Klarna's US IPO: A 24% Revenue Surge Revealed

Table of Contents

Klarna's 24% Revenue Surge: A Deep Dive

The 24% increase in Klarna's revenue isn't just a headline-grabbing statistic; it's a reflection of several key factors contributing to the company's remarkable growth. This Klarna growth can be attributed to a confluence of strategic moves and favorable market conditions. Keywords like Klarna growth, BNPL market growth, Klarna market share, consumer spending are central to understanding this expansion.

-

Increased Consumer Adoption of BNPL: The BNPL model's inherent convenience and flexibility have resonated strongly with consumers, driving significant growth in transaction volumes. This increased consumer spending through BNPL platforms like Klarna directly translates into higher revenue.

-

Market Expansion and Geographic Reach: Klarna's strategic expansion into new markets globally has significantly broadened its customer base. Increased market penetration in diverse regions has fueled revenue growth.

-

Strategic Partnerships and Marketing Campaigns: Klarna's collaborations with major retailers and its targeted marketing campaigns have been instrumental in raising brand awareness and driving customer acquisition. These partnerships have resulted in a significant boost in transactions processed through the Klarna platform.

Geographic Expansion and Market Penetration

Klarna's international expansion strategy has been a key driver of its success. The company's ability to adapt its services to local markets and effectively compete with established players in diverse regions exemplifies a successful market penetration strategy. Keywords such as Klarna international expansion and BNPL competition highlight the strategic importance of this growth.

-

Localized Approach: Klarna has tailored its services to the nuances of various markets, understanding local consumer preferences and regulatory landscapes.

-

Strategic Acquisitions: Acquisitions of smaller BNPL players in specific markets have allowed for quicker penetration and expansion.

-

Competitive Advantages: Klarna’s user-friendly interface, strong brand reputation, and extensive merchant network provide a competitive edge over its rivals in the BNPL competition.

The Role of Strategic Partnerships

Strategic partnerships have been crucial to Klarna's revenue surge. Collaborations with major retailers allow Klarna to tap into existing customer bases and offer its BNPL services directly at the point of sale. Keywords such as Klarna partnerships, strategic alliances, and retailer collaborations are vital in this context.

-

Increased Transaction Volume: Partnerships with large retailers significantly boost the volume of transactions processed through the Klarna platform.

-

Brand Visibility and Awareness: Integration with prominent retailers elevates Klarna's brand visibility and enhances its reach among a broader consumer audience.

-

Mutual Benefits: The partnership benefits both Klarna and its retail partners by driving sales and enhancing customer loyalty.

Klarna's US IPO: Expectations and Implications

Klarna's US IPO is highly anticipated, and the company's substantial revenue growth significantly influences its valuation. The IPO is expected to have a profound impact on the BNPL market, attracting further investment and intensifying competition. Keywords relevant to this section are Klarna valuation, IPO pricing, BNPL investment, Klarna stock performance.

-

Market Valuation: The significant revenue growth positions Klarna for a substantial market valuation during its IPO. The exact IPO pricing will depend on various market factors.

-

Impact on the BNPL Market: Klarna's IPO will likely attract further investment into the BNPL sector, accelerating its growth and evolution.

-

Risks and Opportunities: While the IPO presents significant opportunities, potential risks include market volatility and competition from established financial institutions.

Investor Sentiment and Market Response

The market response to the announcement of Klarna's IPO has been largely positive, reflecting the strong investor sentiment towards the company and the growth potential of the BNPL sector. Analyzing Klarna investors and their outlook is crucial. Keywords like Klarna investors, stock market analysis, and investment opportunities help analyze this.

-

Positive Investor Outlook: Klarna's consistent revenue growth and strong market position have instilled confidence in investors.

-

Long-Term Growth Potential: The long-term prospects for the BNPL industry and Klarna's position within it are seen as highly favorable by many investors.

-

Market Volatility: Despite the positive sentiment, market volatility and macroeconomic conditions could influence the performance of Klarna's stock post-IPO.

The Future of BNPL and Klarna's Position

The future of the BNPL industry looks bright, with continued growth driven by increasing consumer adoption and technological advancements. However, regulatory scrutiny and competition will likely pose challenges. Keywords like Future of BNPL, Klarna future prospects, and BNPL industry trends are key to understanding this future.

-

Regulatory Landscape: Increased regulatory scrutiny of the BNPL industry could impact Klarna's operations and growth trajectory.

-

Technological Advancements: Innovation in areas such as AI and machine learning will play a significant role in shaping the future of the BNPL industry.

-

Competition: Increased competition from established financial institutions and new entrants will necessitate continuous innovation and strategic adaptation.

Conclusion: Klarna's US IPO: A Promising Future for BNPL?

