Klarna IPO: A $1 Billion Filing And Potential Next Week Launch

Table of Contents

The Significance of Klarna's IPO for the Fintech Sector

Klarna's IPO is not just another company going public; it's a benchmark event for the entire Buy Now Pay Later industry. Its success (or failure) will significantly impact investor confidence in other BNPL companies considering an initial public offering. The outcome will influence future investment flows into the sector, potentially accelerating growth or causing a period of consolidation. The ripple effects will be felt across the broader fintech industry. This Klarna initial public offering will signal a significant step in the maturation of the BNPL model, demonstrating its viability on a global scale.

- Increased investor interest in the BNPL sector: A successful Klarna IPO will likely attract more venture capital and private equity investment into the burgeoning BNPL market.

- Potential for increased competition among BNPL providers: The IPO could trigger a wave of new entrants and increased competition, forcing existing players to innovate and improve their offerings.

- Attracting more investment capital to the Fintech industry: The Klarna IPO will showcase the profitability and growth potential of fintech companies, leading to greater investment in the wider sector.

Klarna's $1 Billion Filing and Valuation Expectations

Klarna's $1 billion filing signifies its ambition and the market's high expectations. While the exact number of shares offered and the price range remain to be officially confirmed, analysts predict a substantial market capitalization. This valuation reflects Klarna's impressive market share in the BNPL space, rapid revenue growth, and increasing profitability (though profitability is still a point of discussion and analysis). However, the valuation also presents inherent risks. High valuations often create pressure for continued rapid growth, and any slowdown could negatively impact the stock price.

- Market capitalization projections: Experts predict a significant market capitalization, potentially placing Klarna among the leading fintech companies globally.

- Comparison with valuations of other publicly traded BNPL companies: Klarna's valuation will be closely compared to those of its publicly traded competitors, providing insights into its relative strength and potential for future growth.

- Analysis of financial performance and future growth potential: Investors will scrutinize Klarna's financial statements and projections, assessing its long-term sustainability and profitability.

Anticipated Launch Date and Market Reactions

While the official launch date is slated for next week (exact date pending confirmation), the market is already anticipating its arrival. Investor demand will be a crucial factor in determining the initial success of the Klarna IPO. Favorable market conditions and a positive economic outlook will enhance investor enthusiasm. Conversely, any negative economic news or increased market volatility could dampen the IPO's performance.

- Expected trading volume on the first day: A high volume of trades is anticipated on the first day of trading, reflecting significant investor interest.

- Potential stock price fluctuations in the initial weeks and months: The stock price is likely to experience fluctuations in the initial period, influenced by market sentiment and investor expectations.

- Impact of market volatility on the IPO's success: Overall market conditions will have a significant impact on the success of the Klarna IPO, particularly in the short term.

Risks and Challenges Facing Klarna's IPO

Despite the excitement, several risks and challenges could affect Klarna's IPO. Regulatory scrutiny of the BNPL industry is intensifying, and any significant regulatory changes could negatively impact Klarna's operations. The competitive landscape is also becoming increasingly crowded, with both established financial institutions and new fintech companies entering the BNPL market. Economic downturns also pose a risk, as consumer spending habits and loan defaults can be significantly impacted by economic uncertainty.

- Regulatory hurdles and compliance issues: Meeting evolving regulatory requirements and maintaining compliance will be crucial for Klarna's ongoing success.

- Competition from established players and emerging BNPL companies: The intense competition could put pressure on Klarna's market share and profitability.

- Economic downturns and their impact on consumer spending and loan defaults: Economic uncertainty could increase loan defaults and negatively affect Klarna's financial performance.

Conclusion: Klarna IPO – A Milestone for the BNPL Market

The Klarna IPO represents a significant milestone for the Buy Now Pay Later industry. Its success will have far-reaching implications for the fintech sector, influencing investor sentiment, competition, and future growth. While the next week will bring the anticipated launch and initial market reactions, the long-term success of Klarna will depend on navigating regulatory hurdles, maintaining its competitive edge, and weathering any economic downturns. Stay tuned for updates on the Klarna IPO and the future of the Buy Now Pay Later market. Follow us for the latest developments on the Klarna initial public offering!

