Key Republican Groups Opposing Trump's Tax Legislation

Table of Contents

The Conservative Movement's Concerns

While the legislation was championed as a conservative victory, a significant portion of the conservative movement expressed serious reservations. This opposition stemmed from two main areas: fiscal responsibility concerns and social conservative anxieties.

Fiscal Responsibility Advocates

Many fiscal conservatives viewed the tax cuts as fiscally irresponsible, prioritizing short-term gains over long-term stability. Their primary concerns centered on:

-

Long-Term Debt Increase and Unsustainable Deficits: The substantial tax cuts, they argued, would lead to a dramatic increase in the national debt and exacerbate already unsustainable deficits. This would necessitate future spending cuts or tax increases, potentially harming future economic growth.

-

Tax Cuts Favoring Corporations Over Individuals: Critics pointed out that the legislation disproportionately benefited large corporations and wealthy individuals, leaving middle- and lower-income families with minimal tax relief. This perceived unfairness contradicted core conservative principles of equitable taxation.

-

Examples: Think tanks like the Tax Foundation and certain branches of the Heritage Foundation published analyses highlighting the potential negative long-term economic consequences. Groups like the Committee to Unleash Prosperity, while generally supportive of tax cuts, voiced concerns about specific aspects of the legislation's design.

-

Specific Criticisms: Leading figures within these groups articulated concerns about the lack of sufficient revenue offsets and the potential for decreased investment in critical public services. Quotes from these leaders frequently appeared in media outlets covering the debate.

Social Conservatives' Reservations

Beyond fiscal concerns, some social conservatives expressed reservations due to the potential impact on social programs. Their concerns included:

-

Impact on Social Programs Due to Reduced Government Revenue: The reduced government revenue resulting from the tax cuts raised fears about cuts to vital social programs, including healthcare, education, and infrastructure.

-

Increased Inequality Exacerbating Existing Social Issues: The perceived disproportionate benefits to the wealthy fueled concerns about increased income inequality, which social conservatives believed would exacerbate existing social problems like poverty and crime.

-

Examples: Several religious organizations and social conservative lobbying groups voiced concerns that the tax cuts would worsen societal inequalities and undermine efforts to alleviate poverty.

-

Specific Objections: These groups often highlighted the ethical implications of tax policies that prioritize corporate profits over social welfare, citing their religious or moral beliefs.

The Business Community's Divided Response

While the business community generally favors lower taxes, the Trump tax legislation wasn't universally welcomed. Opposition stemmed from two key areas: the challenges faced by small businesses and the negative impact on certain specific industries.

Small Business Owners' Opposition

Many small business owners felt that the legislation did not adequately address their needs:

-

Complexity of the Legislation and its Impact on Small Businesses: The complexity of the new tax code made compliance challenging and costly for small businesses, often lacking the resources of larger corporations to navigate the changes.

-

Lack of Targeted Relief for Small Businesses Compared to Larger Corporations: Critics argued that the benefits disproportionately favored larger corporations, leaving many small businesses with minimal tax relief and increased administrative burdens.

-

Examples: The National Federation of Independent Business (NFIB) and other small business advocacy groups voiced concerns about the increased compliance costs and the lack of sufficient targeted relief for small businesses.

-

Statistics and Quotes: Reports citing increased small business failures or economic hardship following the legislation's implementation, coupled with quotes from impacted business owners, further supported this opposition.

Specific Industry Pushback

Several industries faced negative consequences under specific provisions of the legislation:

-

Industries Negatively Impacted: Certain sectors, like those reliant on specific deductions or credits eliminated or altered by the legislation, experienced increased taxation and reduced competitiveness.

-

Lobbying Efforts and Public Statements: Affected industry groups launched lobbying efforts and issued public statements to oppose the legislation and advocate for changes.

-

Examples: Industries like renewable energy, which faced reduced tax credits, were particularly vocal in their opposition.

-

Data and News Articles: Data supporting industry claims regarding lost revenue and decreased competitiveness, alongside news articles detailing their protests and lobbying efforts, provided further evidence of their opposition.

The Role of Moderate Republicans

A faction of moderate Republicans also voiced opposition, focusing on issues beyond the purely economic:

Centrist Opposition

Moderate Republicans expressed reservations based on the lack of bipartisan support and concerns about the long-term effects:

-

Lack of Bipartisan Support and Potential for Political Division: The legislation's passage without bipartisan support was seen as a sign of increasing political polarization, counter to the ideal of compromise and consensus.

-

Concerns About the Long-Term Economic Effects and Lack of Transparency: Many moderate Republicans questioned the long-term economic effects of the legislation, citing concerns about the lack of transparency in the legislative process.