Klarna's 24% revenue surge, fueled by increased consumer adoption of BNPL services, strategic partnerships, and successful market expansion, sets the stage for a highly anticipated US IPO. This IPO will significantly impact both Klarna and the broader BNPL landscape. The future outlook for Klarna is positive, though challenges remain in navigating a dynamic regulatory environment and intensified competition. To stay informed on the latest developments in the Klarna IPO and the BNPL market, subscribe to our newsletter! Learn more about the exciting future of Klarna and the Buy Now Pay Later market by visiting our website.

Featured Posts

-

Wta Rankings Update Daria Kasatkina Begins Australian Tennis Journey

May 14, 2025

Wta Rankings Update Daria Kasatkina Begins Australian Tennis Journey

May 14, 2025 -

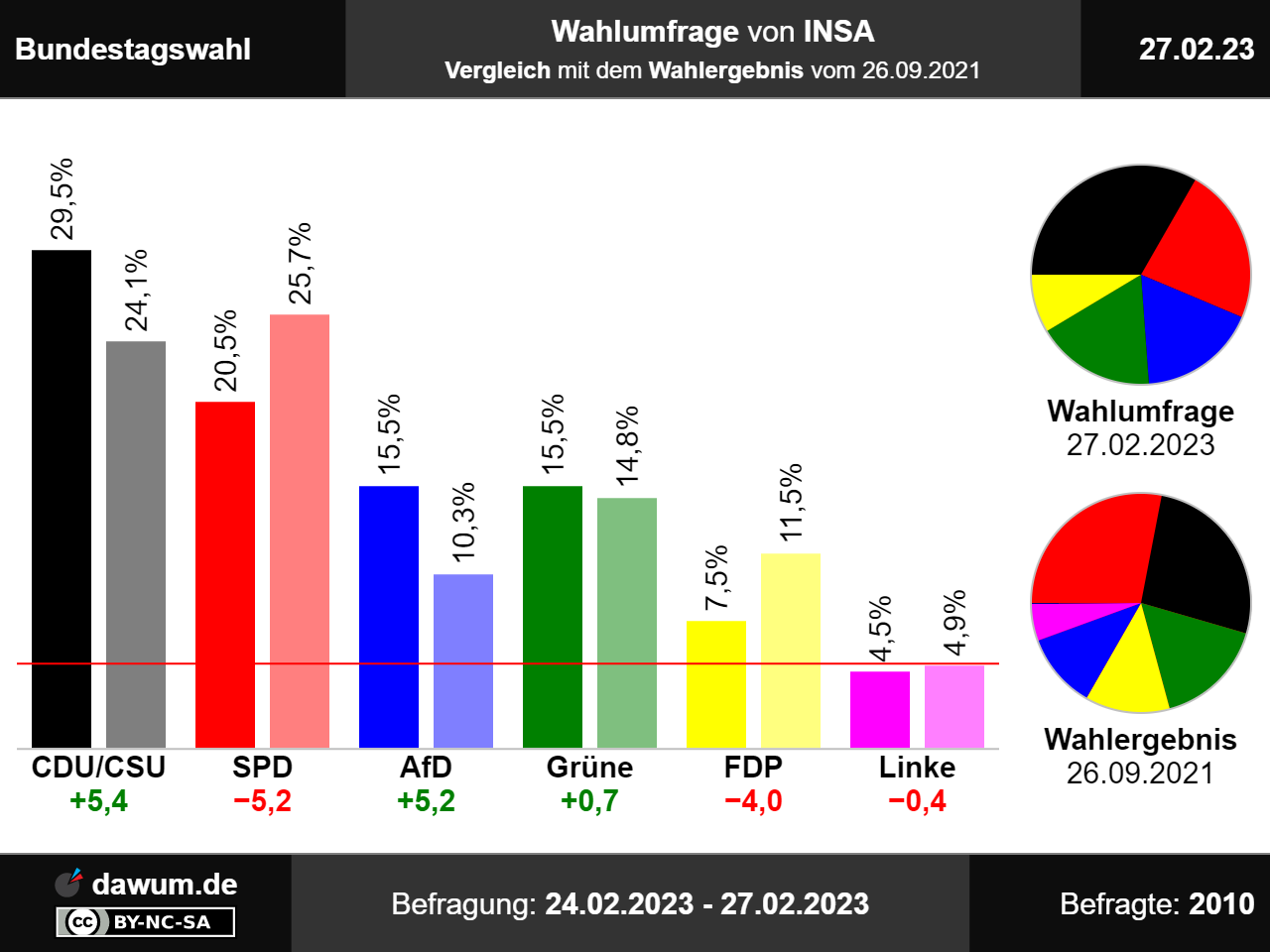

Lokale Wahlen Dresden Schock Fuer Cdu Spd 80 Waehlen Anders

May 14, 2025

Lokale Wahlen Dresden Schock Fuer Cdu Spd 80 Waehlen Anders

May 14, 2025 -

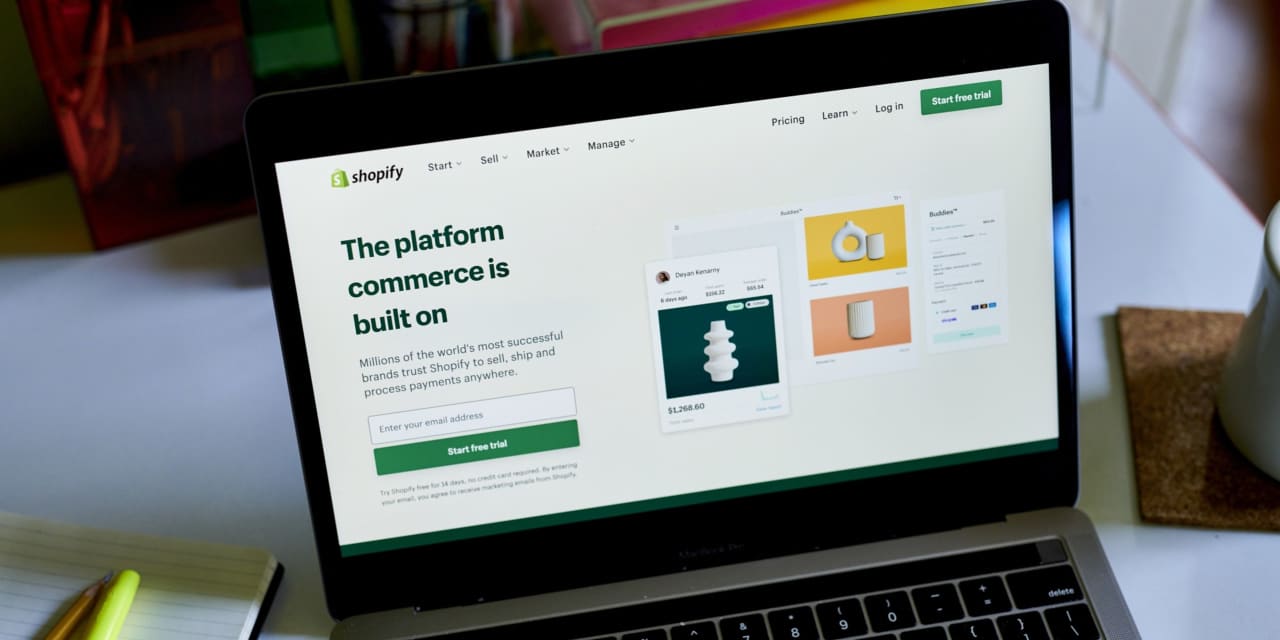

Nasdaq 100 Inclusion Sends Shopify Stock Up 14

May 14, 2025