Featured Posts

-

Moose Jaw Hopes Tariffs Will Attract Canadian And American Businesses

May 14, 2025

Moose Jaw Hopes Tariffs Will Attract Canadian And American Businesses

May 14, 2025 -

Wta Roundup No 3 Seed Stearns Defeated In Austin

May 14, 2025

Wta Roundup No 3 Seed Stearns Defeated In Austin

May 14, 2025 -

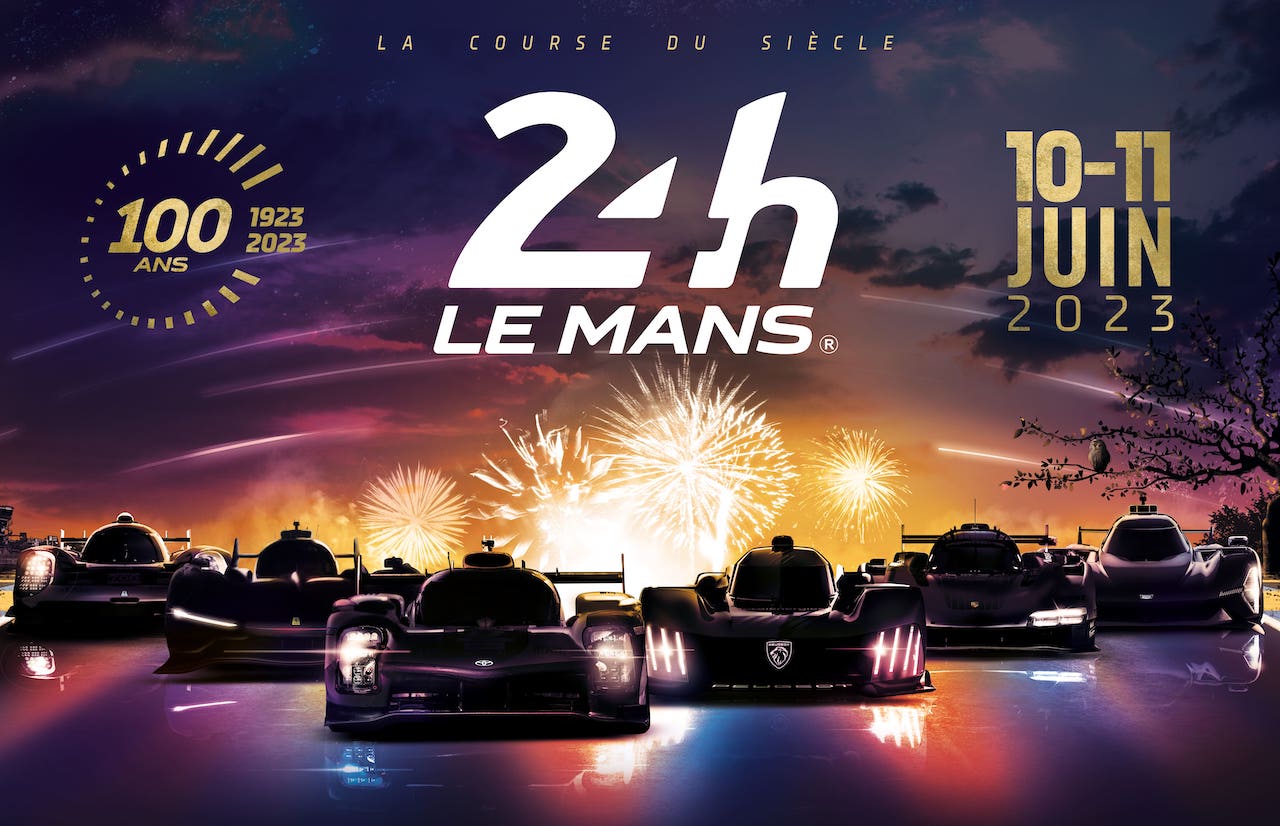

Federer Honorary Starter At The 24 Hours Of Le Mans

May 14, 2025

Federer Honorary Starter At The 24 Hours Of Le Mans

May 14, 2025 -

Emma Raducanu Announces Coaching Change After Brief Trial

May 14, 2025

Emma Raducanu Announces Coaching Change After Brief Trial

May 14, 2025 -

Company News Highlights Fridays Top Stories At 7 Pm Et

May 14, 2025

Company News Highlights Fridays Top Stories At 7 Pm Et

May 14, 2025

Latest Posts

-

Planes En Sevilla Para Hoy Miercoles 7 De Mayo De 2025

May 14, 2025

Planes En Sevilla Para Hoy Miercoles 7 De Mayo De 2025

May 14, 2025 -

Que Hacer En Sevilla Hoy Miercoles 7 De Mayo De 2025 Guia Completa De Planes

May 14, 2025

Que Hacer En Sevilla Hoy Miercoles 7 De Mayo De 2025 Guia Completa De Planes

May 14, 2025 -

Rodzer Federer I Mirka Detaljan Pogled Na Njihove Cetiri Decice

May 14, 2025

Rodzer Federer I Mirka Detaljan Pogled Na Njihove Cetiri Decice

May 14, 2025 -

Blizanci Rodzera Federera I Mirke Federer Nove Fotografije

May 14, 2025

Blizanci Rodzera Federera I Mirke Federer Nove Fotografije

May 14, 2025 -

Mirka I Federer Kako Izgledaju Njihovi Blizanci

May 14, 2025

Mirka I Federer Kako Izgledaju Njihovi Blizanci

May 14, 2025