-

Examples: Several moderate Republican senators and representatives openly voiced their opposition, highlighting the concerns outlined above.

-

Quotes and Voting Records: Specific quotes from these individuals and their voting records on the legislation, along with links to their official statements, illustrate their positions.

Conclusion

This analysis of key Republican groups opposing Trump's tax legislation reveals a multifaceted opposition driven by fiscal responsibility, social concerns, and the disparate needs of various business sectors. The legislation's passage, despite this considerable internal dissent, highlights the complex political dynamics within the Republican party. Understanding the diverse perspectives of these opposing groups is vital to comprehending the ongoing debates surrounding tax policy and its effects. To further your understanding of the intricate political landscape surrounding this issue, continue researching the various [Keyword Variation: Republican factions opposing Trump's tax reform] and their specific arguments. Further investigation into the long-term economic impact of this legislation is strongly recommended.

Featured Posts

-

Complete Guide To Nyt Strands Hints And Answers March 3 2025

Apr 29, 2025

Complete Guide To Nyt Strands Hints And Answers March 3 2025

Apr 29, 2025 -

60 911 Cayenne

Apr 29, 2025

60 911 Cayenne

Apr 29, 2025 -

Invest Smart A Comprehensive Guide To The Countrys Emerging Business Hotspots

Apr 29, 2025

Invest Smart A Comprehensive Guide To The Countrys Emerging Business Hotspots

Apr 29, 2025 -

Listen Now Jeff Goldblum Ariana Grande And The Mildred Snitzer Orchestra Release I Dont Know Why I Just Do

Apr 29, 2025

Listen Now Jeff Goldblum Ariana Grande And The Mildred Snitzer Orchestra Release I Dont Know Why I Just Do

Apr 29, 2025 -

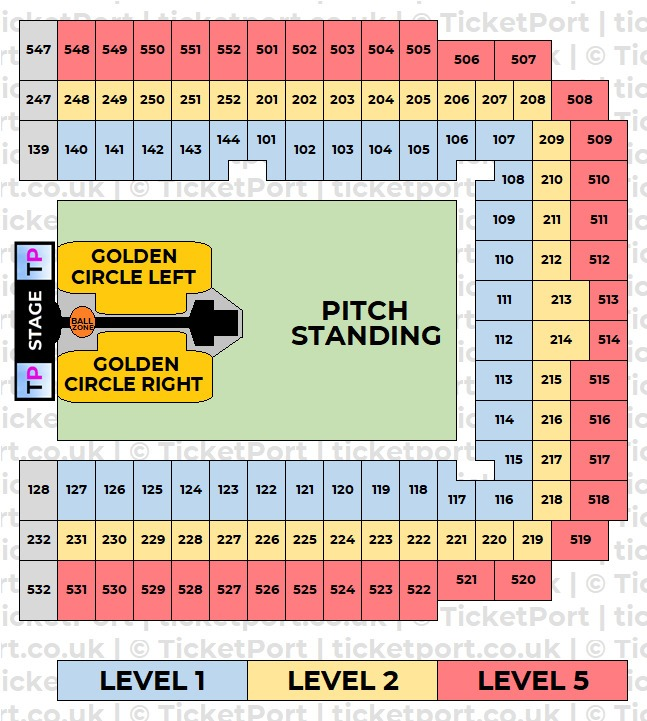

Capital Summertime Ball 2025 Where And How To Buy Tickets

Apr 29, 2025

Capital Summertime Ball 2025 Where And How To Buy Tickets

Apr 29, 2025

Latest Posts

-

Capital Summertime Ball 2025 A Guide To Ticket Acquisition

Apr 29, 2025

Capital Summertime Ball 2025 A Guide To Ticket Acquisition

Apr 29, 2025 -

Levensverwachting Volwassenen Met Adhd Feiten En Fabels

Apr 29, 2025

Levensverwachting Volwassenen Met Adhd Feiten En Fabels

Apr 29, 2025 -

How To Get Capital Summertime Ball 2025 Tickets Official Channels And Tips

Apr 29, 2025

How To Get Capital Summertime Ball 2025 Tickets Official Channels And Tips

Apr 29, 2025 -

Finding Capital Summertime Ball 2025 Tickets Strategies And Resources

Apr 29, 2025

Finding Capital Summertime Ball 2025 Tickets Strategies And Resources

Apr 29, 2025 -

Capital Summertime Ball 2025 Ticket Information For Braintree And Witham Residents

Apr 29, 2025

Capital Summertime Ball 2025 Ticket Information For Braintree And Witham Residents

Apr 29, 2025