Nasdaq 100 Inclusion Sends Shopify Stock Up 14

May 14, 2025 -

Remembering A Giant The Lasting Legacy Of Players Name If Applicable

May 14, 2025

Remembering A Giant The Lasting Legacy Of Players Name If Applicable

May 14, 2025 -

George Straits Dairy Queen Drive Thru Selfie Country Stars Surprise Visit

May 14, 2025

George Straits Dairy Queen Drive Thru Selfie Country Stars Surprise Visit

May 14, 2025

Latest Posts

-

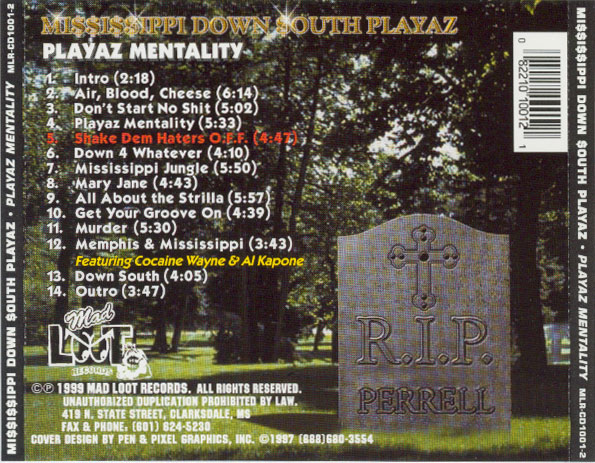

The Dont Hate The Playaz Culture Analysis And Interpretation

May 14, 2025

The Dont Hate The Playaz Culture Analysis And Interpretation

May 14, 2025 -

Dont Hate The Playaz Deconstructing The Slang And Its Origins

May 14, 2025

Dont Hate The Playaz Deconstructing The Slang And Its Origins

May 14, 2025 -

Exploring The Dont Hate The Playaz Phenomenon

May 14, 2025

Exploring The Dont Hate The Playaz Phenomenon

May 14, 2025 -

The Meaning And Impact Of Dont Hate The Playaz

May 14, 2025

The Meaning And Impact Of Dont Hate The Playaz

May 14, 2025 -

Understanding The Dont Hate The Playaz Mentality

May 14, 2025

Understanding The Dont Hate The Playaz Mentality

May 14, 2025