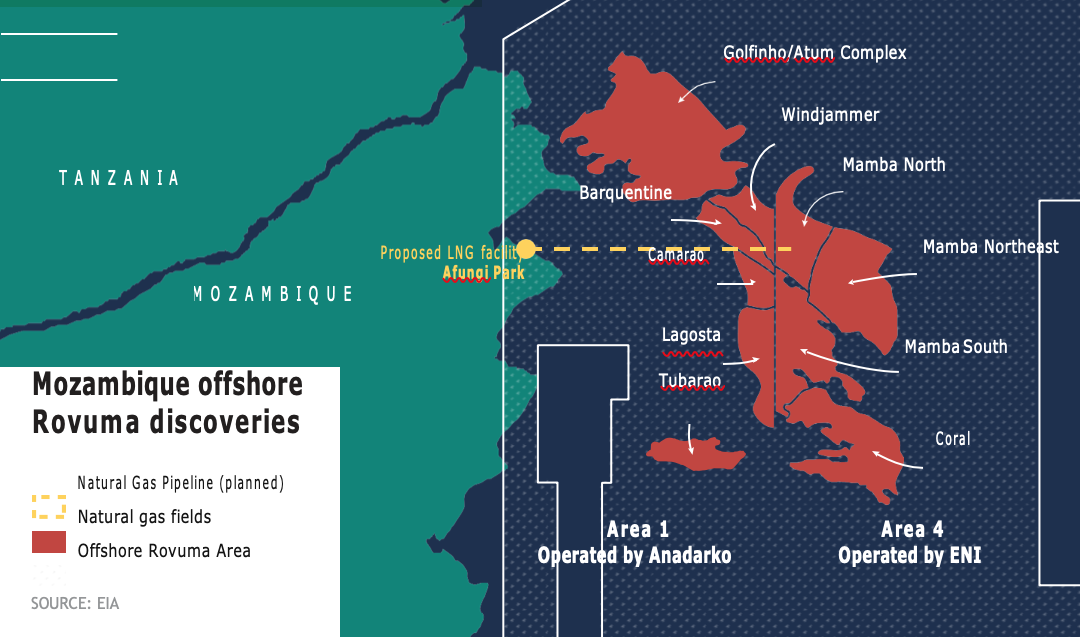

Bcs Lng Ambitions An Examination Of Five Significant Projects

May 30, 2025

Bcs Lng Ambitions An Examination Of Five Significant Projects

May 30, 2025 -

Planifica Tu Concierto Con Ticketmaster Y Setlist Fm

May 30, 2025

Planifica Tu Concierto Con Ticketmaster Y Setlist Fm

May 30, 2025 -

The Impact Of Trumps Tariffs On Indian Solar Energy Exports To Southeast Asia

May 30, 2025

The Impact Of Trumps Tariffs On Indian Solar Energy Exports To Southeast Asia

May 30, 2025